[ad_1]

IvelinRadkov

Author’s note: This article was released to CEF/ETF Income Laboratory members on August 16th, 2022.

I last covered the Vanguard Value ETF (NYSEARCA:VTV), one of the largest, most well-known U.S. value ETFs in the market, earlier in the year. In that article, I claimed that the fund’s diversified holdings and cheap valuation made it a buy. VTV has outperformed since, as growth valuations and share prices have plummeted, while cheaper stocks, industries, and funds have seen below-average losses.

Although VTV has performed reasonably well these past few months, the fund has lagged behind other more focused, cheaper, aggressive value funds. VTV is a reasonable investment opportunity, but I would not be investing in the fund at the present time, as there are simply stronger choices out there. Of these, the Avantis U.S. Small Cap Value Fund (AVUV) is a particularly strong, compelling choice, last covered here.

VTV Basics

- Sponsor: Vanguard

- Underlying Index: CRSP US Large Cap Value Index

- Expense Ratio: 0.04%

- Dividend Yield: 2.48%

- Total Returns CAGR 10Y: 12.20%

VTV Overview

VTV is an index ETF investing in U.S. large-cap value stocks. It is administered by Vanguard, the pre-eminent provider of cheap, diversified index funds in the world.

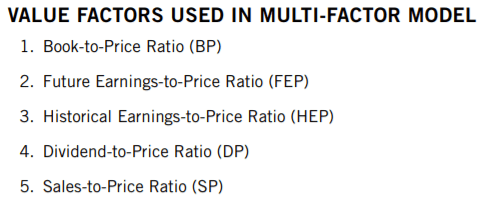

VTV itself tracks the CRSP US Large Cap Value Index, a U.S. large cap value index. It is a relatively simple, broad-based, index. It starts by selecting applicable U.S. large-cap equities, subject to a basic set of size, liquidity, trading, etc., criteria. Criteria is quite lax, so the starting investment universe consists of 85% of total U.S. market-cap. Securities are then ranked according to their valuation, and stocks with below-average valuation are included in the index. Valuations are determined according to the four following standard metrics:

CRSP There are buffers and other assorted rules meant to decrease portfolio turnover. There are also rules meant to more accurately separate value stocks from growth stocks. It is a market-cap weighted index. VTV’s underlying index is quite broad, which results in an incredibly well-diversified fund. VTV invests in over 340 stocks. VTV’s largest holdings are almost all well-known large-cap U.S. equities, including Berkshire Hathaway (BRK.A), Johnson & Johnson (JNJ), and JPMorgan Chase (JPM), amongst others. VTV also invests in smaller mid-cap companies, including Annaly Capital (NLY) and Dell (DELL), but as the fund is market-cap weighted, these smaller companies make up a relatively small proportion of the fund’s assets. VTV currently sports a weighted average median market-cap of $114B, a relatively large figure, as one would expect. VTV’s median market cap is somewhat lower than that of the S&P 500, $169B, due to the fund’s mid-cap exposure. Still, VTV can be broadly characterized as a large-cap value fund, focusing on large companies.

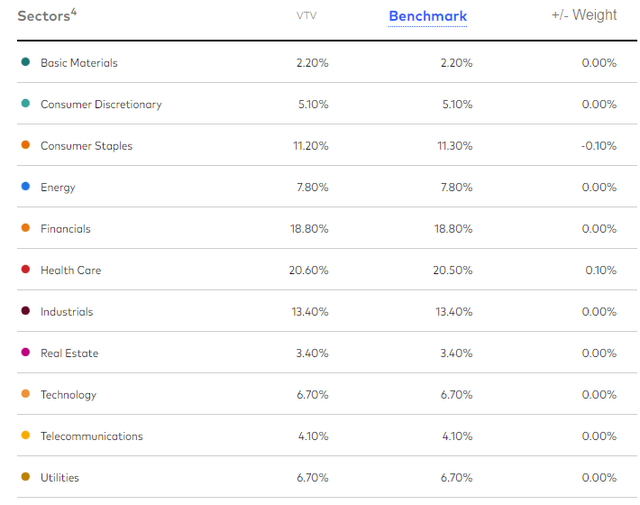

VTV provides investors with exposure to most relevant industries. As with most value funds, it is overweight relatively cheap old-economy industries, including financials and consumer staples, while being underweight expensive tech. Industry allocations are as follows.

