[ad_1]

mysticenergy

Thesis

ProShares Ultra Oil & Gas (NYSEARCA:DIG) seeks daily investment results that are 2x the daily performance of the Dow Jones U.S. Oil & Gas Index. Please note that leveraged products are fundamentally not buy and hold investments, and come with specific risks as identified by FINRA. The fund is a leveraged take on energy via Oil & Gas equities, and has performed admirably so far this year, being up 88% year to date. A key aspect to keep in mind for DIG is regarding the fact that over longer periods of time the fund experiences beta slippage, or the propensity to deviate from matching exactly the 2x performance of the underlying index.

We are seeing weakness in oil prices as we are closing 2022, weakness driven by recession fears and profit taking. There is also a substantial disconnect between oil prices and oil equities which opened up mid-2022, which is going to narrow down into overall oil price weakness. Do not get us wrong, the disconnect is justified, since oil equities can generate substantial profits and free cash flows with oil above $70, but that correlation is still there (even if not 1:1 now) and it will drag oil equities lower in the short term.

Simple is the best. Each year there are always a couple of macro themes, that if played correctly can yield very substantial returns. For 2022 those macro themes have been higher energy prices, higher rates and higher volatility. All else to the side, taking advantage of these macro themes, with little attention to anything else, would have yielded very substantial results in 2022:

- higher energy prices (2x via DIG): +88% Ytd

- higher rates (3x via TYO): +44% Ytd

- higher volatility (leveraged via PFIX): +71% Ytd

Just like any macro theme, nothing goes up in a straight line. Energy is no different. While in our opinion the factors that drove energy higher this year will persist, and result in a multi-year energy super-cycle, prices will retrace some of the move.

Where are WTI prices headed?

There has been a curious move in WTI in the past few months. Despite a helpful macro environment and an ongoing multi-year energy super-cycle, WTI continues to grind lower:

WTI Price (TradingView)

We believe the oil market is anticipating the recession and associated lower demand by selling off. The equity market (and implicitly energy equities) are not there yet, still mired in a bear market rally. They will eventually get there.

From the above chart, courtesy of TradingView, we can see the long-term support and resistance provided by the $65 price level. We can see multiple historic bounces off this level, as well as resistance being hit here. Even during the great post-Covid energy rally, this level acted as resistance first, and then support. In our minds, we are going to revisit that level, this time as a strong support.

Long-term, a WTI selloff is actually healthy. Why? Because it will prevent irrational exuberance. Large energy companies are now extremely profitable, and usually capitalistic economies tend to allocate more resources and investment capital where money is made. In the past, energy companies would have started drilling more and allocating more Capex towards pumping out more oil. But as the old adage goes “once burned, twice cautious”, the Covid crisis and historic negative prices in WTI have taught management a stern lesson – drilling more when the market does not reward you for it (via higher P/E ratios) is uneconomical long-term. Management is now moving from fixing balance sheets to return of capital via dividends and share buy-backs. A charged political environment with talks about windfall taxes and a disdain for old-school energy is removing any fringe incentives to substantially increase production. A lower WTI level will just remind management teams that fortunes can change very fast in this business, and higher capital allocations towards increased volumes in the future is just not rewarded presently.

Holdings

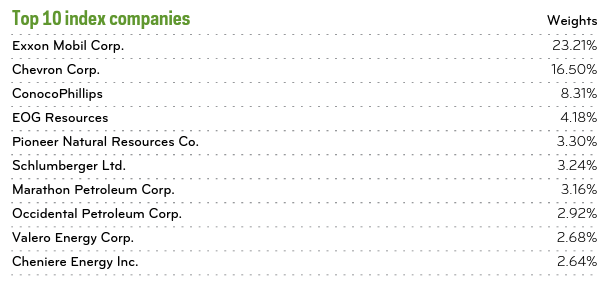

The ETF synthetically matches via swaps the Dow Jones U.S. Oil & Gas Index. Its composition is as follows:

Holdings (Fund Fact Sheet)

We can see its composition is quite reminiscent of XLE’s, with Exxon (XOM) and Chevron (CVX) accounting for a very large proportion of the index (over 39% currently). Having a leveraged exposure simply means the ETF provides for 2x of the underlying index returns. Magnified returns work both ways – they can provide for very rewarding up years, but also can wipe out an investor’s capital during down years. Leveraged products are to be used as shorter-term trading tools rather than anything else.

Speculative Accounts Positioning

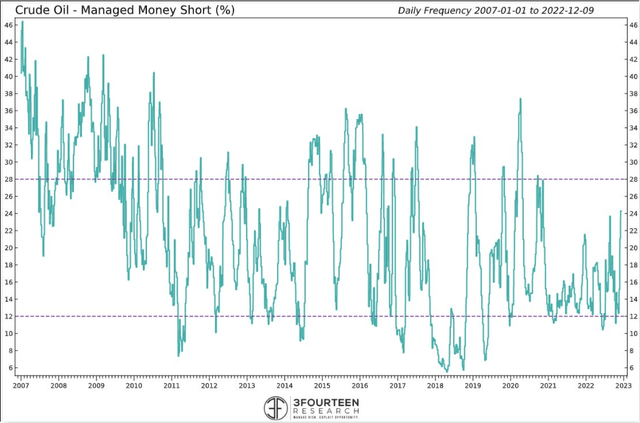

Hedge funds have recently increased their short positioning in WTI:

WTI Futures Positioning (3Fourteen Research)

Unlike their buy-and-hold real money counterparts, hedge funds live by the yearly returns they procure (a bad year can mean the shut-down of the fund), thus represent a good indicator of shorter-term moves.

China Not Re-Opening

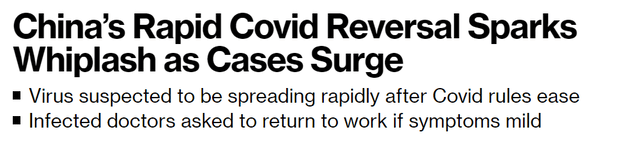

There has been tremendous speculation as of late regarding the China re-opening and its positive impact on oil prices. Today’s headline from Bloomberg says it all:

China Headline (Bloomberg)

The Chinese government rolled back some of its most draconian procedures in place, as a direct result of unprecedented protests. With Covid reversing, do not expect a grand re-opening, but a very slow grind upwards in economic activity. It looks like China cannot shake the pandemic, and the economic re-opening will not be a “big-bang” event.

Conclusion

DIG is an exchange traded fund that offers investors a 2x return on the Dow Jones U.S. Oil & Gas Index. The fund is up an astounding 88% this year, giving a glimpse of how leverage can magnify returns. The fund falls in the speculative instruments category and is to be used for shorter periods of time as opposed to pure buy and hold investments. Nothing goes up in a straight line, and while we believe oil prices and oil equities will experience a multi-year period of gains, shorter term all the flags are there pointing to lower prices. Technically WTI looks like it will go towards $65 on recession fears (despite the China re-opening), and energy equities are being sold into lower oil prices and profit taking. There is another -20% to be had in DIG before investors can re-load into the long energy trade into the new year. A retail investor would be wise to use DIG for what it is – a shorter term leveraged take on energy equities, not a buy and hold forever instrument.

[ad_2]

Source links Google News