[ad_1]

An Australian Home Auction (Source – Sourceable/Homesales)

Many economists often tout Australia to be an idyllic economy where proper monetary and fiscal management has led to an incredible 27-year streak of no recessions. While that track record is certainly great, it is largely due to the fact that Australia is one of the primary suppliers of raw materials to China which has undergone immense infrastructural development over the past three decades.

If you’ve read some of my past articles, you may note that my short thesis for Canada is nearly exactly the same for Australia (also New Zealand). The only difference is Australia is more dependent on China, so the situation could be even worse for the country’s equity market and economy as a whole.

Now that Chinese materials demand is falling and will likely continue to fall over the long-run due to overdevelopment, I believe the trick will be up for the Australian economy. Even more, the country has been flooded with Chinese investment into its real estate which has caused the average Australian to become extremely indebted by high property prices. Now that Chinese capital flows have slowed, housing prices have begun to fall and it is likely that Australian banks will suffer the most.

One ETF that will be hit particularly hard by both of these trends is the iShares MSCI Australia ETF (EWA). The fund holds nearly 50% weight in financials and real estate as well as nearly 30% in materials, industrials, and energy. Thus, 80% of the fund is directly subject to these macroeconomic themes.

Even more, many of these companies are overleveraged and trade at alarmingly high valuations. There are a few possibly good picks, but by in large, all signals seem to sign “sell” for EWA. Let’s take a closer look at these signals.

The iShares MSCI Australia ETF

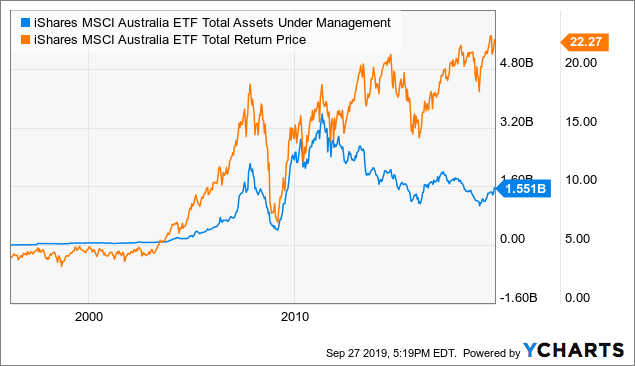

Before we get into the nitty-gritty, let’s go over some of the major details of the fund. It is very old and has been trading since 1996 long before most people tracked ETFs. It has a total AUM of $1.5B which is very high for a single-country ETF these days. Let’s see how those AUM flows have changed over time to see what our fellow investors are up to:

Data by YCharts

Data by YCharts

Here, we can see that fund flows are pretty low by historical standards despite the fact that the ETF’s total return (which includes dividends) is at an all-time high.

We can also see that flows have been very strong in 2019 as EWA’s large price decline last year of about 25% rapidly reversed this year. Indeed, it seems that this recent wave of investors may be leading themselves to yet another edge.

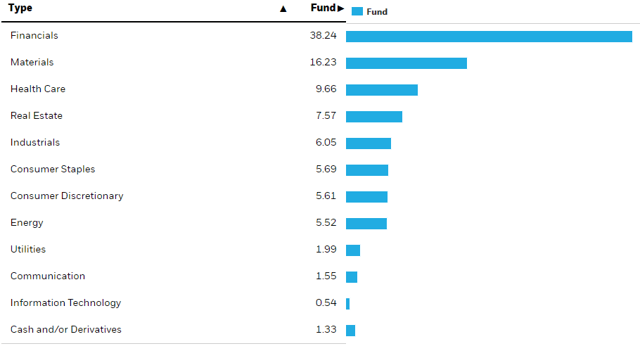

As I mentioned earlier, the fund is very heavily weighted toward the most cyclical, risky, and china dependent sectors in the Australian economy. Here is a breakdown of EWA’s sector exposure:

(Source – iShares)

I find this pretty alarming. If Australia were a developing country, then I would not be too fazed by the fund’s extremely heavy weighing toward financials. However, this is a fully developed country so it is likely due to the fact that Australian banks have taken on far too much risk in order to grow as rapidly as possible. Like Canada and New Zealand, Australia has no reserve requirement, so banks have been able to operate at very high leverage. With property prices falling, that leverage is likely to backfire very rapidly.

Beyond financial, the ETF is still heavily weighted toward cyclical sectors. This is understandable given the fact that Australia is very commodity-driven, but still adds a degree of cyclical risk that does not seem to be accounted for in valuations.

