Anna Moneymaker/Getty Images News

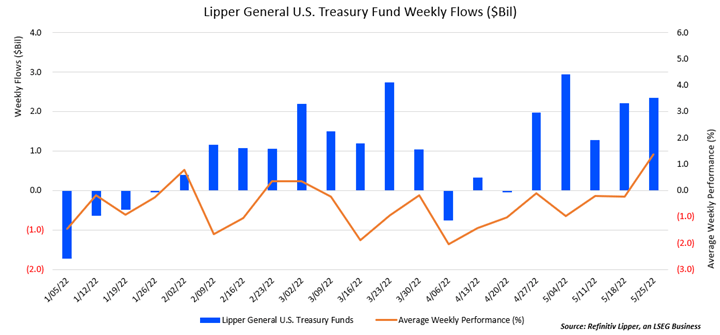

A few weeks ago, we touched on the popular General U.S. Treasury Funds Lipper classification and how it was attracting significant inflows despite poor performance. Well, the inflows into Treasury funds have persisted.

Just this past week, General U.S. Treasury Funds reported the largest weekly inflows under all fixed income Lipper classifications. The classification set a quarterly intake record in Q4 2021 (+$13.6 billion) and is on pace to shatter that record – the preliminary quarter-to-date figure has them at $13.9 billion.

Lipper general US treasury fund weekly flows (Author)

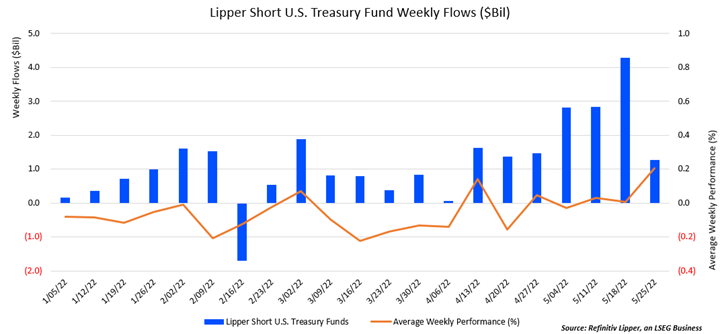

General U.S. Treasury Funds are not the only Lipper classification to produce heavy inflows; Lipper Short U.S. Treasury Funds have also been steadily attracting new capital since the start of the year.

This classification primarily invests in U.S. Treasury bills, notes, and bonds, with dollar-weighted average maturities of less than three years. On average, funds within this classification have a collected duration figure of around one. Lipper Short U.S. Treasury funds have attracted positive flows in 14 consecutive weeks along with topping $1.2 billion in seven straight.

Lipper short US treasury fund weekly flows (Author)

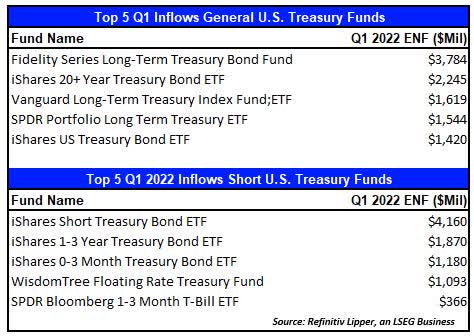

In Q1 2022, Lipper General U.S. Treasury Funds (+$13.6 billion) and Lipper Short U.S. Treasury Funds (+$8.9 billion) were the third and fourth largest attracter of funds under Lipper fixed income classifications. These two safe haven classifications have only gained in popularity since.

So far during Q2 2022, Lipper Short U.S. Treasury Funds (+$15.5 billion) and Lipper General U.S. Treasury Funds (+$13.9 billion) have pulled in the largest and second largest inflows. Year to date the only fixed income Lipper classification that has topped these two is Lipper International Income Funds (+$34.4 billion).

What has made these inflows such a significant feat is the fact that we are seeing major outflows across the board during Q2 – equity funds (-$52.6 billion), taxable bond funds (-$35.1 billion), and tax-exempt bond funds (-$30.9 billion). Taxable bond and tax-exempt bond funds are on pace to report back-to-back quarters of outflows. The last time each asset type did that was in 2015.

While both these two classifications sit on different ends of the duration spectrum, they highlight fixed income investors’ preference to have principal protection over yield-seeking.

Top 5 Q1 inflows (Author)

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.