[ad_1]

phototechno/iStock via Getty Images

FVAL strategy and portfolio

The Fidelity Value Factor ETF (NYSEARCA:FVAL) has been tracking the Fidelity U.S. Value Factor Index since 09/12/2016. It has 129 holdings, a distribution yield of 1.64%, a total expense ratio of 0.29% and a net asset value about $515M.

According to the prospectus, the underlying index “is designed to reflect the performance of stocks of large and mid-capitalization U.S. companies that have attractive valuations”. More specifically, it is based on a score combining four factors in equal weight: Free Cash Flow Yield, EBITDA to Enterprise Value, Tangible Book Value to Price, Forward 12-month Earnings to Price (based on estimates). For the bank industry, only the last two factors are taken into account (Tangible Book Value to Price and Forward 12-month Earnings to Price).

FVAL invests exclusively in U.S. companies and mostly in the large cap segment (75%). As expected, FVAL is cheaper than the S&P 500 index (SPY) regarding the usual valuation ratios reported in the next table.

|

FVAL |

SPY |

|

|

Price / Earnings TTM |

12.98 |

21.72 |

|

Price / Book |

2.77 |

4.16 |

|

Price / Sales |

1.76 |

2.84 |

|

Price / Cash Flow |

10.73 |

16.85 |

Source: Fidelity

FVAL currently holds 129 stocks. The top 10 holdings represent 30.3% of the portfolio value. The next table lists their weights and valuation ratios. Exposure to each of the top two holdings is 6% to 7% (Apple (AAPL) and Microsoft (MSFT)), but the risk related to any other stocks is quite low.

|

Ticker |

Name |

Weight (%) |

P/E TTM |

P/E fwd |

P/Sales TTM |

P/Book |

P/Net Free Cash Flow |

Yield% |

|

AAPL |

Apple Inc |

6.95% |

25.48 |

25.63 |

6.66 |

38.15 |

28.24 |

0.59 |

|

MSFT |

Microsoft Corp |

6.02% |

28.94 |

29.77 |

10.85 |

12.83 |

45.49 |

0.89 |

|

GOOGL |

Alphabet Inc |

3.60% |

21.07 |

20.73 |

5.77 |

6.12 |

22.55 |

0 |

|

AMZN |

Amazon.com Inc |

3.31% |

56.15 |

122.54 |

2.48 |

8.84 |

N/A |

0 |

|

JNJ |

Johnson & Johnson |

2.14% |

23.80 |

17.23 |

4.97 |

6.31 |

54.98 |

2.56 |

|

BRK.B |

Berkshire Hathaway Inc |

2.05% |

8.57 |

24.57 |

2.50 |

1.39 |

30.52 |

0 |

|

V |

Visa Inc |

1.67% |

33.00 |

28.59 |

16.32 |

13.32 |

35.82 |

0.73 |

|

MRK |

Merck & Co Inc |

1.58% |

15.74 |

11.97 |

4.11 |

5.85 |

73.18 |

3.14 |

|

PFE |

Pfizer Inc |

1.52% |

11.11 |

7.14 |

3.01 |

3.61 |

13.20 |

3.30 |

|

PG |

Procter & Gamble Co |

1.48% |

26.99 |

26.43 |

4.91 |

8.76 |

74.47 |

2.37 |

Ratios: Portfolio123

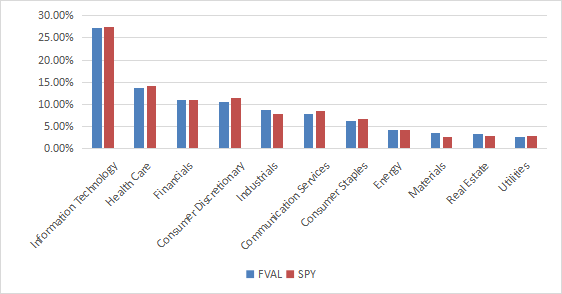

The sector composition is very close to the S&P 500:

FVAL sectors (chart: author; data: Fidelity)

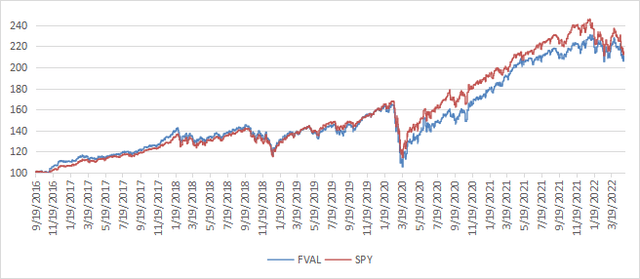

Since inception in September 2016, FVAL has slightly underperformed the S&P 500. However, the difference in annualized return is not very significant. Maximum drawdown and volatility (measured as the standard deviation of monthly returns) point to a moderately higher risk.

|

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

FVAL |

108.63% |

13.96% |

-36.13% |

0.83 |

16.69% |

|

SPY |

113.05% |

14.39% |

-32.05% |

0.92 |

15.18% |

Data calculated with Portfolio123

The next chart plots the equity values of $100 invested in FVAL and SPY since FVAL inception. The two funds were on par until the March 2020 market meltdown, then FVAL started lagging the benchmark.

