RichVintage

By Rob Isbitts.

Summary

Vanguard Short-Term Treasury ETF (NASDAQ:VGSH) is part of a group of short-term Treasury Bond exchange-traded funds (“ETFs”) that are about as exciting as that mundane asset class can get. The historically sharp spike in rates driven by the Fed this year has created the most exciting time to consider this perennially boring asset class. The short end of the Treasury yield curve offers the best of both worlds: high yield and extremely low duration. At a time when so many winning strategies of the past decade are at risk of failing, short-term Treasury investing is suddenly “exciting.” As with some others in its peer group, we rate VGSH a Buy.

Strategy

VGSH follows a similar script as its short-term Treasury ETF brethren. It constrains its portfolio to owning the very shortest-term Treasury Notes. That is, 1-3 year maturities. As a reminder, T-Bills go out to 1-year maturity, and Notes are from 1 to 10 years. Treasury Bonds are 10to 30 year maturities. So, VGSH plays at the very starting point of that T-Note curve.

Proprietary ETF Grades

-

Offense/Defense: Defense

-

Segment: Bonds & Cash

-

Sub-Segment: Short-Term Treasuries

-

Correlation (vs. S&P 500): Very Low

-

Expected Volatility (vs. S&P 500): Very Low.

Holding Analysis

VGSH owns nearly 100 different T-Notes, covering the length of the 1-3 year maturity range. The weighted average maturity comes out right around the 2-year mark. The average price of its holdings is about $95, and its average coupon is about 1.7%, according to fund manager Vanguard. That implies that many of the bonds have fallen in price since purchase, and that investors stand to benefit from price appreciation toward par. It also means that the cash yield of this ETF is still lower than the current “headline” rate we see on short-term Treasuries, which sits in the 4.5% range. It will take some time for the fund’s process to roll off maturing bonds and reinvest in those newer, higher coupons. With a turnover rate historically running around 60%, that implies that the transition to progressively higher yields will continue at a fairly rapid pace. A 60% portfolio turnover means that about 1/3 of the portfolio will be replaced over the next 6 months.

Strengths

This is not about manager skill, though the presence of Vanguard as the fund manager is certainly a positive. This fund is as liquid as they come in this space, with a whopping $17 Billion plus in assets, and about $170mm worth of VGSH traded daily, on average. This is just a vanilla way to access a historically boring, very predictable, high-quality segment of the bond market…that just happens to be at a historically cheap point.

Weaknesses

The 2 biggest secular weaknesses in an ETF like this one are more related to opportunity cost than risk of massive loss. There’s only so much you can lose when the borrower of all the securities in your portfolio is the U.S. Treasury. Now, there are numerous theories about the eventual replacement of the U.S. dollar as the world reserve currency, and the decline of the U.S. economy. That is acknowledged. But in a relative sense, 1-3 Year obligations of the U.S. Treasury are at least the best house in a bad neighborhood.

Opportunities

VGSH is about as timely a recommendation as we can find in the bond market today. While rates can still climb much higher, this ETF has a better chance of keeping pace than bond funds of longer maturities, those carrying credit risk, or both.

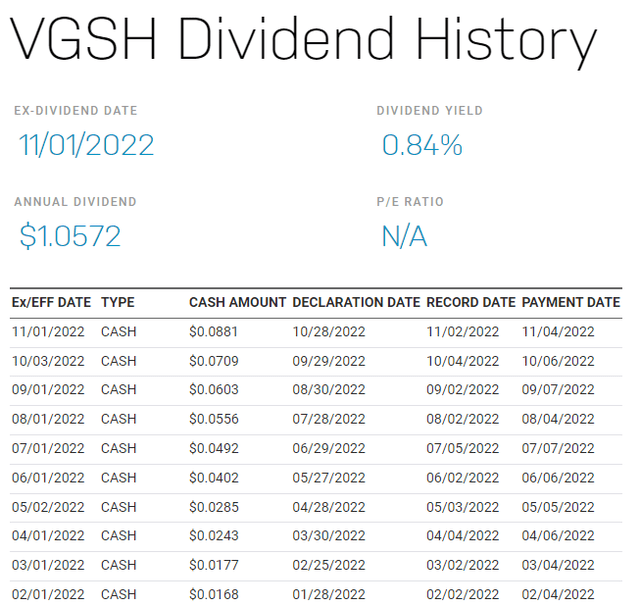

The real opportunity in this space is shown below. Look at the “Cash Amount” column to see the monthly income payout of VGSH. Back in February of 2022, the fund paid out 1.68 cents for the month. 4 big Fed rate hikes later, the latest payout (11/1/2022) was 8.81 cents, a more than 5-fold increase. That still may not sound like much, but for reasons noted in the Holdings section above, the cash yield should continue ticking higher.

