[ad_1]

Incomel/iStock via Getty Images

Russia’s ability to invade foreign countries is closely tied to its energy exports. Russia produces around 11% of the world’s oil. It is also the primary supplier of energy to Europe, making up 27% of Europe’s crude oil imports and a staggering 41% of its natural gas imports. Energy dependence on Russia is exceptionally high in eastern Europe, with Balkan countries nearly entirely dependent on Russian exports. The same is partly true for Italy and Germany, where around half of the natural gas supplies come from Russia.

Compared to the U.S, Europe’s electrical grid is slightly less dependent on natural gas, which makes up just over a third of its total electrical energy sources. Some notable countries such as Poland, Netherlands, Ireland, and Italy derive over half of their electrical power from natural gas. Germany is in the process of shutting down its remaining nuclear plants, meaning its fossil fuel demand will likely rise over the coming year.

While Europe is highly dependent on Russia for energy, Russia’s economy is financially tied to Europe. Russia has a very high 7% current account-to-GDP ratio, with energy commodity sales making up roughly half of its total exports. A large and growing portion of Russia’s federal budget comes from oil and gas sales. The country also has a significant $630B currency hoard, primarily made up of western currencies and over a fifth being gold. Russia has the fourth-largest total international currency reserve in the world and an extremely low government debt-to-GDP ratio. These currency reserves will be critical since Russia has a high 9% inflation rate which will likely accelerate given its recent currency, bond, and stock market collapse.

Overall, these figures demonstrate that Russia and Europe are highly dependent upon each other. Even more, the decisions a handful of individuals make over the coming hours and days will likely have far-reaching consequences on the global energy market. I have been bullish on the energy sector for some time, as last described in November in “XLE: Oil Inventory Builds May Be Followed By Even Larger Drawdowns.” The U.S. has seen continued oil drawdowns since, and the current unfortunate situation may dramatically worsen this issue over the coming months. Let’s take a closer look.

Will Europe Ban Russian Energy?

The situation with Russia is highly kinetic and, at this point, is changing by the hour. That said, Russia’s overwhelming acts of aggression toward Ukraine are already causing disruptions to the global energy market. At the onset of Russia’s invasion, oil prices shot up by double digits to over $100 per barrel but have since declined back to ~$90. This rapid reversal occurred as the NATO nation’s initial list of sanctions against Russia appeared to do very little to target Russia’s energy sector. E.U. leaders planned to ban technology exports that Russia could use to upgrade refineries, while the U.S. said it would restrict Gazprom’s (OTCPK:OGZPY) ability to raise money in the U.S.

In my view, the current sanctions against Russia will do very little to (justifiably) cripple Russia’s economy. As long as Russia sells fossil fuels, its economy will likely remain intact, mainly because oil and gas prices are highly elevated. That said, sanctions banning oil may not be necessary as tanker rates on Russian crude oil routes have tripled since the invasion. I expect tanker rates will remain high as Russia has thus far shelled at least three commercial cargo ships near the Odesa port, and insurers have generally stopped covering vessels in the critical Black Sea region.

While Europe has energy sources that do not involve Russia, the continent is already struggling with extremely high electricity prices. Europe has far less stored natural gas than is seasonally typical. There is some hope that U.S. liquified natural gas (“LNG”) exports to Europe could offset losses from Russia, but only around a quarter of E.U gas is imported via LNG. Like most countries today, the U.S has abnormally low stored natural gas, so it is unlikely to fully-offset declines from Russia.

Despite the strong likelihood of creating an energy crisis, Western leaders appear to have increased efforts to enact more material economic sanctions on Russia. At the time of writing, this includes the removal of “select banks” from the SWIFT messaging system and measures to ensure the Russian oligarchs lose access to western financial assets. These measures will restrict Russia’s ability to utilize its hoard of foreign currency reserves and freeze significant international financial transactions in Russia by cutting off SWIFT. According to Russia, its suspension from SWIFT will result in no goods (oil, gas, and metals) flowing from Russia to Europe. Since non-European countries use SWIFT, the ban could also substantially disrupt Russia’s commodity exports worldwide.

