[ad_1]

Over the last month, substantial volatility has been seen in the ProShares VIX Short-Term Futures ETF (VIXY) with shares rising by 24%, erasing the month-to-date decline in a single week. As seen in the following momentum table, however, long-term returns of the ETF remain to the downside by a fair margin.

It is my belief that the current rally in price represents a strong shorting opportunity in the security based on both the nature of volatility and roll yield. I believe these forces will very soon exert influence on the VIX futures market which will lead to further price declines in VIXY.

The Instrument

When it comes to volatility ETFs and ETNs, it is critical to gain an understanding as per what the instrument actually gives exposure to as well as the implications of its particular methodology. The reason why grasping this is of paramount importance before trading or investing in an instrument is that in the volatility space, in particular, the fine points of the strategy can result in dramatic differences in performance versus expectations.

When it comes to VIXY, it follows the S&P 500 VIX Short-Term Futures Index which basically means that on a daily basis, it rolls exposure from the front month to the next month out in VIX futures so as to maintain a weighted-average exposure of one month. There is a lot of nuance here, so let’s unpack this.

First off, the S&P 500 VIX Short-Term Futures Index tracks VIX futures. VIX futures are a non-deliverable contract provided by the CBOE which is cash settled based on what the S&P 500 VIX is calculated at in a specific window. The VIX itself is an index which is calculated from the implied volatility of certain options on the S&P 500 with a target expiration of 30 days in the future.

There’s a lot there, but basically what it boils down to for traders of VIXY is that when you buy and sell the instrument, you are exposed to the movements in futures prices on a calculated index. Since the S&P 500 VIX Short-Term Futures Index is constantly rolling exposure, this means that roll yield plays a massive role in the underlying returns of the instrument.

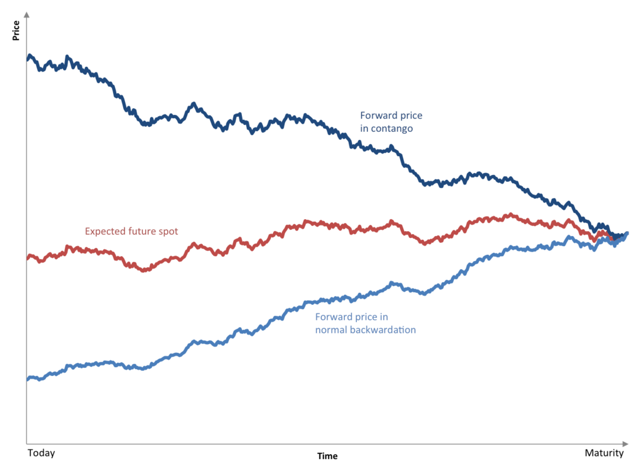

Roll yield is the gain or loss associated with holding a position across the futures curve for any length of time. As seen in the following chart from Wikipedia, there is a general tendency for prices in later months of a futures or forward curve to trade towards the front month contract as time progresses.

This means that if you are rolling a long position in a market caught in contango (front contract under back contract), roll yield will be negative because the long position will be established at higher prices than prompt, and as time progresses, the contract will trade down in value in relationship to the front. For a market in backwardation, roll yield on a long position will be positive because prices will trade up in value in relationship to the front month contract as time progresses. There are excursions from this general market tendency, but it is so consistent across markets that some specialize in simply trading the roll and some ETFs are structure to maximize or minimize roll yield.

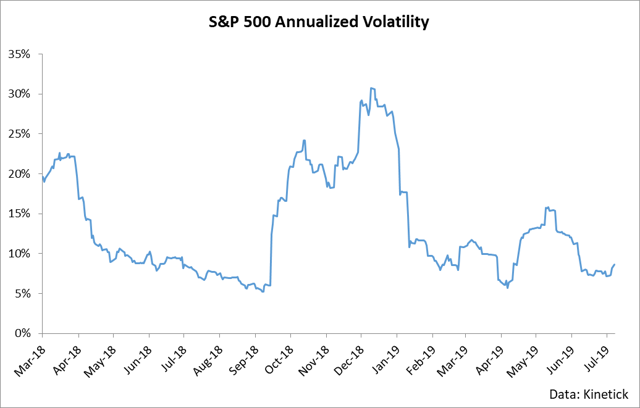

In the case of VIXY, the problem really has to do with the nature of volatility: it doesn’t trend. If you look at a long-term chart of volatility in the S&P 500, you’ll find that it largely just travels sideways with brief periods of pops and drops.

This means that if you are rolling a position for lengthy periods of time in an instrument which basically travels nowhere, roll yield will be almost the entire determinant of the return of your ETF. The funny thing about VIX futures is that they are almost always in contango except during periods of time in which VIX rises strongly. This is the primary reason why VIXY has dropped by 95% over the last 5 years and will likely continue dropping over most time periods: it is rolling long exposure in a market almost always caught in contango.

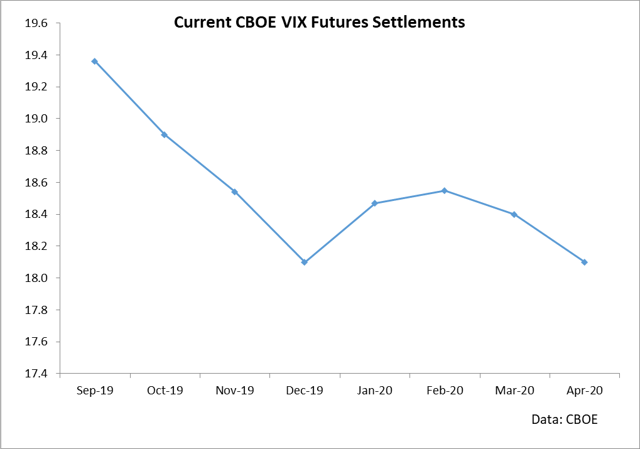

At present, however, roll yield is positive since VIX futures are currently backward in the front two months as seen in the following chart.

