[ad_1]

cagkansayin/iStock via Getty Images

Rising interest rates have increased the interest paid by most newly issued bonds, and reduced the price of most older, lower-yielding bonds as well.

Dividend yield metrics generally ignore these issues, reducing their importance and usefulness when analyzing bond funds under present market conditions.

Yield to maturity metrics do take into consideration these issues, and are hence a more relevant metric under present conditions.

An explanation and analysis of yield to maturity as a bond fund analytical metric, as well as a comparison of the yield to maturity of most relevant bond ETFs, follows.

Dividend Yield: Quick Explanation and Analysis

Dividend yields are an incredibly important metric for most income investors and retirees, for obvious reasons. Income investors want income, dividend yields measure income, so income investors care a lot about a fund’s dividend yield.

Dividend yields are an important metric, but suffer from two important shortcomings when used to analyze bond funds.

First, is the fact that most dividend yields are backwards-looking, and future dividends and dividend yields can materially differ from those in the past. This is particularly important right now, as the Federal Reserve is hiking interest rates aggressively, and these hikes are not taken into consideration when calculating most dividend yield metrics. Forwards-looking metrics are important when interest rates are rising, so investors need to look beyond dividend yields.

Second, is the fact that dividend yields only take into consideration income, completely disregarding potential capital gains and losses. Capital gains are particularly important right now, as most bonds and bond funds are trading with very low prices, due to bearish investor sentiment, low demand, and prospective interest rate hikes. Once conditions settle, at maturity at the latest, bond prices should recover, leading to capital gains for bond investors. Dividend yields do not take into consideration these prospective capital gains, but they are very real, and investors do need to consider these to make informed, profitable investment decisions in the bond space.

Dividend yields are backwards-looking measures which do not take into consideration prospective capital gains, two significant oversights, and particularly impactful under current market conditions. Investors need a better metric to analyze and compare bond funds. Which is where yield to maturity comes in. Let’s have a look.

Yield to Maturity – Explanation

Yield to maturity measures a bond’s expected returns if held to maturity. Unlike dividend yields, yield to maturities are forwards-looking, and take into consideration both income and capital gains. Calculating the yield to maturity of a specific bond might prove instructive, so let’s do just that.

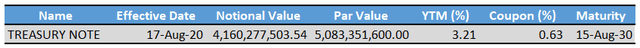

The iShares 7-10 Year Treasury Bond ETF (IEF) is a medium-term treasury bond index ETF. IEF provides investors with detailed information of each of its holdings. IEF invests in 12 different treasuries of varying maturities and characteristics. The fund’s largest holding is as follows.

IEF Corporate Website – Chart by author

Lots of seemingly complicated figures, but these are relatively easy to interpret. In August 2020 (effective date) the fund loaned $5.1 billion (par value) to the government at a 0.63% interest rate (coupon). Weak investor demand and selling pressure has reduced the market value of said loan to $4.2 billion (market value). Importantly, IEF and its investors will receive their entire $5.1 billion investment at maturity, in August 2030 (maturity).

Expected returns are relatively easy to calculate.

Income is simply equal to the interest rate / coupon of the bond: 0.63%.

Expected capital gains are the difference between the bond’s current market value, $4.2 billion, and the payment investors will receive once the bond matures, $5.1 billion. In dollars, that is roughly equal to $0.9 billion. In percentage terms, it is roughly equal to 22.2% at maturity. The bond will mature in November 2031, so roughly 8 years, for 2.7% in expected annual capital gains.

Yield to maturity is simply the expected annual returns of the bond if held to maturity, meaning income + capital gains. From the above, yield to maturity would equal 0.63% + 2.7% = 3.33%.

IEF’s managers themselves calculate the yield to maturity of this bond, and arrived at a 3.21% figure, similar to my own calculation. Differences are due to rounding error and the like.

