Marco Bello/Getty Images News

Investment Thesis

ARK Innovation ETF (NYSEARCA:ARKK) has continued to disappoint its long-term holders (including us) as the bearish momentum has unhinged speculative growth stocks. We presented in our previous article that its bubble has been burst. However, the market makers did another astute trap in April, which sent the ETF further down in the May sell-off.

However, we must highlight that our holdings in ARKK comprised just 1.5% of our total portfolio average cost. While it has made a disappointing round trip from our initial purchase, it has not impacted our portfolio significantly. As a result, we continue to stay vested despite its near-term challenges.

Notwithstanding, our price action analysis suggests that the ETF is at a critical juncture as it last traded above its COVID bottom. Therefore, we suggest investors wait for a successful re-test of its COVID bottom before adding exposure.

Consequently, we revise our rating on ARKK from Buy to Hold as we wait for the re-test.

Nine Of Ten Holdings All In A Downtrend

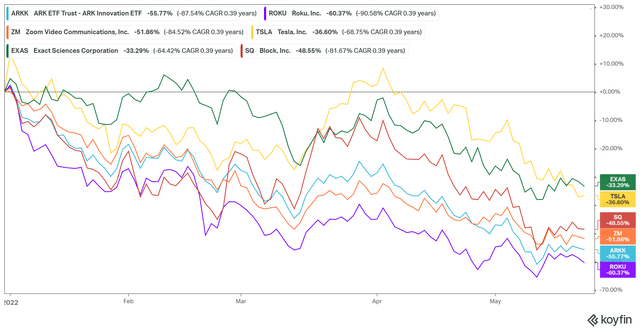

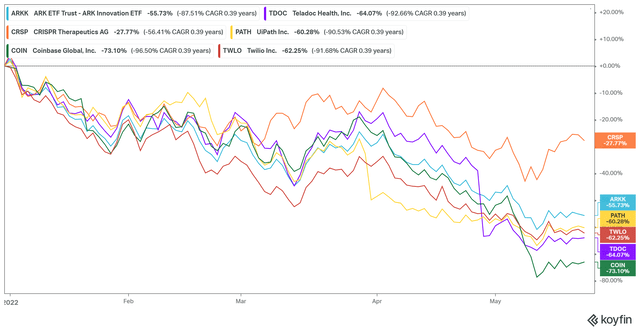

ARKK top ten holdings (part 1/2) (koyfin) ARKK top ten holdings (part 2/2) (koyfin)

It’s easy to see why ARKK is down a massive 55.7% YTD, as it underperformed the market. A closer look at its top ten holdings indicates that all of them sans Tesla (TSLA) stock are in a downtrend. Therefore, fighting against the market forces is impossible when your underlying holdings are getting squashed. ARKK’s best performer is CRISPR (CRSP) stock, with a YTD return of -27.8%. Its worst performer is Coinbase (COIN) stock, with a YTD performance of -73.1%.

As a result, investors shouldn’t be surprised that ARKK has been unable to stage a sustained recovery from its downtrend bias.

Cathie Wood Kept Adding To Her Losers… Quite Stunning

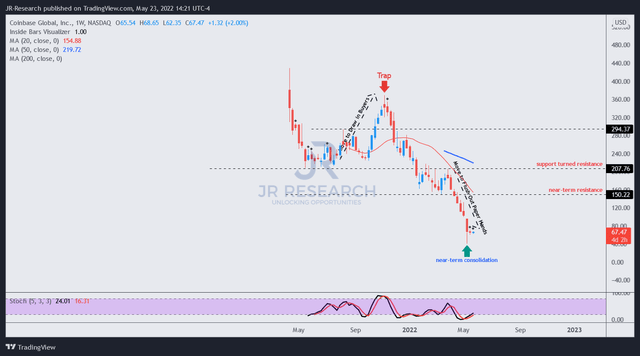

COIN price chart (TradingView)

ARK Invest CEO/CIO Cathie Wood’s most recent significant dip-buying was on COIN stock. Bloomberg reported ARKK added a total of 860K shares recently, as Coinbase crashed after a disastrous FQ1 earnings report (we discussed in a recent update).

Despite its weak moat and unsustainable profitability, we didn’t expect ARKK to add so aggressively on COIN stock. Furthermore, the stock is mired in a significant downtrend, even though it should be at a near-term bottom after an enormous capitulation move.

