[ad_1]

DKosig/iStock via Getty Images

Investment Thesis

The Vanguard FTSE Europe ETF (NYSEARCA:VGK) provides exposure to a basket of European stocks. These countries are generally characterized by high incomes, openness to foreign ownership, ease of capital transfer, and efficiency of the market system. As a result, they are an attractive place to invest, especially when valuations are lower than in other developed markets. However, as previously mentioned in another article on developed markets, I personally believe investing in Europe comes with a unique set of risks, such as a low expected GDP growth rate, elevated inflation, poor demographics, and a high level of both public and corporate leverage which poses a systemic risk for many developed countries.

Strategy Details

The Vanguard FTSE Europe ETF tracks the performance of the FTSE Developed Europe All Cap Index. The fund invests in stocks issued by companies located in the major markets of Europe, such as France, Germany, Switzerland, and the Netherlands.

If you want to learn more about the strategy, please click here.

Portfolio Composition

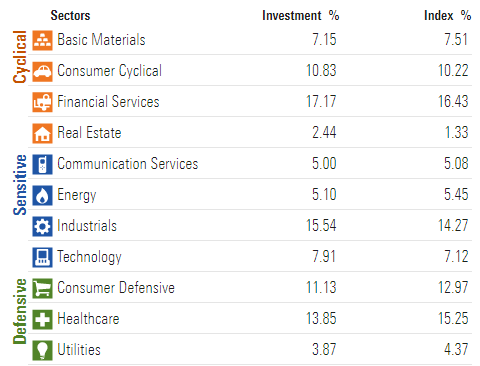

From the sector allocation chart below, we can see the fund places a high weight on the Financial sector (representing ~17%), followed by Industrials (with a ~15% allocation) and Healthcare (consisting of ~14% of total assets). The top three sectors account for ~46.6% of total assets. In my opinion, VGK is well diversified across sectors, which is something you want to have when investing in ETFs.

Morningstar

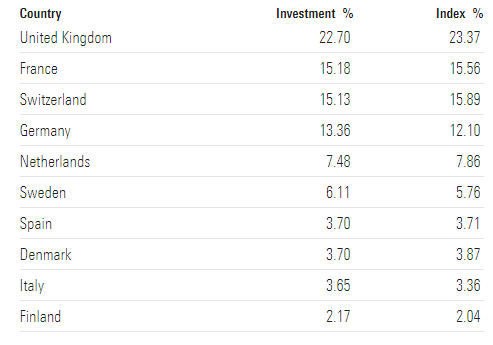

In terms of geographical allocation, the top ten countries represent approximately 93% of the portfolio. The United Kingdom accounts for ~23%, whereas other countries such as Italy seem to be underrepresented given the low weight (only a ~4% allocation to Italy).

Morningstar

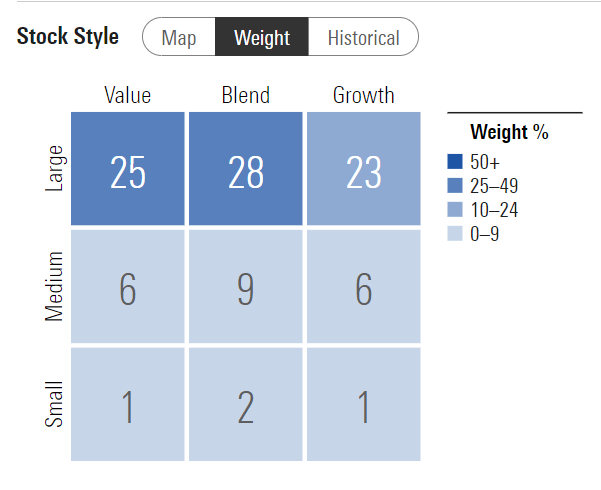

VGK invests over 28% of the funds into large-cap blend issuers, characterized as large-sized companies where neither growth nor value characteristics predominate. Large-cap issuers are generally defined as companies with a market capitalization above $8 billion. The second-largest allocation is large-cap value equities. It is interesting to see that this ETF allocates approximately 76% of the funds to large-cap issuers, which generally have a smaller runway to compound over time than small and mid-cap issuers.

