[ad_1]

gorodenkoff/iStock via Getty Images

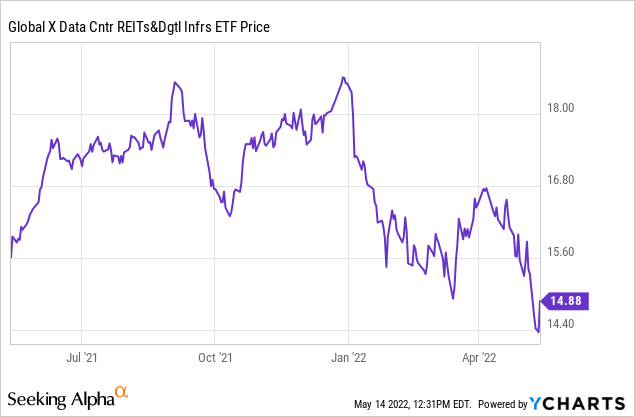

The Global X Data Center REITs & Digital Infrastructure ETF (NASDAQ:VPN) is the perfect way to play the growing industry of data centers and 5G. The global data center market size was valued at $215.8 billion in 2021 and is forecasted to reach $288.3 billion by 2027, growing at a CAGR of 4.95%. While the global 5G services market size is forecasted to reach a staggering $1.67 trillion by 2030, registering a CAGR of 52.0% from 2022 to 2030. The fund was formed in 2020 and increased by 28% to ~$18.50 per share. Recently the share price has pulled back by ~19% from these all-time highs and is now trading below its net asset value. Let’s dive into the holdings, expenses, and valuation to find out more.

VPN Data Center ETF (ycharts)

Top Holdings

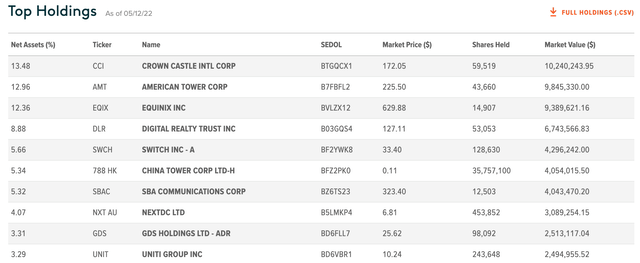

The Global X Data Center REITs & Digital Infrastructure ETF owns 24 holdings, which include data center REITs and digital infrastructure stocks. The fund’s largest holding is Crown Castle (CCI) which is the largest US provider of shared communications infrastructure such as cell towers, small cells and even fiber optic cabling. These are basically the backbone of our digital communications world and help to power the internet. The 2nd largest holding is American Tower (AMT) which owns over 200,000 telecoms sites across the world and was even ranked 410 on the Fortune 500 due to its size. That is a fantastic REIT, which is invested for growth and poised to benefit from 5G tailwinds. The third largest holding is Equinix (EQIX), which is the largest global data center and colocation provider for enterprise networks and cloud computing. While Digital Realty (DLR) invests into carrier-neutral data centers and provides colocation services. The fifth largest holding is Switch (SWCH) which is one of the largest data center REITs in the USA.

Holdings VPN (Global X website)

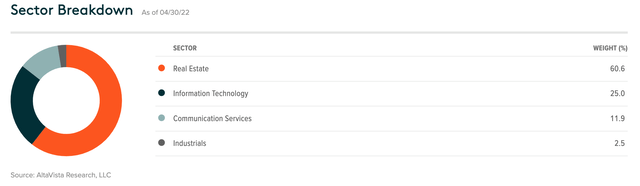

In terms of stocks, the fund has invested into some of greatest tech stocks such as Intel (INTC), NVIDIA (NVDA), and Micron (MU). Overall, these holdings are weighted 60.6% towards Real Estate, followed by 25.6% for IT and 11.9% for communication services.

VPN Sector breakdown (Global X)

Country & Industry breakdown

The fund’s investments are heavily weighted towards US traded REITs and stocks with 72.9% exposure. The fund also has some exposure to Chinese holdings with a 9.9% weighting. This is generally achieved via the use of American Depositary Receipts (ADRs) which are necessary in order to invest into Chinese stocks such China Tower Corp (OTCPK:CTOWY) (788 HK).

Country breakdown (Global X)

The fund invests 80% of its assets in the Solactive Data Center REITs & Digital Infrastructure Index and in ADRs and GDRs based on the securities in the index. The American Depositary Receipts (ADRs) are necessary in order to invest into Chinese stocks such China Tower Corp (788 HK).

Expense Ratio & Assets

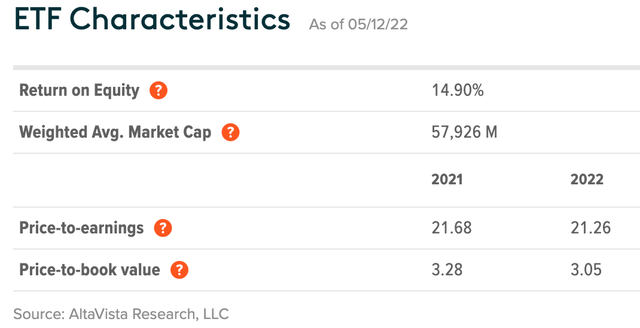

As a fairly new ETF (formed in 2020) the fund only has $75 million in assets. The expense ratio is fairly high at 0.5%. If we compare this to the SPDR S&P 500 ETF which has a rock bottom expense ratio of just 0.09%. However, this is cheaper than the closest competitor REIT ETF which has an expense ratio of 0.6%. This is for the (Pacer Benchmark Data & Infrastructure Real Estate SCTR (SRVR)) which also has similar holdings. The return equity is also strong at 14.9%.

Expense Ratio (Global X)

Valuation

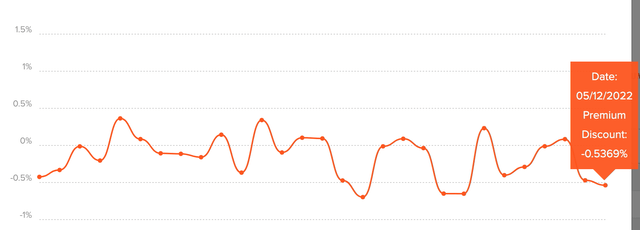

According to the company’s website, the fund is trading at -0.5% discount to the net asset value. The Price to earnings (PE) multiple has compressed to 21.26, down from 21.68 in 2021.

Trading below net asset value (Global x)

With a price to book value of 3.05, which is less than the average in 2021 of 3.28. While the dividend yield is ~1% which isn’t very high but looking at the number of technology stocks more growth would be expected via capital appreciation.

Final Thoughts

The Global X Data Center REITs & Digital Infrastructure ETF is the new kid on the block in the digital REIT industry. Their strategy of investing into the largest & most dominant data center REITs, in addition to leading tech stocks seems fantastic moving forward. The REITs should provide stable industry growth & dividends, while the tech stocks offer upside potential.

[ad_2]

Source links Google News