[ad_1]

piranka

Data Center REITs & Digital Infrastructure ETF (NASDAQ:VPN) is a pretty unimpeachable exposure. Unlike a bond, there is the promise of earnings growth in this one driven by Equinix (EQIX), so an earnings yield in excess of bond yields are much appreciated. In terms of risk, the real estate heavy exposure and the appropriateness of REITs in a late-cycle environment put VPN high up on the list in terms of solid ETFs that equity market investors might consider. It gives recession resistance and inflation resistance, and there isn’t a whole lot that can go wrong for the lion’s share of the ETF’s elements.

Note On Exposures

The exposures in this ETF do represent important and non-displaceable infrastructure connected to markets that do grow rather quickly and nicely. We discuss them in more detail in our last article, but the key one to focus on is the IX market which is represented by EQIX. We have looked at ETFs for infrastructure before and have found them wanting relative to bonds. Regulated utilities do have inflation and interest rate resistance in them, and are not as subjected to market forces, but also don’t have pricing power. In fact, a lot of infrastructure can lack a bit in pricing power depending on the association with regulatory authorities. Therefore, the earnings yield on such ETFs tends to be a little low relative to bonds, where coupons are definitively fixed, especially considering that infrastructure equities still have more risk than bonds. EQIX distinguishes VPN because of its capacity to grow earnings rapidly. The size of its investment into IX facilities drives those facilities’ value proposition, and this demand-side economic business with superb compounding effects sees its earnings rise with little fail. Therefore, an earnings yield of 5% today will grow thanks to exposures like this, where a typical 4% YTM corporate bond won’t and is therefore exposed to duration risks.

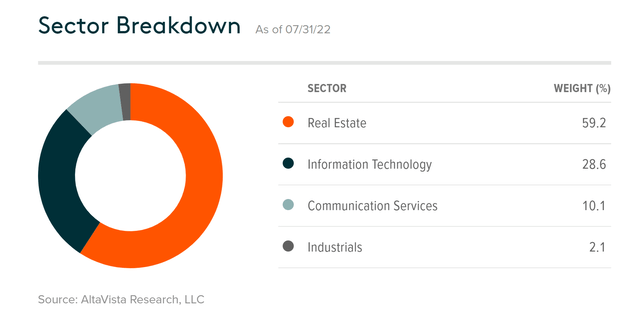

In an aggressively pessimistic scenario it is still a real estate exposure, and those leases are going to be a solid source of resilience. This matter of real estate is an important one for VPN.

Sector Breakdown (globalxetfs.com)

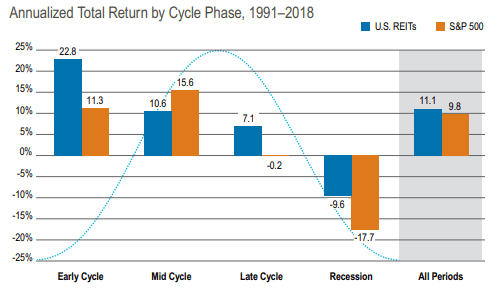

REITs are an excellent source of resilience in markets like these. Not only do they outperform in a downturn, they also outperform in a reversal, so you can sit on them without timing the reversal. EQIX is a REIT, as is the VPN portfolio’s other major Telco exposures, again very safe ones with minor earnings growth built into lease agreements with virtually no counterparty risk.

REIT Returns (Cohen & Steers)

Conclusions

Earnings yields are just under 5%. A typical corporate bond nowadays has a YTM of about 4% with the reference rate target expected by markets at about 2%. The risk premium here is 3% over risk free instruments, and 1% over corporate bonds which might be relatively free of credit risk, but not free of duration risk. Corporate bonds can be expensive in our opinion, something like VPN really isn’t. Yields aren’t high at about 1.65% after fees, but that’s because a lot of the companies inside are premiumized with some not even paying a dividend. Still, the earnings yield is what ultimately matters for shareholders, since you’re entitled to that building equity. With both resilience and value, VPN looks like a solid choice for the ETF investor.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value investor, and serious about protecting your wealth, we at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Source links Google News