VTV

VTV is an incredibly well-diversified fund. Diversification reduces portfolio risk and volatility, both important benefits for the fund and its shareholders. Diversification also somewhat reduces the possibility of significant over-performance or underperformance. Which brings me to my next point.

VTV is Not Much of a Value Fund

VTV’s underlying index is quite broad, with relatively lax inclusion and exclusion criteria.

Broad indexes lead to well-diversified funds, as is the case for VTV.

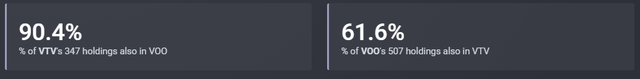

Broad indexes lead to very bland portfolios, which do not materially differ from those of most well-known equity indexes, including the S&P 500. There is actually quite a bit of overlap between VTV and said index, with most of the fund’s holdings being part of the S&P 500, and vice versa.

ETFRC.com

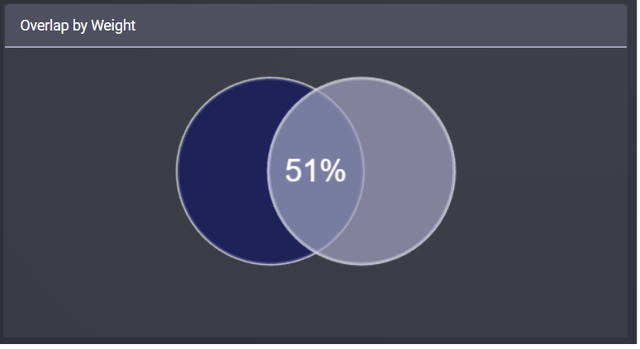

There is also quite a bit of weight overlap between the funds, of 51% to be exact. So, 51% of the assets of both funds are the same, 49% are different.

ETFRC.com

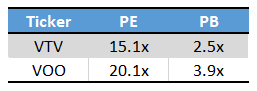

Due to the above, the valuations between the funds are not all that different. VTV’s valuation is moderately cheaper, as one would expect from a value fund, but the difference is not all that great, on an absolute basis, and relative to other value funds.

