cemagraphics

General overview

Leveraged bets on market upside have had a bumper year. Perhaps borne out of tendency to see markets through rose tinted glasses, despite copious amounts of red on the screen, leveraged ETFs have surprisingly flourished in 2022. My outlook for the S&P 500, which underpins (NYSEARCA:SPXL) Direxion Daily S&P 500 3x Shares ETF, is generally neutral.

With market leaders like Direxion Daily building a solid product offering, tactical traders are spoilt for options in the exotic ETF market, dominated by leveraged plays.

We have had a war, a pandemic, eye-watering inflation, a commodities boom, a crypto bust, and crippling food price escalation. Monetary tightening has seen risk-off sentiment seep throughout capital markets, dampening investor sentiment for capital deployment. In summary, 2022 has hardly showcased vintage upside for most active money managers.

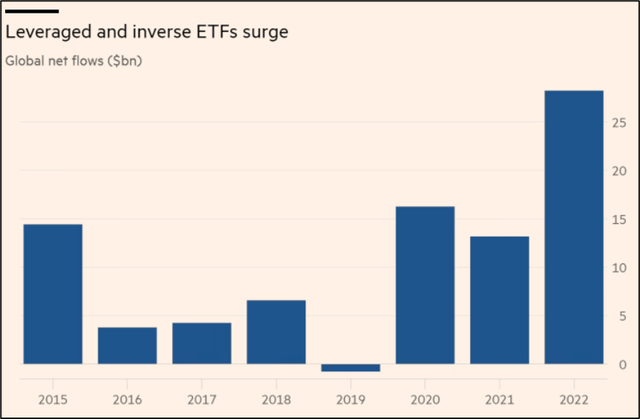

That makes it more puzzling that leveraged bets on indices, particularly on the bullish side, have had a stellar year in terms of inflows. Record sums have poured into risky leveraged ETFs, oft dominated by Direxion Daily, despite the collapse in risk capital.

Leveraged ETFs, engineered to accentuate both upside and downside, have remained a staple in the money manager’s toolbox during the year. According to Morningstar research, $28.3B has been pumped into leveraged and inverse leveraged exchange traded funds year to date, albeit ~ 5% of all ETF purchases. That’s double the money invested one year earlier.

Financial Times

Fund inflows in leveraged and inverse ETFs have skyrocketed this year

Most of this money has found its way into long leveraged vehicles, the likes of Direxion Daily S&P 500 3x Shares ETF (SPXL). Perchance from an abundance of optimism, it appears money managers have been net-long the S&P 500, despite market tumult pushing its to the downside.

However, let’s not discount a prime utility of leveraged wrappers – the ability to hedge out risk. For example, aggressively shorting 300 shares in the index can be dampened by a long-leveraged position in an ETF like the one described above. That’s why fund inflow and outflow data, isolated on its own, provides perhaps a skewed picture of investor outlook.

ETF composition

Direxion Daily S&P500 Bull 3x shares ETF is a leveraged bet on near-term upside in the S&P 500 index. De facto, this is a short-term tactical trading tool used to build immediate 3x exposure to the index.

It should by no means be treated as a long-term holding in any basket of risky assets. It is often over-the-counter futures and other derivatives contracts used by the fund manager to provide the package its artificial lift.

The underlying benchmark – the S&P 500 – is one of the most well-known equity market indices in the world. It is a market cap weighted index tracking the stock performance of the 500 largest exchange listed US stocks. There is concentration here as the top 10 equities roughly make up one third of the index.

