[ad_1]

Continuing on the theme to position for IMO 2020, I published one article featuring Valero (VLO) and another featuring Phillips 66 (PSX). These refiners provide direct exposure to independent, U.S.-based complex refinery operations.

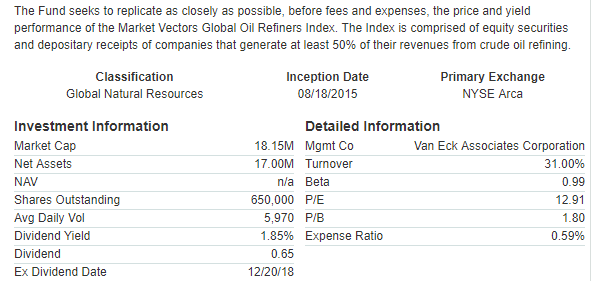

VanEck Vectors Oil Refiners ETF (CRAK) provides exposure to a portfolio of companies that derive at least 50% of their revenues from crude oil refining. The primary benefit of this ETF in my view is to provide diversification among a large portfolio of companies operating in geographical localities worldwide.

As a result, owners of the ETF are not as exposed to a potential loss from some unexpected event such as a refinery explosion, as had recently occurred at the Philadelphia plant. It also provides diversification geographically in case a glut of products develops in a particular area, squeezing refinery margins there.

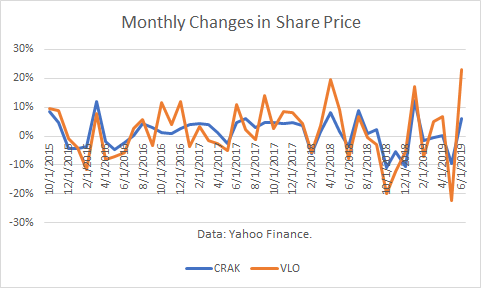

CRAK may provide a smoother ride than owning individual names because the gains and losses among stocks are averaged, though the weights on each stock are not equal. For example, the standard deviation of monthly changes in CRAK was 5.3%, whereas the same calculation for VLO was 9.5%. So, CRAK had almost 50% less volatility.

Two cons of owning CRAK instead of investing directly in an independent U.S. refiner is that IMO 2020 is expected to benefit complex, U.S. refineries the most. The second is an expense ratio of 0.59% associated with the ETF.

Profile

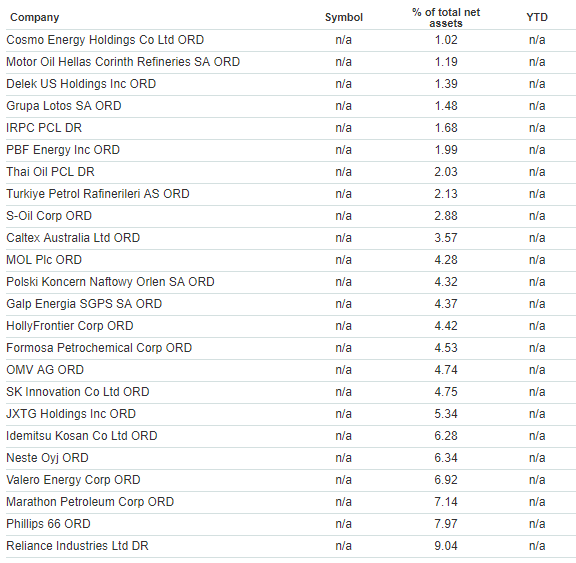

Top Holdings

Performance

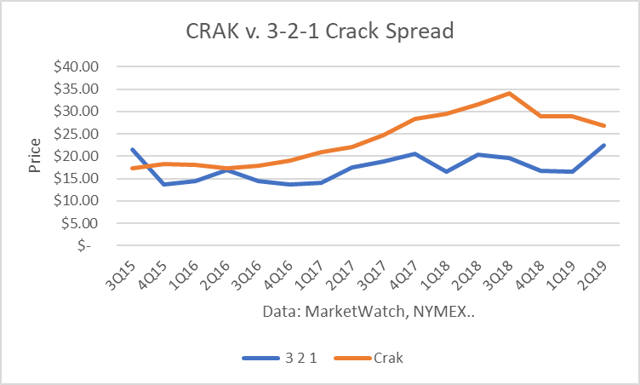

CRAK is trading about 22 % off its high in 4Q18. It seems reasonable to me that CRAK should exceed the 4Q18 high as IMO 2020 approaches on January 1, 2020.

Although current crack spreads do factor into current profitability, it is important to understand that the share prices of these companies are based on the longer-term outlook for the businesses, not just short-term profitability.

In my assessment of quarterly share prices and the NYMEX 3-2-1 crack spread (i.e., 3 crude contracts v. 2 gasoline and 1 heating oil contract), the correlation was 49%. Another factor reducing the correlation is the fact that the NYMEX contracts are based in Cushing, Oklahoma (crude), and the New York Harbor (products), whereas the companies in CRAK sell their products in many locations throughout the U.S. and world.

Conclusions

CRAK provides an opportunity to gain exposure to a diversified group of companies with refining assets. The risk to any one company is reduced and the portfolio effect of having a group of companies may make the ride smoother than a concentration on just a few names.

However, IMO 2020 is expected to provide the biggest benefits to complex U.S. refiners. And so a more diversified portfolio may not yield as strong of a performance as a concentrated, focused portfolio.

Are you pleased with your energy sector returns?

To guide investors who are interested in profiting from outstanding opportunities in the energy sector, I provide a service on Seeking Alpha’s Marketplace oriented toward individual investors, Boslego Risk Services.

I am now accepting new members to Boslego Risk Services and invite you to sign-up. There are monthly and annual pricing options as described here. You may also read reviews posted by members here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News