Fund Filings – Chart by Author

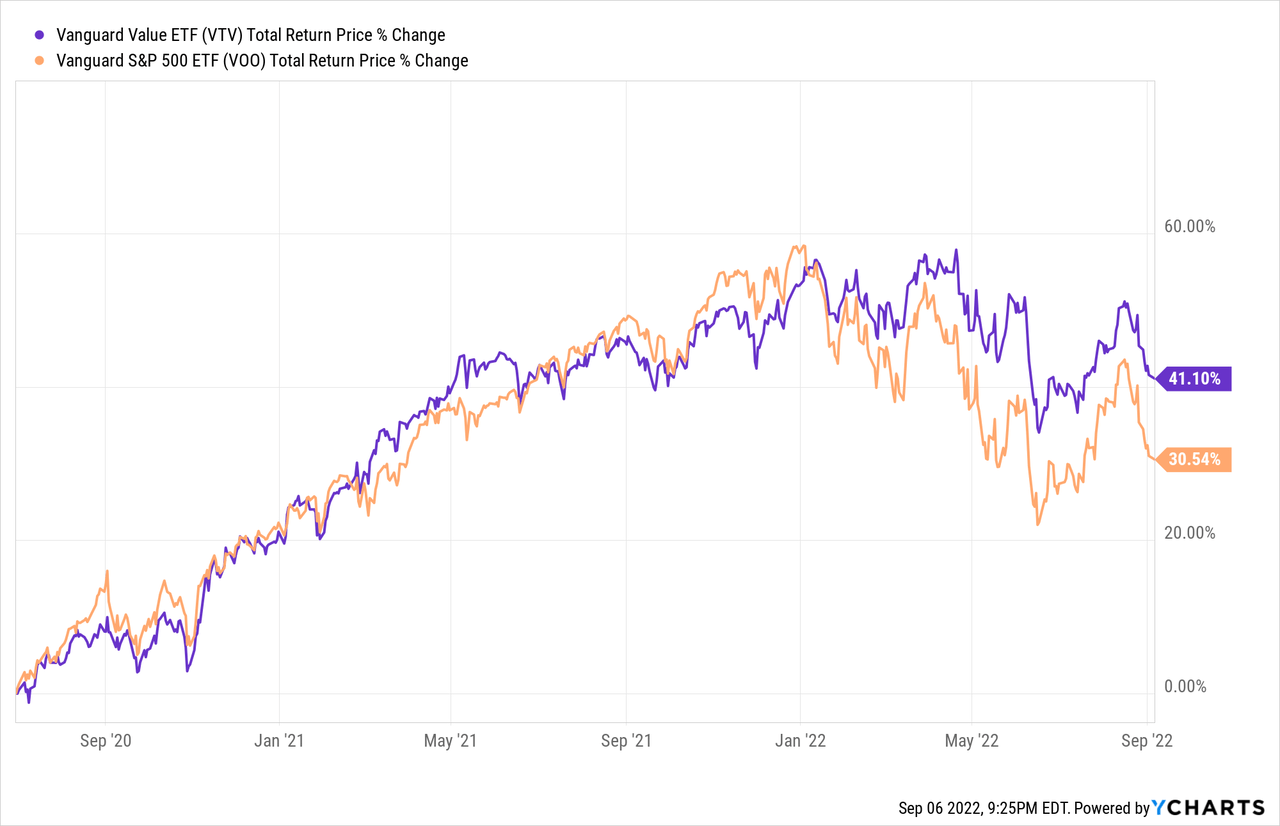

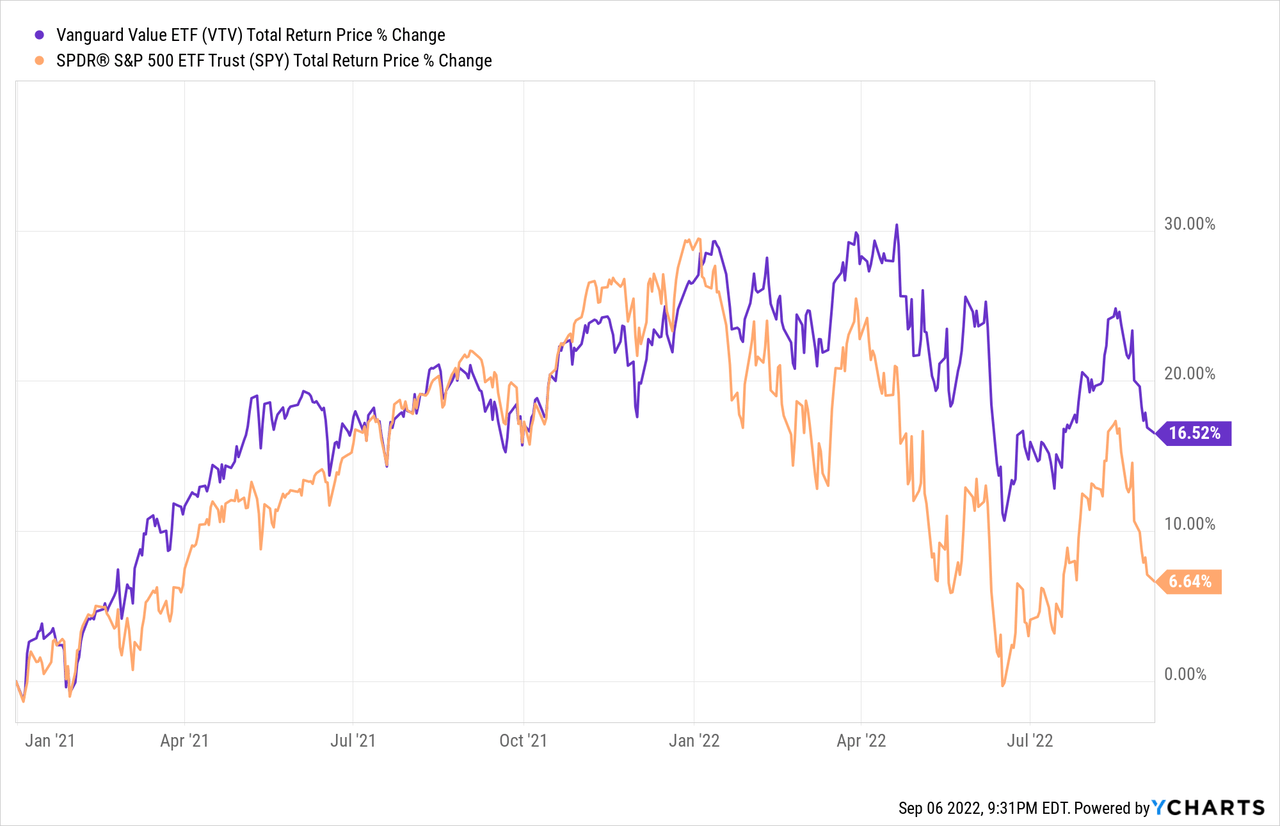

Although there is nothing inherently wrong with the above, it does mean that the fund’s performance will very rarely materially differ from that of the S&P 500. The fund is simply too similar to said index for significant differences in their performance. In most situation, the fund’s returns roughly match those of the S&P 500, as one would expect. As an example, this as has mostly been the case for the past two years or so.

VTV’s performance rarely deviates too much from that of the S&P 500, but it does sometimes happen. VTV significantly underperformed said index from late 2019 to mid-2020, during which tech significantly outperformed relative to the equities market. VTV is underweight tech, so did not benefit from tech gains, and so posted comparatively small gains. From what I’ve seen, this is the only material period of time during which VTV’s performance has significantly differed from that of the S&P 500. The situation is, I think, quite clearly visible in the following graph.

