Main Thesis

The purpose of this article is to evaluate the SPDR Portfolio S&P 500 High Dividend ETF (SPYD) as an investment option at its current market price. This is a fund I have owned for a while, but has been disproportionately impacted by the recent equity sell-off. Despite this stark under-performance, I view the short-term weakness as a great time to add to my position. Specifically, SPYD now yields a healthy 4.7%, which is up markedly from my last review due to a declining share price and robust dividend growth (on a year-over-year basis). Furthermore, the fund’s top sector is Real Estate, which is a top-performing sector this year, a trend I believe will continue due to its primarily domestic focus amidst on-going trade disputes. Finally, high-yielding stocks are quite cheap compared to lower-yielding stocks, based on their historical trading spreads. With interest rates likely to decline further, I expect high yielding funds like SPYD to perform well going in to 2020.

Background

First, a little about SPYD. The fund is managed by State Street Global Advisors, and its stated objective is to “provide investment results that, before fees and expenses, correspond to the total return performance of the S&P 500 High Dividend Index”. SPYD currently trades at $35.87/share and yields 4.67% annually, based on the last four dividends. I covered SPYD in early June, when I reiterated a long-term bullish position on the fund. Since that time, SPYD has not performed well, and it has markedly under-performed the S&P 500, as shown below:

Source: Seeking Alpha

However, given my belief that this fund could be a core, long-term holding, I wanted to re-examine it to see if anything has markedly changed over the past few months to warrant a shift in opinion. After review, my opinion remains the same, and I view this recent pullback as a good opportunity to purchase more shares, and I will explain why in detail below.

The Value Is There

My first point with respect to SPYD relates to the current valuation. This is similar to what I discussed during my June review. Clearly, I was too early in declaring SPYD a buy, due to its noticeable sell-off. However, I did note that SPYD was not “cheap”, but rather cheaper than the broader market. Despite that reality, SPYD has fallen further than the S&P 500. Because of that move, SPYD is even less expensive than the S&P 500, and its dividend gap has widened as well. In fact, SPYD is now almost 38% cheaper than the S&P 500, which is up from around 24% cheaper in June, as shown in the chart below:

| Asset | SPYD | S&P 500 |

| Dividend Yield in June Review | 4.31% | 1.90% |

| P/E in June Review | 16.3 | 21.4 |

| Current Dividend Yield | 4.67% | 1.93% |

| Current P/E | 13.4 | 21.6 |

(Source: State Street, Multpl.com)

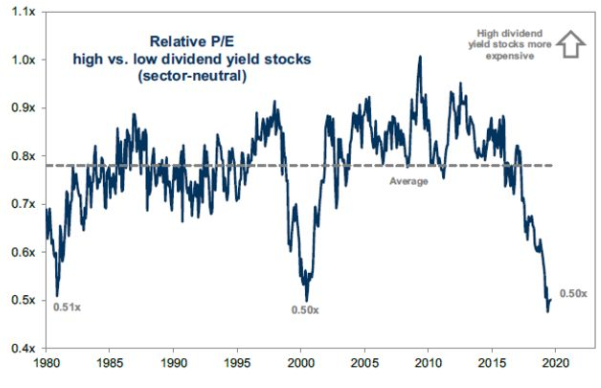

As you can see, the differential is considerable. And if this looks like it is a bit too extreme, it may be because it is. According to research conducted by Goldman Sachs (GS), and reported by Bloomberg, the relative P/E of high-yielding dividend paying stocks compared to low-yielding dividend paying is at a level not seen in roughly twenty years, as shown below:

Source: Bloomberg

Source: Bloomberg

As you can see, this divergence helps explain SPYD’s performance gap. Investors seem very willing to pay up for lower-yielding stocks right now, and are shunning some of the value, higher-yielding alternatives.

Of course, this trend has not played to SPYD’s favor of late, but I believe that it is due for a turnaround. As the graph illustrates, high-yielding equities rarely trade at this steep of a discount compared to their lower-yielding counterparts. As investors look to seek out value and yield, this is an area that is sure to draw some focus. Given how wide this valuation gap is, if we see even a modest reversal back to historical norms, that would translate to a very profitable trade for new SPYD positions.

Dividend Growth Is Present

My next point touches on one of the reasons for the wide divergence in valuation for high dividend yielders, as discussed above. A primary concern among some investors is they do not expect much in terms of dividend growth going forward, given the potential for a slowing economy. While this certainly does remain a risk, SPYD has shown that the current economic environment is not preventing it from increasing the dividend stream. In fact, its annual dividend growth rate is actually quite impressive, as shown below:

| Jan – June 2018 Distributions | Jan – June 2019 Distributions | YOY Growth Rate |

| $.72/share | $.80/share | 11.1% |

Source: State Street

As you can see, SPYD has been delivering in terms of dividend growth so far this year. Aside from the obvious benefit of raising the current yield, this figure gives me confidence that the fund is holding the right types of assets for our current climate. Clearly, the companies within the portfolio have been growing their profits and are able to deliver higher payouts to investors. Considering the volatility we have seen in 2019, this metric helps me feel comfortable adding to SPYD without worrying about deteriorating underlying conditions.