China does have its own cross-border interbank payment system and has increased infrastructure to export its commodities to China. In my view, tightening economic ties to China is a long-term solution Russia is likely to pursue, but it will do little to stop short-term disruptions to the global commodity supply. Considering the overwhelming global reaction against Russia’s behavior, China may not wish to maintain its economic friendship with Russia. The net result could be a substantial increase in near-term worldwide oil and other commodity prices, though this depends on whether or not alternative options are created.

The Fight For Freedom Has Economic Costs

The economic consequences of banning Russia from SWIFT should not be understated. In my view, at the time of writing, global equity and commodity markets have under-reacted significantly. As hedge fund manager Bill Ackman said:

I wouldn’t want to keep money in a bank that can’t access the SWIFT system. Once a bank can’t transfer or receive funds from other banks, its solvency can be at risk. If I were Russian, I would take my money out now. Bank runs could begin in Russia on Monday

Indeed, this bank run has already begun with large queues of Russians at ATMs around the country. On a similar note, it should be pointed out that a large portion of Russian citizens does not support the invasion of Ukraine despite opposing propaganda efforts. I can only imagine that dissent will grow by a magnitude if the ruble sinks and Russian citizens see their wealth rapidly disappear. The potential for immense domestic disruptions within Russia may eventually cause labor disruptions in its oil and gas businesses, potentially exacerbating the global energy shock.

While I aim to focus on the energy market, investors would benefit from considering the larger perspective behind the ongoing crisis. A key reason for Putin’s “frustration” that invading a sovereign nation was “more difficult than he expected” is that Ukrainian citizens have made significant efforts to resist invading forces. I believe it is fair to say that many Ukrainians are putting the yearn for freedom over fears of loss. Similarly, suppose the E.U. and other countries & regions around the world place the ideal of liberty over material and economic motives. In that case, Putin (and company) has zero ability to maintain control without spurring an extreme domestic financial crisis. U.S. and E.U. leaders are undoubtedly concerned that sanctions will exacerbate the ongoing energy crisis. Still, at this point, I am willing to bet that Americans and Europeans are willing to pay more for gasoline and electricity for the cause of freedom.

Where Could Oil Go?

At the time of writing, there appears to be a substantial shift away from the view that this will be like the 2014 Crimea invasion, which had relatively limited global economic consequences outside of Russia. The increased acts of aggression from Russia and the much larger international reaction have, in my view, encouraged western leaders to take more aggressive steps in thwarting Russia, even at the likely cost of negative economic consequences for the west.

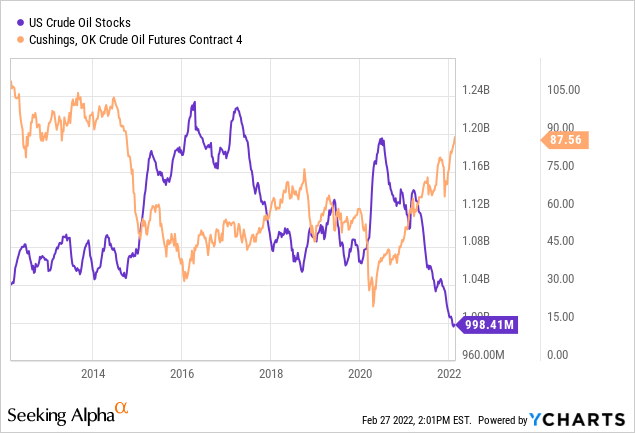

We must keep in mind that most of the globe has been in an energy crisis since COVID lockdowns resulted in substantial production cuts. These cuts resulted in considerable declines in total reserves and higher oil and gas prices. See below:

The U.S Energy Information Administration has forecasted that energy production should meet supply by around Q2-Q3 of this year, implying a potential end to declines in U.S oil storage levels. I have some doubts about this due to the ongoing reductions in “drilled but uncompleted” well inventory levels backed by low CapEx spending on behalf of most U.S producers. As this supply of new oil wells becomes limited, less profitable investments into newly drilled wells will be needed to maintain total oil production. OPEC’s difficulty maintaining production implies they’re experiencing similar challenges in normalizing output levels.

