Bet_Noire

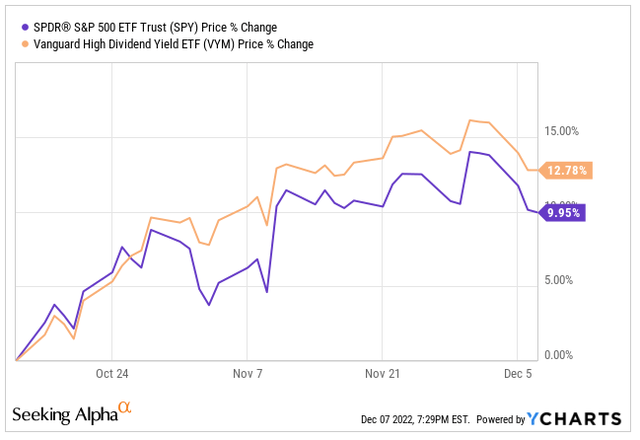

The S&P 500 (SPY) made new annual lows in October, but since then, the broader US market is up ~10%. This was as much of a relief rally as anything due to the fact the US economy has a lot of headwinds to deal with moving into 2023.

- Rising interest rates

- Slowing economic growth

- Increased unemployment

- Weakening consumer

During this relief rally we saw in the markets, which already appears to be done, I did notice something in common. Investors were using this rally to sell the rip and enter into more defensive positions.

Many of those positions are held in the Vanguard High Dividend Yield ETF (NYSEARCA:VYM), which is our focus today. Since mid-October, VYM shares are up ~13%.

ycharts

VYM is an all-around solid ETF with very stable positions at the top, which we will look at momentarily. The ETF takes a conservative approach and is passively managed, meaning it comes with a low expense ratio of just 0.06%.

Given that the S&P 500 has a lot more exposure to growth stocks and top tech stocks, and VYM is more a steady as you go ETF, less focused growth stocks and more on consistent dividend payers.

Some of the primary competitors to VYM include:

- SPDR Portfolio S&P 500 High Dividend ETF (SPYD) 3.97% yield

- Invesco S&P 500 High Dividend ETF (SPHD) 3.81% yield

- Schwab US Dividend ETF (SCHD) 3.35% yield

Top Positions

Here is a look at the top 10 positions and their weighting within VYM:

- Exxon Mobil (XOM) 3.31%

- Johnson & Johnson (JNJ) 3.28%

- JPMorgan Chase (JPM) 2.63%

- Chevron Corp (CVX) 2.55%

- Procter & Gamble (PG) 2.31%

- The Home Depot (HD) 2.19%

- Eli Lilly and Co (LLY) 2.19%

- Pfizer (PFE) 1.89%

- AbbVie Inc (ABBV) 1.85%

- Merck & Co (MRK) 1.84%

In totality, VYM has 445 positions within the ETF and these top 10 positions above make up 24% of the fund.

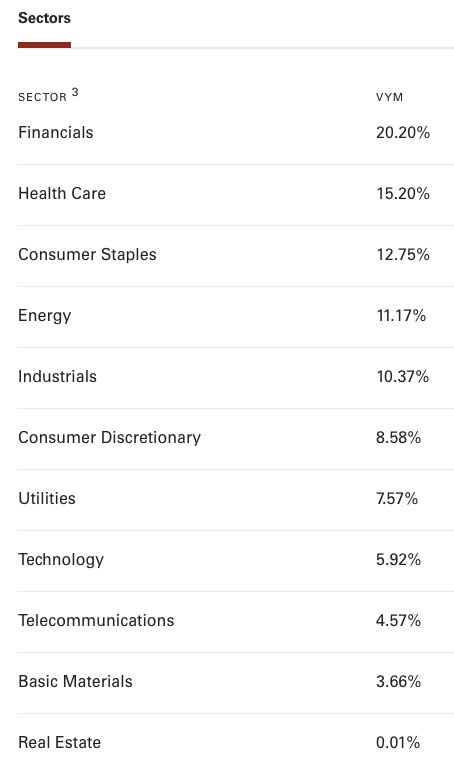

Here is a look at the sector breakdown for VYM.

Vanguard

Nearly 50% of the fund is made up of Financials, Health Care, and Consumer Staples, which all tend to lean more defensive.

The Formation Of The ETF

The fund seeks to track the performance of the FTSE High Dividend Yield Index, by using full replication technique. The FTSE High Dividend Yield Index is made up of the highest-yielding large and mid-cap stocks from the FTSE All-World Index.

As many of you know that have read my pieces in the past, I enjoy investing in REITs, and one asset class VYM does NOT invest in is REITs. That and the lack of dividend growth requirements are two reasons I do not like VYM, but I do own it as a higher yield play and have other ETFs such as the Schwab Broad US Dividend ETF (SCHD) and the iShares Core Dividend Growth ETF (DGRO) for my broader dividend growth plays.

Dividend Analysis

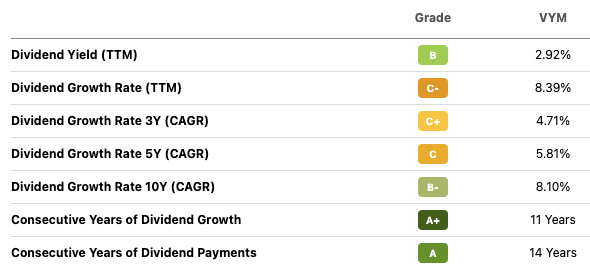

VYM currently pays a dividend yield of 2.92%, which probably does not spark you as a “high-yield” for an ETF focusing on higher yields.

Part of the story for the lower dividend yield is due to the outperformance we have seen in the fund and some of its primary sectors over the past few years, which has driven down the yield. For example, energy and health care are two of the top performing sectors over the past 12-24 months, and they also happen to be two of the top sectors within the VYM fund, which has driven down the dividend yield.

Here is a breakdown of VYM’s dividend and dividend growth over the years. Not only do we have a dividend that is usually over 3%, but over the past 10 years, we have seen a 10-year dividend growth rate of 8.1% as well.

Seeking Alpha

Investor Takeaway

Overall, VYM is a solid well-diversified ETF that focuses on high-quality investments. As of late, the fund has been outperforming the S&P 500, which is not always the case given the lower exposure to big tech, but what the fund does give you outside of dividends, is stability.

Right now, with sizable exposure to Health Care and Energy, and the economy moving towards a slowdown, these are two areas I expect to perform well regardless of those economic headwinds. VYM is a safe and reliable investment in my opinion with sound diversification, which is why I have some exposure within my portfolio.