[ad_1]

gesrey/iStock via Getty Images

Main Thesis & Background

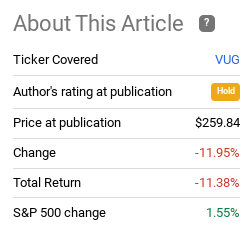

The purpose of this article is to evaluate the Vanguard Growth ETF (NYSEARCA:VUG) as an investment option at its current market price. This is a fund I cover when I am considering buying in to the “growth” theme, although I have been lukewarm on that idea for a while. In fact, when I last covered VUG last year, I placed a neutral/hold rating on the fund. Looking back, this was the right outlook. While the market is up slightly, VUG is in correction territory, showing a disproportionate loss:

Fund Performance Since Last Review (Seeking Alpha)

While this performance over the past year and a half is not too disturbing, if we take a more short-term look at the fund the pressure really becomes evident. Since 2022 began, VUG has seen a drop near 30%:

YTD Performance (Seeking Alpha)

Whenever I see such large swings in short timeframes, I get interested. This got to wondering if buying in to VUG makes sense right now, despite all the negative headlines we are seeing about the market of late. After a review of this fund, I do see enough justification for going long here. While headwinds certainly exist, I think the market sell-off has been a bit too fierce, and we could see an upward correction. If so, VUG will benefit, for the reasons I will outline below.

Global Growth Downgraded, But Maybe That’s OK

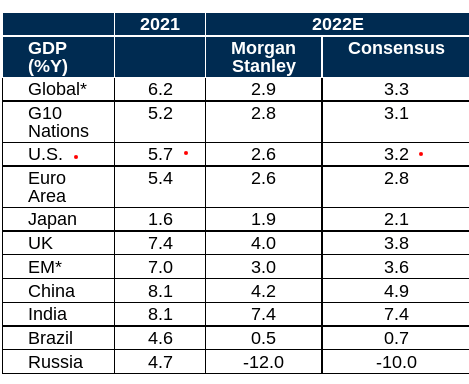

To begin, let us take stock of the global economy. As 2022 has gotten underway, the market has been hit by war in Europe, rapid inflation, and central banks raising interest rates. The impact to equity and bond markets has been severe, but it has extended to broader economic metrics as well. GDP growth figures have been revised downward since the year began, and there are signals they may be revised down again. As it stands now, the U.S. is expected to grow about 3% this year:

GDP Growth Estimates (Morgan Stanley)

Fortunately, that is not too bad of a number. However, with war in Europe dragging on, inflation continuing to remain well above estimates, and central banks being forced to act further, the traits responsible for the downgrades to GDP growth thus far remain in place. Therefore, growth in the U.S. (and across the world) could wind up being even weaker in 2022 than we expect halfway through the year.

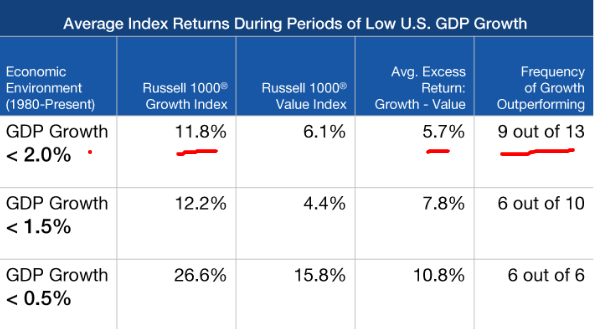

With this in mind, it would make sense to avoid risk-on investment plays, right? This would naturally include growth-oriented ETFs, such as VUG. While intuitive, the reality is that growth funds often perform well during periods of low GDP growth. This tells me that if we do see a downgrade and subsequent lower growth, then this could wind up being a period of gains for VUG. To understand why, let us look at history. Looking back four decades, when GDP growth is in the .5%-2% range, the value index under-performs the growth index:

GDP Estimates (Lord Abbett)

I highlighted the top section because growth in the 2% range is probably the most reasonable estimate if we see a downgrade again. If that happens, there is a strong probability that value is not the better play – growth is. In the majority of cases there is a substantial divergence between the two. Therefore, if the GDP number gets revised down but holds in the 2% range, there is a good chance VUG sees gains. This supports a buy view now.

