[ad_1]

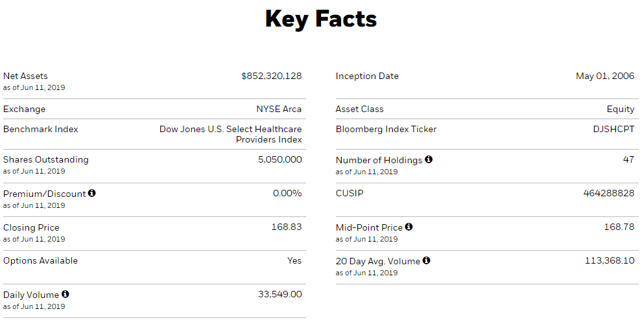

The iShares U.S. Healthcare Providers ETF (NYSE:IHF) tracks a basket of stocks with exposure to health insurance, diagnostics, specialized treatment, and healthcare industry service providers. The exchange-traded fund with an inception date in 2006 currently has over $850 million in assets under management. Only 12 of the 47 equity holdings are in the S&P 500 index highlighting the favorable differentiation of the ETF that focuses on industry factors from a number of small- and mid-cap companies. This article looks at themes in the group and presents performance and current valuation metrics for IHF’s underlying holdings.

IHF monthly stock price performance. Source: FinViz.com

Structural Tailwinds Supporting Healthcare Providers

Healthcare providers benefit from structural tailwinds, which is driving higher spending on medical services. The following points are commonly cited as the positive trends supporting growth in the healthcare industry:

Source: US Census Bureau

2020 Election Risk for Healthcare Providers

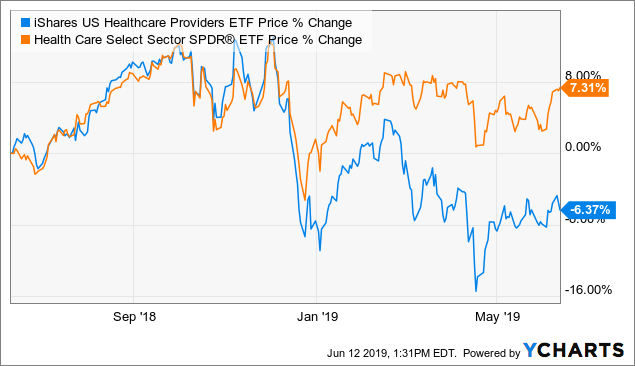

On the other hand, growing calls for publicly funded universal healthcare in the United States, which would presumably lower industry earnings, and uncertainty regarding the 2020 presidential election have pulled back sentiment in the group. IHF has underperformed the market over the past year, up just 1% in 2019 and down 6% over the past year.

Early polling for the 2020 general election that includes a crowded field of Democratic primary candidates suggests that the eventual nominee will have an advantage at least in the popular vote in what will likely be a close election. The consensus is that Trump needs the economy to remain strong to reaffirm his case for reelection. A single payer model as proposed by Democratic candidate Senator Bernie Sanders and supported by other candidates including Senator Kirsten Gillibrand and Senator Elizabeth Warren could push out private insurers and represent a major risk to the industry dynamics. The possibility of a potential disruption to “healthcare providers” is in part reflected through poor sentiment in the underperformance of the group compared to the broader healthcare sector. The Healthcare Select Sector SPDR ETF (XLV) for example includes a separate group of drug manufactures, medical devices companies and biotech firms which would be less exposed to changes in the industry payment model. XLV is up 7.3% over the past year.

Data by YCharts

IHF Holdings Performance

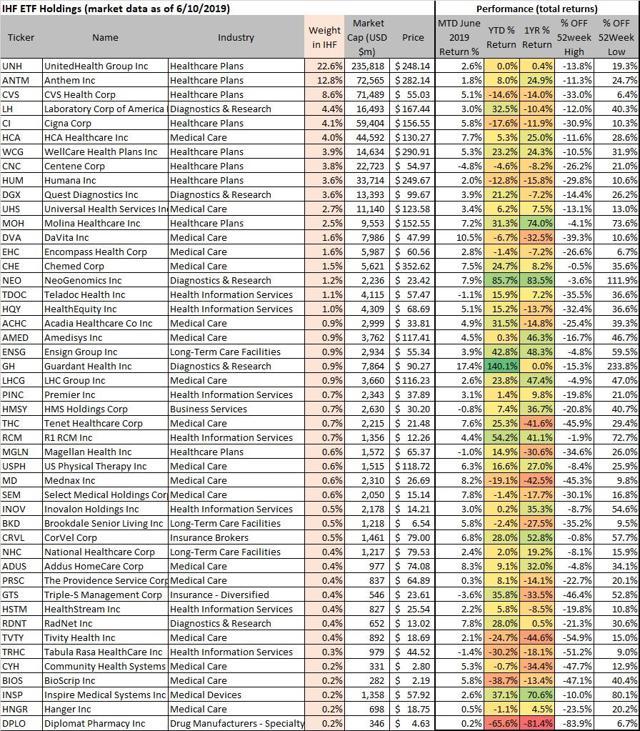

IHF holdings performance metrics. Source: Data by YCharts/ table by author

Based on the performance data above, 23 or nearly half the stocks in IHF are down over 20% from their 52-week high effectively in a bear market. Among the large-cap healthcare-plans companies, CVS Health Corp. (CVS), Cigna Corp. (CI), and Humana Inc. (HUM) are all down double digits in 2019, dragging the performance of the group. Among sub-industries, diagnostics & research companies have been among the biggest winners. Laboratory Corp of America (LH), Quest Diagnostics Inc (DGX), and NeoGenomics Inc. (NEO) are each up significantly year to date.

