[ad_1]

ThitareeSarmkasat/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on January 22nd, 2022.

The Invesco Senior Loan ETF (BKLN) is an index ETF focusing on senior secured floating rate loans from non-investment grade corporations. It offers investors a relatively weak 3.1% dividend yield, but, as the fund’s holdings are indexed to market interest rates, dividends should increase as interest rates rise, all while share prices remain stable. Senior loans are one of the only asset classes which has performed relatively well these past few weeks, and should continue to see strong performance under current market conditions. BKLN is a buy, and particularly appropriate for income investors concerned about rising interest rates and equity valuations.

Floating Rate Bond Comparison and Investment Thesis

BKLN invests in floating rate loans. These are fixed-income securities with several important differences relative to more traditional fixed-rate bonds. Understanding these differences is key to understanding BKLN, so let’s start by focusing on these.

Fixed-rate bonds pay a fixed interest rate payment throughout their tenure. Market conditions may change, but the interest rate on the bonds remain the same.

Floating rate bonds pay a variable coupon throughout their tenure, usually LIBOR, which closely tracks the federal funds rate set by the Federal Reserve, plus a spread. As central bank rates rise, so do interest rate payments on the bonds, and hence shareholder returns. Lower rates have the opposite effect.

As should be clear from the above, fixed-rate bonds and floating rate bonds react very differently to higher interest rates. Let’s analyze this in more detail with a simple example.

You have two bonds with the same characteristics: price, interest rate, tenue, and maturity is all the same, but one is fixed and one is floating.

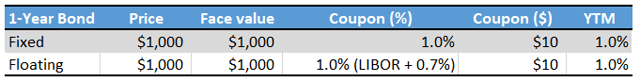

The bonds might look like this:

Chart by author

In the above example, both bonds yield 1%, and those are the returns shareholders can expect from investing in either bond.

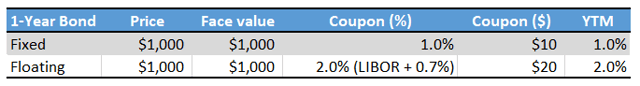

Let’s assume the Federal Reserve hikes rates by 1.0%, as some analysts are expecting is likely to happen throughout the year.

Floating rate bonds should see their coupons increase by 1%, or $10, leading to greater shareholder returns and dividends.

Fixed rate bonds should not see any changes in their coupons, they are fixed after all.

The bonds might now look like this:

Chart by author

As can be seen above, the floating rate bond benefitted from rising interest rates, and now offers greater coupons and higher yields to shareholders. Investors will soon notice that this is the case, and will sell their lower-yielding fixed-rate bonds to buy higher-yielding floating rate bonds. Fixed-rate bonds should see lower prices as a result. Importantly, fixed-rate bond investors receive the entire $1,000 they originally invested once the bonds mature, regardless of the price of the bond: the lower prices are simply a temporary loss. Investors will sell the fixed-rate bonds until their expected returns are equal to those of floating rate bonds. Prices would decrease by about $10, the difference between the coupon payments of the two bonds.

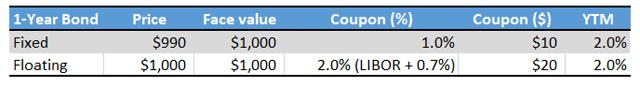

The bonds might end up looking like this.

Chart by author

At these prices the returns for both bonds are roughly the same. Investors in floating rate bonds receive a $20 coupon. Investors in fixed-rate bonds receive a $10 coupon, and should see $10 in capital gains once their bond matures (they buy the bond for $990, but receive $1,000 at maturity).

Let’s review.

Increased federal funds rates led to increased coupon rate payments, dividends, and returns for the floating rate bond.

Increased Federal Funds rates led to a short-term capital loss for the fixed-rate bond.

Increased Federal Funds rate were a benefit for the floating rate bond, a negative for the fixed-rate bond. Considering the near-certainty of federal funds rate hikes in the coming months, floating rate bonds seem like a no-brainer. With this in mind, let’s have a look at BKLN.

