[ad_1]

Andres Victorero/iStock via Getty Images

Investors’ Worries On The Rise

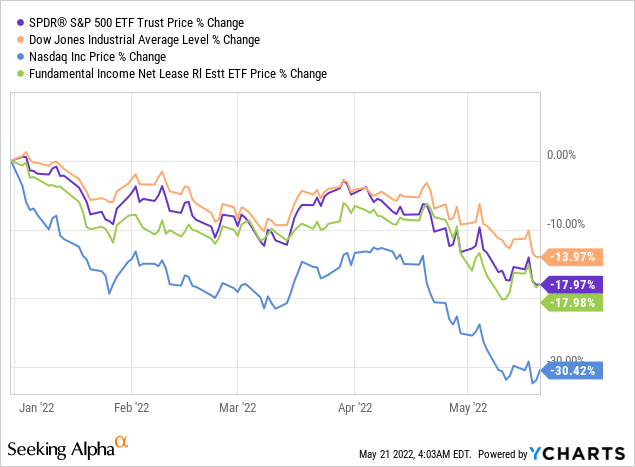

Stock prices across the board have been persistently falling since the start of 2022 due to a myriad of reasons such as normalising valuations, fears of a recession, rising inflation and interest rates. Irregardless, in any market condition, an investor’s main goal is to always remain calm and seek out undervalued/oversold stocks with good fundamentals.

In this article, I will explain why I believe that triple net lease REITs are a safe asset class that have been beaten down too much by the market and investors can turn to them for both near-term downside protection and longer-term appreciation in their portfolios. Additionally, one good way for investors to purchase a collection of good net lease REITs would be through the NETLease Corporate Real Estate ETF (NYSEARCA:NETL).

What Are Triple Net Lease REITs

Before diving into NETL, here is a quick summary of triple-net lease REITs. In the triple-net lease structure, tenants of a property will be in charge of paying for all property and operational related expenses such as taxes, insurance and maintenance costs. Additionally, in most cases, tenants are also responsible of keeping property in good order and conducting repairs/remodelling to ensure the property remains kept in shape.

Therefore, triple-net lease REITs serve more as a “financing” company as they do not have to dabble much in property management. Basically, they will purchase properties to lease it back to the operators, usually with very long lease durations. This provides operators with greater capital for their businesses and recurring rental income for the REITs. Consequently, triple-net lease REITs by nature have strong and consistent income flow, low cost of debt, strong balance sheet and consistent dividend payments

NETL: A Collection Of Strong Net-Lease REITs

Established in 2019, NETL is the first and only REIT ETF that comprises solely of net lease REITs. NETL’s portfolio consists of 24 publicly listed net lease REITs, which total 28,904 properties across all 50 US states. Its top five holdings are as follows:

NETL Top 5 Holdings (NETL Fact Sheet )

To learn more about NETL, its most recent fact sheet can be found here.

Current Concerns Around REITs

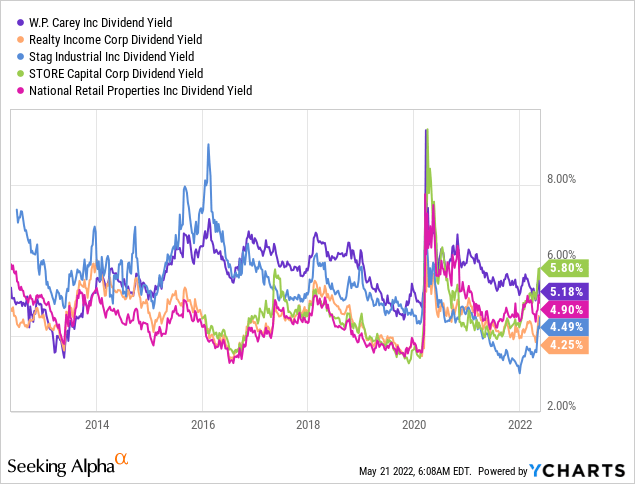

Unsurprisingly, like the rest of the market, NETL has seen its share price fall 18% YTD. There has also been negative sentiments around REITs as an asset class in general, as one can easily find REITs yielding over 4-6% in today’s market!

Inflation & Interest Rate Fears

One of the key drivers of falling REIT prices are rising inflation and interest rates. As these increase, investors start to expect a higher dividend yield in order for the investment to be worthwhile. A 5% yield against a 2% CPI results in a 3% real gain whereas a similar yield against 8% CPI results in a 3% real loss!

