[ad_1]

omersukrugoksu

The iShares MSCI Brazil ETF (NYSEARCA:EWZ) tracks a basket of the largest and most liquid Brazilian stocks through a portfolio of 48 holdings. The attraction here is exposure to Latin America’s largest economy that benefits from an emerging middle class supporting significant long-term opportunities. Still, it’s been challenging several years in Brazil dealing with pandemic disruptions and disappointing indicators. A sharp depreciation of the Brazilian Real currency against a stronger Dollar largely explains the poor EWZ fund performance over the last decade.

That being said, we highlight several signs suggesting a stronger outlook. Compared to the rest of the world plagued by geopolitical risks and deep recessionary fears, Brazil is diverging as a bright spot globally. Indeed, the latest Q2 GDP came in above expectations while a firming labor market and declining inflation set up a positive macro backdrop. It’s an election year in Brazil, and while the headlines can generate some volatility, we like EWZ which is well-positioned to rally higher and deliver positive returns going forward.

Brazil Macro Update

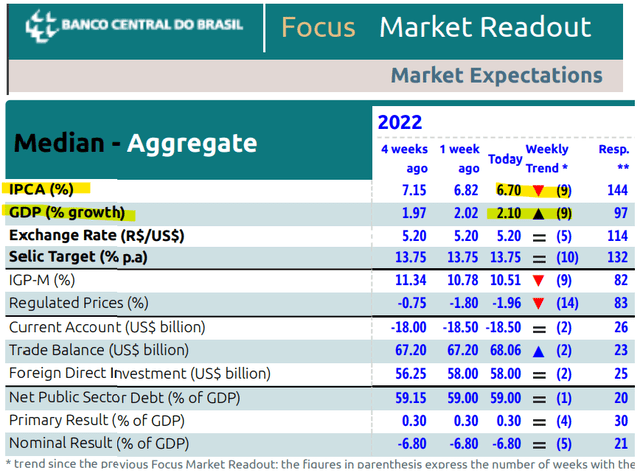

From the current market forecasts published by the Brazil Central Bank, the outlook is for 2022 GDP at 2.1% while the inflation index (IPCA) ends the year at 6.7%. The growth estimate has trended higher over the last nine weeks, and up from a low of just 0.25% back in early Q1. Similarly, the forecast for 2022 inflation has cooled off significantly from a peak above 9% back in June. In this case, the correction lower in energy prices is seen as having a positive effect on the economy.

What is also encouraging is the trend in unemployment which has reached 9.1%, the lowest level since 2015, and down from as high as 15% during the depths of the pandemic in 2020. A recently passed legislative tax cut package has been credited with supporting activity levels and labor market conditions. Other macro fundamentals have also moved in the right direction, including a climbing trade surplus towards $68 billion this year supporting a solid current account deficit of just 0.5% of GDP.

Central Bank of Brazil

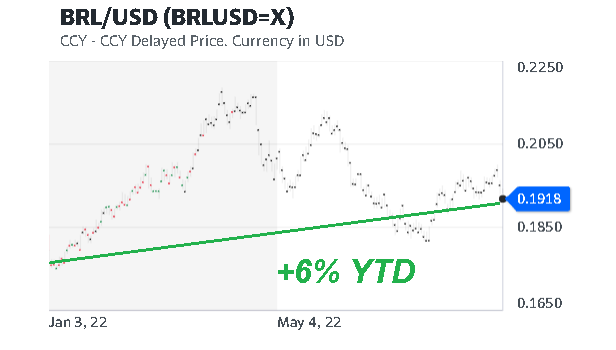

The measure here explains some of the trends in the Brazilian Real currency in 2022. Even as the U.S. Dollar Index has climbed to a nearly 20-year high, the Real has been an exception with a modest 6% gain over the Dollar. Part of this dynamic also reflects a proactive Central Bank that began tightening sooner in the cycle last year compared to the Fed. Messaging by the Brazilian government and Finance Ministry has projected a sense of pride that the inflation outlook is lower than forecasts for the CPI in the U.S., a first in the country’s history.