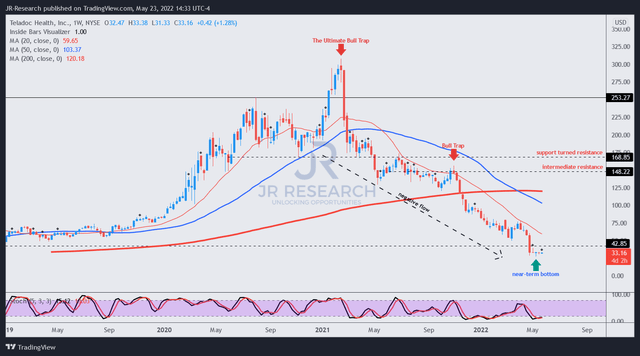

TDOC price chart (TradingView)

A few weeks before Coinbase’s earnings release, ARKK added heavily into Teladoc (TDOC) before its slated earnings card. But, we alerted investors not to add TDOC stock heading into its earnings as we were concerned that its revenue guidance could be at risk, given the macro headwinds.

We were also skeptical about management’s outlook before its earnings card, which we thought did not account sufficiently for the risks of a pullback in corporate healthcare spending. Therefore, you can say that we were utterly stunned that ARKK added TDOC aggressively right before its disappointing earnings.

“Live Or Die” With ARKK – There’s No Other Way To Understand

Cathie Wood’s steadfast commitment to her “disruptive innovation” strategies can be mind-boggling. Because, as ARKK holders ourselves, we have also been stunned by the timing of her purchases.

However, the ARK Invest CEO has continued to demonstrate a high level of conviction, despite an apparent implosion of ARKK from the highs of February 2021 to the current lows. Even we found it challenging to express optimism in her selections at times. But, perhaps some investors have found her conviction levels something of a charm. The ETF Store (an advisory firm) articulated (edited):

Cathie Wood has not wavered at all in her conviction in her strategy, and in fact, has doubled down on her strategy. That’s attractive to a certain segment of investors. Investors know exactly what they’re going to get and can rely on its funds to make pure-play trades on innovation. The benefit of Cathie Wood not wavering from her strategy during this brutal downturn is that I think it will help the longer-term viability of ARK. – Bloomberg

That observation from an advisory firm is interesting. Because ARKK has pulled in net inflows of $1.5B in 2022 despite its hugely underwhelming performance. Therefore, investors need to recognize that there are other investors in the market who continue to put their faith in Wood’s framework. Despite the round-tripping for investors from the 2020 vintage, these investors may not be concerned.

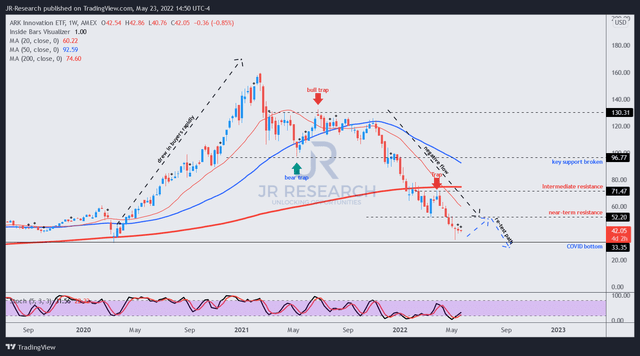

Price-Action Suggests A Near-Term Bottom

ARKK price action (TradingView)

A series of bull traps after its 2021 top reflected the downward bias of many of its underlying stocks. Therefore, we can understand why the concentrated bets on disruptive technology stocks is an inherently volatile strategy, at least in the near term.

Furthermore, ARKK’s momentum is decisively bearish, as it continues to be in “negative flow.” Nonetheless, we observed that it’s consolidating at a near-term bottom. However, we believe that it could rally into its near-term resistance before falling to re-test its COVID bottom.

Is ARKK ETF A Buy, Sell, Or Hold?

Although we think ARKK’s bubble has been burst, there has been no stopping of its pain because of some contentious purchases recently. But, we have continued to hold on to ARKK, given our small exposure. Therefore, it’s highly manageable, and we don’t find its volatility or poor performance particularly worrying.

We also view it as a hedge against our conviction because we could eventually be wrong about Coinbase or Teladoc. If ARKK turns out to be right over the long-term, at least we have managed to participate, despite our small exposure. But, if we are looking for multi-bagger gains, even a little exposure is meaningful.

Notwithstanding, we revise our rating on ARKK from Buy to Hold. We believe the ETF could rally into its near-term resistance before re-testing its COVID bottom. Therefore, we will closely watch its potential re-test before updating our rating moving forward.