This means that currently, holding VIXY will result in a positive roll yield for long traders. However, I believe that the cyclical nature of volatility strongly indicates that prices in VIXY will be low in the immediate future.

The Nature of Volatility

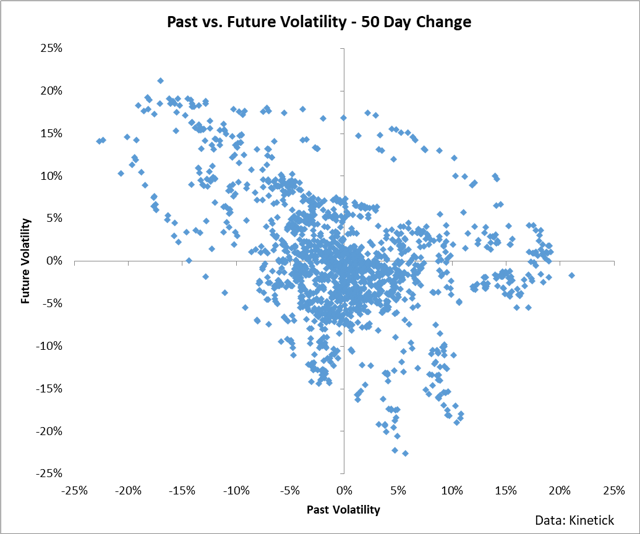

When it comes to understanding volatility, it pays to start with an assumption that it is generally mean reverting. This means that if you see volatility rise over a certain time period, it is likely to fall in the future. Conversely, if volatility drops, it is likely to rise. This relationship can be clearly seen in the following scatter plot which shows the past 50 days change in annualized S&P volatility versus the next 50 days change in volatility. As you can see, when volatility rises, it tends to fall in the future.

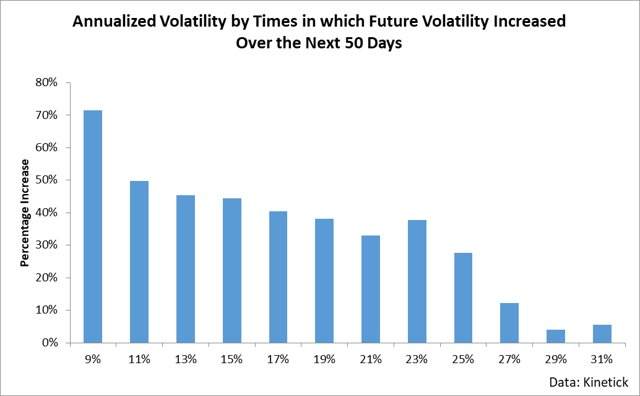

Another way of seeing this relationship is to simply examine the next 50 days change in volatility and see if it increased or decreased based simply on the value of volatility at the onset of the observation. As you can see in the following table, high levels of volatility typically result in lower levels of volatility in the future.

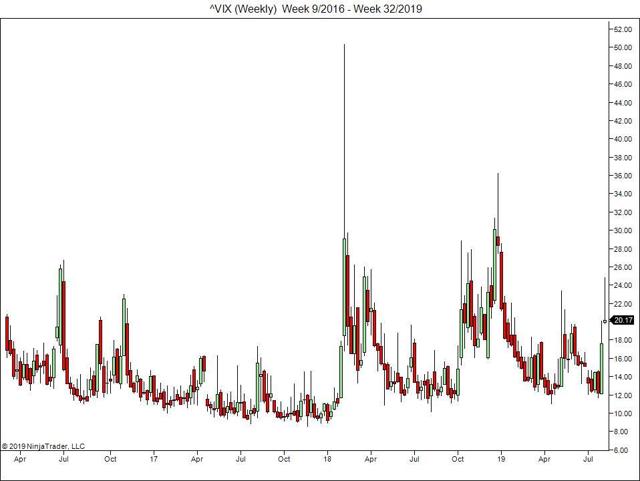

In the case of immediate volatility, I believe that mean reversion will kick in very soon in the VIX which means that the front month VIX futures will drop and the market will shift into contango once again. Indeed, I believe we are seeing this right now in the market data as seen in the following chart.

VIX increased strongly over the last week, however, this week has seen it attempt fresh highs but falter and pull back substantially. In other words, the peak in VIX for this specific movement could be in based on volatility beginning to contract at heightened levels.

There are a few other general statistics which suggest that the odds favor shorting volatility and these revolve around how large the movement in VIX actually was. For example, last week saw an increase in VIX by 5.45 points. Over the last 5 years, we’ve only seen a weekly increase in the value of VIX by this amount or more 16 times. Of those 16 times, VIX was lower 81% of the time one month later. In other words, since we had a strong pop, we are likely to see an immediate drop. Since VIXY is rolling a long position, this is highly bearish its shares since not only will roll yield likely move negative once again but also shares will likely drop in value.

Conclusion

Since VIXY is rolling a long position in a market largely caught in contango, roll yield is almost always negative for the instrument. However, recent volatility has entered the market which has switched this relationship into backwardation as well as increased the value of the futures contracts which VIXY tracks. Volatility has recently surged and market statistics strongly suggest that it will fall as a result. This makes shorting VIXY (or buying put options to cap the downside) a good trade at this point in the volatility cycle.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News