Financial Risks not Incorporated into Valuations

The problem with having no recessions for many decades is that everyone comes to expect no recessions. Often, the belief that recession risk is low causes companies, individuals, and governments to take excessive risks that often cause recessions. The business cycle cannot be avoided, it can only be delayed.

Because Australia has delayed a cycle for so long, it is likely that many companies in the country are “swimming naked” and will be burned as the tide of liquidity and economic growth finally recedes.

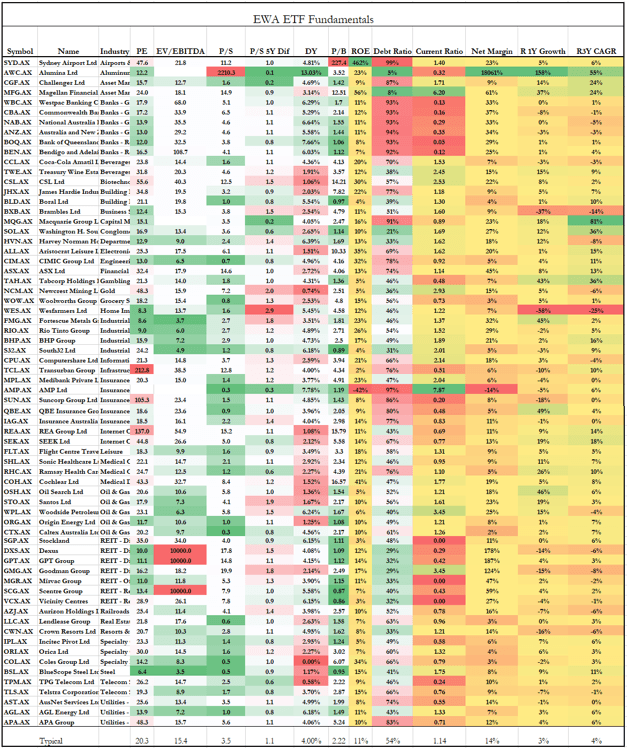

To illustrate, take a look at the fundamental statistics of all of the companies in EWA:

(Data Source – Unclestock)

As you can see, most of these companies have extremely high valuations with the typical company having a P/E ratio just over 20X. Usually, companies with valuations this high have low debt, strong margins, and high revenue growth. To say the least, these companies have neither.

Debt is very high for the bank stocks in the ETF with many running at 15:1 leverage or more. Even for many of the non-financial companies, debt is still very high. Current ratios are also very low with many companies not having enough cash on hand to make debt payments over the next years. When insolvency and illiquidity is high, equity value is often destroyed.

Revenue growth is also weak. This is largely due to the slowing Chinese economic demand, but as I’ll explain in the next section, revenue for these firms may be quite a ways from bottoming.

Macro Landscape is Rapidly Deteriorating

As I mentioned earlier, there are two major issues threatening the Australian economy: property prices and falling exports. Home prices in Australia are very high with price to income ratios of 7.5X or greater which is at or above the peak home price valuation in the U.S. in 2006.

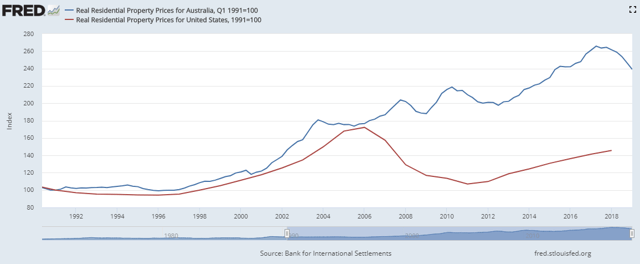

These high prices are not fueled by strong savings as they are in most of Asia, they are fueled by debt. To begin, take a look at real property prices in the U.S. vs. Australia as indexed to 1991:

(Source – Federal Reserve)

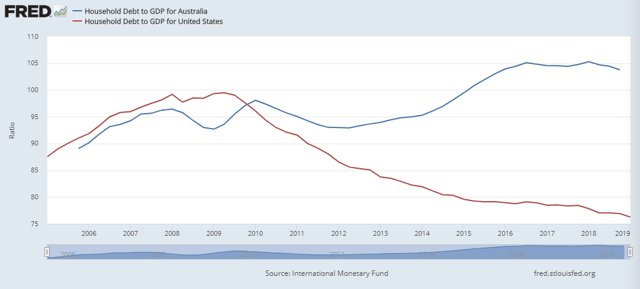

Real prices have been climbing for both countries, but Australia managed to avoid a crash in 2007 and has kept on marching higher. This is also reflected in the household debt to GDP in both countries:

(Source – Federal Reserve)

While Australia has a far less public debt to GDP than the U.S., they have more household debt to GDP than the U.S. did at its peak. In my opinion, household and private debt, in general, is far more important for a country’s future stock market performance. At the current level, Australian people will not be able to organically grow the country’s economy at all because they cannot expand private credit. As real property prices continue to fall, many Australian homeowners are likely to find themselves very underwater. Beware the “wealth effect”.