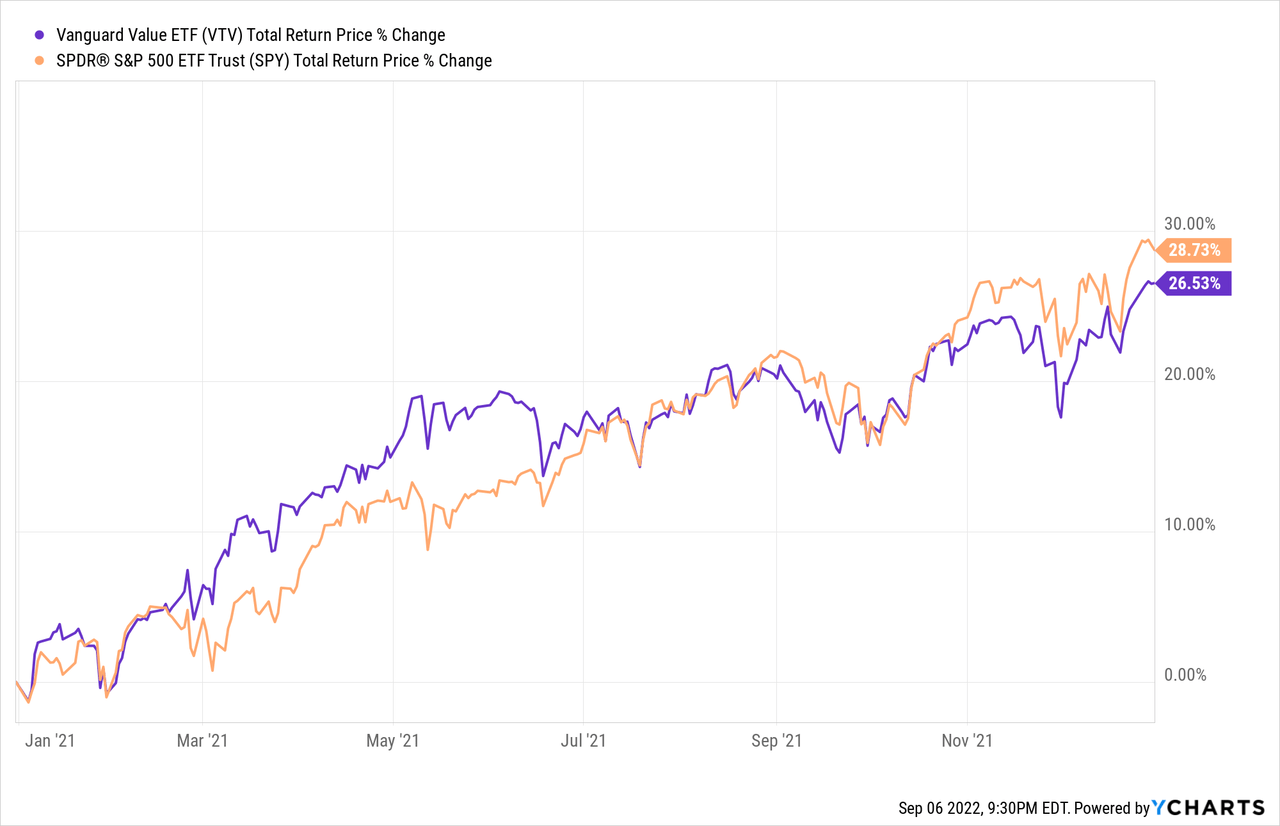

Due to the above, the fund should not see significant gains or outperformance if value stocks outperform. As an example, 2021 was the strongest year for value stocks in decades, as per FactorResearch, and as per J.P. Morgan, due to improved economic fundamentals and investor sentiment. Value performed exceedingly well, but VTV did not, with the fund slightly underperforming relative to the S&P 500.

VTV’s lackluster performance was partly the result of bad timing and normal volatility, with the fund moderately outperforming the S&P 500 from 2021 onwards, including performance for 2022.