Yahoo Finance

We also mention that the level of public debt as a percentage of GDP declined to 77.7% in July, the ninth consecutive monthly decline. The net figure, balanced with FX reserves, is closer to 59% as per the table above. For context, during the pandemic, there were forecast for this measure to reach 100%. This metric is often considered one of the most important gauges of “country risk” and external stability. In our view, the BRL currency is structurally undervalued, considering it is still down by more than 40% over the past 5 years. The potential for further appreciation from the current level can add to positive equity returns, particularly for foreign ADR investors.

What is the EWZ ETF?

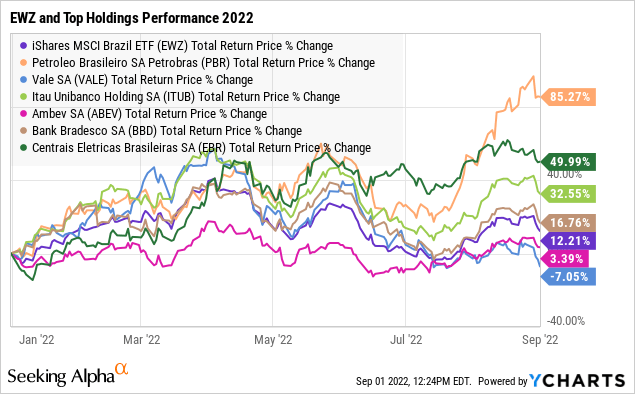

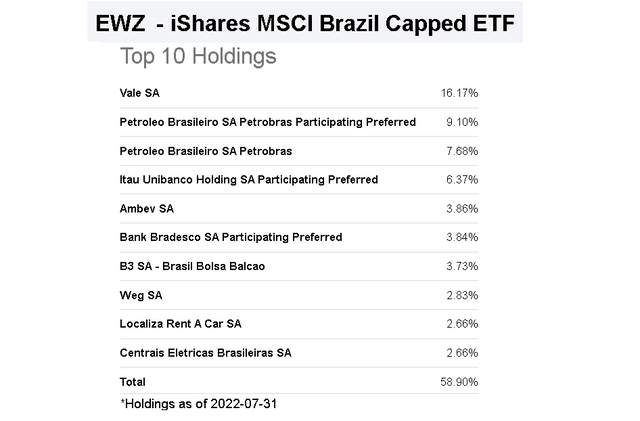

The EWZ ETF is an easy way to capture these high-level macro trends from the Brazilian economy. The first point to highlight is that the fund’s largest holdings are in Petrobras (PBR) (PBR.A) with a combined 16.8% weighting between the common and preferred shares. PBR is a stock that has delivered an impressive 85% total return this year considering the strong momentum in energy prices. Beyond global oil price benchmarks, Petrobras also benefits from conditions in the Brazilian economy through its integrated downstream refinery business. We expect the stock to benefit from the improving Brazil macro outlook through lower country risk that could be reflected in a higher valuation multiple.

Next up, Vale S.A. (VALE) with a 16% weighting, is the world’s largest iron ore producer and a major exporter. In this case, shares of VALE have underperformed in 2022 given the correction in commodity prices more recently, outside of the conditions of the local economy. Nevertheless, the stock plays an important role within EWZ as a global leader within the materials sector and adds good diversification to the fund next to the significant exposure to the financial sector names that comprise 23% of the overall weighting.

We are particularly bullish on companies with exposure to the Brazilian consumer and discretionary spending that can benefit from declining unemployment and more positive growth. EWZ holdings across Itau Unibanco Holding S.A. (ITUB), Ambev S.A. (ABEV), Banco Bradesco S.A. (BBD), and even smaller names like Localiza Rent a Car S.A. (OTCQX:LZRFY) are included this group. There are also telecom names like Telefonica Brasil S.A. (VIV), utilities, and even retail players within the portfolio which also capture the positive macro fundamentals.

