[ad_1]

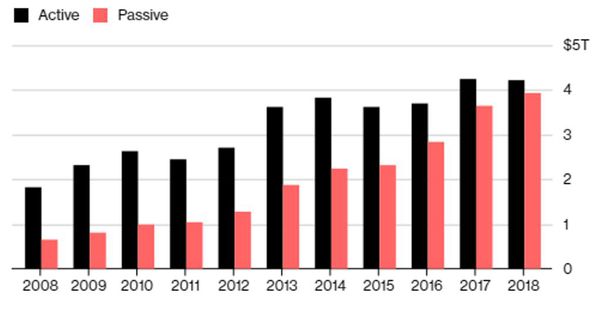

Since the end of 2006, investors have withdrawn nearly $1.2 trillion from actively managed U.S. equity mutual funds, and have allocated roughly $1.4 trillion to U.S. equity index funds and exchange-traded funds (ETFs). When it comes to mutual funds and exchange-traded funds that buy U.S. stocks, those that passively track indexes now hold 48 percent of market assets according to estimates from Morningstar. According to Bloomberg, passive funds will top 50 percent in 2019 if the current trend holds. That would mark a tipping point for the investing industry, which for decades built its stature on the prowess of stock-and-bond pickers seeking to beat the markets.

Indexing on the RiseMorningstar

One of the benefits of the growing trend towards passive investing is lower fees to the investor. Not only do passive ETFs generally charge lower fees, but the competition is driving fees lower among active managers. Sophisticated investors should seek active managers in asset classes with low efficiency and high dispersion, and look to passive investing in the most efficient asset classes.

Below are the net annualized return numbers for the last 20 years for the S&P 500 Index (SPY) ETF, the Vanguard S&P 500 Index (VOO) fund, the actual S&P Index, and the entire Morningstar universe of all domestic stock managers. Unlike test grading in school, a money manager universe ranking lists 1 as the best and 100 as the worst.

Annualized Return to date in %Morningstar

Annual 12-month Rolling Return Universe Rank in %Morningstar

It’s interesting to see the cyclicality of the swings. Some years the index is in the 12th percentile, meaning the index beat 88% of the active managers. Some years the index is in the 72nd percentile, meaning that 72% of the active managers beat the index. The index funds tend to track the index closely but underperform slightly by the amount of the fees and other fund costs.

There is another effect from a 50/50 mix of active and passive management. This 50/50 ratio effectively takes half of the buying power out of the market. A good active manager may research an attractive company with terrific fundamentals, but the passive half of the market does not care about fundamentals and just buys across the board based on company size. Conversely, when investors go bearish and decide to sell, they tend to move as a group, sometimes known as “the thundering herd.” When the herd stampedes out of the passive investments, the active half the market may not be interested in buying the entire index of stocks, and prefers to cherry pick the ones perceived to have good fundamental characteristics. The concentration in the market has gone up with passive managers the largest shareholder in at least 40% of all U.S. listed companies. Further, this concentration raises concern about new financial risks including increased investor herding and greater volatility in times of severe financial instabilities. There may indeed be opportunities imbedded in this new risk, but what is more clear we may be experiencing increased volatility in the market going forward.

[ad_2]

Source link Google News