Honestly, I would be bullish on crude oil prices even if Russia was not disrupting the globe. There is some thought that OPEC will boost production to make up for Russia’s export losses, but this would require enormous and timely investments, considering Russia makes up such a large portion of global oil and gas exports. At any rate, OPEC has thus far been unable to raise production even to its capacity levels, so I highly doubt any country will manage to offset a decline in Russia’s exports.

It is difficult to say what the impact on oil prices will be. Total Russian oil production is currently 11.2M BPD, while total global production declines from 2019 to 2020 was 6.5M BPD. So, if Russia’s oil exports decline by 50%, the net effect would be similar to that of COVID lockdowns. However, the situation is different since, at this point, I do not expect demand to exogenously decline as it did with COVID. Thus, the rate of global declines in oil storage could likely be more extensive than they’ve been over the past two years. Accordingly, I believe it is fair to say that if SWIFT measures cause Russia to stop selling fossil fuels, commodity prices may see a larger rise since 2020.

In my view, a $150-$200 price per barrel is not off the table. This may seem high, but let us not forget that oil was around $150 back in 2008 when the U.S dollar was more valuable (from an inflation perspective), and the global oil supply was far more secure. Of course, if Russia cannot sell oil, it will need to shut down well production. As we’ve learned since 2020, when you shut down an oil well, it takes a lot of time and money to turn it back on. Thus, if Russia shuts down oil and gas wells, it would likely lead to a multi-year disruption in global fossil fuel supplies, meaning oil may rise and remain expensive for years.

Hedge Opportunity With XLE

Oil and gas companies are perhaps the only benefactors from this situation. The SPDR U.S Energy Sector ETF (XLE) has risen slightly since the onset of the invasion, and I suspect it will increase more if oil crosses above the $100 line. Most of the smaller firms in the fund have most of their operations in the United States and will thus benefit from more significant exports at higher prices. The ETF’s higher market-cap holdings, such as Exxon Mobil (XOM), have some exposure to Russia and will be negatively impacted by sanctions. That said, XLE generally has minimal exposure to Russia since most of its holdings focus on production in the U.S.

XLE is also a cheap fund despite an 18% estimated annual EPS growth. The ETF currently has a weighted-average price-to-cash flow of 9X and a forward “P/E” of only 12X. Its dividend yield is also relatively high at 3.4%. I expect XLE’s holdings’ earnings to rise at a faster-than-expected pace if oil increases as high as I suspect. The total earnings of many of these firms could relatively quickly rise by 50-100% of crude and gas rises by 50-100%, if not by more due to the profit margin expansion that usually comes with higher prices.

In any likelihood, this situation may likely result in a significant increase in XLE’s value. Of course, a considerable shock in oil prices would negatively impact the U.S. and, combined with other financial disruptions, may soon cause a material decline in U.S financial asset prices. That said, the only sectors which I believe have upside potential are energy and gold miners, with XLE being one of the more well-rounded options for energy investors.

Since we cannot know what will occur in this highly kinetic situation, XLE’s and oil’s upside is not guaranteed. We live in a time where it is perhaps best not to maximize gains but to position yourself in a manner that allows you to sleep better at night. To me, a position in XLE or other energy stocks is not a traditional “bullish speculation” but is instead a robust means of hedging against today’s numerous downside risk factors. Even if I look to buy energy-producing stocks, I would likely keep position sizing small and maintain ample cash reserves, which can be deployed when asset prices better reflect reality.

[ad_2]

Source links Google News