[ad_1]

Emerging markets were one of 2017’s hottest trades, but quickly turned into on of 2018’s trades to avoid. Indeed, the 27% rally in 2017 was completely undone in 2018. So what could 2019 have in store?

In this article I will look at some of the tailwinds for emerging markets and why I think the recovery could have more to go. I will also explain why I like the Vanguard FTSE Emerging Markets ETF (VWO) over other funds.

Why VWO?

The obvious alternative to VWO is the popular iShares MSCI Emerging Markets ETF (EEM). It’s more liquid and has a similar performance with slightly higher beta. This is because it is more concentrated, with 1003 holdings compared to a much more diversified 4103 in VWO. EEM’s top 10 holdings account for 23.97% of the fund while VWO’s makes up 19.24%. You could argue EEM’s 1003 stocks is diversified enough, but I do like the slightly lower beta of VWO as emerging markets are volatile. I also like the low expense ratio of VWO, 0.12% compared to EEM’s 0.67%. To top it off, VWO has a higher dividend yield of 2.61% paid quarterly, compared to EEM’s 2.04% paid semi-annually.

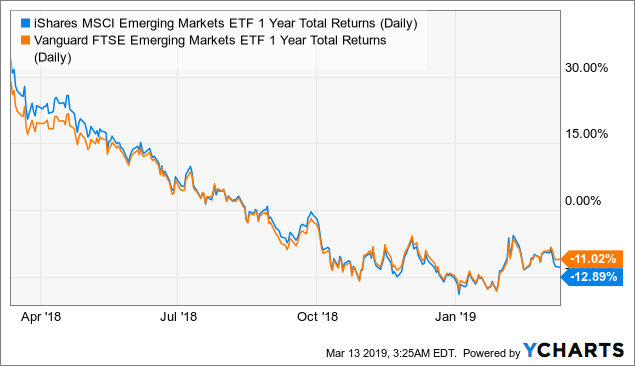

The cumulative effect of all these differences are subtle. Total returns over the past year and declining markets are better in VWO.

Data by YCharts

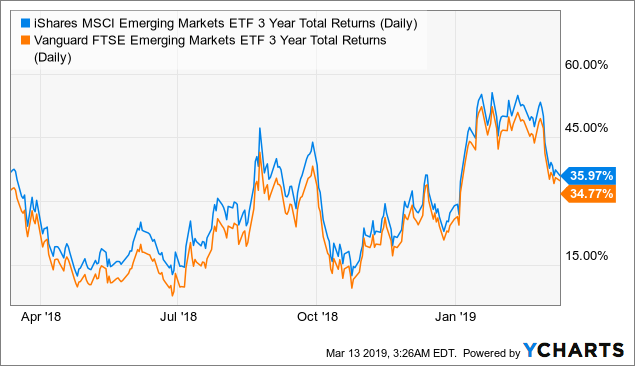

Data by YChartsHowever, over 3 years and a rising market are better in EEM.

Data by YCharts

Data by YChartsConsequently, I can’t conclude one fund is better than the other and much is down to personal preference. I am more conservative and like to take care of the downside risks and collect a quarterly dividend, so VWO is my choice.

Holdings

With 4103 holdings, there is little point focusing too much on individual stocks in the fund as the majority will have little influence. Tencent Holdings (OTCPK:TCEHY) and Alibaba (BABA) are by far the largest holdings and make up 4.73% and 3.67% of the fund, respectively. It is worth paying attention to Tencent in particular, as it tends to influence the movements of VWO, if only because of its effect on sentiment. The collapse last August on poor earnings was felt in most emerging market funds.

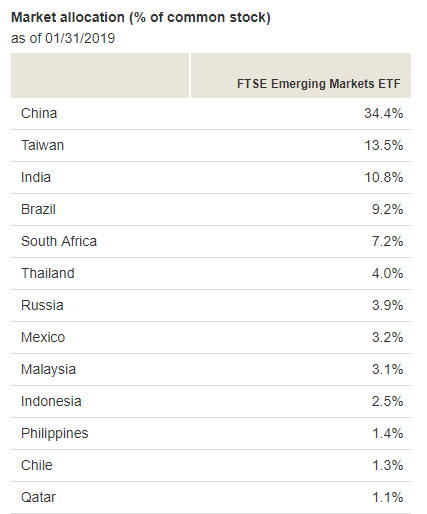

However, the macro is more important than the micro. As we can see below, Chinese stocks make up more than a third of VWO’s portfolio, and the effect of this will be explored in the next section.