FVAL vs. SPY (chart: author; data: Portfolio123)

Comparing FVAL with other large cap value ETFs

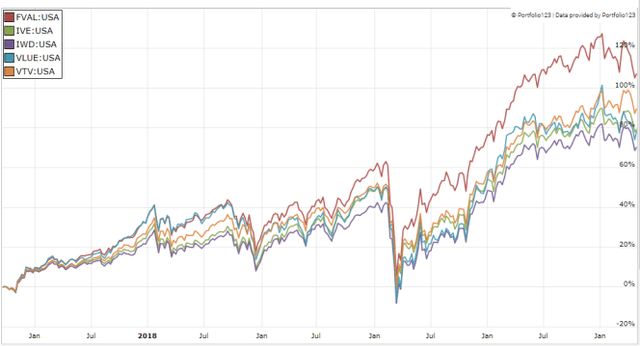

The next table compares FVAL performance since its inception with four other large and mid cap value ETFs by different issuers and based on different underlying indexes. FVAL leads the pack in return and risk-adjusted performance (Sharpe ratio).

|

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

FVAL |

108.63% |

13.96% |

-36.13% |

0.83 |

16.69% |

|

IVE |

80.98% |

11.12% |

-34.71% |

0.71 |

15.54% |

|

IWD |

72.00% |

10.12% |

-36.21% |

0.64 |

15.75% |

|

VTV |

91.10% |

12.20% |

-34.61% |

0.79 |

15.06% |

|

VLUE |

79.35% |

10.94% |

-37.68% |

0.62 |

17.78% |

Value ETFs since Sept. 2016 (Portfolio123)

Why is FVAL better? Value indexes usually have two shortcomings. The first one is to classify all stocks on the same criteria. It means the valuation ratios are considered comparable across sectors. Obviously they are not: you can read my monthly dashboard here for more details about this topic. A consequence is to privilege sectors where valuation ratios are naturally cheaper, especially financials. FVAL calculates the value score in a different way for the banking industry. The bias across all sectors and industries is not completely fixed, but at least it is reduced in the most problematic sector.

The second shortcoming of value indexes comes from the price/book ratio (P/B). Speaking probabilities, a large group of companies with low P/B contains a higher percentage of value traps than a same-size group with low price/earnings, price/sales or price/free cash flow. Statistically, such a group will also have a higher volatility and deeper drawdowns in price. The next table shows the return and risk metrics of the cheapest quarter of the S&P 500 (i.e.125 stocks) measured in price/book, price/earnings, price/sales and price/free cash flow. The sets are reconstituted annually between 1/1/1999 and 1/1/2022 with elements in equal weight.

|

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

Cheapest quarter in P/B |

9.95% |

-72.36% |

0.48 |

21.05% |

|

Cheapest quarter in P/E |

11.25% |

-65.09% |

0.57 |

18.91% |

|

Cheapest quarter in P/S |

12.62% |

-65.66% |

0.6 |

20.46% |

|

Cheapest quarter in P/FCF |

12.23% |

-63.55% |

0.61 |

19.05% |

Data calculated with Portfolio123

FVAL uses an inverse P/B ratio (Tangible Book Value to Price), but it weights only 25% of the value score, which is a less than for other value indexes.

This also explains my choice of not using P/B in my Dashboard List model (more info at the end of this post).

Takeaway

FVAL follows a systematic value strategy based on four valuation ratios in a large and mid cap universe. Its sector structure is very close to the S&P 500, whereas other value ETFs usually overweight financials. Since inception in 2016, it has slightly underperformed the S&P 500, which is not a deal breaker: most value-oriented strategies and funds have lagged during this period. However, FVAL has beaten other value ETFs by a significant margin. The underlying index implements a smarter concept of value by giving a lower weight to the P/B ratio and by calculating the score in a different way for banks. FVAL is one of the most attractive large cap value ETFs for long-term investors. It may also be useful in a tactical allocation strategy switching between value and growth depending on market conditions. FVAL has the maximum rating of 5 stars at Morningstar.

[ad_2]

Source links Google News