[ad_1]

Leestat

Investment thesis: The Vanguard FTSE Europe ETF (NYSEARCA:VGK) offers broad, diverse exposure to the EU economy. At a time when the likes of Deutsche Bank (DB) are forecasting an economic contraction of 2.2% for the euro area in 2023, broad exposure to European investments is the exact opposite of what should be desired by investors in regards to European exposure at the moment. Aside from perhaps some careful stock picking, I do not see much benefit from a broad European investment exposure position, until at least the end of next year. In a worst-case scenario, Europe’s energy crisis could persist throughout the decade and beyond, making this ETF as well as other funds that provide broad exposure to European stocks, one of the riskiest investment positions within regional ETF fund choices.

Many VGK components are deeply and directly exposed to the energy crisis or other geopolitical & political headwinds.

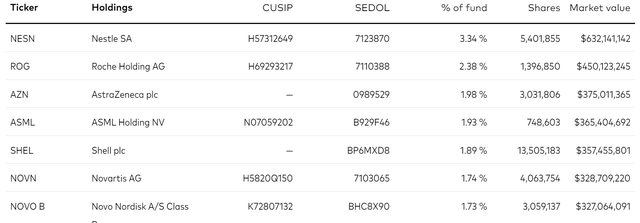

Looking at the companies that make up the largest share of the VGK fund, most of them have direct exposure to the new environment of big power confrontation on the economic front as well as in terms of proxy war skirmishes. In the case of the EU economy, the main problem is a steep rise in energy costs, which has the potential to negatively affect most companies. There are however other factors, such as the growing power competition in the technological sphere, such as between the West & China.

Vanguard

Nestle (OTCPK:NSRGY), which tops the stock list in terms of weight, is ordinarily thought of as a defensive stock, which one would want to hold in case of economic turmoil. In this particular case, we are looking at supply-side issues, which are different from the demand-driven economic slowdowns of the past few decades. Nestle is looking at higher costs of energy, as well as higher soft commodities input costs, even as the market in Europe in particular for its goods is getting to be increasingly battered. The net effect, especially for its European operations will be a severe squeeze on profits, where production prices are set to rise severely, while the ability to pass on a part of those costs will be limited. A drop in sales in Europe is also likely to occur. The good news is that Nestle is greatly diversified in terms of its geographical presence in terms of sales as well as production.

Roche (OTCQX:RHHBY) may seem like a good bet to do well, regardless of economic or market conditions, except that its reliance on intermediary products such as specialized petrochemicals for its complex pharma products may leave it in a bind, starting perhaps this winter, as Europe’s petrochemical industry is in danger of shutting down. AstraZeneca (AZN) may be faced with similar problems. There is also a chance that government spending throughout Europe on health care will be slashed, as more and more money needs to be allocated to subsidizing household energy bills, bailing out companies, and perhaps dealing with a Lehman-style financial collapse as we are learning that there might be a 1.5 trillion euro energy short trading loss to deal with. Faced with mounting costs, and collapsing revenues, EU governments, as well as the UK government can be expected to slash long-term investment plans in health facilities, in favor of tending to mounting immediate needs.

Next on the list is the Dutch tech company ASML (ASML) which makes chipmaking equipment. This company may be less exposed to the high energy costs environment. It is also unlikely to be asked to shut down its EU operations in the event that there will be natural gas or electricity shortages in the near future. It may however lose a growing number of potential markets, as the Western technological war with a growing number of nations intensifies. Right now, it is facing curbs on sales to countries like China and Russia and only a handful of other sanctioned countries. That list may expand significantly in coming years, perhaps to include all BRICS nations or all SCO nations. The recent curbs imposed on technology exports to China are some recent examples where ASML is vulnerable.

There are a host of issues that most European companies are dealing with, aside from the headline-grabbing energy crisis. Shell (SHEL) for instance is dealing with dwindling upstream reserves and declining production as a result. It is still trading like a company that has a bright upstream future ahead, thus it still trades favorably when oil & gas prices rise. Shell should be considered a positive asset in this fund and in the short term it will be, but in the longer term it is set to be a drag, given the bleak geological realities it is faced with, not to mention the political pressures meant to turn it into a green energy company. I find it hard to fathom how Shell will be able to chart a path to becoming a mostly green renewable energy company, with a market cap of $200 billion. If it cannot pull this off, its long-term investors will suffer, and it will not have a long-term positive impact on VGK either.

Aside from these top fund components by weight that I highlighted, a host of companies, almost 1,400 of them are represented in the fund, and most of them are vulnerable to some extent, whether directly or due to potential fallout effects. At this point, we have to wonder how many of them might not survive the winter, especially if it turns out to be especially cold, and perhaps in a worst-case scenario, the wind will not blow much either. Even if this winter will turn out to be tame, there is always the next winter and the one after that. There is currently no indication that Europe’s energy predicament will ease in the foreseeable future, so this issue goes beyond the immediate threat of the current impending winter season.