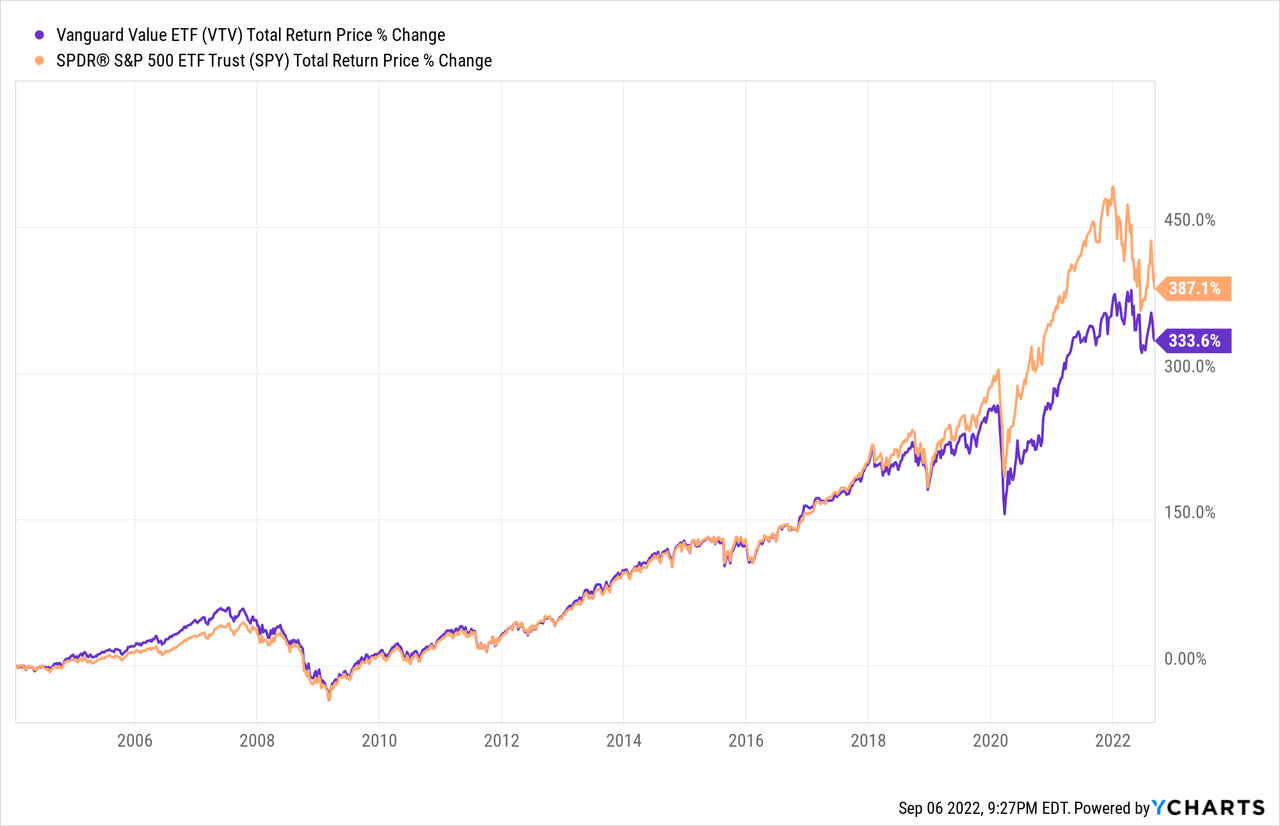

Notwithstanding the above, VTV’s performance has been broadly mediocre. These have been the best years for value stocks in about a decade, and the fund matched the performance of the S&P 500 for an entire year, and only really outperformed said index for a couple of months earlier in the year. Importantly, these gains are mostly a belated, partial recovery from COVID losses. VTV’s performance only seems good because the fund performed so badly in prior years.