BLKN Basics

BKLN Overview

BKLN is a floating rate loans index ETF. It tracks the S&P/LSTA U.S. Leveraged Loan 100 Index, an index of senior secured loans, the largest type of floating rate bond. BKLN’s holdings have several important characteristics.

BKLN’s holdings are all senior secured loans. Senior means these loans are a company’s senior-most financial obligation, and must be paid, in full, before the company makes payments on other loans, bonds, or even dividend payments. Secured means these loans are backed by hard assets from the company. In the event the company is unable to meet its financial obligations, investors receive these hard assets, allowing them to (partially) recover their investment. Due to this, senior secured loans are relatively safe securities, at least compared to equities or high-yield corporate bonds.

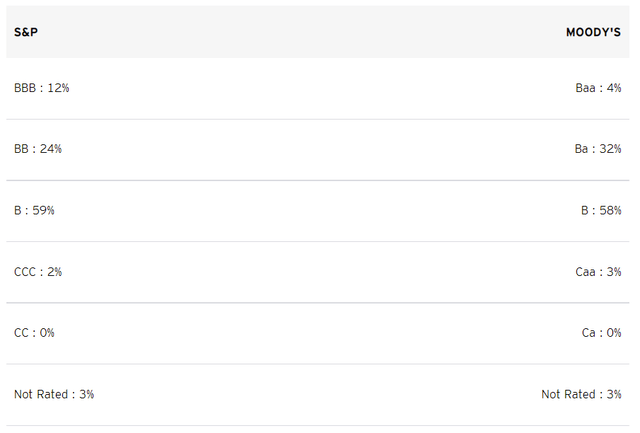

BKLN’s holdings are generally comparatively low-quality securities, with low credit ratings and high default rates. The fund’s average holding has a credit rating of B, an incredibly low credit rating, and indicative of companies with weak balance sheets and financials.

BKLN Corporate Website

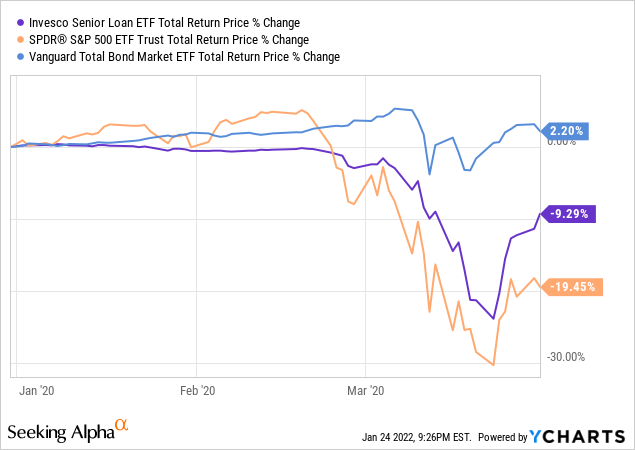

Focusing on low-quality securities increases risks, while focusing on senior secured securities lowers risk. The result is a moderately risky fund, somewhere between that of an investment-grade bond fund and an equity fund. Expect moderate losses during downturns and recessions, as was the case during 1Q2020.

