[ad_1]

Vanguard International High Dividend Yield ETF (VYMI) focuses on quality international high-yield stocks and weights them by their market capitalization. The fund selects stocks from large and mid-cap stocks in the FTSE All-World ex-U.S. Index. VYMI has a diversified portfolio with no single stock consists over 2% of its total portfolio. However, financial sector represents nearly 39% of its portfolio. Since this sector is rate-sensitive and will generally underperform in an economic recession, we think investors should take a conservative approach as we are already in a late cycle environment.

Fund Analysis

A diversified portfolio of over 1,000 stocks

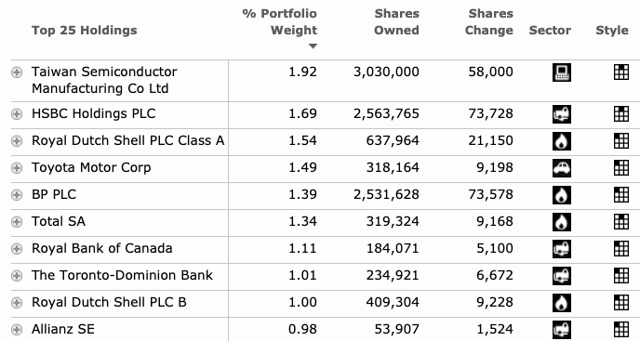

VYMI’s portfolio currently includes 1,010 stocks. This broad selection is diversified and helps to reduce the risk of high concentration to a few companies. As can be seen from the table below, no single stock constitutes more than 2% of its entire portfolio. In fact, its top 10 stocks only constitute about 13.5% of its total portfolio weighting. As can be seen from the table below, these are quality companies that have a long history of dividend payment. In fact, most of these companies have increased their dividend payments consistently on an annual basis.

Source: Morningstar

Attractive 4.2%-yielding dividend

VYMI has an attractively trailing-12-month 4.2%-yielding dividend. This high dividend yield is good for income investors. However, investors should keep in mind that the increasing dividend yield we have seen from the chart below in the past year is really due to the declining fund price.

Data by YCharts

Higher concentration to rate-sensitive financial sector

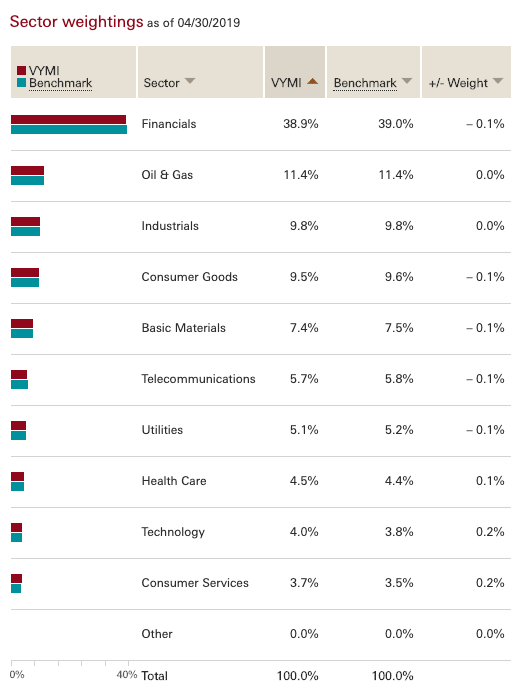

VYMI does not constrain its sector weightings or rebalance its portfolio of stocks based on sector weightings. This means that the fund can be over-exposed to a few sectors. As can be seen from the table below, about 38.9% of its portfolio is related to the financial sector.

Source: Vanguard Website

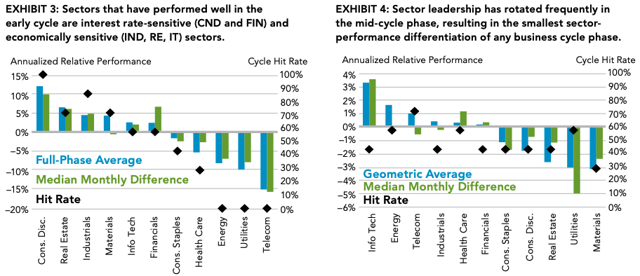

The financial sector is a rate sensitive sector. Therefore, VYMI’s fund can perform well when the economic cycle is in the early or mid-phase when interest rates start to rise or are rising. As can be seen from the chart below, financial sector tend to outperform many other sectors in these two environments.