Property investing has become a bit of a national past time in Australia with exciting block party-like property auctions and 95%-105% (get “paid” to borrow) LTVs. While the Australian government has been working to tighten home lending standards, the damage has already been done and it is likely that this tightening of liquidity will only help catalyze the bubble’s popping.

As with most of the Australian economy, Chinese capital flows into property have been the primary driver of real estate prices. Indeed, Australian property valuations are cheap compared to those in Hong Kong and Beijing. That said, now that the Chinese economy is slowing, the Australian economy will be dragged down with it.

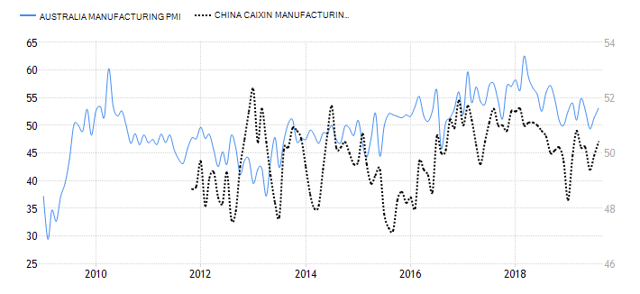

As shown below, manufacturing PMIs for both Australia (left axis) and China have fallen to the 50 level:

(Source – Trading Economics)

As the slowdown continues and the high debt buildup in each country turns into liquidity problems, both are likely to continue lower.

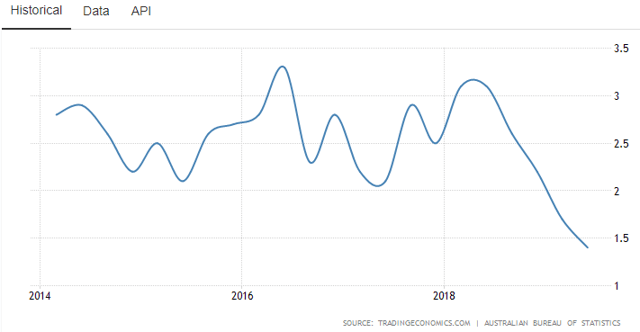

While consumer sentiment is still near a peak in Australia, industrial sentiment has been falling for three years and is accelerating to the downside as we speak:

(Source – Trading Economics)

Clearly, the leading macroeconomic indicators are indicating a recession in Australia. The country’s GDP growth rate indicates Q4 2019 or Q1 2020 as the likely quarters of negative growth. If you’re curious, here is Australia’s GDP growth rate:

(Source – Trading Economics)

The Bottom Line

The Australian economy is the perfect example of one that has not had a recession in too long. Debt buildup has been far too large and investors have come to expect low financial risks. From a risk-adjusted standpoint, Australian stocks are perhaps the most expensive in the world.

While Chinese demand for Australian goods may bump up in the short-run due to U.S. tariffs, the long-run trend will be lower. The reality is that many of the commodities Australia produces will need to find homes elsewhere. Most likely, “elsewhere” will be the Indian ocean region that has huge industrialization potential.

That said, China has too much infrastructure that won’t need to be fixed for decades so there will be a gap where the Australian economy struggles with exports. Their trade surplus is near a peak today and tends to fall drastically after making such a peak.

There is a perfect storm where GDP growth will be weak and property prices will put many homeowners in a precarious situation. Unlike the U.S., the Australian government does have the wherewithal to move some of this debt into its own books (as the U.S. did in 2008), but the banks are likely to suffer big-time before that happens.

In other words, EWA is a clear “sell” and I am likely to look for a short opportunity on the ETF.

Interested In Closely Following Global Events?

“The Country Club” is a dedicated service that focuses on single-country and regional ETFs with the goal of helping our subscribers diversify globally and get a better grasp on how world events will affect their portfolio. We will certainly be providing subscribers further updates on this idea.

Subscribers receive exclusive ideas, model portfolios, and a wide range of tools including our exclusive “Country Club Dashboard” which allows them to visualize global financial and economic data. If you haven’t already, please consider our 2-week free trial and get your passport to global markets today!

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a short position in EWA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News