[ad_1]

imaginima/iStock via Getty Images

Sometimes simple works. With geopolitical tensions at high levels, the Biden administration refusing to commit to new drilling, and renewables not scalable on large enough levels, fossil fuels are here to stay for some time.

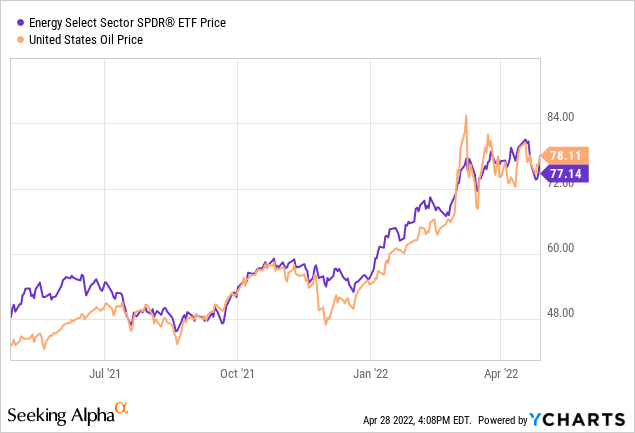

Oil prices have been on a huge run for over a year now, and energy funds such as the Energy Select Sector fund (NYSEARCA:XLE) have performed very well.

The Energy Select Sector fund is up over 60% in the last year, and the fund has significantly outperformed the S&P 500 and most major benchmarks during this period as well.

Despite this big run this fund has had over the last year, this fund still looks undervalued, and this ETF should continue to be able to deliver solid income and total returns for investors. The fund should also be able to offer inflation adjusted returns.

The Energy Select Sector fund has $36.1 billion in assets under management and this ETF is 99.6% invested in energy stocks. The fund is weighted to energy stocks in the S&P 500. This ETF has an impressively low expense ratio of just .1%, The fund’s turnover rate is 13%, and the fund is in the State Street global family of advisors. The fund is invested in upstream and downstream operations, and both oil and natural gas producers. The fund’s 10 biggest holdings are Exxon Mobil (XOM), Chevron (CVX), EOG Resources (EOG), ConocoPhillips (COP), Schlumberger (SLM), Pioneer Natural Resources (PXD), Occidental Petroleum (OXY), Marathon Petroleum Corporation (MRO), Valero Corporation (VLO), and Williams Companies (WMB). Exxon Mobil and Chevron make up a combined 43% of the fund.

This fund looks undervalued for several reasons, and the dividend should be able to offer investors an inflation adjusted return moving forward. Most major integrated oil companies such as Chevron and Exxon Mobil, are seeing record cash flow with oil and gas prices at current levels. These companies are also committed to returning cash to shareholders. Exxon Mobil and Chevron are two of the XLE’s fund’s biggest holdings, and they make up 43% of this fund’s weighted holdings.

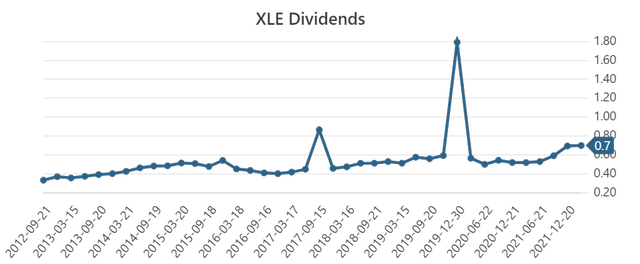

The five-year dividend growth rate of this fund is 8.57%, and the ten-year dividend growth rate is 10.72%. The current yield is 3.92%.

A chart showing the dividend growth of the XLE energy fund (stockanalysis)

Even though the current yield of 3.4% is obviously below the high current 5.3% rate of inflation, energy stocks are expected to raise dividend payouts at record levels this year with oil and gas prices at the very high current levels we are seeing. Exxon Mobil recent saw revenues double from last year, and the company just tripled the share buyback plan, which will obviously help the dividend as well. Chevron recently report record cash flow, and the company raised the dividend 10% last year when oil prices were much lower than we are seeing today. Both Chevron and Exxon Mobil, as well as many energy companies, should be able to return cash to shareholders at record levels this year.

This fund also looks undervalued using a number of historical metrics. Many leading energy companies such as Chevron and Exxon Mobil trade at historically cheap valuations. Chevron currently trades at 6.5x forward cash flow 5.6x forward EBITDA. The company historically trades at 8x forward cash flow and 6.7x forward EBITDA. Exxon Mobil trades at 6x forward cash flow and just 8x forward enterprise value. The company historically trades at 9x forward cash flow and 10x forward enterprise value. ConocoPhillips is also trading at what has historically been a cheap valuation. The company currently trades at 4.65x forward cash flow, while this oil producer has traded at 7x forward cash flow. 82% of the XLE fund is invested in energy producers, and many leading oil and gas companies are also trading at historical discounts to current forward cash flow and earnings estimates.

Projecting exact prices of any commodity is impossible, but the bull case for oil and gas prices is strong. With geopolitical tensions in Eurasia at high levels, economies opening back up after Covid, and the US no longer committed to supporting new exploration and development projects, oil prices aren’t likely to fall anytime soon. The bull case for natural gas prices remains strong as well. The world is facing a coal shortage this is making thermal coal prices very expensive, and the US and Europe continues to transition from coal to natural gas. Russia is also a major natural gas provider to Europe and other parts of the world. Europe has also seen a number of disruptions in natural gas pipelines over the past year as well. Natural gas prices remain strong in North America as well because of shortages in the coal market and impressive demand.

Every investment carries risk, and two biggest risks this fund carries are the fact that this fund is more volatile and less diversified than most ETFs. 82% of this fund is invested in energy producers, and this fund is obviously very heavily correlated with the price of oil, which can be volatile. Natural gas prices have also at times been volatile, with prices falling significantly in late 2021. Because this fund is almost exclusively invested in upstream energy producers, the fund’s high correlation to the price of should not be surprising. The Fact the fund can be very volatile, as was seen during the pandemic when energy prices oscillated significantly.

This fund also has nearly fifty percent of the fund’s assets invested in two companies, Chevron and Exxon Mobil, so that makes this ETF potentially more volatile and obviously less diversified than even most energy funds. This ETF is weighted to the energy holdings of the S&P 500 and the fund rebalances periodically, but the fund is obviously likely to remain heavily overweight these two companies. Chevron and Exxon Mobil are very well run companies, but Exxon Mobil did underperform the energy sector for many years when natural gas prices lagged behind oil prices.

Still, energy and commodity prices have risen significantly over the last year, and the bull case for oil and gas prices remains strong. Natural gas prices in the US and abroad have also been strong for some time, and oil prices have remained at elevated levels for over a year as well. Even though funds such as the energy select sector fund have risen significantly with the move up in oil and gas prices over the last year, this fund is well positioned to offer investors stable income and strong total returns for years to come.

[ad_2]

Source links Google News