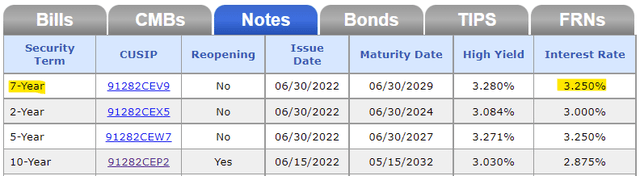

Importantly, the yield to maturity of the bond above is very similar to the interest rate on newly issued treasuries with similar maturities (remember, the bond above was issued in August 2020, so its interest rate was set when rates were much lower yield).

U.S. Treasury

The reason for the above is simple. Investors can receive a 3.25% interest rate on newly issued 7Y treasuries. Investors only receive 0.63% in interest from older issues. Investors will sell these unprofitable older issues until their prices drop by enough that their expected returns, including interest and capital gains, roughly equals 3.25%. Once the expected returns of newer and older treasury issues are equal, prices will stabilize. This process has already played out for these bonds, which is why the yield to maturity of the older issues, of 3.21%, is very similar to the interest rate on the newer ones, of 3.25%.

An implication of the above is that yield to maturity is also an indication of a bond fund’s expected future dividend yield, assuming no changes in underlying conditions. If treasuries currently yield 3.25%, then a treasury fund should yield 3.25%, but it might take a while until fund yields reflect market fundamentals.

Let’s summarize the above.

Yield to maturity measures a bond’s expected returns if held to maturity. Unlike dividend yields, yield to maturities are forwards-looking, and take into consideration both income and capital gains, and so are a more relevant metric when analyzing a fund’s future expected returns.

Yield to Maturity – Fund Analysis

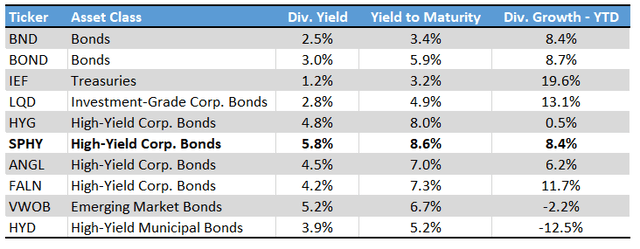

Finally, wanted to include a quick graph with yield to maturities of select bond ETFs. I’ve also included dividend yields and dividend growth metrics, for reference.

Fund Filings – Chart by author

As can be seen above, yield to maturities for all funds are higher than dividend yields, due to rising interest rates and plunging bond prices. As such, expected returns for most bond funds are materially stronger than implied by backwards-looking dividend yields, an important fact for investors to consider. At the same time, conditions are such that bond fund dividends should see some growth moving forward, as has been the case for most of the funds above. Only significant exception is VanEck High Yield Muni ETF (HYD), which recently changed its underlying index, which is almost certainly causing heighted dividend volatility. Growth will likely turn positive in the coming months, once conditions settle.

Of the funds above, the SPDR Portfolio High Yield Bond ETF (SPHY) boasts 8.6% yield to maturity, highest in its peer group. SPHY is a strong high-yield corporate bond fund, and a buy. I last covered the fund here.

Yield To Maturity – Other Considerations

As a final point, would like to add that yield to maturity metrics do not take into consideration fees, discounts, premiums, or (usually) leverage.

This is not a significant issue for ETFs, as these funds are generally cheap, rarely use leverage, and very rarely trade with discounts or premiums.

This is an issue for CEFs, as these funds are generally expensive, leveraged, and do trade with discounts and premiums. I still believe that yield to maturity is an important metric for bond CEFs, but investors do need to consider how said metric interacts with the CEF’s other characteristics.

In any case, most funds report yield to maturity metrics, so investors should generally be able to easily look-up said metric. Some funds do not report these, but report yield to worst instead. There are small differences between these two metrics, none of which are all that significant.

Conclusion

Yield to maturities are an important, yet sometimes overlooked, metric to consider when analyzing bond funds. Hopefully, the information presented in this article was of use and interest to readers and investors.

[ad_2]

Source links Google News