[ad_1]

marchmeena29/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on January 30th, 2022.

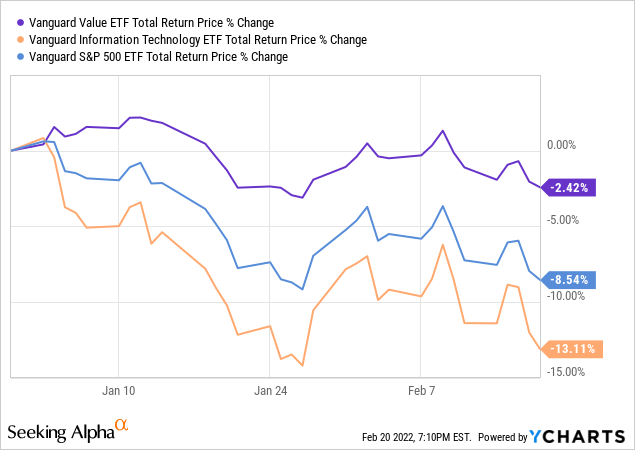

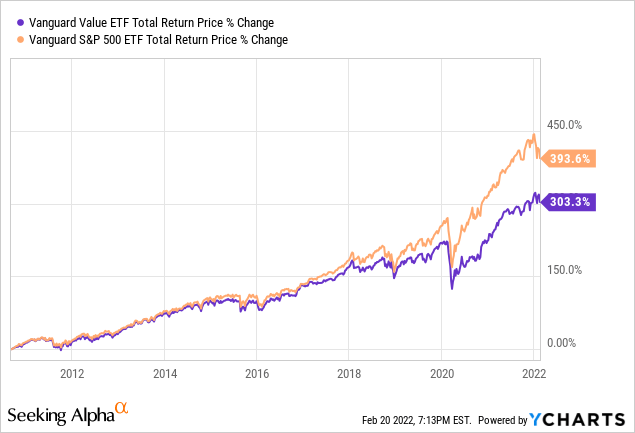

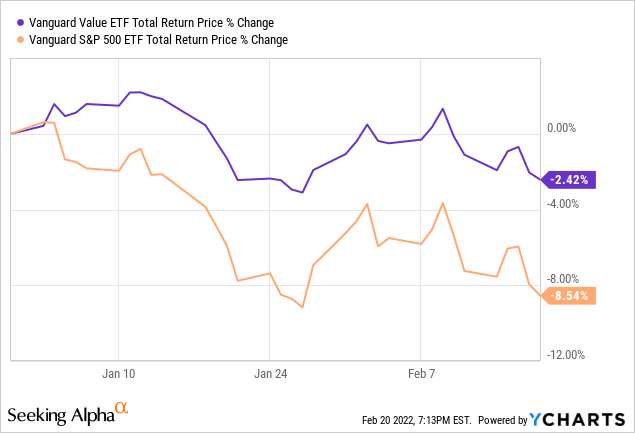

Value stocks have outperformed YTD, as improved economic conditions and the prospect of higher interest rates cause investors to shift from more speculative, high-growth companies, towards cheaper, cash-flow generating, old-economy value stocks. The trend is likely to continue, which should lead to further value outperformance in the coming months and years.

The Vanguard Value ETF (VTV) is a diversified value index ETF, providing investors with simple, cheap exposure to hundreds of U.S. value stocks. The fund should benefit from current economic trends, outperforming in the coming months and years, and is a buy.

Value Factor Analysis

VTV is a relatively simple factor ETF, focusing on value stocks. VTV’s characteristics, investment thesis, risks and drawbacks are effectively identical to those of value stocks more broadly. As such, to understand VTV we must first understand what we mean by value stocks, so let’s do just that.

Factors are characteristics that determine the risks and returns of an investment.

Certain factors tend to boost returns, leading to market-beating performance.

One of these factors is value.

Companies have a fundamental value, based on their key financial metrics, including revenues, earnings, cash flows, and assets. Companies with strong earnings and lots of assets are very valuable. Companies with low earnings and few assets have very little in value.