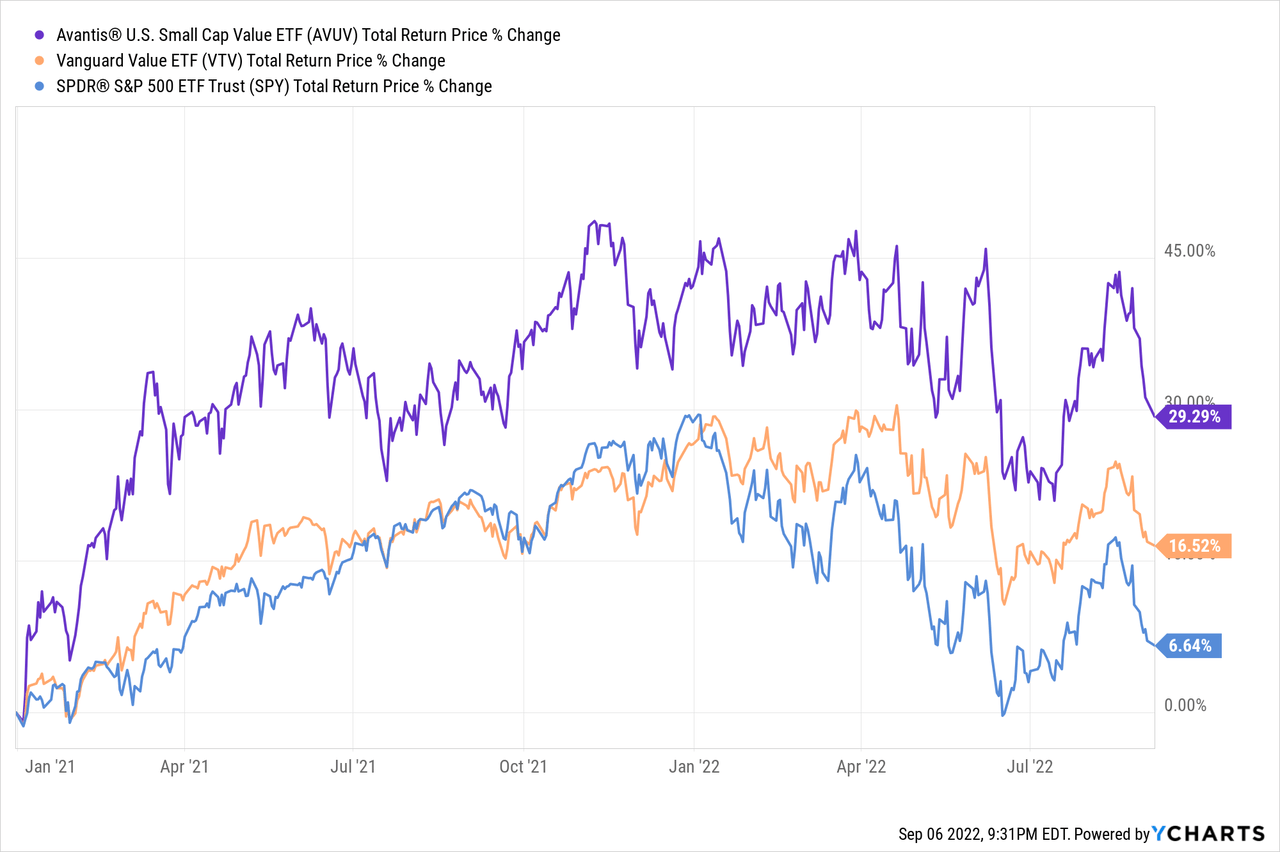

As mentioned previously, these have been the best years for value stocks in quite a while, but VTV’s performance barely reflects that. In my opinion, this is an important negative for the fund, and a significant hit to its investment thesis. Value’s main selling point is significant, market-beating returns when valuations normalize, and the fund barely delivers on that. Importantly, this is not an issue for other value funds. AVUV, for instance, has significantly outperformed since 2021, as one would expect from a value fund.

