Editor’s note: Seeking Alpha is proud to welcome Michael O’Mara as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to the SA PRO archive. Click here to find out more »

The advent of artificial intelligence (AI) and robotics-based technologies in recent years has been nothing short of phenomenal with many industry experts indicating it may usher in a Fourth Industrial Revolution. When considering the disruptive potential these technologies pose, many are left speculating which industries will be most upturned by their application. From asset management to healthcare, AI is redefining the inner-workings of many industries.

AI presents a tremendous opportunity for investors with estimates indicating that AI could increase the global GDP by nearly 16 trillion by 2030. AI and robotics-based solutions are attractive options for companies looking to reduce labor costs through process automation. For this very reason, it’s plausible to infer that investments in and robotics will not only continue to outperform in the current bull market but will remain robust in recessionary environments as industry need for reductions in labor costs will increase.

Individuals can passively hedge against concerns that their professions may be rendered obsolete through developments in AI and robotics by backing these technologies with personal capital. One inherent risk associated with investments in this space is undoubtedly the uncertain nature of policies associated with the implementation of these technologies. While it appears that certain industries could be entirely upturned by automation and intelligent learning, it is worth noting that there is a large element of uncertainty associated with the political and social implications of the matter – implications which remain unknown at this point in time. For this reason, it may be prudent for investors who are looking to capture growth associated with AI and robotics to take a sectoral indexing approach as opposed to narrowing investments into specific applications and individual companies. This article examines the indexing-based options investors can take in order to gain exposure to AI and robotics in their portfolios.

AI and Robotics themed ETFs:

IRBO

Expense Ratio: 0.47%

(Source:www.etf.com)

iShares newly launched AI and robotics ETF, iShares Robotics and Artificial Intelligence ETF (NYSEARCA:IRBO), is an attractive option for investors who are looking to gain broad exposure to AI and robotics. With its top 10 holdings representing 15.33% of the total fund, IRBO is a strongly diversified fund. IRBO places more weight in software as opposed to industrial automation/robotics with software representing 72% of fund holdings. Furthermore, IRBO’s top two countries in terms of representation are the United States and Japan at 58% and 11%, respectively.

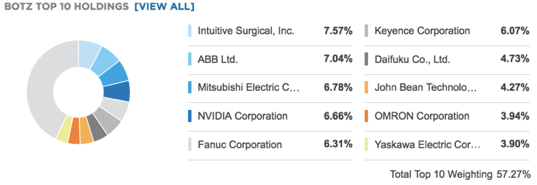

BOTZ

Expense Ratio: 0.67%

(Source:www.etf.com)

Another indexing option is Global X’s AI and robotics themed ETF (NASDAQ:BOTZ). In comparison to IRBO, BOTZ takes a more aggressive allocation approach with its top 10 holdings representing nearly 58% of the total fund. Moreover, BOTZ places less emphasis on software and focuses more on automation and robotic application with industrials representing 63% of the total fund. The fund’s heavy robotics and automation weighting can furthermore be seen through the fact that Japan is the funds top country in terms of holding at 43%.

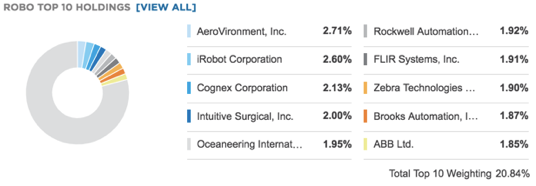

ROBO

Expense Ratio: 0.95%

(Source:www.etf.com)

Investors looking to gain moderate exposure to both software and robotics should consider Global Robotics and Automation Index ETF (NYSEARCA:ROBO). In comparison to IRBO and BOTZ, ROBO takes more of a hybrid allocation approach with software and robotics with holdings equitably split between both. Additionally, ROBO maintains a fairly diversified position with its top 10 holdings representing 21% of the fund. ROBO’s primary drawback is its high expense fee at 95 basis points.

Alternative “plays” on the space:

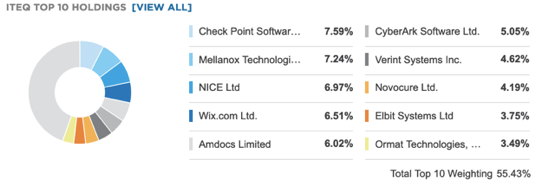

ITEQ

Expense Ratio: 0.75%

(Source:www.etf.com)

Despite the fact that Israel is on the forefront of many secular technological trends including agri-tech, cyber security, and autonomous vehicles, the Start-Up Nation remains highly underrepresented in international funds and individual investor’s portfolios. I recommend BlueStar TA-BIGITech Israel Technology ETF (NYSEARCA:ITEQ); many of its holdings are either directly involved in AI development or positioned to be intriguing indirect players in the space (i.e. CyberArk Software Ltd (NASDAQ:CYBR)). Furthermore, many of ITEQ’s holdings trade at significantly lower valuations than American tech companies and offer noteworthy upside potential. American tech companies are taking note of Israel’s dominance in artificial intelligence and computing – NVIDIA (NASDAQ:NVDA) recently acquired Mellanox Technologies (NASDAQ: MLNX) following Intel’s (NASDAQ: INTC) Mobileye acquisition.

