[ad_1]

William_Potter/iStock via Getty Images

Investment thesis and background

The Vanguard Global ex-U.S. Real Estate ETF (NASDAQ:VNQI) offers a good choice to invest in international REITs with a relatively low valuation, excellent diversification, and low cost. It is especially attractive for investors now particularly, for a few good reasons:

- Hedge against inflation. REITs have been a good hedge against inflation historically, and VNQI is no exception.

- Attractive valuation. Currently, the fund is valued not only cheaply in relative terms, but also in absolute terms. It is valued below its book value.

- Good odds for price appreciation. Its dividend yield surged above 6%, which has only happened twice in the past decade. And the past two times were all followed by a sizable price appreciation.

- Diversification. Historical data have also shown that international REIT provides a relatively uncorrelated income stream to US equities to better diversify our portfolio. In particular, the fund has no substantial exposure to the Russian region and therefore is relatively immune to the conflicts.

And in the remainder of this article, you’ll see these four reasons discussed in detail one by one.

1. Hedge against inflation

The VNQI fund invests in public global equity markets ex-US region. The fund invests in stocks of companies operating across different real estate subsectors encompassing a wide market spectrum in terms of style (growth vs value) and market capitalization.

REITs have been a good hedge against inflation historically. VNQI is no exception and offers investors a hedge under the current inflationary environments. Since its inception in 2010, its return has beaten inflation with a substantial margin in this period of time. Its return has been 6.7% over the past decade, compared to an inflation averaging 1.9% CAGR.

Also, as with other Vanguard products, VNQI charges a lower fee, 0.12% (for example, vs the 0.59% charged by RWX, the SPDR Dow Jones International Real Estate ETF). Such low cost better helps investors to fight inflation in the long term.

2. Attractive valuation

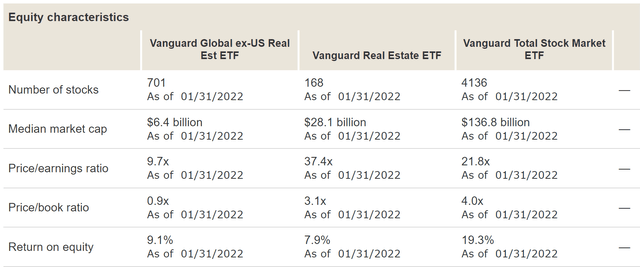

Another attractive feature of VNQI is its relatively low valuation as shown below. After a long bull run, the overall market is quite expensive even after the recent corrections. As seen, the domestic REIT fund VNQ is valued at ~37x PE and 3.1x book value, and the total US market is at 21.8x PE and 4.0x book value. In contrast, VNQI’s PE ratio is 9.7x, and the price to book value ratio is only 0.9x. Such a contrast in valuation is too large to ignore. I expect such valuation to provide a large margin of safety going forward, and also a better total return in the long term compared to the domestic market.

Source: Vanguard

3. Good odds for price appreciation

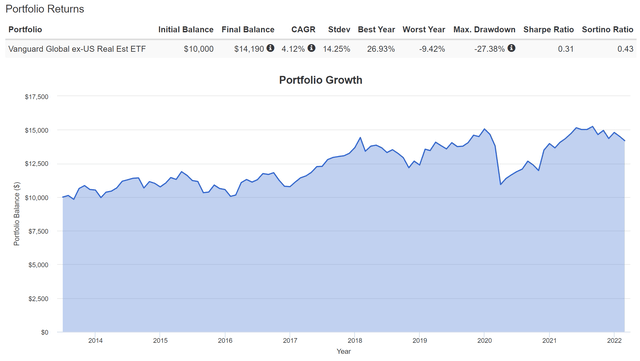

As you can see from the following chart, its dividend yield surged above 6% due to the recent market correction (and the Russian war). Now its dividend yield stands at 6.96%. As you can also see, this level of dividend yield has only happened twice in the past decade – once in 2013 July and the other time during the COVID crash starting in 2020 March.

And in both times, a sizable price appreciation followed in the years after. The second figure in this section shows the total return if an investment were made in July 2013 when the yield surged above 6%. As you can see, there have been some large price volatilities after that. However, despite those price volatilities, the investment has not lost money even during the 2020 COVID crash.

