[ad_1]

andresr/E+ via Getty Images

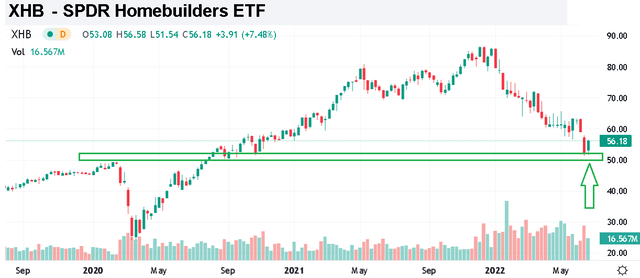

The SPDR S&P Homebuilders ETF (NYSEARCA:XHB) invests across a diverse group of companies with broad exposure to the U.S. housing market. Beyond “home builders”, the ETF includes stocks covering home furnishings, home improvement retail, household appliances, and building products. From the hot pandemic housing market last year, the story has now been concerns of a deeper economic slowdown and the impact of rising interest rates. Indeed, XHB is down around 35% year to date amid the extreme market volatility.

That being said, we like the fund at the current level following a reset of expectations which can set up a new buying opportunity. A scenario where inflation peaks in the coming months and mortgage rates at least stabilize can be positive for sector sentiment and support more bullish momentum in homebuilders.

What is the XHB ETF

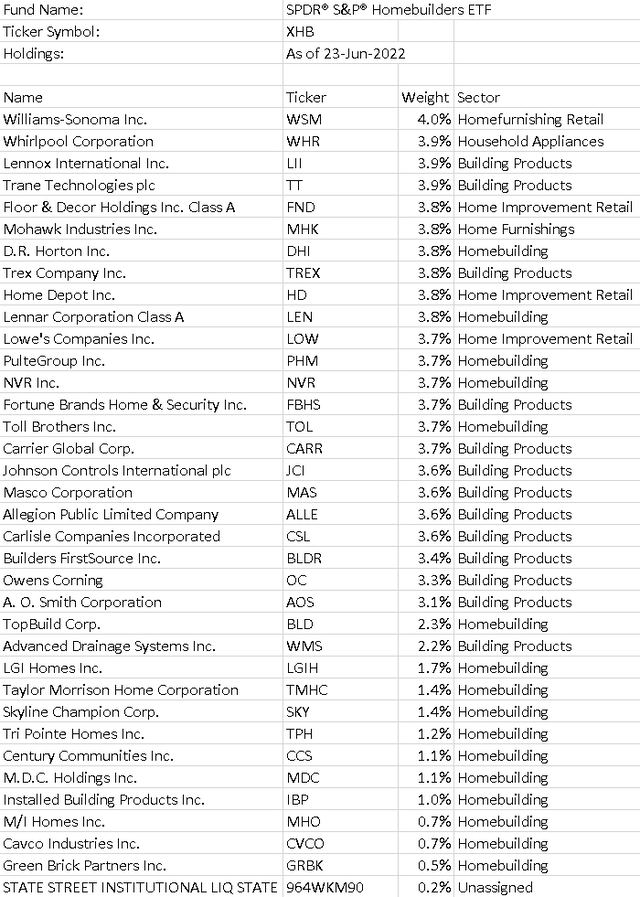

XHB technically tracks the “S&P Homebuilders Select Industry Index” which utilizes a modified equal-weighting methodology. With a current portfolio of 35 holdings, the average position represents approximately 3% of the fund with slight adjustments based on each stock’s float and trading liquidity. The idea of the equal-weighted approach is that some of the smaller companies gain importance relative to their market value compared to larger stocks.

An example of this dynamic is the fund’s largest current holding in Williams-Sonoma Inc (WSM) with a market cap of $8 billion and a 4.0% weighting has a similar contribution to XHB’s performance as a mega-cap leader like Home Depot Inc (HD) that currently represents 3.8% of the fund. The result is that the fund captures high-level themes in housing and consumer spending beyond company-specific factors.

Taking a look across the top holdings, there are the pure-play home builders like D.R. Horton Inc (DHI), Lennar Corp (LEN), Toll Brothers Inc (TOL), and PulteGroup Inc (PHM) among others. Names like Lennox International Inc (LII), Trane Technologies PLC (TT), and Carrier Global Corp (CARR) representing “building products” are manufacturers of HVAC and air conditioning units with sales typically correlated to the strength in the housing market. On the retail side, besides Home Depot and Williams Sonoma, there is also Lowes Companies Inc (LOW), and Floor & Decor Holdings Inc (FND) facing similar market trends.

