[ad_1]

Melena-Nsk/iStock via Getty Images

iShares S&P Global Timber & Forestry Index ETF (NASDAQ:WOOD) is an exchange-traded fund enabling investors to get exposure to timber and forestry companies. The fund is concentrated, with only 25 holdings. The benchmark index is the S&P Global Timber & Forestry Index. The fund carries an expense ratio of 0.65%, so it is not cheap, but also unsurprising given the niche nature of the fund’s strategy.

The fund has performed well since the lows of 2020, but since the start of 2021, WOOD has traded in a range.

TradingView.com

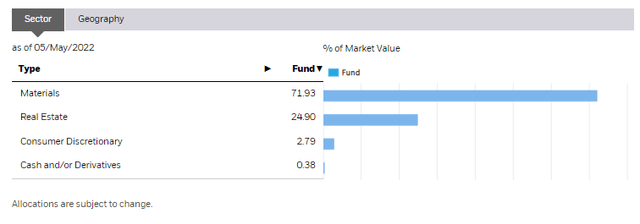

Considering the fund’s exposures you would basically expect a large rebound in the price into a new business cycle. The sector exposures are basically all “Materials” (72%), classically thought to be a cyclical sector.

iShares.com

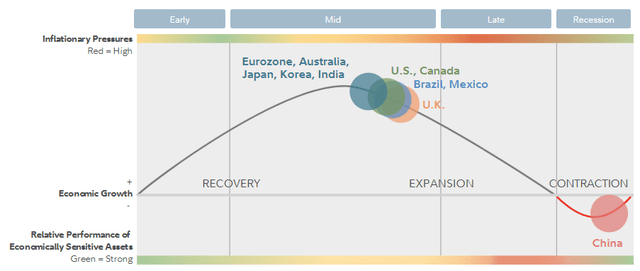

Based on research from Fidelity, the U.S. is probably heading into the later stage of its current business cycle (which has itself been fast-paced given the unprecedented level of coordinated stimulus following COVID-19).

Fidelity.com

With the early and middle stages of the business cycle petering out, you are looking now at the potential for slowing growth and potential recession, perhaps over the next 12-24 months. It is still subject to debate as to whether the United States will enter into a recession over the next 12 months, or even whether it is already in a recession in real GDP terms due to high inflation. In any case, it is probable that WOOD is now cyclically poorly positioned. This does not make it a bad investment necessarily, but there are cyclical headwinds in contrast to the tailwinds enjoyed through 2020 and 2021 (notwithstanding that WOOD struggled to appreciate even during 2021).

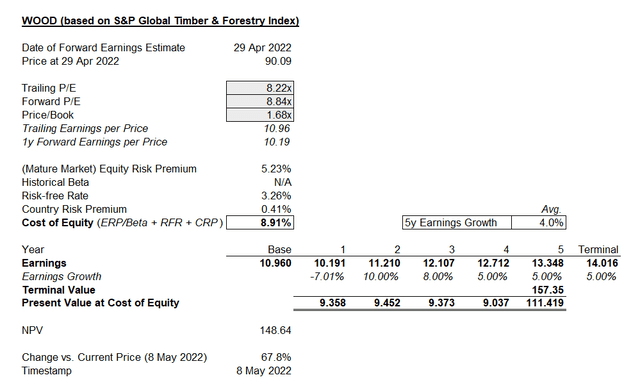

Morningstar consensus analyst estimates place three- to five-year average annual earnings growth at circa 9.63% per annum. This is not an overly optimistic rate of growth, especially with elevated inflation and commodity prices. Meanwhile, WOOD’s benchmark index can be used to gauge its short-term pricing and other factors like underlying earnings and returns on equity. As of April 29, 2022, the index’s price/earnings ratio was 8.22x on a trailing basis and 8.84x on a forward basis. The rise in the price/earnings ratio actually implies a decline in earnings; a normalization from a higher but unsustainable base. We should note this well, as Morningstar’s analyst estimates may well be optimistic in light of this. The price/book ratio was 1.68x, implying a forward return on equity of 19%, which is strong in spite of declining earnings.

