gorodenkoff

Why use leverage? Leverage has always been the most effective way to build wealth. It also has been the most potent way to destroy it. Hence the bad name attached to it, from the disrepute attached to 3X leveraged ETFs to the fatherly advice Warren Buffett freely dispenses. Here’s what the Sage of Omaha said in his 2010 shareholders letter: “History tells us that leverage all too often produces zeroes, even when it is employed by very smart people.” I tend to watch what Warren does rather than listen to what he says, as this advice coming from someone running an insurance company always sounded bizarre to me: who can possibly rely more on other people’s money (OPM) than an insurer? “Do as I say, not as I do”…

As we know, real estate has always been the most effective way to build riches, the main reason being that all the real estate moguls have been masters of leverage. Same can be said about bankers and hedge fund managers. But what about you and me? Thankfully, this bad rap does not extend to leverage through mortgage financing, good source of wealth creation, accessible to all. But as the 2008 GFC demonstrated, this leverage too did produce zeroes, and even worse, for underwater homeowners. Leverage is a powerful tool when used smartly, but as all tools, if misused, it can lead to disastrous outcomes. This article aims at clarifying how and when to use it and when to shun it to build wealth over time while steering clear of its potentially toxic effects.

How to use leverage? Leverage for individual investors comes in three main forms: futures contracts, margin accounts and leveraged ETFs (LETFs). The first two are aimed at “accredited investors”, who supposedly know what they are doing, while leveraged ETFs are directed at retail investors, providing easy access to leverage through a ready-made (if somewhat costly) product. We will focus here on Leveraged ETFs but the rules defined -eliminate leverage when market conditions change- apply to all forms of leverage.

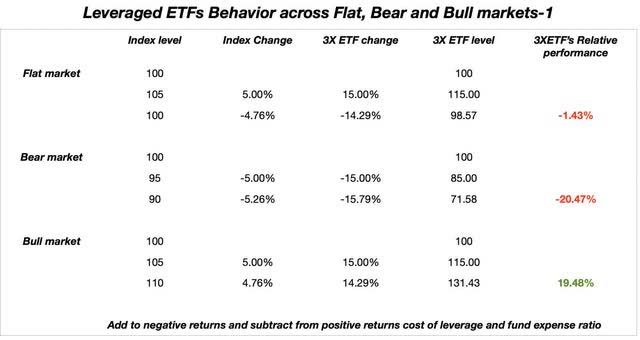

Do Leveraged ETFs deserve their bad rap? This bad rap is built on the fact that LETFs suffer from what is called “volatility decay”. The typical demonstration shows that in a flat market, whereas the unlevered product will have returned to its original level, the LETF will end the period below that level. Similarly, in a bear market, the LETF will experience a larger loss than the unlevered product. But conversely, in a bull market, compounding will run its magic and propel the LETF way above its unlevered kin. So there is indeed volatility decay, but also volatility compounding. The below table illustrates decay and compounding in the various markets:

Author

So what this table teaches us is that LETFs suffer from downward volatility -decay- while upward volatility -compounding- helps. No surprise in that conclusion but it kind of weakens the blanket rejection of LETFs. Conventional wisdom is to avoid leveraged products because of time decay. But time decay reflects cumulative negative returns: to express it intuitively, each negative return impacts a lower base due to preceding negative return, therefore magnifying its impact -the opposite of compounding. So in down or even flat markets, leverage indeed eats up the investment. Hence the toxic reputation of leveraged ETFs and the idea that they are not for long-term holdings. But what common wisdom on ETFs forgets is that in bull markets, the decay effect highlighted in flat or down markets is reversed and leads to stellar performance eclipsing traditional Buy and Hold strategies, provided the market trends consistently higher.

Investors who held positions in 3X ETFs UPRO and TQQQ from March 2020 to December 2021 can attest to this (Ask me how I know…).