source: State Street

XHB Performance

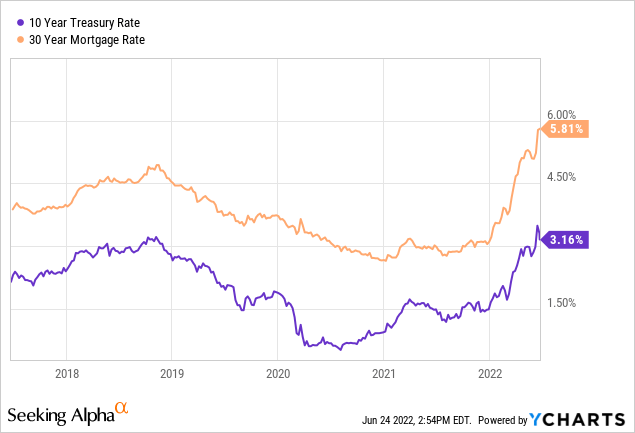

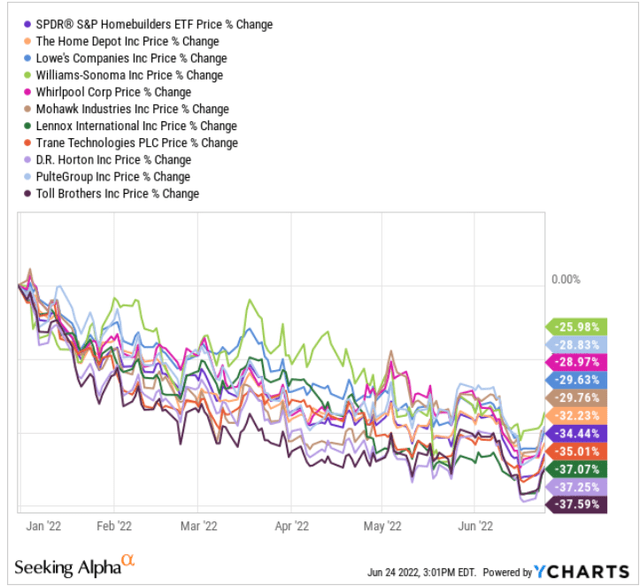

We mentioned XHB has been under pressure, amid a broad selloff in homebuilder names. The context here is that compared to strong economic enthusiasm at the end of 2021, macro data this year has largely disappointed. The biggest development has been the persistently hot inflation surprising to the upside that has had the effect of both pressuring consumer spending while also forcing the Fed to take a more aggressive approach toward monetary policy with climbing interest rates. The biggest impact as it relates to housing is a surging 30-year mortgage rate that has approached 6%, the highest level in over a decade.

The majority of the stocks within XHB are in a “bear market” down more than 20% from their 2021 levels and many are down significantly more. Homebuilding companies like D.H. Horton and Toll Brothers, both down more than 37% year-to-date have tended to underperform with their financials more closely tied to the moves in interest rates.

source: YCharts

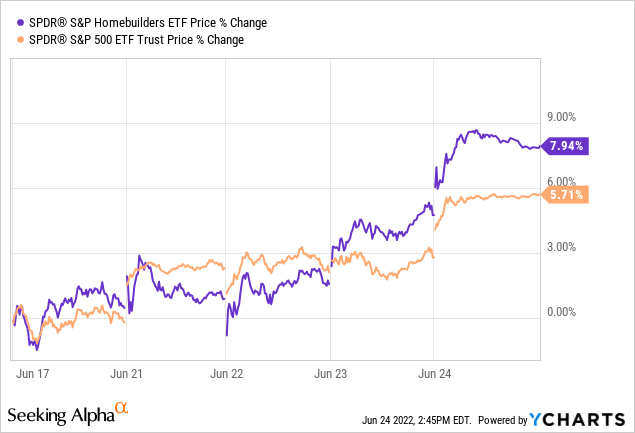

Among the retailers and building product manufacturers, issues like supply chain disruptions have also added to costs and pressured margins hitting near-term profitability. Overall, what we’ve seen is a reassessment of the growth and earnings outlook by the market against most companies. The good news is that XHB has rallied alongside the broader market over the past week, and is currently up over 10% from its recent low. While it’s hard to say “the low” is in, there are some good reasons to expect this rally to continue.

XHB Analysis and Price Outlook

The silver lining from the selloff in homebuilders this year is that it has worked to depress valuation multiples into what are now low expectations. We like the setup in the XHB ETF which has come down to nearly a pre-pandemic range.

Seeking Alpha

If macro data begins to come in better than expected going forward, the narrative can change with an improving growth outlook. Favorably, one nugget of market insight that came in this week was a surprisingly strong May new home sales at 696K, up 11% from April and above the 588k expected. Similarly, the prior month’s data was also revised higher.

One scenario we see playing out is a “soft landing” for the U.S. economy which we define as a general resiliency in the labor market and consumer spending even as the Fed continues to hike. This would be in contrast to the doom-and-gloom predictions of a deep recession and deteriorating outlook that may have already been priced in by the extreme volatility in stocks. The most important indicator to watch will be some confirmation that inflation has peaked.

On this point, a case can be made that the next few months could see the CPI cooling with some recent indications that the monetary tightening this year is already having an impact. Comments from major retailers suggesting a glut of inventory forcing merchandise discounting along with a recent correction in oil and gas prices well off their highs can provide some relief to the consumer price index.

From there, the FED may have some room to back off on rate hikes into 2023 as inflation trends lower against more difficult 2022 comps. If we’re right, stabilizing mortgage rates and a tailwind for stronger consumer spending can be positive for homebuilders.

Final Thoughts

We rate XHB as a buy with a view that the current level is a good spot to add exposure to a segment that has been beaten down but maintains a positive long-term outlook. From the extreme pessimism, the risks are tilted to the upside with room for market sentiment to swing in the other direction.

In terms of risks, further deterioration of the macro outlook can open the door for a leg lower in the XHB ETF. The recent cycle low in the fund at $51.23 is now an important support level the bulls will need to hold. Monitoring points over the next few months including housing data, inflation, and mortgage rates.

[ad_2]

Source links Google News