R.M. Nunes

Published on the Value Lab 10/17/22

The iShares MSCI Europe Financials ETF (NASDAQ:EUFN) contains much of what you’d expect from a financial ETF. Plenty of insurance and banking players, all businesses that are benefiting in the current rate cycle. However, European peers to US banks and insurance companies aren’t necessarily benefiting from an economy with the same rapid rate hikes, and part of that might be due to structural reasons that the ECB is well aware of. With closer proximity to the energy crisis and the Ukraine war, European financial players are disadvantaged, and the discount in multiples works to acknowledge that.

EUFN Breakdown

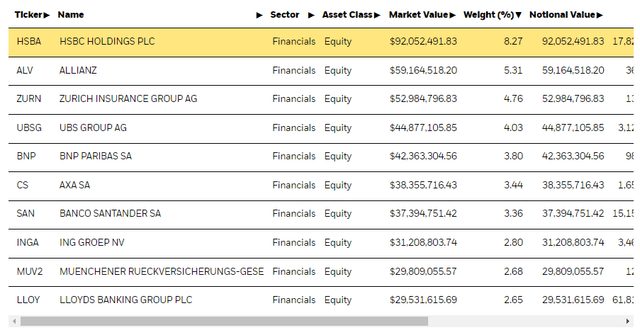

Let’s have a quick look at the EUFN top holdings.

Top Holdings (iShares.com)

We must note, as we’ve done in the past with this ETF, that HSBC (HSBC) really is not a European stock at all, it is mostly levered to Asian markets, and a lot to China. It is also a bank that is going to be dealing with very major and fundamental problems around its status in the Asian markets driven by China’s increasingly aggressive One-China concept. They are disposing assets left right and center to prove that its parts have value, but ultimately they have to deal with the fact that their business really is a threat to China due to their importance to the prosperity of Hong Kong and integration with financial markets there, and self-neutering will be very expensive with years of restructuring in their future.

Even in a more free market arena, influential people in Hong Kong don’t much like that HSBC is running unprofitable operations abroad, and that the global focus means that profits generated in Asia are being used to keep other businesses whose returns are weak up and running. Ping An Insurance Group (OTCPK:PNGAY) is seen as a more Hong Kong and Asia focused financial company that is more likely to be reinvesting in the region as compared to HSBC, and there is quite a lot of pushback from shareholders to consider Asian interests more, with some even demanding that Ping An, another company entirely albeit with 9% of HSBC’s shares, should have a seat on the HSBC board. Moreover, Ping An supports the breakup of the company. Being the largest single shareholder and on the same side as China lends to their case, and this is another factor that could cause the bank’s breakup and lots of costs to shareholders.

Besides HSBC, which is a permanent blemish on the EUFN, other exposures are broad European banking and insurance exposures, that should all benefit from rising rates and expansion of NIMs and increasing yields on short term fixed income portfolios.

Remarks

The issue is that the ECB and European bonds aren’t seeing the same massive increases in interest rates as the Fed and the US. This has been reflected in the poor performance of the Euro compared to the USD, which has been rocketing.

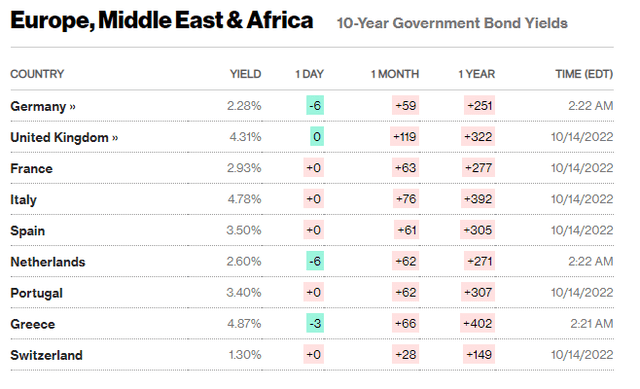

Yields (Bloomberg)

If you consult the yields of bonds as given here you can see that with the exception of countries whose finances have been traditionally a little more questionable from back in the BRIC days and Euro crisis days, yields are definitely lower. In particular, German yields remain very low, despite Germany’s private sector being very exposed to the energy crisis. Us rates are at exactly 4%, so 2.28% is a far cry and shows the much slower pace of rate hikes of the ECB.

The ECB aren’t morons, and they can read headlines just like us. They probably know the Fed’s strategy, but are taking a slower approach. We think it’s because they recognize that as opposed to America, which has a very different dynamic to its labor market and is much more self-sufficient from a commodity perspective, the European inflation is far more driven by supply side forces, and is thus less addressable by rate hikes and unemployment. Because of this, the earnings potential of banks and insurance companies is diminished, and indeed, the EUFN multiple lies at around 7x, so an earnings yield of 14% and a multiple discounted by about 20% from the iShares U.S. Insurance ETF (NYSEARCA:IAK). While 20% sounds compelling, it reflects a concrete difference in where nominal rates are likely to end up, and actually comes to a fair value in our opinion, especially with HSBC also weighing down the prospects of this ETF.