Dilok Klaisataporn/iStock via Getty Images

Investment Thesis

The iShares Core High Dividend ETF (NYSEARCA:HDV) just had its latest quarterly reconstitution, and the purpose of this article is to perform an objective analysis on the changes to ensure it remains a buy. I’ve run the numbers and compared them to 63 other dividend ETFs I follow monthly, and I’m pleased to report that HDV is still a top candidate to outperform this quarter. The combination of its high 3.40% estimated yield, low 15.43x forward P/E, low 0.83 five-year beta, and double-digit EPS growth is rare, and investors shouldn’t ignore it. You don’t need to worry about selling HDV this quarter, and I hope you’ll enjoy this update on one of the best-performing dividend ETFs this year.

HDV Overview

Strategy And Fund Basics

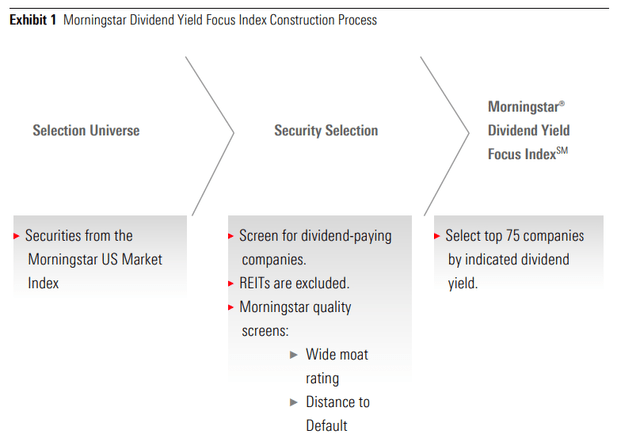

I’ve already written several times on HDV, so I’ll keep this section brief. HDV tracks the Morningstar Dividend Yield Focus Index, derived from a parent index representing about 97% of total U.S. market capitalization. After screening for dividend-paying companies and Morningstar’s propriety Wide Moat and Distance to Default ratings, it selects the top 75 companies (excluding REITs) by indicated dividend yield. The graphic below summarizes this process.

Morningstar

The Index is one of the few to reconstitute quarterly, ensuring that the highest-yielding dividend stocks are selected. It means dividend yield will remain high but won’t always have good dividend growth characteristics. The exclusion of REITs means all income received is qualified, and I have listed some additional features below for quick reference:

- Current Price: $106.66

- Net Assets: $8.72 billion

- Shares Outstanding: 84.00 million

- Expense Ratio: 0.08%

- Launch Date: March 29, 2011

- Trailing Dividend Yield: 3.30%

- Five-Year Dividend CAGR: 5.38%

- Ten-Year Dividend CAGR: 17.99%

- Five-Year Beta: 0.92

- Number of Securities: 75

- Portfolio Turnover: 75%

- Median Bid-Ask Spread: 0.02%

- Tracked Index: Morningstar Dividend Yield Focus Index

HDV’s low 0.08% expense ratio is a key feature for investors since fees come directly out of your distributions. Over ten years, assuming an 8% continuously compounded return, investors will lose 1.37% of their total gains to fees. Contrast this with the SPDR S&P Dividend ETF (SDY), which has an expense ratio of 0.35%, and you’ll lose 5.95% to fees. I liken it to the way mortgage math works. In the beginning, there’s no way around paying a good chunk of fees, but the difference between 0.08% and 0.35% isn’t significant for the first couple of years. But if held for a long time, the fees have the same compounding power as your dividends. Should you be in the market for a high-yield core dividend ETF, keep this in mind.

I also want to mention the significant increase in shares outstanding from when I reviewed HDV in late December. Shares increased by 10.10 million, or 13.67%, so there is potential the dividend payment scheduled for the end of the month will be diluted. From a total returns’ perspective, it has no impact as the difference shows up in NAV, but I want to prepare current owners just in case.

Sector Exposures, Top Ten Holdings, And Index Changes

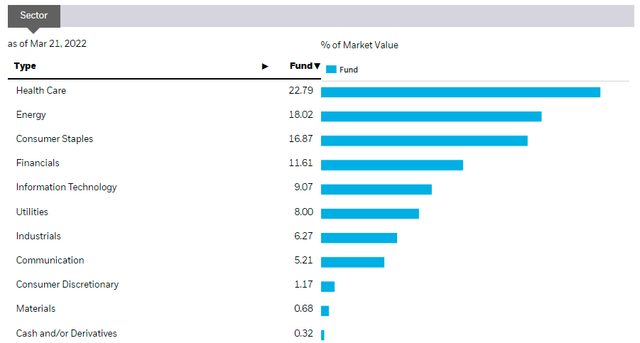

The latest reconstitution saw HDV’s exposure to energy stocks decrease by 2.27% compared to where it was at month-end, primarily through weight adjustments during the normal rebalancing process. The sector now makes up 18.02% of the ETF, slightly behind Health Care (22.79%) and slightly ahead Consumer Staples (16.87%). This quarter, a key addition was JPMorgan Chase, boosting HDV’s Financials sector exposure from 5.57% to 11.61%.