How to protect leveraged investments from downside risks? Market timing. Now of course the issue is “can we capture upward volatility and limit exposure to downward one” -which is everybody’s quest in the market-? Academic research shows that one cannot predict stock returns (or so imperfectly that it makes the prediction useless to generate alpha) but one can predict volatility as it tends to cluster. This was established on the basis of the GARCH (General Autoregressive Conditional Heteroskedasticity) models (I know, I know, that’s some mouthful right there) of Nobel Prize fame (Robert Engle, NYU Professor of Finance)

What it says in plain English is that volatility clusters and does so in Bear markets: volatility is asymmetric, higher in Bear markets than in Bull markets. So basically stocks go up somewhat orderly, they go down more erratically. And leverage helps in Bull market but hurts in Bear market. Duh… But how can we know the type of market we are heading into? Both scholars and practitioners have shown that the 200-Day Moving Average and its twin brother, the 50-week moving average (50 WMA) are very useful yardsticks separating Bear and Bull markets. For instance, Charlie Bilello showed that between 1896 and 2018, the annualized volatility of the Dow after a close below its 200-day moving average was 22.4% versus 13.6% above it. Over the same period, the annualized return of the Dow after closing below its 200-day was -3.2% versus +9.7% for closes above. Paul Tudor Jones famously said that when the market trades below the 200 DMA, it’s time to play defense as opposed to aggressive positioning above. Michael Gayed advocated leverage for the long run with a move to cash whenever the market dipped below the 200 DMA. Meb Faber advocates a broadly similar strategy. One explanation for this increased volatility in bear markets is that, as their market capitalization declines (lower stock prices), companies are less insulated against adverse shocks, so volatility is asymmetric, higher in bear markets, it clusters below the 200 DMA, hence the requisite posture, defensive below, aggressive above.

The issues with market timing: Conventional wisdom tells us that Buy and hold strategies (B&H) are preferable to market timing as whipsaws and wrong-footing will cost in-and-out trading due to transaction costs, less time in the market and taxes. So why bother with 200-day moving average? First, the 200 DMA strategy will keep you out of bear markets. This has so far not compensated the market timing shortfall in US markets as US markets have always consistently recovered after corrections. But if we look at other markets, the situation is different: Japanese investors exiting their market in 1989 in line with the 200 DMA rule are still doing better than their Buy and Hold counterparts, as the local market has still not recovered its level of 30+ years ago. Furthermore, not everyone can afford the luxury to wait for the recovery, even if it is shorter than 30+ years… But most importantly, a judicious use of leverage allows to beat unlevered B&H: in line with the clustering volatility below the 200 DMA, restricting the use of leverage to markets trading above 200 DMA and moving to cash or an unlevered position below the 200 DMA is the way to capture the benefits of leverage while avoiding its toxic impacts.

Levered Investing without market timing: the levered Stock/Bond portfolio: Up to 2022, this was achieved by replicating a levered Stock/Bond traditional portfolio by using two LETFs, UPRO (3X SPY) and TMF (3X TLT), the idea being that when stocks would crash, bonds would soar as the Fed would come to the rescue by aggressively cutting rates and showering the market with liquidity (QE). This worked beautifully over the last 20 years or so, triggering the popularity of the levered Stock/Bond (55% UPRO, 45% TMF), presented as a “set it and forget it” road to riches. This looked too good to be true, and indeed it turned out to be so. Came 2022 with the Fed aggressively raising rates to fight inflation, the levered 60/40 portfolio came crashing down full speed. Instead of compensating for stocks nosediving, bond prices compounded the losses all along 2022.

Setting up filters to avoid whiplashes, false alarms and attendant costs. The market can flirt with the 200 DMA, triggering costly false signals. To manage this, a good filter is the 50-week moving average (50 WMA). Advantages are numerous: it allows to wait for confirmation if the 200 DMA is only breached temporarily; it has the same memory as the 200 DMA (with the same approximate duration). It also avoids being triggered at the same time as other traders, as 200 DMA is quite popular: sometimes it pays to shoot a little later than the crowd as the money left on the table by moving a little late on the signal is more than made up for, by avoiding the false alarms. Another type of filter is the 200 DMA signal but with the trade in or out occurring on the last day of the month where the signal occurred. This is actually the strategy with the most successful back testing, but there is no guaranty that it will remain so going forward.

Risks to the strategy: In addition to highlighted risks, one needs to factor the cost of leverage. QE and money printing made leverage costless. What costed 0% or close to 0% so far, now costs 5%. This directly affects the cost of swaps used by the 3XLETFs and will negatively impact their performance. We’re in a different world from the last 40 years of a Bull Bond Market and a Bull stock market propped up by the Fed. So be careful out there. Furthermore, a protracted bear market or a flat market would dramatically change things. So far, buying the index and leveraging it was the road to riches. Indexed funds in a flat or down market will lose all appeal and revive the need for stock picking. More generally, leverage magnifies upside AND downside. So levered investments are definitely not a “set it and forget it” strategy, hence the necessity of a “managed leverage”. See what the SEC has to say about this here.