There Are Bright Spots To Be Found

As my readers know, I am not exactly an optimistic these days. I am advocating staying diversified, which includes looking overseas for value. So it may seem as odd to recommend a U.S.-dominated, large-cap fund like VUG. In fairness, a few weeks ago I might not have, but the drop down to calendar-year lows has me wondering just how bad things really are. Stocks are getting hammered, and VUG is down so much it seems like the world is falling apart. Yes, there is a lot of bad news out there, but there are bright spots too. I feel this is not balancing out the bad enough – investors are too focused on the negative headlines and not given enough credence to the positive news.

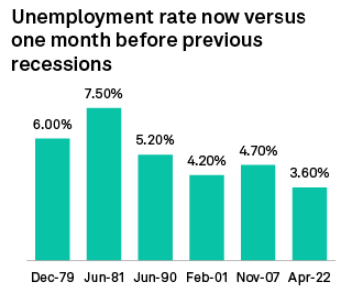

So, what are some of the positives? One is the labor market, which remains pretty tight. Job openings are up, and unemployment is down. This is giving workers pricing power in a way we have not seen in a long time. This reality is helping working households, especially middle and upper-middle class households, cope with the rising cost of living. I bring this up because it is a very important point. In past recessions, the unemployment has never been this low. In fact, it is often markedly higher:

Unemployment Rates Prior To The Start of Recessions (S&P Global)

I bring this up because I do not see the U.S. economy collapsing. American households are understandably worried. But the job market is hot, which means households are able to handle the rising prices we have seen. There is a limit to this yes, but so far, the country is managing it. Further, other major problems, like the conflict in Ukraine, is a faraway problem. This is not a reason to avoid the U.S. stock market. In fact, it may be a reason to consider it, at the expense of developed and emerging economies in Europe, which are closer to the front-line. Ultimately, I want readers to understand there is good news to be found, we just have to look beyond the headlines to find it.

Growth Doesn’t Always Mean No Cash

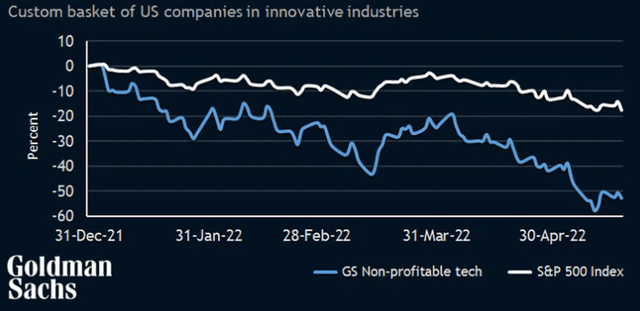

I now want to take more about VUG specifically. Clearly, this is a “growth” idea. But “growth” can mean many things. Often it means companies that are new, growing quickly, or have a lot of potential. These are often risky endeavors and are firms that are short of cash. During times of inflation and rising interest rates, investors can lose patience waiting on these “growth” companies to show actual returns. This patience is indeed what investors are lacking right now. In fact, non-profitable tech companies (which often coincide with growth ideas) have been hammered year-to-date. While the S&P 500, which is also Tech-heavy, has been punished, non-profitable firms are faring much worse:

YTD Performance (Goldman Sachs)

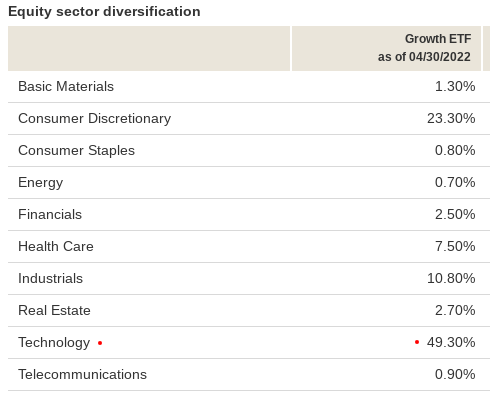

This is relevant to the discussion because VUG is a Tech-oriented growth fund. In fact, the Tech sector makes up almost half of total fund assets:

VUG Sector Weightings (Vanguard)

On the surface, this may seem like the type of fund to avoid, based on the prior comments I just made.