Companies also have a market (share) price, which is partly dependent on their fundamental value, but is also influenced by market forces and sentiment.

Price tends to track value, but there are many exceptions.

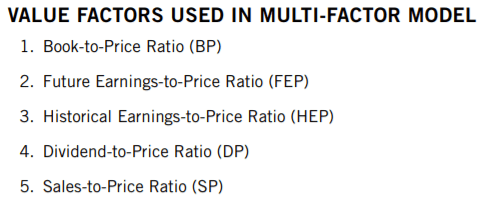

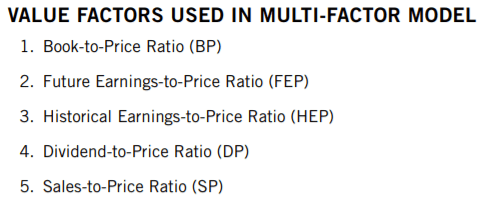

Value stocks are those stocks with strong fundamental value, but low share prices. There are several metrics which can be used to gauge a stock’s value, most of which directly compare a specific financial metric with the stock’s share price. VTV itself uses the following five industry-standards metrics, to analyze a company’s value score:

CRSP Corporate Website

As can be seen above, value stocks would be those with lots of book value, earnings, dividends, and sales per share, but low share prices.

In theory, value stocks should outperform, as markets are (somewhat) efficient, and tend to re-price stocks to more closely align with fundamentals as time goes on. Even when markets are inefficient, or slow, value stocks should still outperform, as valuable companies generate strong cash-flows, which can be used to pay dividends. Dividends are not dependent on fickle market sentiment, and so should lead value stocks to outperform long-term.

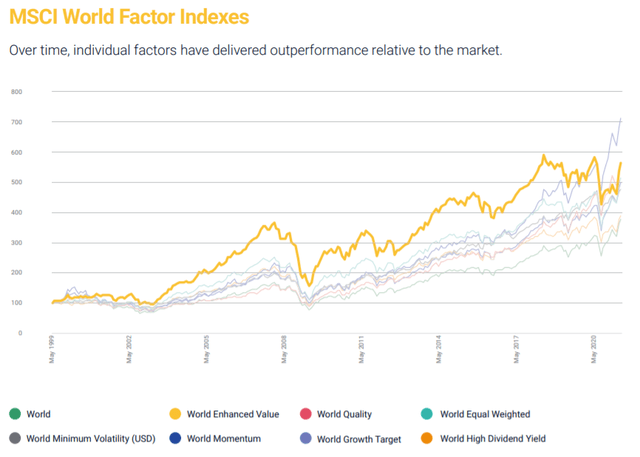

In practice, value stocks have outperformed the broader equities markets for decades, but performance is spotty. Value goes through long cycles of outperformance and underperformance, although the long-term trend is positive.

MSCI

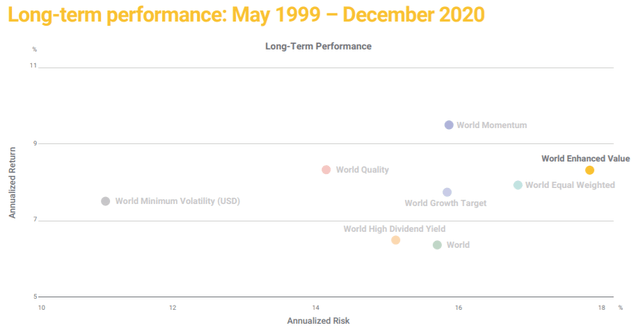

On a more negative note, value stocks tend to be riskier than average, as safe, high-quality companies tend to sport premium valuations. Value stocks outperform, but at a higher level of risk and volatility.

MSCI

Value stocks seem like reasonable investments for more aggressive investors. There are many funds which focus on these stocks. VTV is a particularly simple, straightforward one. Let’s have a look.

VTV Basics

VTV Overview

VTV is an index ETF investing in U.S. large-cap value stocks. The fund is administered by Vanguard, the second-largest investment management firm in the world, and the largest index fund provider in the same. Long-time readers know Vanguard is almost always my top choice for simple, cheap index funds, and VTV is no exception.