source: Vanguard website

Headwinds turned Tailwinds

As mentioned in the introduction, 2018 was a challenging year for emerging markets and for VWO. The trade war between China and the US escalated which hurt Chinese stocks and the economy. Additionally, the US dollar (UUP) was strong all year, and this weighed on emerging markets as they hold a lot of US dollar-denominated debt. Plotting VWO against an inverted dollar (beta adjusted) shows just how important it can be.

charts by Tradingview

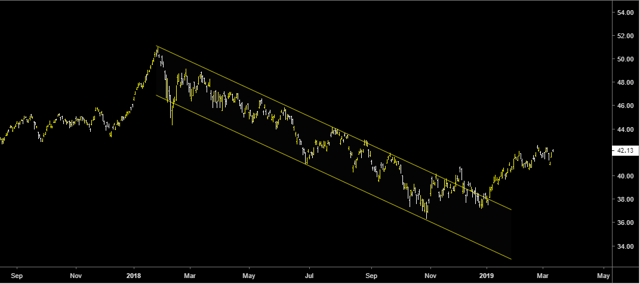

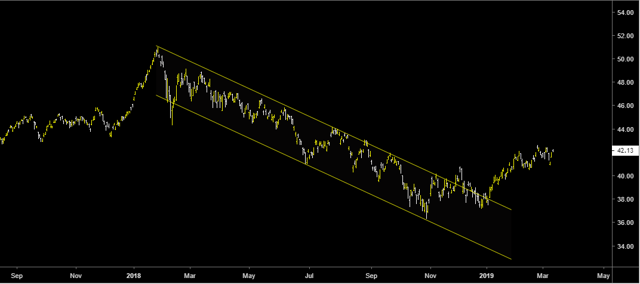

The dollar does not always move in line with interest rates, but 2018’s dollar strength was accompanied by four rate hikes, and this was especially bad for emerging markets. All this led to a persistent downtrend on the charts, but then in early 2019 it broke out and is moving higher again.

So what has changed? Well, at first glance the dollar is still strong and has barely budged from its highs around 97.7. However, it has been boosted by a weak Euro and Yen, the largest weights in the dollar basket. Emerging market currencies (shown below by the MSCI Intl Emerging Market Currency ETF) actually bottomed last September and have recovered well.

I can’t tell how much more they will recover, but the fear of a currency crash has at least passed and sentiment has much improved. Last July and August there were a lot of scary headlines around and minor currencies such as the Turkish Lira crashed around 50% against the USD. Capitulation and stabilization in these currencies helped the VWO bottom in late October, much ahead of other global indices and could support a continued rally in 2019.

An added boost will come from the Fed’s about turn on policy. Rates are firmly on hold, and judging by Chair Powell’s recent comments, not even a tick up in inflation will get the Fed to act. This could further weaken the dollar and take the pressure off emerging market debt in USD.

China is also showing signs of bottoming ahead of some kind of trade deal with the US. Data is still weak, but the Chinese stock markets seem to think the worst is over. Resolution of the trade war may be mostly priced in by the short-term rally, but the long-term effects will help keep emerging markets supported.

To conclude, all the headwinds weighing on emerging markets in 2018 are gradually turning into tailwinds; emerging market currencies has stabilized and are recovering, the Fed has flipped dovish, a trade deal looks imminent and Chinese markets look like they have bottomed.

Risks

Emerging markets are volatile with high risk and high reward. The main risk to VWO is that the 2018 downtrend was only the first part of a larger decline and any rally fades for another move lower. This could happen if the negative drivers re-assert themselves. However, I think this is unlikely for several reasons; the Chinese need a trade deal to save the economy and the U.S, or more specifically President Trump, needs a trade deal to help campaign for re-election. I also think it is very unlikely for the Fed to flip back hawkish and risk upsetting (and confusing) the markets. Finally, emerging market currencies may turn lower, but after crashing and washing out so severely in 2018, this scale of move isn’t likely to be repeated so soon.

Conclusions

VWO is a well-diversified fund with a decent quarterly dividend of 2.61%. It offers exposure to emerging markets, particularly China, and has a number of positive macro drivers for 2019. As long as these stay intact, VWO could reach $48-$50.

Disclosure: I am/we are long VWO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News