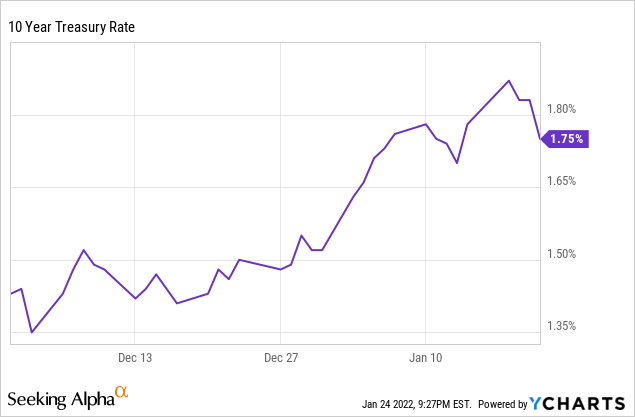

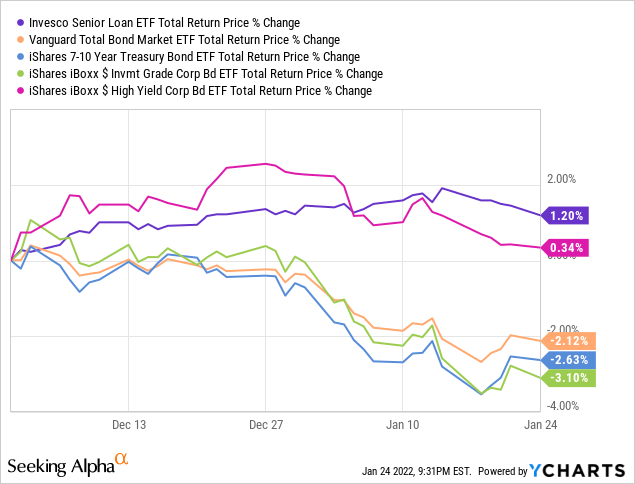

BKLN’s holdings are almost all floating rate loans, as almost all senior secured loans have floating rates. There are exceptions, these two securities are not identical, but these are few and far between. As per the fund’s latest annual report, approximately 96% of its non-cash holdings were floating rate loans, with the rest being fixed-rate loans. As the vast majority of BKLN’s holdings have floating rates, we can characterize the fund as a floating rate fund, with all the benefits that entails. BKLN should outperform its peers when rates rise, as has been the case for several time periods in the recent past. As an example, rates have risen since December 2021, with the 10Y treasury rate rising by about 0.35%.

BKLN has outperformed its peers since December 2021, as expected.

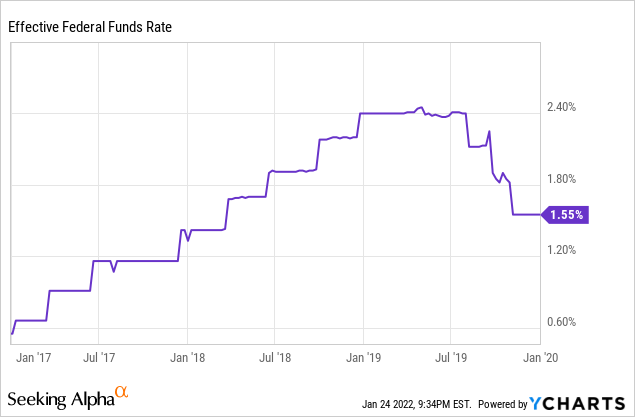

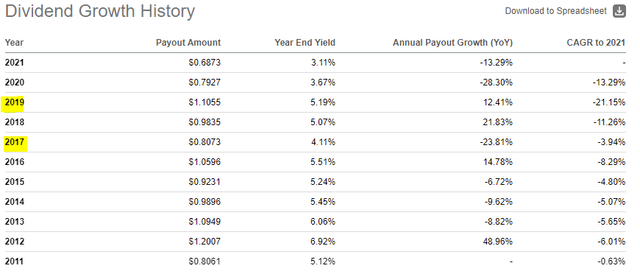

BKLN should also see higher dividend payments when the Federal Reserve hikes rates later in the year, although it might take a few months for these hikes to percolate to shareholders. As an example, the Federal Reserve last hiked rates between 2017 and 2019.

BKLN’s dividends saw some growth, as expected. Growth was, however, uneven, volatile, and somewhat dependent on the specific time period analyzed.

Seeking Alpha

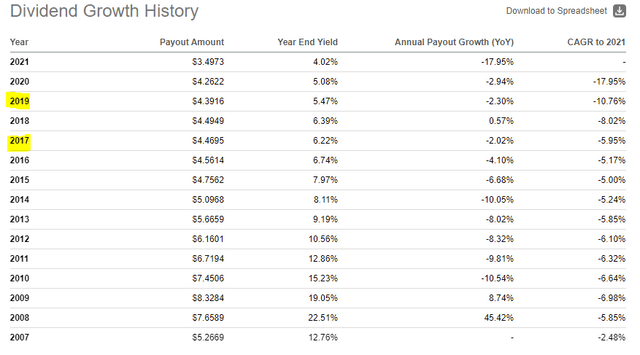

As a comparison, the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), a high yield corporate bond index ETF, saw declining dividends during the same period of time.