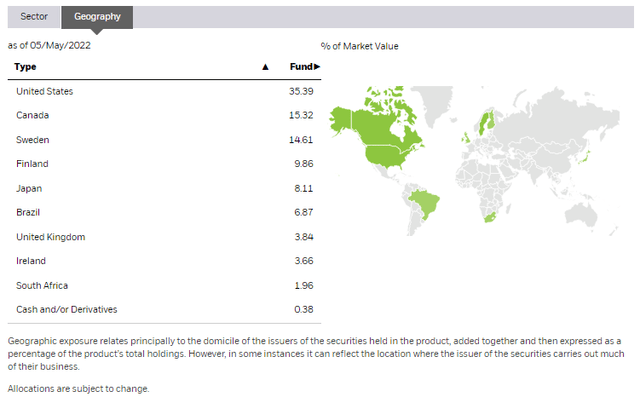

WOOD is actually exposed to various geographies too, so before attempting to value the fund we would need to adjust the cost of equity for its international exposures.

iShares.com

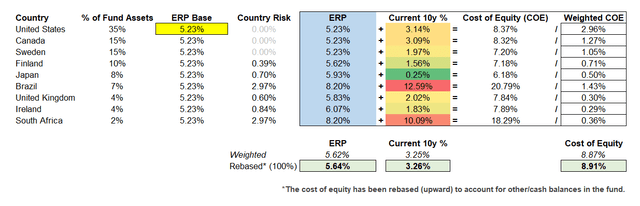

Based on equity risk premium and country risk premium estimates from Professor Damodaran, and 10-year bond yields as proxies for risk-free rates, I gauge the underlying fair cost of equity for WOOD ETF investors as being circa 8.91%, which seems intuitively reasonable. If we took a U.S.-only approach, the base equity risk premium of 5.23% plus the U.S. 10-year yield of 3.14% currently would come to 8.37%, so 8.91% is pretty close but fair. The beta of the fund is, as reported by iShares, almost exactly 1.00x. Again, if anything 8.91% is slightly “harsh” but probably fairer than using beta alone.

Author’s Calculations

I can use the above assumptions to gauge the valuation of WOOD at present, but I have to be conservative with earnings growth. While Morningstar place medium-term earnings at around 10% per annum, the underlying benchmark index provider S&P Dow Jones Indices is clearly less forgiving. Instead then, beyond year one I will start with a 10% boost, but taper this down to 5% into the terminal year, which is still safely above the current U.S. 10-year yield of 3.14%, thus it still assumes positive earnings growth in real terms. This is a starting point in any case.

Author’s Calculations

My valuation attempt suggests significant upside of 67.8% based on potentially conservative earnings growth estimates. I would prefer to keep the range “conservative”, i.e., not experiment with stronger assumptions. But remember that the market ultimately chooses equity risk premiums, not individual investors with spreadsheets. So, rather than 68% upside, my model is really just suggesting that investors are pricing in greater risk into WOOD’s value, and perhaps this is fair in light of business cycle positioning.

To reconcile the current price with my possibly conservative earnings stream/trajectory, the implied cost of equity (i.e., our potential returns) is not 8.91% but a higher 14.53%. This is pretty good, and also means that should medium- to long-term earnings growth exceed my expectations, the returns will be even stronger, and probably sharper as the embedded risk premium would probably contract more closely toward our 8.91% (at least using present figures).

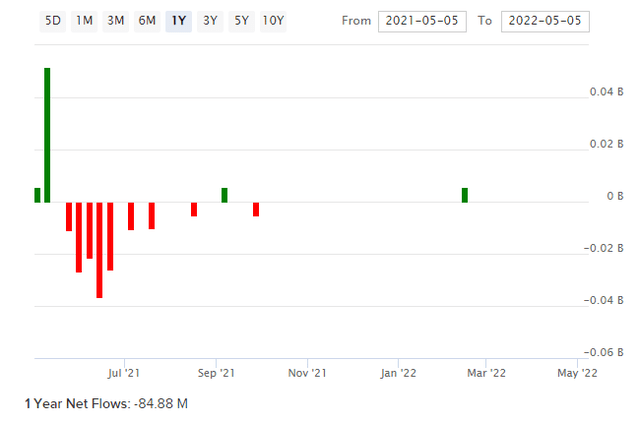

Overall then, even if investors are pricing elevated risk into WOOD, I like the fact that returns are likely to be pretty good in a base case, toward 15% per annum. Being bullish on WOOD therefore seems to make sense, and I quite like the fact that this feels contrarian. Not only is the fund not well positioned from a cyclical and intuitive standpoint, but fund flows have also been basically non-existent:

ETFDB.com

This would seem to fit the picture of elevated embedded risk premiums. The fund is also not particularly popular; assets under management were about $313 million as of May 5, 2022. I also like the fact that this general bullish viewpoint that I feel obligated to take, in light of my valuation, also supports my bullish perspective on metals and mining stocks; see for example my recent article covering XME. I think WOOD investors will do reasonably well over the medium term.

[ad_2]

Source links Google News