The Qs

Expense Ratio: 0.2%

(Source:www.etf.com)

Invesco’s (NASDAQ:QQQ) ETF is a play on the usual American suspects with Microsoft (NASDAQ: MSFT), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), and Google (NASDAQ:GOOG) comprising nearly 40% of the fund’s total holdings. While the fund has significant exposure to American tech “disruptors” pioneering artificial intelligence, consumer cyclicals and healthcare respectively make up 21% and 9% of the fund.

SOXX

Expense Ratio: 0.47%

(Source:www.etf.com)

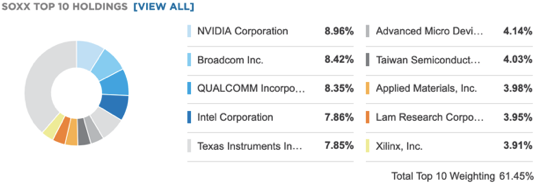

iShares PHLX SOX Semiconductor Sector Index ETF (NASDAQ:SOXX) holds companies involved in the production of semiconductors. Because data centers and various data intensive mobile applications require the chips these companies produce, the demand for these chips should increase with the growth in artificial intelligence. Numerous holdings in SOXX (NVIDIA, Intel, Texas Instruments (NASDAQ: TXN), etc) are preeminent contenders in the race to lead the self-driving revolution. NVIDIA, SOXX’s largest individual holding, has pioneered an AI supercomputing platform, DRIVE PX 2, which employs 360 vision, sensor fusion, and deep learning to help vehicles interpret and learn from their surroundings. NVIDIA has brilliantly secured an array of strategic self-driving partnerships (Toyota (NSYE:TM) and Honda (NYSE:HMC) are amongst these) and proves to be one of, if not the top competitor in this space. While Intel previously was not considered to be a top self-driving competitor, their acquisition of Mobileye has catapulted them to the forefront of the self-driving race due to the strength of Mobileye’s vision-based advanced driver-assistance systems (ADAS). While the self-driving space is highly competitive (NVIDIA and Intel are in an absolute bloodbath with both companies racing to develop the superior self-driving platform) and is still largely in its infancy, companies involved in the production of self-driving systems are going to completely gut traditional auto companies and SOXX is postured to benefit. For this reason, SOXX is a tremendous way to gain exposure to both the self-driving revolution and broader artificial intelligence space.

Associated Risks

Currently technology stocks comprise 26% of the S&P 500 and are trading at high forward price to earnings ratios – indications that the sector could be overvalued. Technology stocks have been on a decade long bull run with many investors continuing to funnel money into “FANG”, a popular acronym Jim Cramer coined for Facebook (NASDAQ:FB), Amazon, Netflix (NASDAQ:NFLX), and Google in 2013. Technology is historically a cyclical sector. While many investors took catastrophic haircuts after making malinvestments during the 2000 tech bubble (a plethora of “disruptor” companies such as Webvan did not survive), investors who purchased broad swaths of companies under the protection of an index recovered their investments. While indexes always recover, the same cannot be said for individual companies.

Conclusion

AI poses a once in a lifetime investment opportunity for investors. While individuals can elect to play individual stocks which they believe are postured to do well, I believe it is most prudent to take an indexing-based approach as this will allow investors to capture growth opportunities across the entire sector at a fraction of the risk. Barring QQQ, the outlined indexing options ensure that investors gain exposure to foreign companies which not only provide added diversification but have established themselves as top notch contenders in the race to dominate AI and robotics. Japan in particular is a leader in industrial automation and robotics (these technologies are vital to their future due to their declining population) and thus is one of the highest represented countries in BOTZ and ROBO. Of the AI and robotics themed ETFs, IRBO has the lowest expense fee and superior diversification. Additionally, IRBO places more emphasis on software as opposed to robotics. This is important to note because while robots and industrial automation are predicated on software, robots and industrial automation hardware are not a requisite for software. Logically it follows that software should be favored over robotics and industrial automation from an investment standpoint.

Disclosure: I am/we are long IRBO, SOXX, ITEQ, QQQ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.