Seeking Alpha

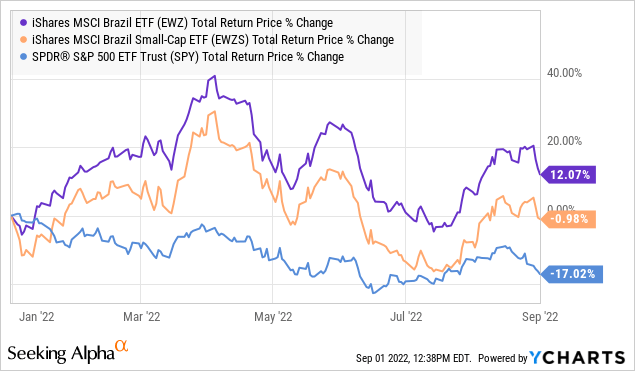

Keep in mind that there is also the iShares MSCI Brazil Small-Cap ETF (EWZS) as another option for investors, which could outperform its large-cap sister in a bullish environment. Still, one advantage EWZ has over EWZS considers the positions in what we refer to as Brazilian “blue-chips” and sector leaders like VALE and ABEV that add a layer of quality.

It’s worth noting that EWZ has already outperformed global equity benchmarks this year with a 12% return compared to the S&P 500 Index (SPY) which is off by 16%. From the chart below, EWZS has been more volatile as a high-beta version of EWZ.

Brazil’s Big Election

We won’t get too much into the weeds of politics but will mention that the upcoming Presidential election results could create some volatility over the next few months. On the other hand, a conclusion to the voting by removing a layer of uncertainty regardless of the outcome could open the door for a more sustained move higher.

The latest indicators bode well into the final stretch of the campaign for the reelection of Jair Bolsonaro ahead of the first-round voting in early October. While recognized as a controversial figure, the market-oriented economic policies in place during Bolsonaro’s administration, including efforts to privatize state-owned companies should be welcomed by investors. His term was defined by the setback of the pandemic although a current message of an improving outlook and stronger conditions could play into a second-round runoff victory in November.

On the other side, former leftist President Luiz Inácio Lula da Silva (Lula), embattled by a history of corruption charges, is a frontrunner staking his campaign on a message of being a voice for the common folk and a return for larger deficit spending. While there are concerns that a Lula victory would mark a shift towards a socialistic Argentina-style government, we sense a Lula government would end up being more pragmatic and “centrist” than worst-case fears. There is a case to be made the new government could ride the current wave of economic momentum, and not undermine Brazil’s rebound.

Even with an opinion that a Bolsonaro victory should be better for Brazilian stocks, we also believe the risks of a Lula win may be benign. It’s simply too close of a race to call at this point.

EWZ Price Forecast

The way we look at Brazil is that the country is large enough that it can remain relatively immune to global macro challenges like the weaker conditions in Europe and even mixed signals out of China. The bullish case for EWZ is that the positive trends in economic growth continue and can drive a rebound in sentiment towards the region while working as a tailwind for high corporate earnings. In this regard, EWZ could diverge higher and open a spread compared to other developed and emerging market equity benchmarks based on stronger country-specific factors.

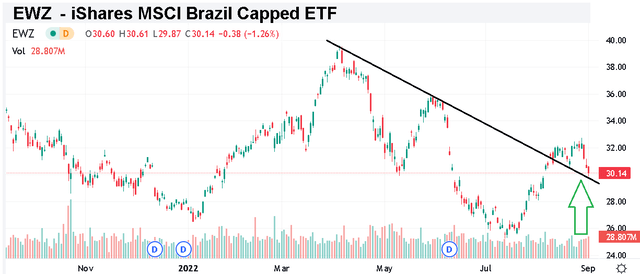

We view the current level in the fund around $30.00 per share as an area of support, representing an attractive buying opportunity. In terms of risks, there is always the potential that the data begins to disappoint or a deeper deterioration in worldwide trade activity opening the door for a leg lower. Overall, our take is that the risks are tilted to the upside.

Seeking Alpha

[ad_2]

Source links Google News