iShares

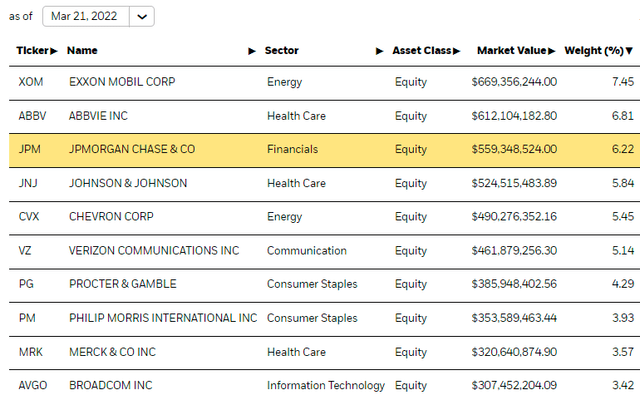

The top ten holdings currently total 51.12% of the ETF. Exxon Mobil (XOM) and Chevron (CVX) bolster the Energy sector, while Health Care is well-represented with stocks like AbbVie (ABBV), Johnson & Johnson (JNJ), and Merck (MRK).

iShares

The top five adds this quarter were:

- JPMorgan Chase (JPM): 6.22%

- United Parcel Service (UPS): 2.36%

- Amgen (AMGN): 2.25%

- Pioneer Natural Resources (PXD): 1.89%

- Sempra Energy (SRE): 0.74%

The top five deletions this quarter were:

- Pfizer (PFE): 4.24%

- McDonald’s (MCD): 2.07%

- Truist Financial (TFC): 1.42%

- Newmont Goldcorp (NEM): 1.10%

- General Dynamics (GD): 0.68%

And the top five weight changes as a result of the rebalancing were:

- Exxon Mobil (XOM): -2.47%

- Chevron (CVX): -1.22%

- AbbVie (ABBV): +0.91%

- Verizon Communications (VZ): -0.83%

- Philip Morris (PM): -0.71%

Historical Performance

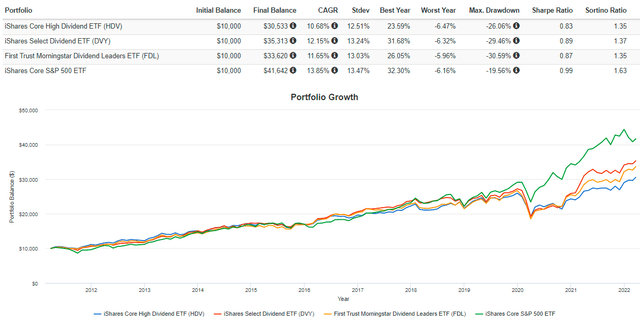

HDV’s long-term performance record is poor. Through March 21, 2022, HDV’s annualized gain of 10.68% was 3.17% worse than the iShares Core S&P 500 ETF (IVV). It also trailed the iShares Selected Dividend ETF (DVY) and the First Trust Morningstar Dividend Leaders ETF (FDL) by 1.47% and 0.97% per year, respectively.

Portfolio Visualizer

However, performance has been strong this year. HDV has outperformed IVV, DVY, and FDL by 1.62%, 0.67%, and 11.36% in 2022, as the market has shown its favoritism for low P/E stocks and funds. This sentiment change was detectable as early as November during the Q3 2021 earnings season. The downward trend of declining earnings surprises continued into Q4, and unprofitable and high P/E stocks sold off accordingly.

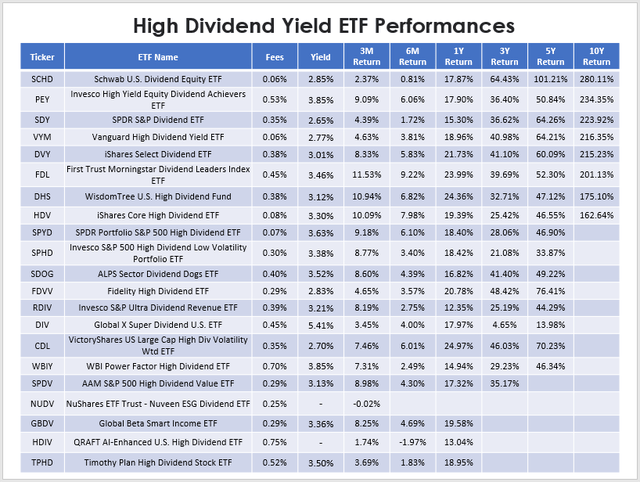

I’m optimistic that the trend favoring value stocks will continue, but I also want to prepare if my macro view is wrong. A way to do this is to find ETFs with attractive valuations that still have some growth potential. A bonus is inflation protection, and I think HDV checks many of those boxes. Before I get into the details, here’s a comprehensive list of high-dividend-yield ETFs and their performances through February 2022.