Seeking Alpha

BKLN’s dividends fare better during a rising rates environment than those of HYG, as expected.

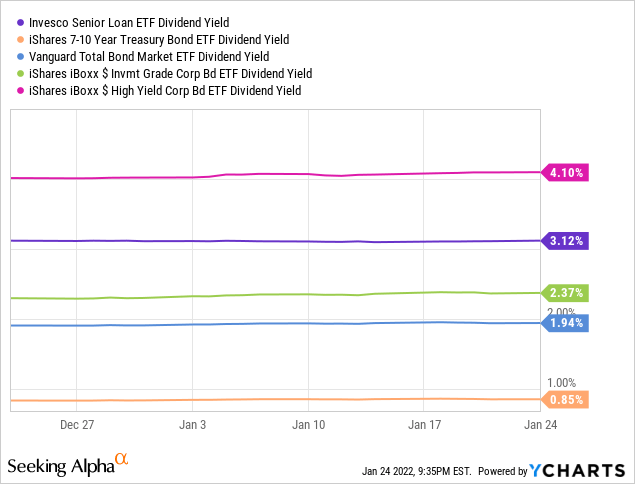

Finally, and on a more negative note, BKLN currently yields a paltry 3.1%. It is a relatively low yield on an absolute basis, and the lowest yield in the fund’s entire history. It is somewhat higher than average for a bond fund, but lower than that of most high-yield corporate bond funds. As mentioned previously, BKLN should see higher dividends as the Federal Reserve hikes rates, but that has yet to happen, and the fund’s current dividends are quite low.

Finally, BKLN currently sports a 0.65% expense ratio. Expenses are relatively high, and quite a bit higher than average for a broad-based index ETF. BKLN’s high expense ratio directly reduces the fund’s dividend yield and total shareholder returns, and is a significant negative for the fund and its shareholders. I’m generally wary of investing in expensive index funds, but there are not that many options available in this particular niche, and the fund does have one important benefit. Let’s have a look.

BKLN Investment Thesis

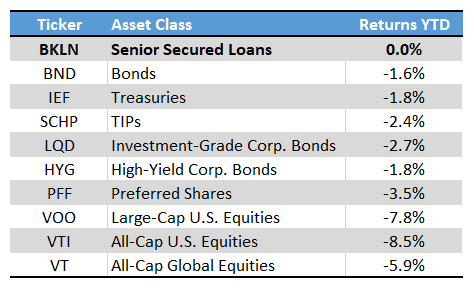

BKLN’s entire investment thesis rests on the fund’s comparatively strong performance when interest rates are rising, as they currently rare. Extremely few asset classes and funds can reliably perform well when interest rates are rising, especially when these coincide with bearish market sentiment, as has been the case YTD. Senior secured loans are one of the only asset classes which has not posted losses YTD, with most equities, bonds, and even safe haven assets like treasuries, being down.

Seeking Alpha – Chart by author

BKLN is likely to outperform most broad-based asset class index funds as long as interest rates are rising and economic conditions remain bearish. This is a significant benefit for the fund, and particularly important for investors concerned about current economic conditions, especially rising interest rates. As mentioned previously, there are simply few funds and asset classes which perform well when BKLN does, so the fund could conceivably be a top performer if current conditions continue.

Conclusion – Buy

BKLN invests in senior secured loans, which should see higher yields and stable share prices as interest rates continue to increase. BKLN should benefit from current economic trends, outperforming most of its peers. The fund is a buy, and particularly appropriate for investors concerned about rising interest rate, and tough market conditions.

[ad_2]

Source links Google News