Another worry is that as interest rates rise, so does the cost of borrowing. REITs are traditionally debt reliant in order to expand their portfolio hence rising rates would increase interest repayments and possibly reduce FFO and dividends to investors.

Possible Recession Upcoming

Additionally, with world economies in an unstable state, it is highly likely that we will be approaching a recession within the next one or two years. When this happens, lower consumer demand and sales could lead to high tenant default rates which would affect REITs hard.

Why NETL & Triple Net Lease REITs Will Outperform

All of these have possibly led to negative sentiments around REITs in general, driving down stock prices. However, as a net-lease REIT, NETL’s constituents’ strong business model and fundamentals make them well positioned to deal with these headwinds.

Minimum To No Operating Expenses Borne

As mentioned, triple-net lease REITs do not bear any property-related expenses. This means that increases in electricity, water or maintenance costs due to inflation will not be borne by the REIT. Hence, triple-net lease REITs and NETL will be able to keep their operating expenses consistent despite a period of inflation.

Rent Escalations Tied To CPI Provides Downside Protection

Additionally, many net-lease REITs also have CPI-tied rent escalators, meaning that during periods of inflation, rent received would also increase. Take some of NETL’s top holdings as examples:

- WP Carey (WPC): 99% of rent has contractual increases, 39% are uncapped CPI (no limit to increase) while another 20% are CPI-based (tied to CPI but with a cap)

- Realty Income (O): Rent beyond the tenth year will escalate at the greater of 1.75% or CPI – capped at 2.5%.

- STORE Capital (STOR): 85% of rent are CPI-based

While rent increases will lag high inflation levels since the majority of lease escalations are capped, this still provides these REITs and NETL with downside protection as investors will almost definitely see growth in rental revenue, despite a weaker macroeconomic environment. In a period where many companies are expected to see falling sales revenue, NETL will still be able to secure growing rental revenue, albeit not keeping up with inflation through pure internal growth.

NETL’s Tenants Are Financially Stable & Have High Rent Coverage

With much of the cost burden on the tenants, some investors might be worried that tenants might be unable to shoulder these costs, especially in a probable recession. However, I believe that NETL’s tenants will hold up well as a large proportion of tenants are investment grade, have high rent coverage ratios or are consumer-defensive companies which will hold up well regardless of market conditions. Take the following REITs as examples:

- Agree Realty (ADC): 67% of tenants are investment grade

- Realty Income (O): Over 30% of tenants are grocery stores, pharmacies or convenience stores with 51% classified as investment grade

- STORE Capital (STOR): An average contract can tolerate a ~40% fall in revenue and still be able to fulfil rent obligations

Additionally, the strength of these tenants have been further reinforced by past recessions and the COVID pandemic, where occupancy rates have always remained high and above 95%. Arguably, I would also say that COVID lockdowns might have a larger impact on businesses considering that there were literal restrictions on human traffic, hence NETL’s tenants which have been able to withstand the pandemic will also be able to hold up well in weak economic environments.

Unlikely To Require Huge Financing At Higher Costs Of Debt

With one of the worries being rising debt servicing rates, this impact on NETL will be minimal as unlike many REITs, triple-net lease REITs tend to have longer and lower debt terms due to their superior financial position. Consolidated, NETL has a 7.3-year weighted average debt term and 3.5% average borrowing rate.

NETL Average Debt Term And Rates (NETL Web Page)

Therefore, I do not believe that NETL will require heavy refinancing in the near term and will be able to ride out high inflationary periods while keeping cost of borrowing low.

Consistent And Safe Dividend Payments

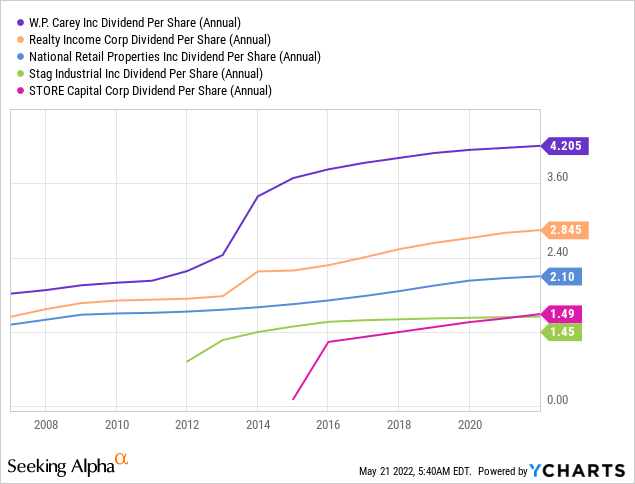

Since NETL has only been active for 2 years, they do not have a reliable dividend track record. However, many of NETL’s constituents have been around for decades and have continuously paid and raised dividends, even in recessions. The following chart depicts the dividend record of NETL’s top five holdings which are exceptionally good.