Some early signs of economic deterioration within the EU

Perhaps the most immediate and obvious sign that the EU economy has suffered through a severe deterioration already is the slide of the euro versus the dollar. It is true that the dollar has been strong against most major currencies this year, nevertheless, the magnitude of the decline is quite impressive, especially for a currency that is supposed to be a viable alternative to the US dollar.

XE

FX volatility is nothing new and ordinarily, we do not put much emphasis on it when we evaluate economic performance. In this case, in particular, we should, because I do not see a path for the euro to recover. In fact, the weaker euro has arguably become the tool that shrinks the EU economy by stealth. In other words, its total output measured in euros is not declining nearly as much as it does when measured against the dollar. I expect the decline of the euro to continue, and perhaps even accelerate, meaning that VGK investors will see a decline in the value of the fund accordingly.

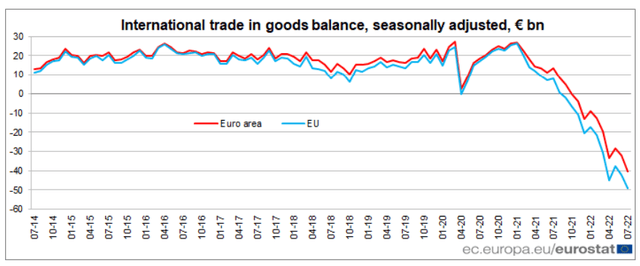

An ominous sign of this is the trade data, where the EU traditionally used to enjoy a steady trade surplus, while it is now battling a widening trade deficit gap.

Eurostat

As the EU continues to bid up the price of imports such as LNG, where the likes of China are re-selling LNG that is being delivered as part of long-term contracts, it is creating a vicious cycle, where the euro is weakening, the costs of production are rising, leading to EU goods becoming uncompetitive, leading to a widening trade gap, which in turn leads to further weakening of the euro. We are most likely just at the early stages of it. Other factors, such as Russia’s refusal of payments in euros by third parties are starting to take a big chunk out of international FX market demand for euros. There is no telling where this trend will take the EU economy.

Other early indicators of trouble include the decline in industrial production in certain sectors, such as in petrochemicals as well as metals. Aluminum production for instance has been cut from 4.5 million tons of total EU smelting capacity to 3.5 million tons. Fertilizer production is about 70% below capacity, as reported by Bloomberg. At some point, the EU may become a major net importer of fertilizers as well as metals, as its own production shrinks and will at some point permanently shut down, which should lead us to contemplate what net effect it will have on the trade data trends we are seeing.

Despite the natural gas demand destruction that has taken place in the industrial sector already, as evidenced by the numbers we are seeing in certain industries, it seems that it will most likely not be enough, as some countries such as Germany are predicting that they will completely run out of natural gas this winter or early spring. Clearly, there is far more demand destruction ahead, which is why the Deutsche Bank forecast of a 2.2% economic contraction for the eurozone next year may in fact be somewhat overly optimistic.

Investment implications

Russia’s recent announcement that it will back the referendums of four regions in Ukraine to join Russia, which came together with a mobilization plan, suggests that there is no end in sight to this conflict. Russia is digging in for a long conflict, announcing a boost to manpower, together with a call on its military industry to ramp up production. Massive, open-ended military hardware and financial support for Ukraine, as well as other forms of support, will keep it fighting for the foreseeable future. The EU-Russia economic rupture will thus continue unabated, with economic consequences being felt accordingly.

The current energy crisis, centering around a lack of adequate natural gas supplies will most likely be amplified once the Russian oil import ban will go into effect in just two months. That will be followed by a ban on Russian refined product imports in February. There is a chance that this move will lead to a regional liquid fuels crisis, that will come on top of the current natural gas crisis that the EU is facing, as some countries, including the US, might limit by law the volume of refined products such as diesel that it exports, in order to protect its own consumers.

VGK is down almost 30% YTD as I write this, and it may therefore make it on the radar of investors as an enticing investment opportunity. I would caution against seeing it this way, given that the EU’s economic woes are just starting to emerge. Aside from recent economic growth downgrades, and worsening macro indicators, we are also seeing potential systemic risks emerging, with a liquidity squeeze potentially totaling 1.5 trillion euros in its energy markets. Looking forward, there are no prospects for improvement, while the ECB is increasingly being squeezed between a surging inflationary crisis, a plunging euro currency, and the need to continue providing support to certain national sovereign debt markets that find themselves entering this crisis with massive debt loads that need to be rolled over at an interest rate that will not create an interest payment explosion crisis. Then, there is also the plunging EU economy that needs support.

The EU is entering a long and deep economic emergency, meaning that this is not the time for broadly diversified exposure to the region, which is what VGK offers. There are potential opportunities for some stock picking. I personally like the prospects of green hydrogen startup Fusion Fuel (HTOO), as I pointed out in a recent article. On the other hand, I recently sold my last remaining BASF (OTCQX:BASFY) shares from my portfolio. I will consider taking a second look at it perhaps much later on when there will be some glimmers of light at the end of the very dark tunnel that the EU economy is now just entering. Perhaps I will also take a second look at VGK then, but right now there is no point, because this is just the beginning of the EU economic crisis, and there is no telling just how bad it will get.

[ad_2]

Source links Google News