Daily Rebalancing

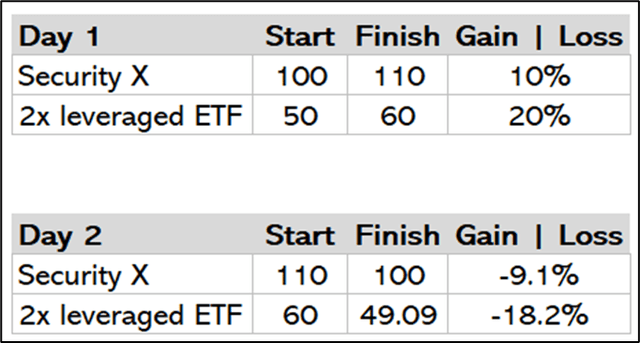

Daily rebalancing of the product implies that holding periods greater than one day are unlikely to resemble 3x exposure to the S&P 500. It is one of the key important points to takeaway from any leveraged ETF. For simplicity, consider a new theoretical security X trading at $100 and its 2x leveraged ETF trading at $50 (both in this case fictitious).

Spreadsheet developed by author

If security X rises 10%, to $110 the next day (10% gain), then my 2x levered ETF will increase by 2x of that amount or 20% to $60. However, if security X then declines back to $100 on day 2 (a decrease of -9.1%), my 2x leveraged ETF will decline by -18.2%.

That translates into a 2-day loss for my 2x leveraged ETF of -1.8% despite the underlying security effectively round-tripping.

For products tied to underlying securities with flat to down-trending bias, (an example is oil which is roughly the same price it was around 2010), the rebalancing effect described above would have a detrimental effect to returns over time.

Compounding

Compounding associated with leveraged ETFs can be either positive or negative. When market volatility is high, that compounding will tend to be negative.

Oppositely, compounding will tend to be positive (for example, generate returns that are greater than 3x the returns of the cumulative index returns) when volatility is low.

In any case, the key thing to remember is both daily resets and compounding, either positive or negative, will work together with the end-result being a leveraged product which is somewhat imperfect.

Spreadsheet developed by author

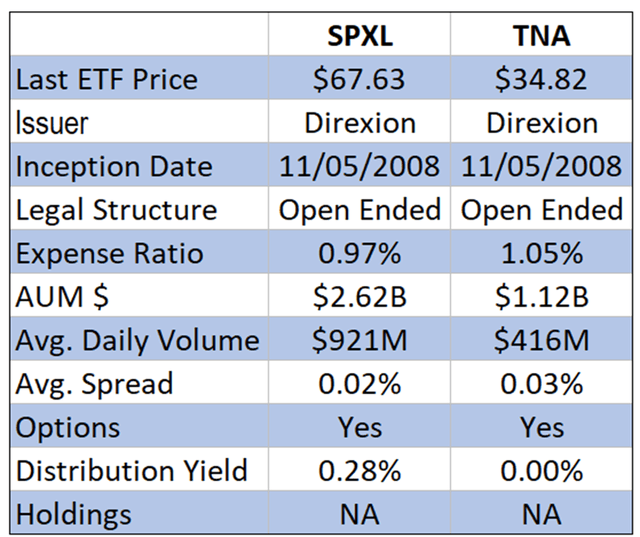

Comparative analysis SPXL v TNA

Direxion Daily has a comprehensive range of ETFs all geared to suit specific needs. I recently covered (TNA) – which focuses on leveraged bets for small cap indices. While the underlying is different, the general mechanics underpinning the ETF are very similar.

Risk Factors

Leveraged ETFs while being useful tactical trading tools, should not be the central underlying asset to any portfolio. These products are aimed specifically at short-term tactical trading or hedging out risk. Due to their synthetic nature, they often hold counterparty risk (OTC derivatives are used to provide the ETF gearing).

That means in times of extreme market stress, a failing counterparty backing the derivative could effectively bring the product down. It is unlikely, but we have seen ETFs explode in the past. Other key risks mentioned earlier include daily product resets and the effects of compounding.

Key Takeaways

ETFs have increasingly become advanced while gaining widespread popularity. Once somewhat vanilla and arcane, ETFs today not only assist in managing very specific risk but some too are very exotic, treating a niche or addressing a given problem.

Direxion Daily’s package of leverage ETFs do this – they are great for very quick punctual upwards or downwards exposure or even portfolio hedging.

Just don’t hold onto them or take them home to mom and dad.