Source: Fidelity: The Business Cycle Approach to Equity Sector Investing

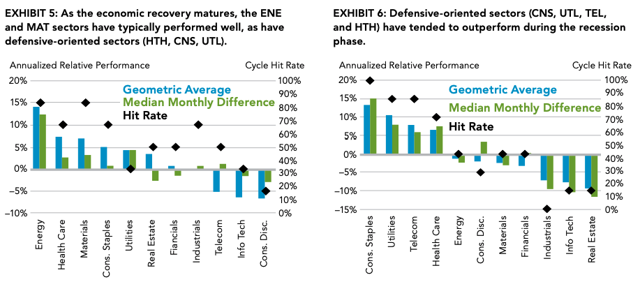

However, the fund may not perform as well in the late cycle phase or recession phase (see the two charts below). It is important to also keep in mind that VYMI’s top 3 sectors (financial, oil and gas, and industrials consists about 60% of its portfolio weighting) will likely perform poorly in an economic recession (see bottom right chart). Since we are likely already in a late cycle environment, we are not far from an economic recession. Therefore, we do not expect VYMI to perform well at this point of the cycle. More will be discussed later in the article.

Source: Fidelity: The Business Cycle Approach to Equity Sector Investing

Low management expense ratio

Vanguard charges a low management expense ratio of 0.32%. While this may be high compare to other ETFs, the MER is comparable to other ETFs whose focus are in large international stocks. As a comparison, Schwab Fundamental International Large Company Index ETF’s (FNDF) MER is 0.25% while iShares MSCI EAFE Value ETF’s (EFV) MER is 0.39%.

Investment Strategy:

Where are we in the current economic cycle?

The current economic cycle has been well into its 10th year in the United States. While the economy in the United States continues to run at a full capacity (Q1 2019 U.S. GDP growth rate of 3.2% and unemployment rate of 3.6%), things aren’t as positive in other international markets. As can be seen from the chart below, global PMI, a leading economic indicator, continues to trend downward since reaching the peak in early 2018. The uncertainty surrounding trade disputes between U.S. and China also has the potential to derail the global economy. Therefore, we are likely at a turning point from late cycle economic phase towards a recession phase. As we have discussed earlier in the article, about 60% of its portfolio weightings are in sectors that will not perform well in an economic recession (financial, energy, and industrial). Therefore, now may not be the best time to invest in VYMI.

Global PMI (Source: Trading Economics)

Pay attention to the strength/weakness of USD

Besides foreign exchange risk, investors investing in international markets need to pay attention to the strength and weakness of U.S. dollar. This is because when the USD strengthens against other currencies, a significant amount of funds will flow from the U.S. to other countries. To be more precise, it is often the Federal Reserve’s policy that depicts the strength of the USD. When the Fed raises the interest rate, it will often result in a stronger USD as money flows from other countries to the U.S. to take advantage of higher interest rates. On the other hand, when the Fed lowers the interest rate, funds will flow out of U.S. to other countries. The money will often invest in international markets and drive the stocks oversea higher. In fact, we can see that VYMI’s fund performance is inversely correlated to the strength/weakness of the USD (see chart below).

Data by YCharts

Investor Takeaway

VYMI is a good investment vehicle for investors to increase exposure to international markets. The portfolio’s dividend with a yield of 4.2% is attractive. However, like many other equity ETFs, this fund is not immune from an economic recession as its top three sectors (financial, industrial, and energy which consists about 60% of its total portfolio) will generally not perform well in an economic recession. Since we are likely already in a late cycle environment, investors may want to stay on the sidelines and wait for a better entry point.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

[ad_2]

Source link Google News