Morningstar

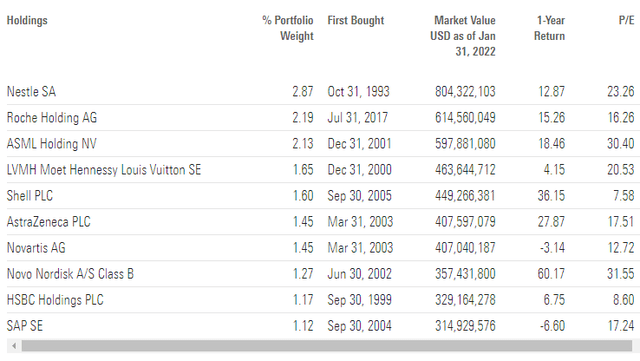

The fund is currently invested in 1,374 different stocks. The top 10 holdings account for ~17% of the portfolio, with no single stock weighting more than ~3%. All in all, I would say that VGK is very well-diversified across constituents.

Morningstar

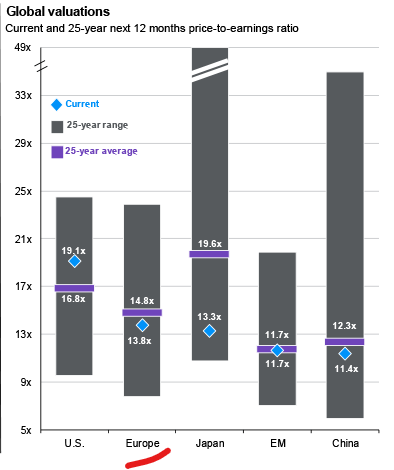

As we are dealing with equities, one important characteristic is the portfolio’s valuation. According to data from Vanguard, VGK currently trades at an average price-to-book ratio of 1.9 and an average price-to-earnings ratio of 13.6. In addition to that, the portfolio has a return on equity of ~13%. This makes VGK cheaper than a plain vanilla S&P 500 ETF. Moreover, European equities currently trade below the 25-year average valuation and towards the lower end of the 25-year range.

Guide to the markets JPM

Is This ETF Right for Me?

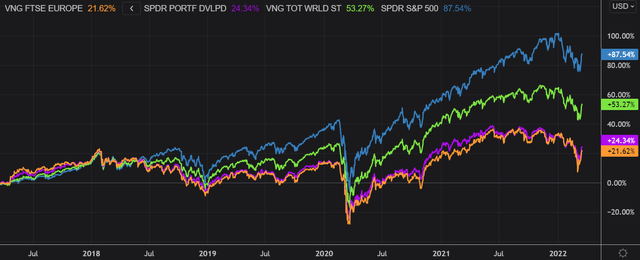

I have compared below VGK’s price performance against the performance of the SPDR Portfolio Developed World ex-US ETF (SPDW), the Vanguard Total World Stock ETF (VT), and the SPDR S&P 500 Trust ETF (SPY) over the last 5 years to assess which one was a better investment. Over that period, VT clearly outperformed SPDW and VGK thanks to the strong performance of the US equity market. However, it is interesting to see that all strategies delivered similar returns up until Q4 2018 when the performance spread started to widen and SPY really started to outperform other markets. To put VGK’s performance into perspective, a $100 investment 5 years ago into this ETF would now be worth ~$121.62. This represents a compound annual growth rate of ~4% excluding dividends, which is a mediocre absolute return.

Refinitiv Eikon

If we take a step back and look at the performance from a 10-year perspective, the results don’t change much. Both SPY and VT came on top once again, outperforming VGK since early 2014. In my opinion, VGK’s past performance accurately reflects the state of the majority of European economies. The limited GDP growth rate coupled with, poor demographic trends, high government spending, and in many cases, a negative trade balance, clearly impeded growth prospects in the past. Going forward, I don’t see any clear catalyst that will accelerate economic growth and drive European equity markets higher. On top of that, I believe there are some developed economies-specific risks that are currently overlooked by the markets. The Eurozone debt crisis back in 2010 is an example of such risk.

Refinitiv Eikon

Key Takeaways

VGK provides exposure to a basket of European equities. The fund is well-diversified both across sectors and issuers. It can therefore be used as part of a broader portfolio strategy to get targeted exposure to European economies. In terms of valuation, VGK is cheaper than a plain vanilla S&P 500 ETF at the moment but comes with a set of unique risks associated with the European market. I personally see low GDP growth rate, elevated inflation, and high public and corporate leverage as serious threats for many European countries in the upcoming years.

[ad_2]

Source links Google News