[ad_1]

Shares U.S. Medical Devices ETF (IHI) is an ETF that provides exposure to U.S. companies that manufacture and distribute medical devices. It has performed significantly well in the past years, and my expectations are that it will continue to perform well in the near future.

Investment Thesis

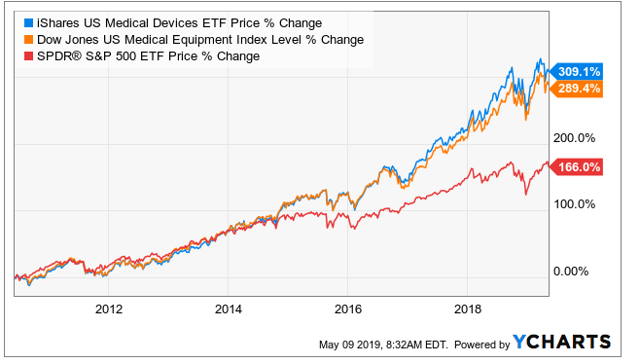

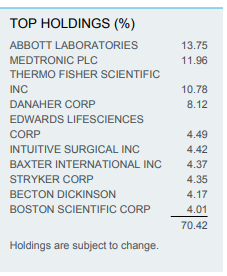

Shares U.S. Medical Devices ETF provides access to U.S.-based companies that manufacture and distribute medical devices. In the last decade, it performed significantly better than the S&P500 and marginally better than the Dow Jones U.S. Medical Equipment Index. This historic performance compared to other similar healthcare ETFs, relatively low expense ratio, and the positive market outlook make it an attractive investment opportunity.

Source: Ycharts.com

Overview

IHI provides access to U.S.-based companies that manufacture and distribute medical devices. IHI seeks to “track the investment results of an index composed of U.S. equities in the medical devices sector”.

IHI has 56 holdings as of 07-May-2019 and reported that it has almost $3,4 billion in assets. On the first of May, the ETF celebrated its 13th birthday. It trades on average 296,419 shares per day (Yahoo Finance) and the ETF has an expense ratio of 0.42%.

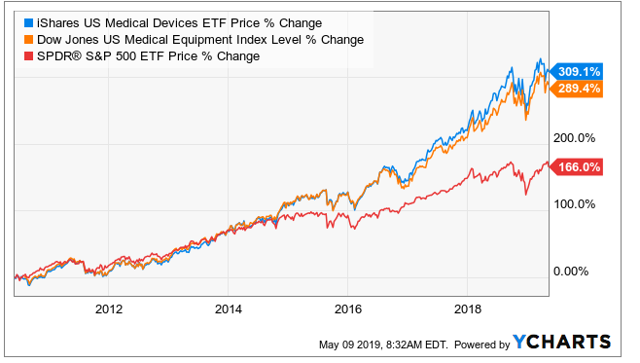

The top 10 investments make up 70.42% of the total portfolio and include some well-known companies such as Abbott Laboratories (ABT) and Medtronic PLC (MDT).

Outlook – The future looks bright

Both the global medical device market and the global medical equipment market are witnessing a surge in technology-based expansion. Technologies such as digital solutions, cloud solutions, remote care, and telehealth are some examples driving the growth of the medical device and medical equipment industry.

Some other authors here on SeekingAlpha who extensively researched some the top 3 holdings of IHI, all have a positive outlook:

Comparison between similar ETFs

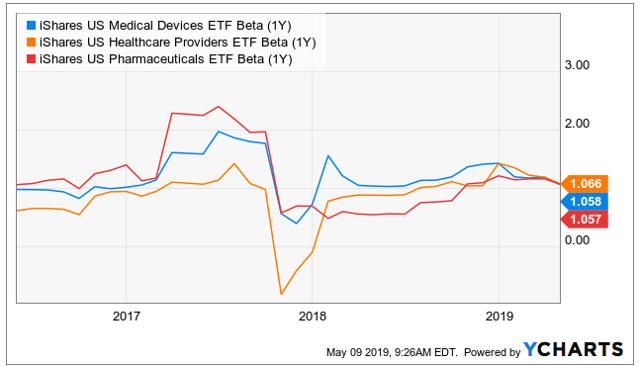

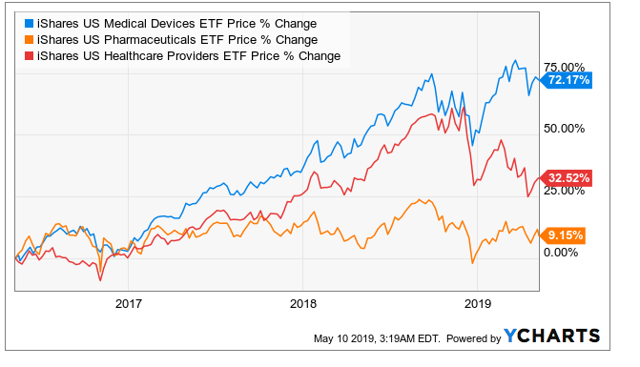

IHI’s Beta is only 5.8%, meaning that has a bit more risk than the broad market. IHF has a beta of 6.6% and IHE has the lowest, with a beta of 5.7%. Furthermore, IHI, (IHE), and (IHF) all have the same expense ratio, but where IHI really stands out is its performance, which is significantly better than the other ETFs. It performed more than twice as well as the second best, IHE.

Source: Ycharts.com

Source: Ycharts.com

As for dividends, IHI has a very low yield of only 0.23%, which comes down to a yearly dividend in 2018 of $0.5277. In the past 5 years, the dividend actually decreased at a CAGR of -5.74%. Needless to say, don’t go long in IHI if you are looking for dividend yield or growth. For comparison, IHE has a dividend yield of 1.20% and a 5-year CAGR of 8.22% and IHF has a yield of 3.97% due to a massive special distribution of $6.21 in 2018. For investors who are looking for dividend growth, I would recommend IHE over IHI.

Summary

| ETF | Expense ratio | Performance (3yr) | Beta | Yield | Dividend 5-yr CAGR |

| IHI | 0.43% | +72.1% | 5.8% | 0.23% | -5.74% |

| IHE | 0.43% | +32.5% | 5.7% | 1,20% | 8.22% |

| IHF | 0.43% | +9.15% | 6.6% | 3.97% | 97.92% |

Source: Self-made table based on ETF data

I believe that of the three different ETFs, IHI is the best investment choice. It has an expense ratio similar to that of the other ETFs, yet its performance over the past 3 years has been almost double that of the second best ETF, IHE. In addition, the market outlook for medical devices remains positive, and I believe that IHI will continue to outperform the other healthcare-related ETFs.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in IHI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News