[ad_1]

Luis Alvarez/DigitalVision via Getty Images

Right now inflation is one of the most fundamental issues dictating market confidence. With the Fed’s decision-making being primarily based on the prevailing sentiment around this issue, inflation can have several channels of impact upon markets. While we have our views on the validity of concerns about inflation, we think that investors are wise to hedge against inflation, even just its headline risks, for the medium-term while being cognizant of value, where low multiples give a margin of safety in the current environment. Moreover, we want to underweight early-stage biotech, which has been a speculative area and suffers from reflexivity, the phenomenon where the stock price actually impacts the prospects of a business due to equity financing dependence. In the end, the iShares Biotechnology ETF (IBB) does the trick, with cash generative big pharma companies at the fore of it.

Is Now a Good Time to Invest in ETFs?

Of course, there are many different types of ETFs, including bond ETFs, and ETFs that track the prices of all sorts of interestingly engineered products to suit a variety of environments, even those not favourable for equities. However, if we want to ask the question of whether equity ETFs, indeed the most common, are sensible at this given point in time, we’d say yes. It is impossible to time the market, and generally, ownership in a business that is suited to the sort of dangers that are facing the markets today is a good bet.

What are the risks then? Well, we mainly have commodity risks, connected both to geopolitical issues, specifically concerns around a Russian invasion of Ukraine, which together with general inflationary pressures is concerning markets. We are seeing rapidly rising prices in key commodities, and inflation is a dangerous force for equities. While fixed income exposed equities, like some regulated businesses and even certain REITs, depending on the nature of lease agreements, are all at quite a major risk if inflation persists, it is possible to find picks that can resist inflation quite well. Indeed, those picks will be quality stocks with pricing power and as much operating leverage as possible. One of the most conservative picks in this regard is pharmaceuticals.

What are the ETFs to Watch in 2022?

While exposing yourself directly to commodities would be one way to play ETFs in the current markets, and indeed this is not a bad way to do it, we think pharma could be safer and just as wise in the face of inflation. While commodity-related investments could see continued rises on the back of inflation and operating leverage working in these stocks’ favor, with supply-side conditions persisting, inflation could last for at least another couple of years before capacity builds out, these commodity stocks are always exposed to cycle risk. Depending on the evolution of inflation, where indeed if it is actually just transitory and will be resolved by expanded capacity, which usually takes two years to build out, growth in productivity could reverse price rallies and damage sentiment for commodities. Pharma does not have this problem and can flex to an inflationary environment through pricing power. That is why we chose the IBB.

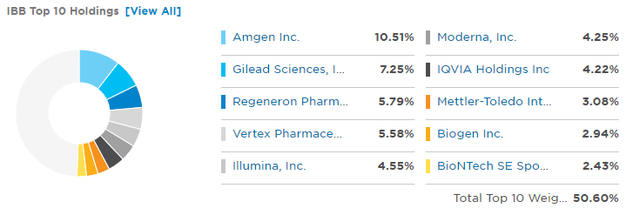

While there are other pharma ETFs out there, we go with the trusted IBB for several reasons. The first is that it is weighted heavily towards big pharma, and is not particularly weighted towards nascent biotech companies that suffer from reflexivity. Indeed, 50% of the ETF is weighted right away towards highly cash generative and established big pharma companies. Among them are Regeneron (REGN), which boasts one of the best infrastructure-style patents in pharma with the VelociSuite technologies for drug development, and Gilead (GILD), which is an emerging exposure especially in cancer treatments, but with also a robust dividend yield from its incumbent HIV and anti-viral portfolio. It offers great diversity and has quite low expense ratios at around 0.45%.

Top IBB Holdings (ETF.com)

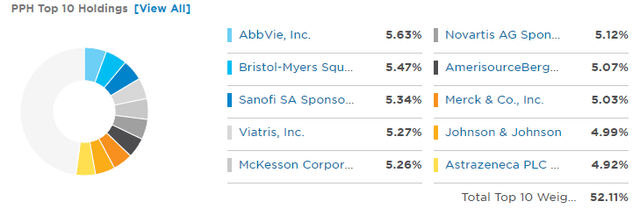

If you want to go even further in this direction, with even more conservative exposures, we also think that the VanEck Pharmaceutical ETF (PPH) could also be interesting. While it is less diversified, it has an even lower expense ratio at 0.35%. In some respects, it has even more conservative picks, with even less biotech exposure than the IBB. Indeed, its top holdings are big dividend payers or companies that are highly established in pharma like Bristol-Myers Squibb (BMY), the cancer giant, most of which have excellent pricing power and superb margins. While the PPH gives you even less exposure to biotech, where reflexivity is a bit of a concern, if inflation is to turn markets sour in the medium-term, we don’t love its focus on AbbVie (ABBV) as the top holding, due to the Humira risk which still hasn’t been compensated for by the newly approved portfolio, and because it has quite a few downstream pharma exposures like McKesson Corporation (MCK) which won’t be very inflation resistant at all.

Top PPH Holdings (ETF.com)

Bottom Line

In the end, we always believe that some subset of equities will always offer investors what they need for every environment. We think focusing on relatively cheap stocks, where that gives an immediate margin of safety, and stocks where inflation, really the main concern of the day, can be resisted, is the way to play the markets. The ETFs above, focusing on pharma, provide that quality and pricing power on relatively fixed cost bases thanks to patent economics, in order to flex ahead of the inflationary environment, however long it may last. With big pharma valuations being quite under control, especially for the ETFs above which focus less on early-stage biotech which has been a speculative area and suffers from reflexivity as well as on COVID-19 related stocks where the validity of baked-in expectations are harder to ascertain, a risk reduction approach has been achieved with the IBB especially while still getting exposure to cash generative businesses. Of course, risks still remain. Fed rate hikes are coming, and they could come sooner than expected depending on how they digest CPI figures, which remain quite alarming. This will discount the market, even more so if inflation doesn’t die down, which we believe it won’t as it’s mostly supply side in our view. This will impact all equity ETFs, including IBB, especially in some of its more nascent company exposures. Nonetheless, we can’t time or predict the market, and pharma exposures offer what investors need right now.

[ad_2]

Source links Google News