[ad_1]

About two years ago, a friend introduced me to Scott Acheychek, President of REX Shares. REX creates unique ETPs that traders may find compelling. We caught up a couple weeks ago and I suggested that readers may want to learn more about REX Shares, and so we set up a brief interview.

Tell me about REX Shares, Scott.

Sure thing. REX is focused on bringing first-to-market access products to the market. This can be accomplished by creating brand new underlyings that have not been issued previously or by analyzing existing products and trying to improve upon them. We are traders and structurers at heart so we look to create products that we would trade ourselves.

Our founder/CEO, Greg King, is a true pioneer in the ETP world. He created the iPath ETN platform at Barclays (NYSE:BCS), created the firm Velocity Shares and had business development roles at firms like Global X and Credit Suisse (NYSE:CS). Throughout his entire career he innovated access for traders, and that is our mission at REX Shares.

REX appears to be focusing its product lines around “MicroSectors.” Can you explain to readers what MicroSectors are designed to do, and how they differ from other sector-based ETPs?

Our goal with MicroSectors is to provide dedicated exposure to specific sectors of the equity market. We want to give investors and traders a way to trade products that contain the names they know in the sectors they follow. This can be accomplished a couple ways. Our first set of ETPs is linked to the FANG+ index, which is the ten most innovative tech names as determined by our index partner, NYSE.

Another suite of products we launched is linked to what we call Big Oil. It’s the largest companies focused on the energy sector. These two suites are interesting because they are dedicated exposures to the biggest names within the popular energy and tech sector that is unlike anything that is in the market at this time.

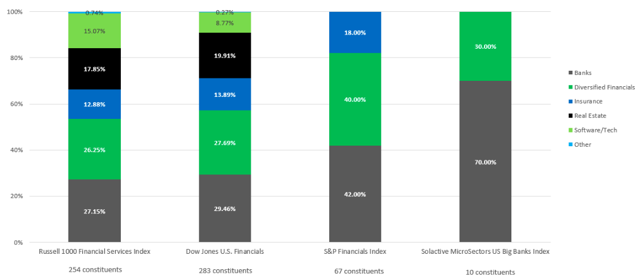

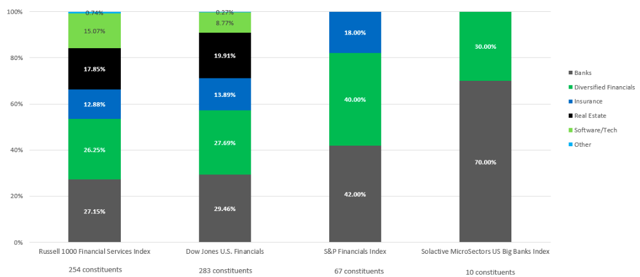

Targeted access can also be accomplished by creating a “microsector” within a sector. For example, when we look at the indices underlying Financial Sector products and even some bank-named products, we see a variety of different types of firms. So we wanted to create a suite of products with varying daily leverage exposures (3x, 2x, -1x, -2x, -3x) linked to just the biggest banks in the U.S. These ETNs contain names like C, GS, BAC, JPM, etc.

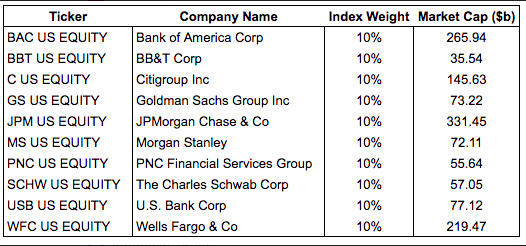

SOLACTIVE MICROSECTORS U.S. BIG BANKS INDEX HOLDINGS:

Source: Bloomberg, market cap data as of 3/29/2019

Let’s zero in on the Big Bank suite of products you have. Tell me about BNKO.

This is our edge. Many of the popular financial sector indices contain all sorts of industries like banks, insurance companies, REITS, credit card companies, exchanges and even software! Even indices that claim to be a Banks index contain lending and insurance companies.

Many active traders take positions in the financial sector with a view on rates or news generated by Big Banks. I find it nuts that many of these products have large REIT allocations which perform quite differently than banks. We believe when some people are trading the financial sector, it’s driven partly or largely on views about the Fed, rates, macro, and news from BoA, Citi, Morgan Stanley (NYSE:MS), GS, JPMorgan, etc.