Source: Seeking Alpha. Source: Portfolio Visualizer Silicon Cloud Technologies LLC

4. A further diversification of your portfolio

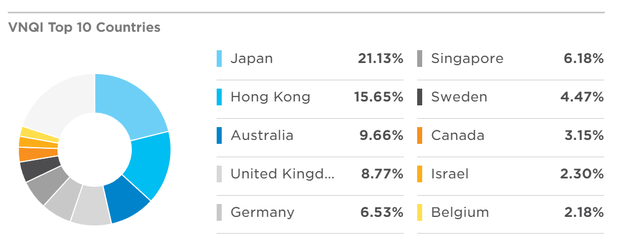

VNQI’s underlying index is well balanced across a broad spectrum of countries/regions and REIT sectors. It invests in 701 different securities and the top 10 countries are shown below. As seen, Japan is the largest exposure (about 21%), followed by the greater China/Hong Kong region (~16%). In particular:

- Note that the fund has no substantial exposure to the Russian region. Therefore, the fund is relatively immune to the conflicts and the outcomes of Russia’s war with Ukraine.

- Part of the reason for the fund’s large recent price correction was the Chinese real estate bubble. At this point, I think most of the bubble has burst and the negative impacts have been priced in.

- Looking forward, I am optimistic about the massive urbanization progress ongoing in China serving as a growth driver for this fund for the years to come.

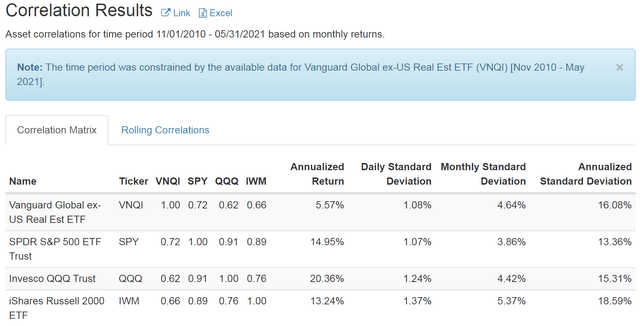

Lastly, if there’s one free lunch in investing, it is diversification. However, there are not many truly uncorrelated investments available to most investors. And as you can see from the chart below, VNQI provides a good diversification relative to the US market. Its correlation against the main US market indices ranges from 0.62 to 0.72. In contrast, the US market indices themselves are correlated between 0.76 to 0.91.

Source: etf.com Source: Portfolio Visualizer Silicon Cloud Technologies LLC

Conclusions and final thoughts

Now is a good time to consider adding VNQI to your portfolio, for a few good reasons:

- Hedge against inflation.

- Attractive valuation. Currently, it is valued below its book value.

- Good odds for price appreciation. Its dividend yield surged above 6%, which has only happened twice in the past decade. And the past two times were all followed by sizable price appreciations.

- Diversification. The fund has no substantial exposure to the Russian region and therefore is relatively immune to the conflicts. The China real estate bubble has largely burst and negative impacts price in.

Lastly, potential investors need to be aware of the risks too. Specifically,

- As shown in the chart above, the Pacific region (Japan, the greater China, and Australia) has an outsized impact on the fund. Factors such as Yen and RMB exchange rates could impact the fund.

- VNQI has also historically underperformed the broader market as represented by the S&P 500 historically.

- The dividend distributions have been patchy and not very consistent.

Check out our marketplace service

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 2x in-depth articles per week on such ideas.

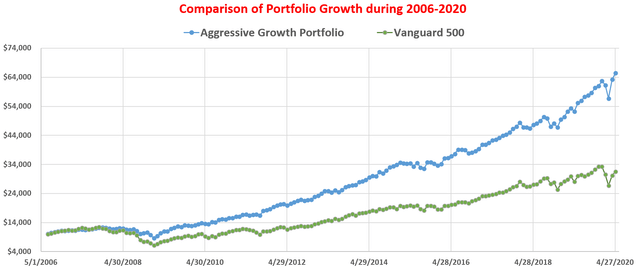

We have proven and perfected our methods with our own money and efforts for the past 15 years. For example, our aggressive growth portfolio has helped ourselves and many around us to maximize return with minimal drawdowns.

Lastly, do not hesitate to take advantage of the free-trials – they are absolutely 100% Risk-Free.

[ad_2]

Source links Google News