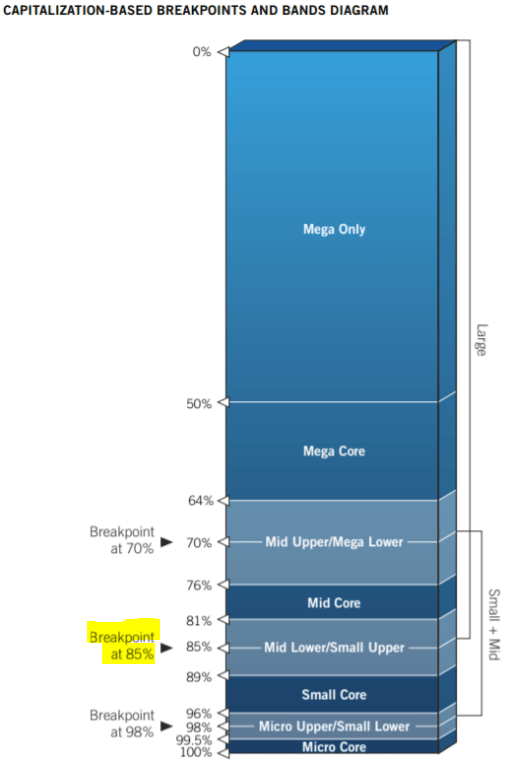

VTV itself tracks the CRSP US Large Cap Value Index, a U.S. large cap value index. It is a relatively simple index. It first selects applicable securities by market-capitalization. It includes U.S. securities whose market-cap accounts for the top 85% of total U.S. market-cap, excluding the bottom 15%. So, only relatively large companies, but encompassing most of the U.S. equity investment universe. The following graph summarizes the situation.

CRSP

The index then selects the cheapest equities. It does so using a complicated set of formulas, which are outside the scope of this article. Simplifying things a bit, we can say that the fund estimates a stock’s value using the following five standard value metrics.

CRSP

Stocks with above-average value scores are then included in the index. As with most other indexes, there are some basic set of liquidity, trading, etc., inclusion criteria, as well as buffers and other assorted rules meant to decrease portfolio turnover. There are also rules meant to more accurately separate value stocks from growth stocks.

In my opinion, and from reading through the available documentation, the fund’s underlying index is sound, and without any significant issues or negatives.

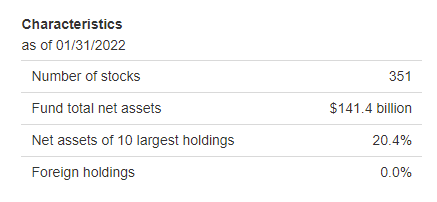

VTV’s index is relatively broad-based, with relatively few filters and inclusion / exclusion criteria. This results in a reasonably well-diversified fund, with investments in 355 stocks, and with exposure to most relevant industry segments. Concentration is quite low too, with the fund’s top ten holdings accounting for just 20% of the value of the fund.