Source: Bloomberg, as of 3/31/2019

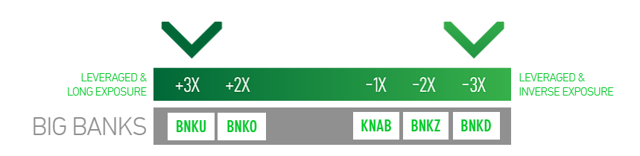

BNKO is our 2x Big Banks ETN. We have created a variety of leverage options so that traders and investors can obtain the level of risk they are most comfortable with; BNKU is 3x, BNKD is -3x, BNKO is 2x, BNKZ is -2x, and KNAB (Bank spelled backwards) is -1x. Each of these levered products resets daily.

Source: microsectors.com

So you strip out the components of a more traditional index that long-term, buy-and-hold investors may be interested in, and target the exposures that sophisticated traders may want. Would you ever launch 1x?

Exactly what we are doing. I think it’s an incredible alternative to the existing line of Leverage and Inverse products linked to Financial Sector indices.

Regarding 1x, we are constantly analyzing the ETP market place and listening to our clients. If we feel the demand for 1x is real, then we will try to work with our partners to do so.

Let’s talk about the leverage. Can you explain to readers how the 2x leverage on BNKO works.

This is very important. BNKO and our Big Bank linked Leveraged and Inverse ETNs are reset daily, the leverage is based on daily moves. So ignoring trading costs, expenses, etc. if the Big Banks index starts at $100 and ends the day at $102, the 2x daily reset product would be up 4% (2 times the 2% gain). If on the next day the index closes back at 100, the index is exactly flat but, and it’s an important but, the investment in a 2x resetting daily product would be down slightly.

There’s also the saying the trend is your friend (or enemy if going in wrong direction) in that the leverage can compound in your favor if the market rallies consistently for your bullish trade. We go through detailed scenarios in our prospectuses for all of our products.

My goal is for REX to be a leader in education for Leverage and Inverse products, ins, outs, how they can be used, etc. We plan to regularly publish pieces on different sectors and highlight what all of the leading indices contain.

You and I have joked how people still think the NDX is a pure tech play. I want to highlight to investors how that index contains companies like Pepsi (NASDAQ:PEP), Starbucks (NASDAQ:SBUX), Costco (NASDAQ:COST), etc. all in its top 25 holdings. If you want a tech trade you should look for a pure tech fund. These pieces will be regularly added to REX Shares | Insights

So the big-bank suite of ETPs you offer can get traders a variety of exposures then. Traders just step up and pick the direction (long or short) and the leverage option they want.

That is exactly right. We wrap the ten largest banks in the US in one index and offer products that have a variety of leverage and inverse leverage exposures; 3x (NYSEARCA:BNKU), 2x (NYSEARCA:BNKO), -1x (NYSEARCA:KNAB), -2x (NYSEARCA:BNKZ), -3x (NYSEARCA:BNKD).

With such a defined basket, especially with such popular names, we felt equal weight was the best way to gain exposure rather than market cap weighting which would be dominated by a couple massive banks.

With five different products out around this big-bank theme, what’s your take on liquidity? It’s difficult enough to introduce one niche exchange-traded product to market, let alone an entire suite.

Great question. First, liquidity is really determined by the liquidity of what is inside the product. Market makers make markets based on how well they can get in and out of whatever is inside an ETF or ETN. If it’s a difficult security or the security trades on a foreign exchange that is closed you could see wide two ways to reflect that risk the trader has. If it’s a liquid underlying you’ll see tighter two ways. Now in MicroSectors’ case, our products contain large and liquid stocks. I fully expect our market makers to be able to trade significant size in our products.

Second, it’s important to note, for all ETPs, the issuer is responsible to provide the value of the underlying security in real time (the IOPV). We highly recommend all ETP traders and investors know what the security is valued at prior to placing an order to buy or sell.

We work with our MMs all the time and try to get them to be as tight as possible. I fully expect our trading volumes to grow significantly as people learn about our unique offerings and as they see that our MMs are great at what they do.

Thanks, Scott. I wish REX well as they continue rolling out these products, and I am glad that you’re putting an emphasis on trader education at your firm.

Note to Readers: Scott and I have had some pretty in-depth discussions on structural issues as it concerns the niche ETP space, so we will likely put out another, similar interview that highlights some of their new product lines and also gets into some detail on topics that hopefully interest/educate traders.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News