Declining Interest Rates Should Help High Yielders

Another point on SPYD has to do with the interest rate forecast, which is currently quite dovish. With the Fed recently cutting interest rates, investors have resumed the strategy of locking in higher current yields, in anticipation that yields may move lower still. While SPYD has not benefited much from this trend over the past month, I expect it will soon as the rush to treasuries is looking a bit over-done. With the 10-year treasury sitting at 1.58%, there seems to be little incentive to buying in to those assets now. While treasuries provide a shelter from equity exposure, the fact that the 10-year was sitting at 2% under a month ago tells me that this momentum could stall out a bit from here. Investors may be forced to consider upping their risk tolerance in order to capture a more meaningful yield, and SPYD could be a way to do just that.

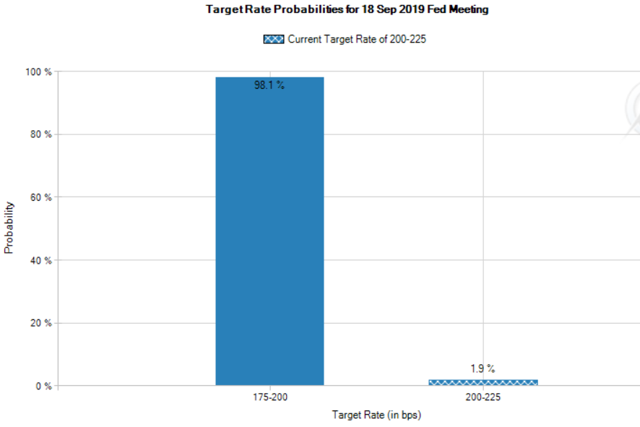

And investors are likely going to need to act sooner rather than later. While the Fed has stopped short of forecasting any further rate cuts going forward, the market is widely expecting another cut at the September meeting, less than four weeks away. In fact, another cut is being priced in at a near certainty, according to date compiled by CME Group, shown in the graphic below:

Source: CME Group

Source: CME Group

My takeaway here is this is positive for SPYD, because it signals interest rates are going to continue moving south. While this could benefit equities of all types, I like the fact that SPYD’s yield-spread with the Fed’s rate has widened considerably, and is expected to widen further. It makes the fund look especially attractive by comparison, and I believe it will begin to draw investor interest at the expense of broad market funds. For those with an income focus, this interest rate outlook is not a good sign, and those investors are going to need to act to lock in higher yields before rates move even lower. I expect SPYD to be a primary beneficiary of this reality over the next few months.

Real Estate: Less Trade Sensitive

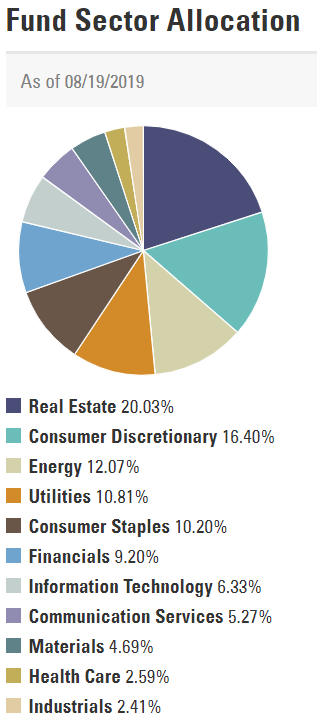

A final reason for my optimism on SPYD has to do with Real Estate being the top sector by weighting. This exposure comprises over 20% of total fund assets, as shown below:

Source: State Street

Source: State Street

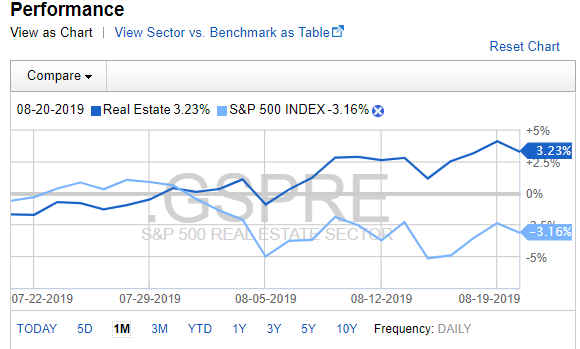

This exposure has benefited SPYD, especially in the very short-term. In fact, as trade concerns flared up again making headlines, Real Estate has markedly out-performed the broader market over the past month, as shown below:

Source: Fidelity

Source: Fidelity

There are a couple of reasons for this divergence in performance when trade concerns dominate the market. One, Real Estate holdings often sport above-average yields, so investors often rotate in to this sector for defensive positioning during market sell-offs. Two, the revenue streams (and profits) within the sector are predominately obtained domestically. This feature makes Real Estate less trade sensitive than the average market sector, and can be used to hide from trade-induced volatility.