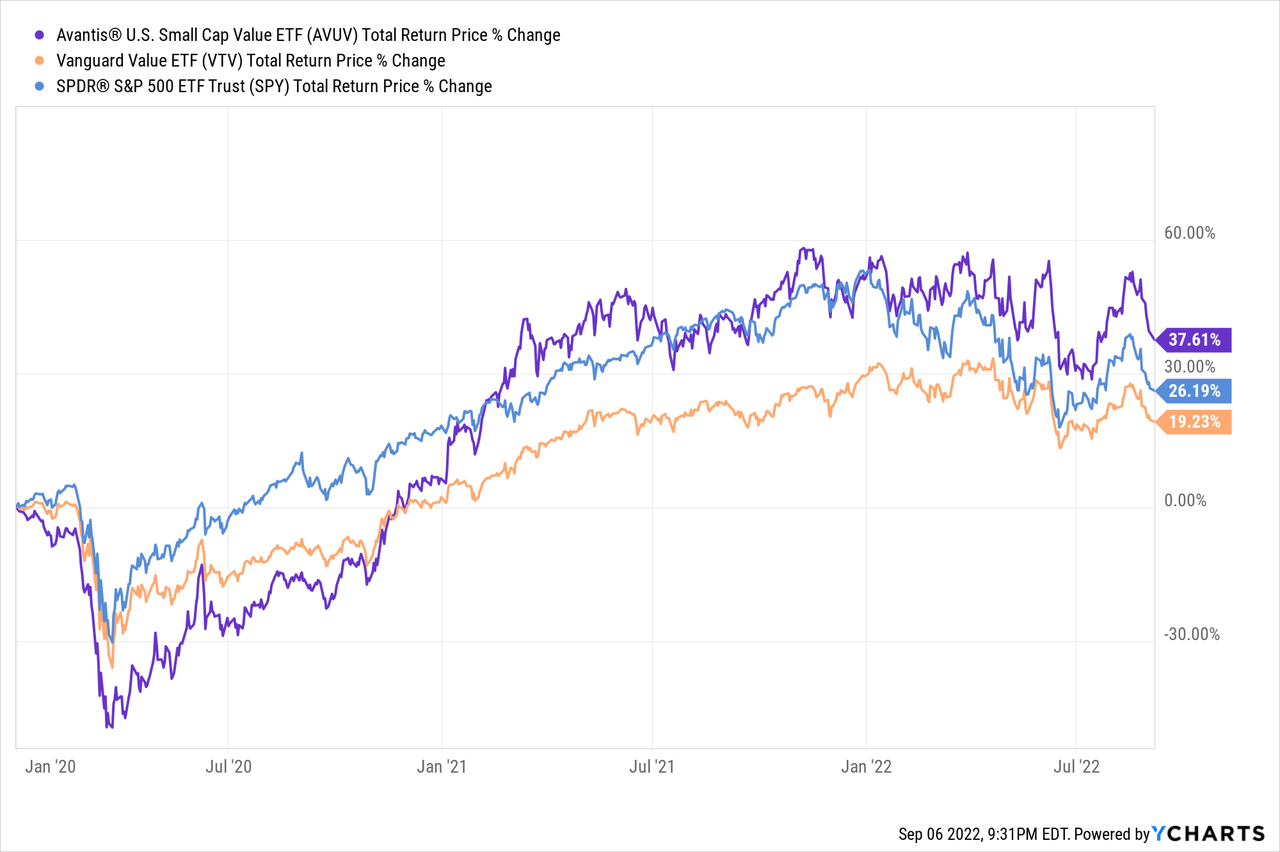

AVUV’s long-term performance is stronger too, with the fund outperforming relative to both VTV and the S&P 500 since inception.

Considering the above, VTV looks like a very lackluster value fund. It is too similar to broader equity indexes, in strategy, holdings, fundamentals, and performance. AVUV and other value funds are simply superior investment opportunities, in my opinion at least.

Conclusion

VTV is one of the largest, most well-known U.S. value ETFs in the market. Although there is nothing inherently wrong with the fund, there are other broadly similar, but superior, value ETFs out there. As such, I would not be investing in VTV.

[ad_2]

Source links Google News