- Realty Income: 5/yr annual dividend growth rate of 3.71% and 25 years of growth

- WP Carey (WPC): 5/yr annual dividend growth rate of 1.3% and 9 years of growth

- STORE Capital: 5/yr annual dividend growth rate of 5.85% and 7 years of growth

- National Retail Properties (NNN): 5/yr annual dividend growth rate of 3.10% and 12 years of growth

Therefore, investors can be rest assured that dividend payout will remain stable (and might even increase) even during weak macroeconomic conditions as NETL’s constituents have had a strong track records. Even for newer companies, almost all of them did not cut dividends during the COVID-19 pandemic, a show of strength.

Interest Rates & REITs Return Are Not Negatively Correlated

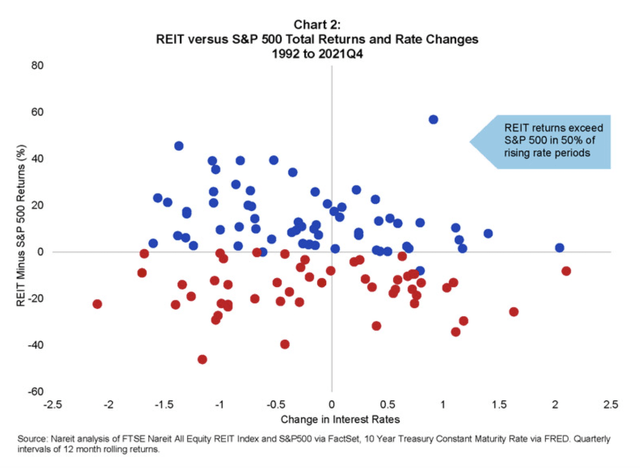

With the fundamentals aside, I will be moving on to the statistical side of things. While many investors seem to believe that high interest rates will depress the returns of REITs, history does not agree with this assertion. In fact, the inverse seems to be true! Per Nareit, REITs returns were positive in 85% of periods of rising rates while and even exceeded S&P returns 50% of the time!

REITs Performance Vs Interest Rates (Nareit)

Hence, while historical performances do not dictate the future, I believe that many of the fears have been overblown both from a fundamental and statistical perspective.

NETL Provides Strong Diversification

With NETL, investors can own a stake of all publicly traded net-lease REITs in the US. This provides great diversification effects as investors will not be greatly affected by the actions or performance of any one REIT. For example, if a certain REIT decides to cut dividends due to a very bad recession, the overall impact on payout would still be minimised.

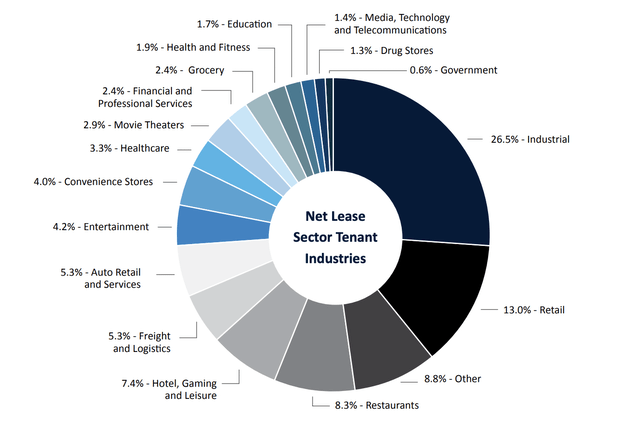

Additionally, NETL is sector diversified apart from a larger proportion of industrial and retail companies making up 40% of the total portfolio.

NETL Tenant Breakdown By Industry (NETL Web Page)

While 40% might be huge, this is quite proportionate to the US economy breakdown and as discussed earlier, NETL’s tenants are financially strong hence even in a downturn where industrials and retail are usually hit badly, NETL will still weather the storm well. Fortunately, industrial production still remains high now, hence NETL’s tenants are likely performing well as things stand.

Catalysts & Risks For NETL

Risk 1: Low Liquidity Of NETL

NETL has considerably low liquidity with only 24,000 shares traded on average per day. This might put off larger investors from investing or put current investors through large price swings.

