[ad_1]

Marko Geber

By Alex Rosen

Summary

Global X Video Games & Esports ETF (NASDAQ:HERO) seeks to follow the Solactive Video and Esports Index. The fund has lost 34% YTD, but since inception is up 20% with $170 million in assets. The fund focus is on the world of online gaming including Esports and multi-player games. We rate HERO a hold as we believe in the future of a sector that generates more revenue than Hollywood, or real sports.

Strategy

According to the fund prospectus, HERO

“seeks to invest in companies that develop or publish video games, facilitate the streaming and distribution of video gaming or esports content, own and operate within competitive esports leagues, or produce hardware used in video games and esports, including augmented and virtual.”

Proprietary ETF Grades

- Offense/Defense: Offense

- Segment: Aggressive

- Sub-Segment: New Growth

- Correlation (vs. S&P 500): Moderate

- Expected Volatility (vs. S&P 500): Very High

Holding Analysis

HERO is a sector dominated fund, and that sector is communication services, representing 86% of the fund. BY region the fund is much more diverse, with top holdings in the U.S. at 33.3%, Japan at 25%, South Korea at 15% and China at 11%.

The top individual holdings make me nostalgic for my youth, with Electronic Arts (EA) Sports leading the way at 6.81%, Activision Blizzard Inc. (ATVI) at 6.47, Nintendo (OTCPK:NTDOY) at 6.22% and NCSoft Corp, a South Korean video game maker at 5.47%.

Strengths

Video games have come a long way since my father brought home an Atari 2600 for us, and we played Pong. Then someone had the bright idea to put a line in the center of the screen, and Pong became tennis. The closest thing we had to online gaming was when my friend would call me up and invite me over to play RealSports Football.

Today, online video gaming is a multibillion dollar industry with professional leagues and a global integrated network. It has become so advanced, that urban legends about terrorists using them as missile guidance systems were credible. The majority of all video games today are online interactive, with people from around the world being able to connect in real time and play together.

Unlike other new tech funds including crypto, cannabis and online betting, Esports faces very few barriers to legitimacy. ESport leagues are existing everywhere, and the dream of becoming a professional gamer is now a reality. You can even bet on Esports.

Weaknesses

There is an old adage in baseball that momentum is only as good as tomorrow’s starting pitcher. What’s hot in the gaming industry today may be old hat tomorrow. Every time a new game comes out, we are amazed at how life like the graphics are. Some games glorify violence, and people argue that it desensitizes us to it, but I grew up watching the Three Stooges and Tom and Jerry, yet never did I try to pull my sister’s tongue out with a pair of pliers, or poke her in the eyes (On a side note, one time my older sister did hit my other sister over the head with a mini-golf club, but that was not Stooge-incited). The parental concerns about video games is clearly not a barrier to the industry.

The real challenge with Esports is how to properly monetize it. Which direction will the industry go? Will it become a true spectator sport, filling arenas and stadiums around the globe? Will people pay to sit around and watch a bunch of kids play video games? This is a serious question, not a dismissal of the genre.

Do companies make their money by selling consoles and games? Are ad revenue and in-game purchases the key to future success? Or is it some combination of all the options? There are an infinite number of ways this can go and it makes it nearly impossible to predict.

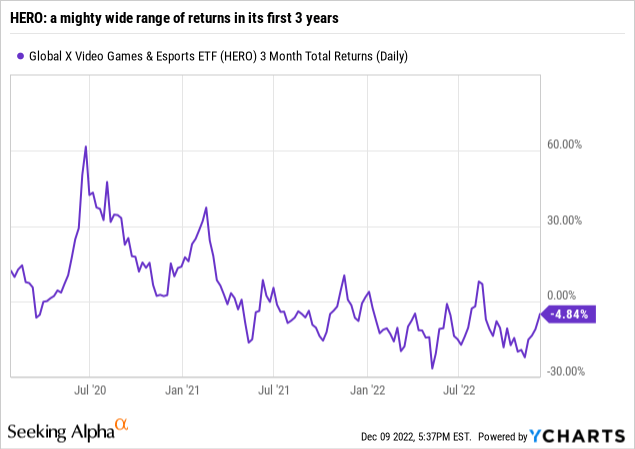

HERO has invested in gaming companies with a proven track record. In fact, so proven that even a dinosaur like me is familiar with them. However tomorrow, some previously unknown company can come out with the greatest game ever and put all the others to shame. This is just one reason the ETF has produced a very wide range of returns in its first 3 years of existence.

Opportunities

Right now, E-Gaming generates more revenue than Hollywood. No longer is this just a fringe sector filled with teenage boys playing in the basement. People of all ages play recreationally, and yes the opportunity to go pro exists now. It has also become a spectator sport, and it would not be surprising if in the near future, you see at events like the Super Bowl, World Cup, Olympics and Tennis grand slams an additional ECategory, where gamers show off their skills and compete in popularity with the real athletes. The future of Esports and gaming is bright.

Threats

One of the biggest risks facing the industry is that it does get lumped in with some of the other new investment sectors and develops a reputation as shady. It is not shady, but you hang around with the wrong crowd, and you become guilty by association. Moreover, when the stock market goes into “risk-off” mode, it matters very little what Esports and gaming stocks are doing in their business. The stocks sell off with the rest of the market for aggressive growth stocks.

Proprietary Technical Ratings

- Short-Term Rating (next 3 months): Hold

- Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

HERO is one of several innovative ETFs made available by Global X Funds. It is not a huge fund at $175mm in assets, and only trades about $700,000 a day in volume. So investors should take that into account when considering or trading into or out of HERO.

ETF Investment Opinion

This sector has some significant user-driven momentum behind it. If there is a continued bull market for playing games as a complement or replacement for activities in the everyday world, HERO could be one of the bigger beneficiaries. The hurdle right now is the market’s treatment of growth stocks, particularly those that need to borrow to turn revenue growth into sustainable earnings growth. So we rate HERO a Hold, and maintain it on our list of “undiscovered ETFs” that might rise to prominence in the years ahead.

[ad_2]

Source links Google News