G0d4ather/iStock via Getty Images

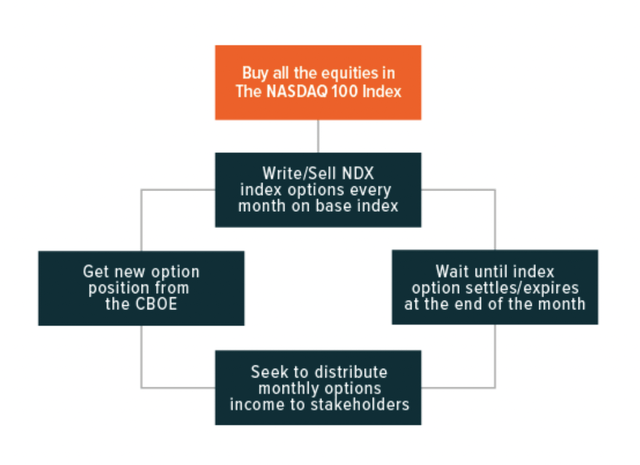

The Nasdaq 100 Covered Call ETF (QYLD) writes covered call options on the Nasdaq-100 Index (QQQ). The ETF distributes the income generated from selling those calls on a monthly basis. Historically, this type of strategy produces higher yields in periods of volatility, and we are in one of those right now.

QYLD structure and strategy QYLD’s Covered Call Options, Explained

I am not trying to pick a bottom in the triple Qs here, though they may be going through a correction and bottoming process. This strategy primarily benefits from high volatility, with the underlying outperformance of the equities being secondary. A clear turnaround would likely mitigate volatility, as well as get the portfolio called out of positions, which would mean the QQQ is likely to outperform in a continuing bull market.

QYLD is likely to outperform if there is a period of high volatility, with the QQQ staying within a sideways trading range, or a slowly declining one. Actual underperformance will depend upon how you receive those monthly distributions. For example, one could redeploy that capital back into the ETF through a DRIP, or buy calls, or possibly use it for living and travel expenses.

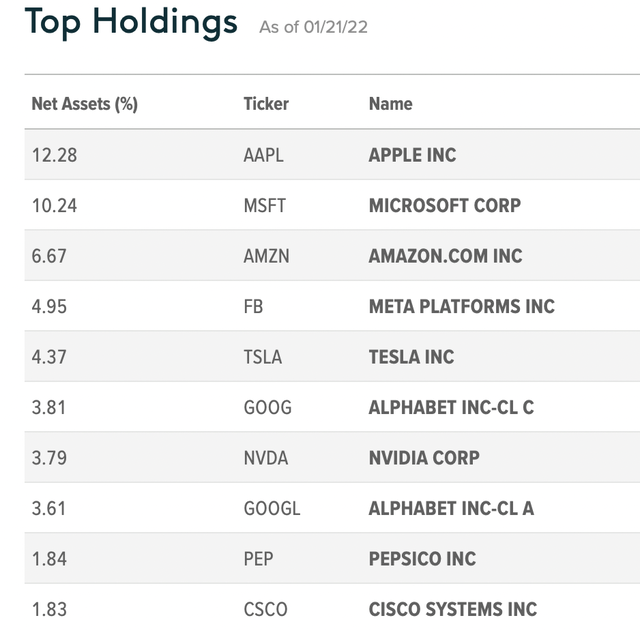

QYLD’s top holdings:

QYLD top 10 holdings QYLD info page

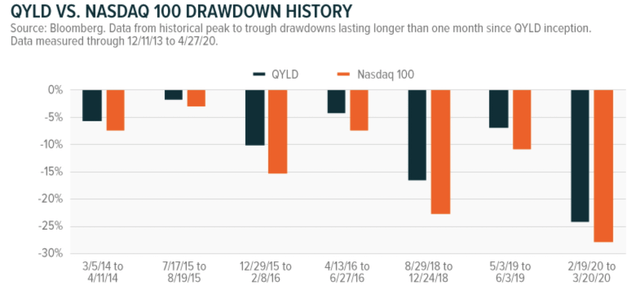

During an actual drawdown, QYLD is likely to outperform QQQ. The difference may be significant and is likely to increase over time. The potential for outperformance is capped each month by the premium received.

QYLD in drawdowns QYLD info page

Volatility appears to be either peaking or entering a new phase of increased volatility. Either situation should bode well for QYLD. Implied volatility is a crucial factor in the pricing of options, so increased volatility should result in increased relative options pricing. Because of this QYLD’s payout will vary from month to month.

Risk

Rising interest rates are generally seen as a risk to high tech equities. This is largely because future profitability is worth less when compared to a higher present risk-free return. Those companies with high quality present income are less vulnerable to interest rate risk, but still often susceptible to it.

Greater volatility may mean increased income, but it may also mean increased agitation. This is true for not merely this ETF, but also the underlying QQQ. Slightly outperforming a declining asset can still result in significant losses.

QYLD has a 0.60% percent management fee, which is significant for a core holding. For this reason, this ETF is best used as a supplement to a core holding. That fee, though high for a passive strategy, is reasonable in consideration of the call writing strategy that is being implemented, as well as the relative income being distributed.

Conclusion

QYLD is an uncorrelated method of generating income from high tech equities. Covered call strategies may outperform in flat to down markets, which we may be entering. QYLD appears likely to provide significant income along with the possibility of appreciating from here, even if interest rates do continue to increase.

QYLD appears best suited as a supplement to a portfolio that already has a significant position in equities, including high tech, as well as a portfolio of income-producing assets. QYLD allows that portfolio to enhance income and also maintain some exposure to the technology sector’s potential to outperform.