Author

The best-performing ETF in the category is the Schwab U.S. Dividend Equity ETF (SCHD), with ten-year returns through February 2022 of 280%. That’s about 118% more than HDV for just a small sacrifice in yield. However, I don’t solely rely on historical performance since it assumes the past will repeat itself. My preference is to look at the fundamentals of an ETF. The above table clarifies that in the last three months, the highest-dividend ETFs like HDV, FDL, DHS, SPHD, and SPDV, substantially outperformed.

Fundamental Analysis

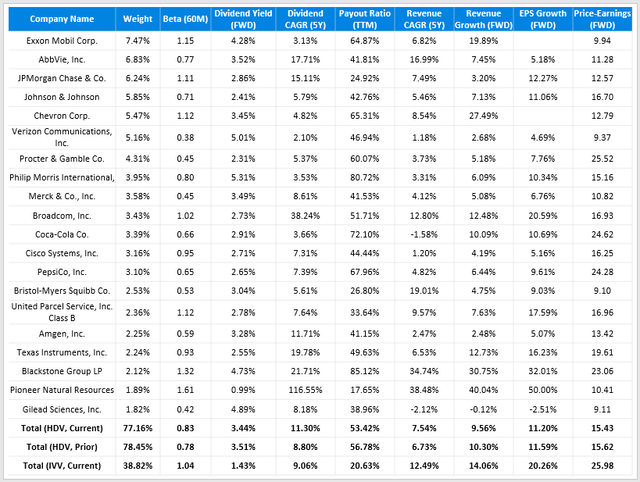

I will be comparing HDV with its holdings last month to highlight any changes in fundamentals. The table below highlights selected risk, dividend, growth, and valuation metrics for HDV’s top 20 companies.

Author

At a high level, the fundamentals haven’t changed much. That’s positive news, as previous Index reconstitutions resulted in significant changes that didn’t always benefit the shareholder. The latest data reveals:

1. An increase to the five-year dividend growth rate from 8.80% to 11.30%. This figure is slightly skewed due to the addition of Pioneer Natural Resources, but JPMorgan Chase is also a good value play right now. Its price is down about 10% in the last year while the average HDV holding is up 10%.

2. A slight decrease in yield from 3.51% to 3.44%. Given the fluctuations in shares outstanding I mentioned earlier, it’s hard to pin down exactly what the payment will be each quarter, but 3.50% is the long-term average for the ETF. I’m confident it will be around this level this quarter and next.

3. The dividend payout ratio decreased from 56.78% to 53.42%. Payout ratios look elevated for the Energy companies like Exxon Mobil and Chevron, but that’s on a trailing basis. As you’re undoubtedly aware, oil prices have risen sharply to the point where some members of Congress are calling for a windfall tax on oil and gas companies. I think the proposal is dead-on-arrival, but my main point is that energy companies have plenty of free cash right now. Payout ratios should decrease, and besides being an excellent inflation hedge, dividends may become an even more significant portion of these stocks’ total returns.

4. Naturally, IVV has stronger revenue and EPS growth rates. Due to the inclusion of mega-cap growth stocks like Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL, GOOG), Amazon (AMZN), and Tesla (TSLA), IVV’s EPS growth rate is almost twice as high. It’s worth a premium on valuation, but I don’t think it’s worth paying 25.68x forward earnings vs. 15.43x for HDV.

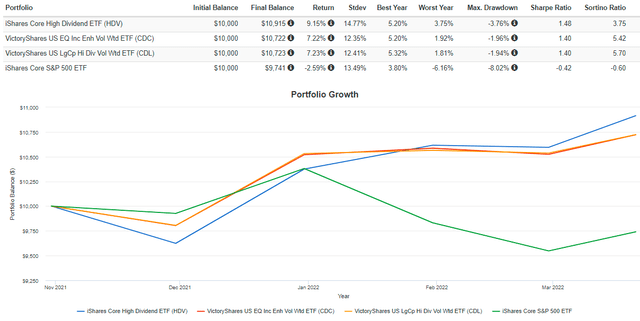

5. The combination of high dividend, low beta, low P/E, and double-digit EPS growth is hard to find. To illustrate, I screened my database of over 800+ U.S. equity ETFs for the following metrics based on February 28, 2022, holdings:

- Forward dividend yield above 3%

- A five-year beta below 0.85

- Forward P/E below 17

- Forward EPS growth rate above 10%

Only three ETFs qualified: HDV and two volatility-weighted dividend ETFs offered by VictoryShares (CDL and CDC). Since November, they’ve all significantly outperformed IVV, suggesting these factors are what the market currently favors.

Portfolio Visualizer

Investment Recommendation

Given HDV’s history for flare during its quarterly reconstitutions, I tend to take a cautious approach. HDV is a long-term underperformer, so it’s only prudent to keep a close eye on it. However, I want to remind readers that ETFs are just baskets of securities that can change significantly over time. It’s essential to recognize that the market favors high-dividend, low-beta, and low P/E stocks this year. HDV’s features make it a terrific defensive ETF right now, and its double-digit EPS growth rate suggests it will still make solid gains if the bull market resumes. Therefore, I’m maintaining my buy rating, and I look forward to doing another update after the next Index shuffle.