[ad_1]

ThitareeSarmkasat/iStock via Getty Images

Dividends are one of the best options for passive income. They don’t require any creativity on the part of the shareholder. This differs from the passive income that comes from royalties that arise from writing a song or a book. There’s no real work other than putting money to work from a job. Unless you’re investing in REITs, holding real estate for passive income can actually come with quite a bit of work before you have enough income to outsource much of the work.

Once you buy a diversified collection of stocks or a fund, dividends will continue to flow your way, hopefully indefinitely. However, like other options for cash flow, dividends can lose some of their purchasing power if they don’t constantly grow to keep up with the rate of inflation. Many people decide to purchase dividend growth stocks as a result. These stocks have a history of growing their dividends, usually at a rate that exceeds inflation. If you’re looking to find a fund that’s invested in stocks that pay growing dividends, Vanguard’s Dividend Appreciation ETF (NYSEARCA:VIG) might catch your eye. However, this might not be the best time to enter a position with VIG.

VIG And Dividend Growth

This fund holds only dividend payers. Vanguard summarizes the fund, which had its inception in April 2006, by noting that it seeks to track the S&P’s Dividend Growers Index. It primarily looks at large-cap stocks that have a history of dividend increases. The top 10 holdings in VIG include some with decent dividends, like Coca-Cola (KO) and Johnson & Johnson (JNJ). These stocks yield 2.48% and 2.79% as of June 24, 2022, respectively. Also, both of these stocks have grown their dividends for 60 straight years. There’s no doubt that investors in KO and JNJ have been well-compensated over time.

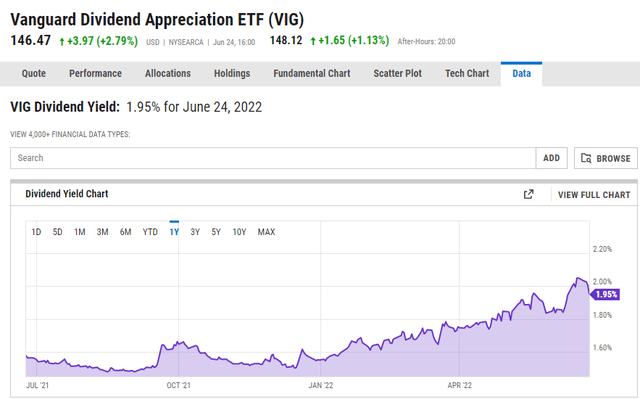

However, VIG also has some stocks that have very low dividend yields in the top 10 holdings. Microsoft (MSFT) has a dividend yield of 0.93% and Visa (V) has a current yield of 0.73%. These dividends tend to grow more rapidly than stocks like Coca-Cola and Johnson & Johnson, even though their yield appears paltry at the moment. Overall, VIG has a current yield of 1.95%. However, this has elevated because of the recent drop in the stock market, which has caused a corresponding drop in the price of VIG.

Current yield for VIG (YCharts)

According to YCharts, the yield of VIG has been as low as 1.48% in the past year.

Growth History For VIG

The Vanguard Dividend Appreciation ETF has indeed shown solid growth over the past several years. As of the end of last year, the fund had seen a compounded annual growth rate of the dividend of 8.54% over the past 10 years. Since its first full year of existence, the CAGR of the dividend has been 8.28%. This is definitely healthy dividend growth. However, for a fund that promises dividend appreciation, it is not as impressive as it might seem.

Vanguard also offers a High Dividend Yield ETF (VYM). This fund holds some of the same stocks as VIG. For example, companies like JNJ, JPMorgan Chase (JPM), and Procter & Gamble (PG) show up on the top 10 lists of both VIG and VYM. However, this fund attempts to get a higher yield, which it does. Its current yield is 3.10%. Over the past ten years, VYM has had a yield that’s generally been between 1% and 2% higher than VIG’s. Additionally, the 10-year dividend CAGR is 8.84% for the higher dividend ETF. This is actually higher than the Dividend Appreciation ETF, although the CAGR when tracked to the inception of the fund has only 6.07%, which is a little more than 2% less than VIG’s dividend growth rate. However, it’s interesting that a dividend growth fund has a lower growth rate than a high yield fund over the past decade.

Both funds come with a low 0.06% management fee, so this is a negligible cost for investors for both options. When it comes to volatility, VYM has a more stable price. Over the past 52 weeks, there is only a 15.86% difference between the high and low price in VYM. This is compared with a 24.21% difference in the high and low for VIG. Both have bounced slightly above the recent lows.

Inflation

Inflation is currently running at more than 8% on a year-over year basis. Therefore, investments will have to return more dividend growth to maintain purchasing power. In the past several years, inflation held generally between the 2% and 3% range. A dividend increase of 8% or 10% did a good job of increasing the purchasing power of a person’s dividend income. Those who allowed their dividends to compound did an even better job of seeing this growth.

However, when inflation is running 8% and dividend growth is running at 8%, it’s basically a wash in the amount of goods and services your dividend income can buy. There’s also the possibility of a dividend cut in individual companies, and this will get passed down to dividend-focused funds like VIG. In both 2009 and 2013, VIG cut its dividend payment on a year-over-year basis. This is more likely in a recession, and economic growth actually dropped by 1.4% in the first quarter of this year. If this continues for another quarter, the US will technically be in a recession, which is usually defined as two straight quarters of economic contraction.

Recessions frequently come with higher unemployment, which can lead to lower demand for products and services. A recession may or may not lead to lower costs for producers. If there is a period of low economic growth with relatively high inflation, this will likely put pressure on profits as companies try to move inventory, which will likely put pressure on dividend growth (and stock prices) in the short run. If prices start to drop because of lower economic activity, this will also impact dividend growth.

Conclusion

A long-term investment in VIG will likely provide solid returns over the long run. However, those who are looking for dividend growth with a higher starting yield and lower volatility might opt for VYM. These two ETFs have a solid record of dividend growth over the last decade, but the higher yield with a similar growth rate will lead to more income over the long run. Where VIG has done better than VYM is the share appreciation. Both entered the market at $50 a share in 2006, but VIG’s share price is currently $146, whereas VYM’s is $103.

Those looking for higher total growth would likely do better with VIG in the future. Those looking for higher income in the near term might look elsewhere. However, both types of investors are likely to be disappointed in the short run as inflation erodes the power of the dividends to provide a higher level of purchasing power in relation to passive income.

[ad_2]

Source links Google News