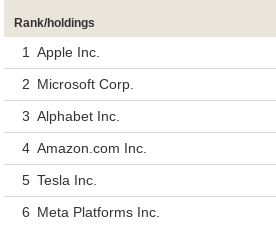

However, we have to consider that all growth is not equal. Non-profitable, small-cap, fad companies can often be growth names, that is true. But those are not what I would recommend now, nor is that what VUG owns. While this is a “growth” fund, it is comprised large-cap growth stocks. The top holdings are some of the most recognizable as a result:

Top Holdings of VUG (Vanguard)

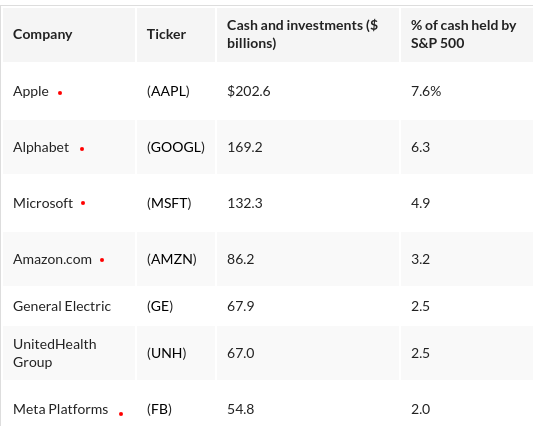

Why is this a good thing? For one, these are not those cash-poor, risky companies that have me concerned. With the exception of Tesla (TSLA), the other five of the top holdings have large amounts of cash on hand. In fact, they have more cash than almost every other company in the S&P 500:

Cash Available (FactSet)

The conclusion I draw here is that these are not the overly risky, prone to disappointment growth firms that make up other funds. VUG holds some time-tested large-caps that also happen to have plenty of cash to weather further market and economic volatility. This makes me comfortable buying-in at these levels.

The Value Advantage Has Been Evident, But Could Be Time To Reverse

My final point looks at the growth versus value discussion that often comes up when considering one or the other. In all honesty, I see nothing wrong with owning both, it really doesn’t have to be a one or the other proposition. But it is also true we do not invest in isolation so when we add to one idea, we are neglecting another.

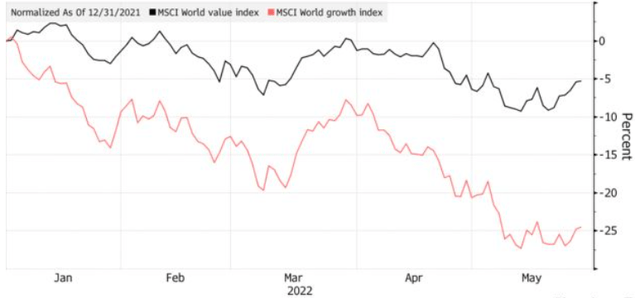

When considering year-to-date performance, I would be remiss if I did not acknowledge that value has been the right move so far. With economic worries mounting, investors took comfort in relative value. While the value index is down this year anyway, the loss is significantly less than the growth index. This is true for the world, not just in the U.S.:

Value vs Growth Return (Bloomberg)

My takeaway at this juncture is to take a contrarian stance. True, value has been rewarding, and it can easily be argued to stick with it. But as a long-term investor who has been in the market over fifteen years now, I know these trends don’t last. The balance between growth and value fluctuates, and this sharp divergence in performance suggests to me a changing of the guard may be near. Growth is in bear market territory, and that is the time to start buying, in my view.

Bottom line

VUG has had a disaster of a year so far. But brighter days could be ahead. The fund can be seen as risky given its 30% year-to-date loss and the risk aversion the market seems to have for “growth” right now. But I would focus on the positives. The world always faces challenges, and we always overcome them. Further, VUG is not holding unproven growth names. It is overweight some of the biggest names in U.S. tech, many of which have massive cash hoards. This tells me there is some relative safety here, even if macro-headwinds dissipate in the near term. As a result, I am looking at starting a position in VUG, and I would encourage readers to give this idea some thought at this time.

[ad_2]

Source links Google News