VTV Corporate Website

VTV Corporate Website

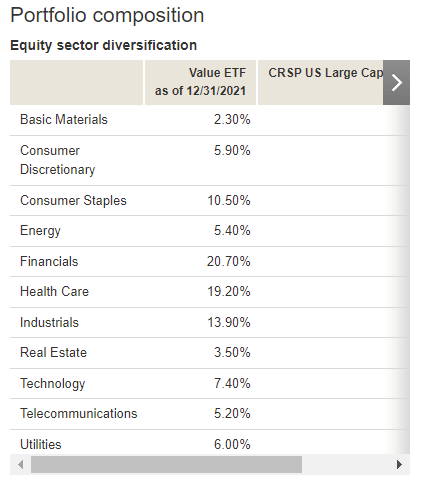

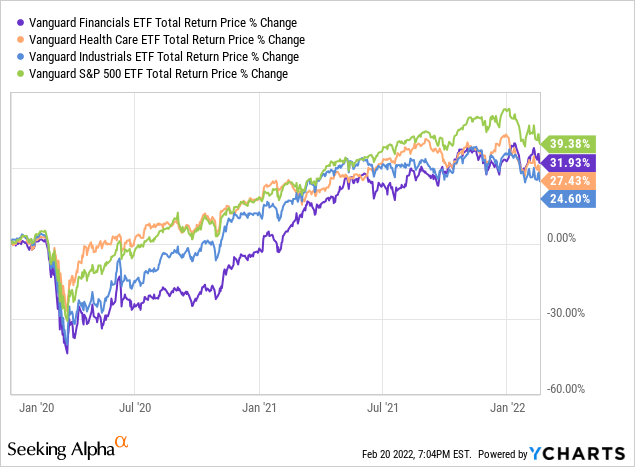

As can be seen above, VTV is moderately overweight financials, health care, and industrials. These three sectors have underperformed since the onset of the coronavirus pandemic, and so currently sport comparatively cheap prices and valuations.

On the other hand, the fund is significantly underweight tech, as the sector has seen rising share prices and valuations during the same time period.

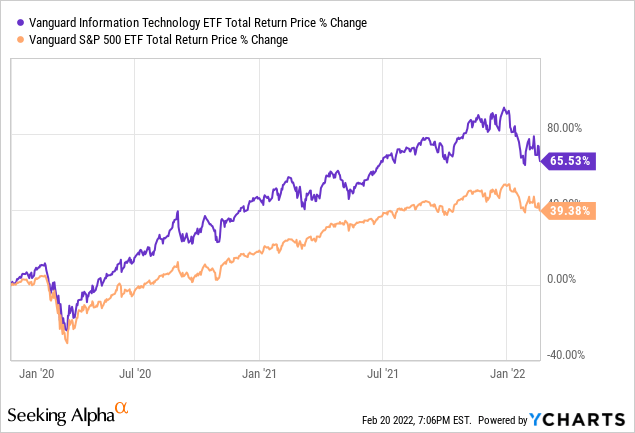

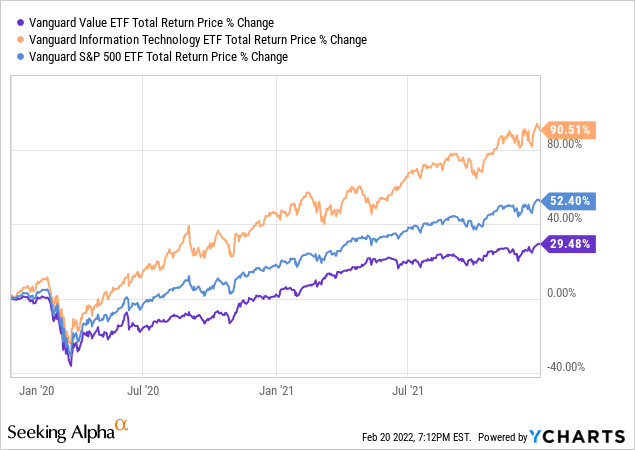

Due to the above, VTV’s relative performance is strongly dependent on the relative performance of U.S. tech equities. Expect the fund to underperform when tech outperforms, as was the case during 2020 and 2021, during and in the immediate aftermath of the coronavirus pandemic.

At the same time, expect the fund to outperform when tech underperforms, as has been the case YTD.

VTV’s industry exposures make it an inappropriate investment for tech bulls and the like. Although this seems a bit obvious, with VTV being a value fund, mentioning it seems important.

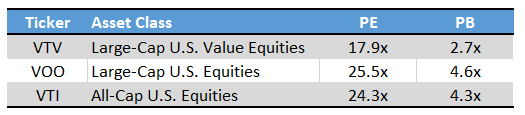

VTV focuses on cheap stocks and industries, which results in a cheaply valued fund, as expected. VTV sports a PE ratio of 17.9x and a PB ratio of 2.7x, both of which are about 30% lower than average for U.S. equities.

