[ad_1]

ZargonDesign

By standard measures, the U.S economy is now in a recession after posting two-quarters of negative GDP growth. While the NBER has avoided using the term, we now know with certainty that the U.S economy is not slowing but contracting. To convolute the situation, inflation and employment remain strong due to the leading declines in global economic supply. In other words, the U.S economy is in a rare inflationary recession where traditional methods of stimulus do not work. For example, the Federal Reserve may not be able to stimulate the economy through interest rate cuts or Q.E. because that could cause inflation to worsen dramatically.

Now that the economy is in a recession, many investors appear to be racing into traditional counter-cyclical investments like bonds. Indeed, long-term interest rates have declined at a rapid pace over the past two weeks as it has become apparent the economy is contracting. However, investors may want to avoid these investments since there are still few strong signs that long-term inflation will decline. In the short-run, the decline in economic demand should cause a peak in inflation, but evidence suggests prices will still rise faster than most bonds yield.

As such, inflation-resistant investments such as the Treasuries inflation-indexed bond, available through the ETF (NYSEARCA:TIP), may be superior options. I have been bullish on TIP since the end of May, and the fund has risen sharply recently. With more investors realizing the economy is slowing, TIP may have strong short-term upside potential as real interest rates plummet toward record lows.

An Inflationary Economic Recession

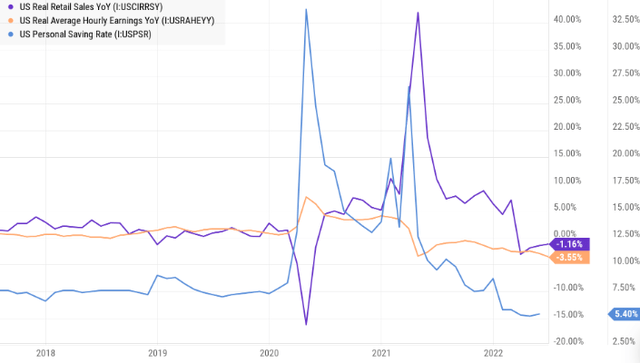

We must understand today’s economic situation to understand inflation-indexed bonds’ potential in today’s market; notably, inflation is unlikely to decline dramatically despite the sharp slowdown. Over the past year, real wages, confidence, personal savings, retail spending, and other key metrics have all decreased. There has been a strong negative trend in nearly all leading economic data since last fall, but trends have accelerated to the downside in recent months. First, see earnings, savings, and real retail sales:

U.S Real Retail Sales, U.S Real Average Hourly Earnings, U.S Personal Savings Rate (YCharts)

These metrics peaked in early 2021 when the economy was still stimulated by the Federal Reserve’s Q.E. policy and immense direct stimulus that boosted people’s savings and spending capacity. Of course, when economic demand is artificially supported to be above economic supply, prices rise until people reduce spending – causing demand to return to supply. We are seeing that pattern today as people’s real wages and savings rates decline, more recently causing a sharp decline in retail sales.

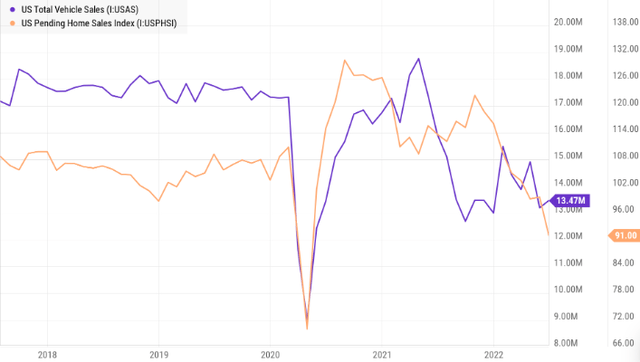

Many people are also deferring significant purchases such as homes and vehicles. This trend has accelerated throughout 2022 as higher long-term interest rates have decreased borrowing capacities. See below:

U.S Total Vehicle Sales, U.S Pending Home Sales (YCharts)

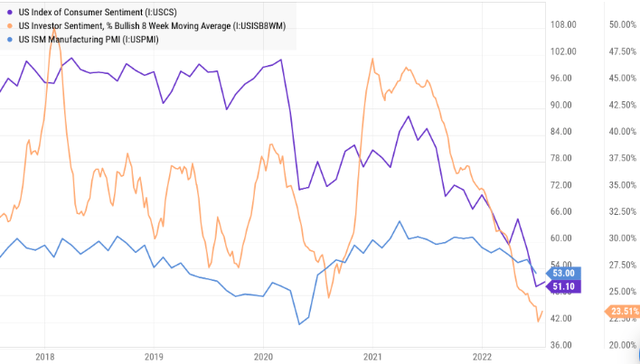

The “hard data” has pointed to a recession for nearly a year. I have been warning investors of an inflation-driven slowdown since last year and, since June, have been confident the economy was in a recession. More recently, there has been a sharp deceleration in investor and consumer sentiment and a strong negative trend in leading business activity. See below:

U.S Consumer and Investor Sentiment and U.S Manufacturing PMI (YCharts)

Sentiments for consumers, investors, and businesses are shallow and have been weak for some time. The data, and logic, illustrate that economic consumption must decline if economic supply is not rising. Though not necessarily services, the production of goods has been depressed since 2020 as most commodities’ production has not returned to 2019 levels.

That crucial point, lower supply forcing demand to decline, makes the current recession different from the past. In a typical economic cycle, economic demand eventually rises faster than supply, causing minor inflation and ultimately resulting in a slowdown in credit growth which causes demand to reverse lower. In the current situation, aggregate supply declined dramatically due to COVID lockdowns, the war, and possibly regulatory mistakes. As long as demand for scarce goods remains, prices must rise to avoid shortages. Today, prices are growing fast compared to wages, that demand is declining due to rapid inflation and not due to a slowdown in credit growth.

Inflation Will Decline, But Not For Long

The data indicates the current recession is not “soft” or “minor,” as some have suggested, but it is atypical. Inflation and unemployment are usually inversely correlated and are so today. While there has been a minor rise in initial jobless claims, unemployment may remain low since the demand for workers should persist as long as there are shortages. However, areas of the economy that lack shortages, such as the services sectors (notably technology, government, and banking), may see significant employment reductions since those segments do not benefit from inflation in the goods market.

The recession will likely cause inflation to begin to decline toward healthier levels, given two key assumptions. First, the supply of critical commodities such as oil and natural gas does not weaken further. If so, then gas prices (the largest inflation factor) will rise to new highs, and demand will need to weaken even further. Indeed, the continued rapid declines in total oil storage levels suggest this is probable.

The second fundamental assumption is that the Federal Reserve, and the U.S government, do not try to stimulate economic demand artificially. An example would be to subsidize gasoline, as the only solution to high gas prices is lower consumption or higher production, and the latter is not feasible in the short run. While the Federal Reserve may be more likely to pursue rate cuts or Q.E. now that the economy is in a recession, doing so may worsen the critical inflation situation.

I believe the probabilities of either of the two are pretty significant. Despite not validating the recession, the Federal Reserve has already begun to signal a dovish shift in monetary policy. Traditionally, the Federal Reserve would hike interest rates if employment is substantial and inflation is high. That is the cornerstone of the “Phillips curve theory” and is the “dual mandate” of the institution. However, there appears to be an unspoken third mandate of maintaining stability in financial markets. Low unemployment, high inflation, and a contracting economy are a net negative for most businesses as costs rise as demand wanes. Corporate profits, the driver of stock prices, are highly unlikely to sustain current levels without supportive monetary and fiscal policies. Realistically, a large decline in financial markets may be a stronger career-ender for Federal Reserve members than a rise in unemployment or inflation.