My overall takeaway here is this exposure really fits my risk-tolerance level right now. In fairness, the Real Estate sector is looking quite expensive, so I am reluctant to buy in to an ETF with a single-sector focus. However, this is precisely an area I want to own when trade headlines drive the broader market lower, as Real Estate stocks are often moving higher under those conditions. Therefore, I see SPYD’s high weighting to Real Estate to be a perfect balance for me personally. I get a fair amount of exposure, without going “all-in” on a pricey sector.

What Could Go Wrong?

While I continue to recommend SPYD, the last few months have made it clear that this is not a risk-free proposition. The market has not been favoring this fund, despite multiple positive attributes. With this in mind, I see two primary risks for the fund going forward that I will discuss.

One, the expectation of lower interest rates in the near-term is priced in to the market right now, and that has benefited higher-yielding sectors. If this forecast proves inaccurate, and the Fed declines to adjust rates further, defensive, higher-yielding sectors such as Utilities and Real Estate could feel the brunt of the pain. Investors have been moving in to these asset classes on the premise they need to lock in higher yields, and that point becomes less relevant if rates remain in neutral (or increase). Therefore, the next few months will be pivotal to see if these currently profitable trades will remain profitable heading in to 2020.

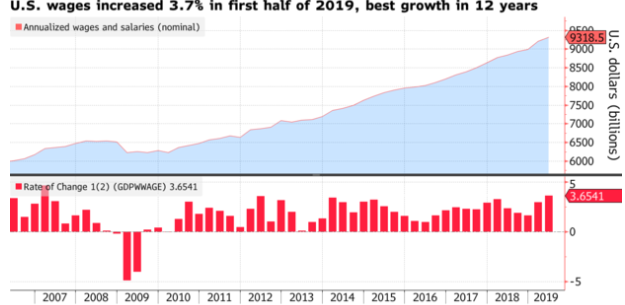

Two, while Real Estate is the fund’s largest sector by weighting and is not very trade sensitive, the same cannot be said for its second largest weighted sector, which is Consumer Discretionary. At over 16% of fund assets, this is an area that is disproportionately impacted by tariff talk, and will be greatly hurt if consumer spending begins to falter. On the positive side, U.S. wages are rising at a healthy clip, as shown below, which is helping contribute to continued strength in the consumer spending figures:

Source: Bloomberg

Source: Bloomberg

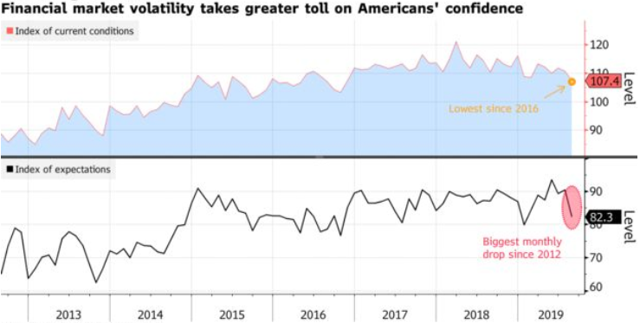

Clearly, the American worker is on pretty solid footing, but negative trade headlines can have a negative impact on actual spending. Recent surveys from the University of Michigan, reported by Bloomberg, do show that household confidence has taken a hit, with expectations of future economic conditions dropping due to trade-induced volatility, as shown below:

Source: Bloomberg

Source: Bloomberg

While we do not know yet if the American consumer is going to hit the brakes on spending, the concern that they might is taking its toll on the Consumer Discretionary sector.

In fairness, I believe that consumer spending is going to hold up fairly well going forward, as employment numbers and wage gains are the real story here, not negative headlines. But if the trade disputes drag on with no resolution, expectations will likely continue to drop, and that is bound to have some type of impact on discretionary spending, which will hurt SPYD overall.

Bottom Line

Despite some short-term weakness, I remain convinced SPYD is a solid core holding. The recent slip in share price provides an attractive entry point in to a fund that yields over 4.6%, has plenty of Real Estate exposure, and has a valuation markedly cheaper than the broader market. Looking ahead, I expect investors to resume their hunt for above-average income streams, and SPYD will likely draw plenty of interest. Therefore, I remain long SPYD, and would recommend investors give the fund serious consideration at this time.

Disclosure: I am/we are long SPYD, SPY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.