Vanguard Corporate Website – Chart by Author

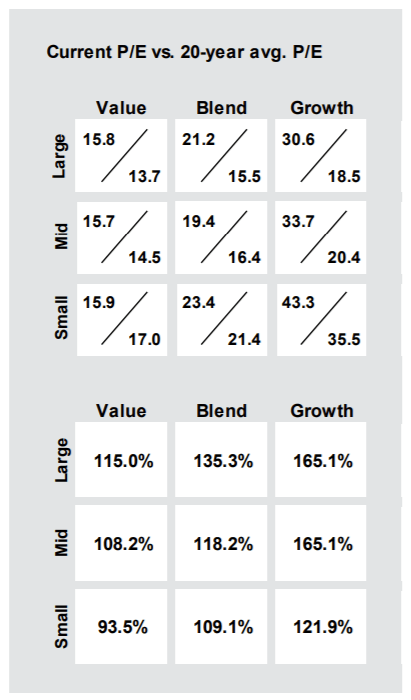

Value stocks are always cheaper than the market average, by definition, and as can be seen above. On the other hand, as per J.P. Morgan, value stocks are currently slightly more expensive than their historical average, due to the unprecedented equity bull market of the past decade. At the same time, equities, especially growth equities, are significantly more expensive than their historical average, as they have benefitted more strongly from said bull market. As such, value stocks currently offer some amount of relative historical value. Value stocks are always cheaper than the market average, but the gap is wider than average.

J.P. Morgan Guide to the Markets

Implicit in the above, is the fact that value has underperformed for years: the valuation gap between value and growth would not be so large otherwise. Although underperformance will not necessarily continue, it is definitely a negative, and important for investors to consider.

VTV Investment Thesis

VTV’s investment thesis is remarkably simple. The fund focuses on cheaply valued large-cap stocks, which could see significant capital gains and market-beating returns if valuations were to normalize. Valuations are strongly dependent on investor sentiment, which is quite fickle. Valuations have normalized YTD, as investors grow weary of tech industry valuations, worsening inflation, and the possibility of significant rate hikes.

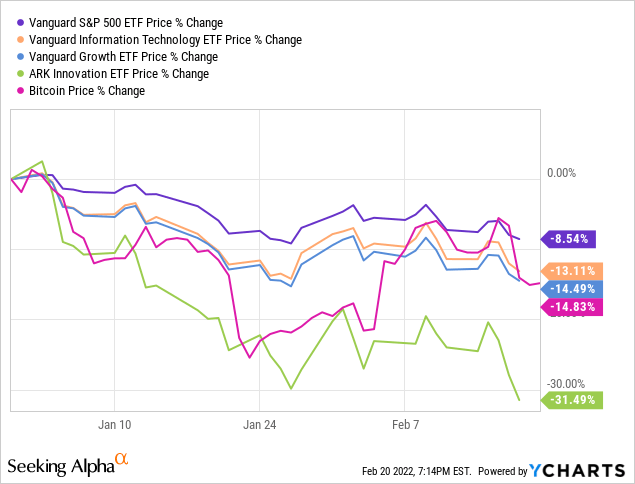

Higher interest rates could act as a catalyst for valuations to continue normalizing, as sky-high growth valuations grow more difficult to justify as bond yields rise to more attractive levels. Tesla’s (TSLA) 0.34% earnings yield might make some amount of sense with interest rates at 0%, but will have trouble surviving +2% rates. We’ve seen most growth stocks go down these past few weeks, on anticipation of future rate hikes. Growth and tech are both moderately down, while more speculative tech, including the ARK Innovation ETF (ARKK) and bitcoin, are massively down.

In my opinion, valuations should continue to normalize as economic conditions and interest do, which should ultimately benefit value funds like VTV, and their shareholders.

Conclusion

Value stocks offer investors the possibility of substantial capital gains and market-beating returns, as economic conditions and valuations continue to normalize. VTV provides investors with simple, cheap exposure to hundreds of U.S. value stocks, should outperform in the coming months, and is a buy.

[ad_2]

Source links Google News