TIP May Soar On A Dovish Shift

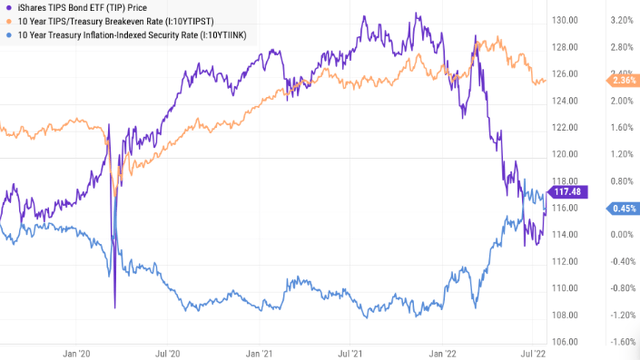

Many investors are already calling for interest rate cuts despite no fundamental need (sharply rising unemployment). With inflation likely to remain elevated, interest rates should only fall so far, if at all. However, real interest rates (or interest rates after inflation) may decline dramatically if the Federal Reserve ends its hawkish stance preemptively. Inflation-indexed Treasury bonds, such as those in the ETF TIP, are directly inversely correlated to real interest rates. TIP pays the CPI annual inflation rate plus a “real yield,” which usually fluctuates from -1% to 2%, depending largely on economic conditions and monetary policy.

Real interest rates were at record lows of ~-1.2% before this year. This drop occurred during a period of highly dovish monetary policy. When interest rates are below long-term expected inflation (measured by the breakeven rate), the economy is stimulated as businesses can borrow below the long-term expected inflation rate. Today, as the Federal Reserve ends asset purchases and raises short-term rates, real interest rates have risen to 0.45%. See below:

TIP ETF Price vs. 10-Year Inflation-Indexed Bond Rate and Breakeven Inflation Rate (YCharts)

The long-term expected inflation rate is still above the Federal Reserve’s target level of 2%. Indeed, the bond market may be underpricing inflation risks as it is unclear if inflation will decline from 9% to ~2-3% so quickly. Accordingly, overall long-term interest rates may not decline since they are supported by chronically elevated inflation. That said, interest rates may decline rapidly after inflation as the Federal Reserve shifts back toward a dovish stance.

The Bottom Line

Fundamentally, a long position in TIP is a bet that the Federal Reserve will not continue to hike interest rates if the economy is slowing. Since inflation is already high, a dovish shift would likely cause inflation to remain high or rise even higher. Since fixed-rate traditional Treasury bonds like those in (TLT) or (BND) carry significant inflation risk, I believe they are best avoided and may decline further despite the economic slowdown.

The core risk with TIP is if the Federal Reserve remains staunchly hawkish despite the recession. Indeed, it is logical for the Federal Reserve to continue interest rate hikes given high inflation and low unemployment. Of course, that situation may cause a rapid decline in financial markets as investors realize there will be no “Federal Reserve put” to protect them. Even if this occurs, it’s unlikely real interest rates will rise too quickly unless there is a sharp and lasting decline in financial market liquidity. The second significant TIP risk is a government debt default since inflation-protected bonds cannot be easily monetized. For now, a U.S government default seems unlikely, but this risk could change as the economy shifts gear.

TIP has paid a 6.5% dividend yield over the past year, and its TTM yield will likely rise higher in line with the 9% annual CPI growth. Income investors should not expect its yield to remain so high as the economic recession should cause some declines in inflation. Of course, given the Federal Reserve’s apparent readiness to shift its stance, I doubt inflation will decline back to baseline levels and may even rise by next year if Q.E. is reinstated. Inflation-indexed bonds are a much better “risk-off” bet since they stand to benefit both from inflation and the dovish shift. I am bullish on TIP and expect the fund to return to $122+ as the 10-year real interest rate returns toward zero.

[ad_2]

Source links Google News