Guardant Health Inc. (GH) is the best performer, up 140% in 2019. The stock rallied on both a Q1 and Q2 earnings beat with strong guidance for the year ahead. Last December, it was reported that the company was working with drug maker AstraZeneca Plc (AZN) to develop specific blood based testing supporting the commercialization of a new line of oncology treatments.

At the other end, Diplomat Pharmacy Inc. (DPLO), a specialty pharmacy company that supplies hospitals with medicines, is the biggest loser, down 66% in 2019. The stock fell 20% on disappointing Q4 earnings back in March with weaker announced guidance pushing the stock lower ever since.

IHF Holdings Valuation Metrics

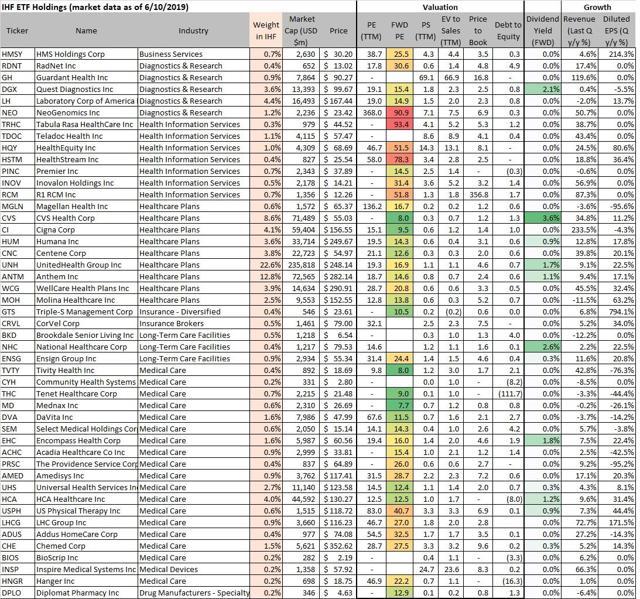

IHF holdings valuation metrics. Source: Data by YCharts/ table by author

Sorted by sub-industry group with forward price-to-earnings multiples highlighted, the data above presents valuation metrics for the IHF holdings. Health Information Services companies like Tabula Rasa HealthCare Inc. (TRHC), HealthEquity Inc. (HQY), HealthStream Inc. (HSTM) are among the fastest growing stocks in the group and command a premium evident by forward PE ratios at 90.9x, 51.5x, and 78.3x each respectively. The growing integration of technology is an emerging trend in the industry. Healthcare-plans companies as a group are the least expensive based on earnings multiples with an average PE of 14x for the year ahead compared to a simple average of 25x for the entire ETF. The fund manager iShares reports an official PE ratio over the trailing 12-month period of 20.2x.

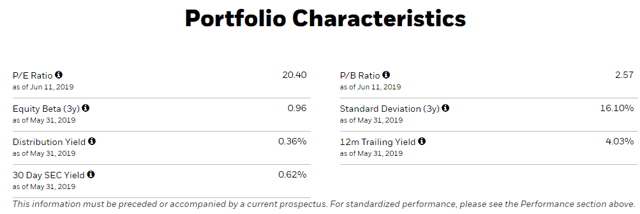

IHF Portfolio Characteristics. Source: iShares

It’s worth nothing that despite the wide range of sub-industries, there is a concentration at the top in terms of weighting with the largest holding UnitedHealth Group, Inc. (UNH) representing 22.6% of the ETF. This makes sense given UNH is by far the largest company with a market cap of $236 billion. The top 10 stocks together combine for 70.6% of the total weighting. The concentration helps to lower the daily volatility considering the large number of small-cap firms. The concentration also helps with the ETF yield as 6 of the top 10 holdings pay a dividend, while 34 of the 47 stocks are non-payers. IHF’s trailing 12-month dividend yield at 4.03% as stated above is misleading at it considers a non-qualified distribution in December 2018 of $6.12. The forward yield is closer to 1% by my calculation.

IHF key stats. Source: iShares

Conclusion

IHF allows investors to take a strategic or tactical exposure to industry trends by isolating the factor performance from the broader market. I use the data above as a starting point for further research and due diligence on the individual holdings. The 2020 presidential election represents a unique risk to this industry group which may trade under higher volatility as poll numbers change and uncertainty over the outcome grows. Investors should be aware of healthcare proposals set forth by Democratic Party candidates and how they may affect the individual stocks.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News