Risk 2: High Expense Ratio & Short Track Record

NETL itself has only been active for 2 years which is a short period and an expense ratio of 0.6% is definitely not cheap. Hence, some investors might not be comfortable with this and might avoid investing. Coupled with risk 1, these factors may make it harder for NETL to realise a higher valuation. However, as this is the first net-lease fund, I believe that it is normal to both have lower liquidity and a “lack of” track record initially. Considering that net-leases historically do better than traditional REITs, investors will likely experience superior returns in the long run. To avoid these risks, investors can also pick individual net-leases.

Catalyst 1: Greater Attention & Demand For Net-Leases

As share prices continue to fall, more investors could start to be aware about the attractiveness of triple-net lease REITs. Should this happen, there could be greater demand and capital inflow which will boost NETL’s price. Given that passive investing is a rising trend now, there is a high likelihood that most of the capital inflows will be via an ETF, namely NETL.

Valuation For NETL

Dividend Yield

NETL currently has a forward dividend per share of $1.14, representing a 4.4% yield over a $26 share price. Looking at the historical dividend yield for net-lease stocks, I believe 4.4% is close to a fair value range hence NETL is not undervalued based on this metric.

FFO Multiple

Currently, NETL has a P/FFO multiple of around 14.5x, which is slightly lower than a historical net-lease REIT range of 15-18x. Hence, it is also trading rather close to fair value on this metric.

DDM With Scenarios

Finally, I constructed a DDM with various three scenarios. I used a flat discount rate of 8% as together with a 4% yield, an annual 12% return would suffice for me for defensive positions. The other inputs are as follows:

| Bear | Base | Bull | |

| Y1-5 Growth Rate % | 3 | 5 | 7 |

| Y6-10 Growth Rate % | 2 | 3 | 5 |

| Terminal Growth Rate % | 2 | 2 | 3 |

| Intrinsic Value | $25.13 | $27.58 | $35.57 |

With an average price of $29.43, a $26 share price represents 12% undervaluation which is not a lot.

Recommendation

Therefore, while NETL is a fundamentally strong net-lease play, I believe that the ETF is currently trading quite close to its fair value. Investors who wish to add a defensive position into their portfolio now can still add NETL as it is a unique and strong ETF that will withstand macroeconomic headwinds well and be a strong dividend payer. Otherwise, given the negative sentiment around the market, I believe that investors can keep NETL on their shortlists and pounce, should the price continue to tumble.

Investing in an ETF would be good for investors who wish to be more “hands-off” and reap the benefits of the industry/sector of choice. On the other hand, investors like me who wish to maximise returns can pick individual net-lease REITs that have the strongest fundamentals. As a younger investor, I tend to look for both growth and stability. Hence, for net-lease REITs, I recommend the further two REITs for a deeper consideration:

STORE Capital

STOR is a mid-cap triple net-lease REIT which has posed strong dividend growth of 7% annually since inception. Its strength comes from its property level underwriting which results in tenants being able to see a 40% drop in revenue before paying rent becomes an issue. Since going public in 2014, revenue and FFO have increased 4x and 5x respectively and the company expects to continue this growth. One concern hampering STOR’s price now is the unexpected departure of co-founder Volk, but this can be mitigated by the fact that the CEO is still another co-founder, Mary Fedewa, who has the same principles as Volk. Should STOR be able to prove to investors that their philosophy has not wavered in future quarters, their share price could see a sharp rise.

Agree Realty

ADC is another fast growing triple-net lease REIT, with revenue and FFO increasing 3x over the past five years. Its dividend has grown for 10 years and poses a 5-year average growth of 6.57% which is one of the fastest in the industry. Additionally, ADC has the highest proportion of investment-grade tenants among net-lease REITs, putting it in a very strong position. Another key factor that draws me to ADC is the fact that the business is still run by Joel Agree who is the son of CEO Richard Agree, both of whom have shares in the business. This gives greater confidence that management will seek to protect both the interest of the business and shareholders. However, ADC is relatively expensive to its peers, with only a 4.1% dividend yield, which is somewhat justified given its superior positioning.

Conclusion

In all, I believe that the market has overestimated the inflationary and recessionary impacts to triple-net lease REITs in general. Like the market and other REITs, triple-net leases have taken a strong beating, despite barely recovering to pre-COVID levels the year prior. However, triple-net lease REITs have a very unique business model which gives them stronger recurring revenue, cash flow, tenant quality and financial position which will serve them well in an economic downturn. Passive investors looking to average down into ETFs can strongly consider NETL while individual net-lease companies which can be considered include STOR and ADC.

[ad_2]

Source links Google News