Monthly dividend rising (Nasdaq.com)

Regardless of the cash-on-cash return trend of VGSH, the portfolio of 1-3 Year Treasury Notes it currently holds are in sync with the total return implied by today’s short-term yields. Translation: this ETF is current returning in the 4-5% range, annualized. Yet it is quite possible that investors don’t realize this. That includes many who own funds like VGSH. They see it as a “safety valve,” a way to escape stock and long-term bond volatility. And they see the “sticker price” yield and think that’s all there is. In reality, there’s a lot more.

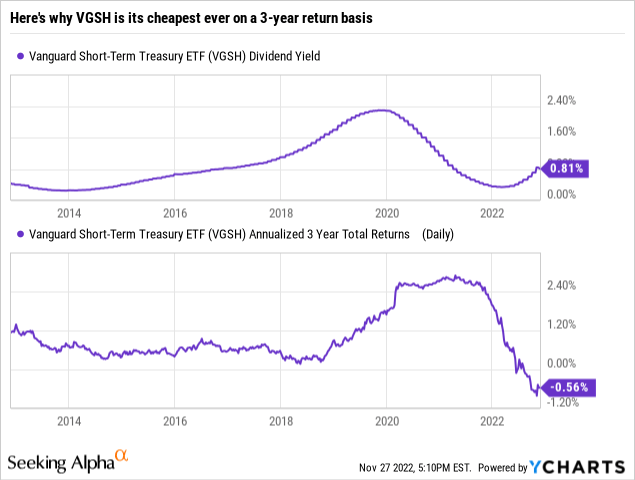

You see, the top part of this graph is misleading. It makes you think that VGSH “yields” less than 1%. That’s because most investment data services publish the trailing 12-month yield of an ETF.

VGSH: not as boring as usual (Seeking Alpha and Ycharts)

The bottom part of the above chart helps bring the opportunity of VGSH in focus. Look at the past decade in this ETF. It has been a “sleeper,” with its rolling 1-year return spending all but a few years yielding just over zero percent, topping out at around 2.5%, and then crashing below zero. That was the cost of absorbing the unique historical anomaly of the Fed raising rates sharply from zero. This sets up VGSH with the best reward/risk tradeoff we have seen since the global financial crisis over a decade ago. Yields are up, and the fund will be rolling into those higher yields. And, if rates continue higher, VGSH will be there to benefit from that too.

Threats

To examine the threats to VGSH and its peer group, look no further than what just happened last year and early this year. A rapid rise in rates with minimal yield “cushion” to start with combine to push returns into the very rare negative return scenario. If rates continue to spike higher, part of that problem could linger. However, it, will be from a higher base rate of income VGSH is currently bringing in.

Conversely, a crash in rates from here would likely be a boost to this type of ETF, as it would have the reverse effect we just saw, raising prices. But the yield would come down, making VGSH a limited-time opportunity.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Buy

-

Long-Term Rating (next 12 months): Buy.

Conclusions

ETF Quality Opinion

Vanguard, a big asset base, and a near-cash type of investment strategy make VGSH a high-quality ETF. It is one of a few we keep on our short-list of short-term Treasury ETFs to consider.

ETF Investment Opinion

The biggest decision regarding VGSH is not whether to own it. It is when to own it, how much to own as a portion of a portfolio, and for how long. The more scattered the rate picture continues to be, the more VGSH may be more of a tactical vehicle than a long-term hold type of ETF. But in an environment where we the most certain thing is heightened uncertainty, this type of port in the storm asset class offers a historically-unique window of opportunity. We rate Vanguard Short-Term Treasury ETF a Buy.