[ad_1]

The Vanguard FTSE Developed Markets ETF (VEA) is one of the best ETFs available for gaining exposure to the developed market. It’s among the cheapest and also tracks an index that features the largest breadth compared to the other major competing funds.

Vanguard FTSE Developed Markets ETF

VEA tracks the FTSE Developed All Cap ex US Index and has an expense ratio of .05%. Other major developed markets ex-US ETF funds include the Schwab International Equity ETF (SCHF), iShares Core MSCI EAFE ETF (IEFA), iShares MSCI EAFE ETF (EFA), and the SPDR Portfolio Developed World ex-US ETF (SPDW). As we said in the intro, the fund has the largest breadth with almost 4,000 holdings, and at the same time is among the cheapest.

|

Ticker |

Index |

Num. of Holdings |

Expense Ratio |

|

VEA |

FTSE Developed All Cap ex US Index. |

3954 |

.05% |

|

SCHF |

FTSE Developed ex US Index |

1508 |

.06% |

|

IEFA |

MSCI EAFE IMI Index |

2478 |

.08% |

|

EFA |

MSCI EAFE Index |

928 |

.31% |

|

SPDW |

S&P Developed Ex-U.S. BMI Index |

1832 |

.04% |

(Source: Fund websites)

The only ETF that sticks out like a sore thumb is EFA due to its .31% expense ratio. Besides that fund, the rest are very similar. All the remaining funds give investors pretty broad exposure with at least 1,500 individual holdings, and the expense ratios only vary by 4 basis points. Although all track slightly different indices, the funds end up looking similar. Indeed the top three country weightings for the funds are very close. Japan ranges from 21.6% to 24.6%, United Kingdom from 15.2% to 16.9%, and France from 8.6% to 11.1% (in some funds, Canada is number three and France number four). We don’t really have a strong opinion on whether tilting a few percent towards or away from one country is good or bad over the long term. We suspect investors are probably just best off picking whatever fund works for them among the four. We’d say pick the cheapest, but given the ongoing ETF fee wars, we aren’t sure that the fund that’s the cheapest today will be the one that’s the cheapest a year or five or ten from now.

Hedging Foreign Currency Exchange Rates?

What is worth examining in depth and caring about is the issue of currency hedging. There is another developed market ex-US fund available, the iShares Currency Hedged MSCI EAFE ETF (HEFA), which attempts to hedge against foreign currency fluctuations for US dollar based investors. The fund carries an expense ratio of .34%, and its holdings comprise the EFA index fund along with a variety of currency hedges.

So, is currency hedging worth it? Most of the research we’ve seen shows that over the long term, hedging foreign currency for large diversified equity fund investors is not worth it. It’s debatable whether or not it enhances returns. Most research we’ve read seems to point to foreign currency fluctuations basically canceling each other out over the long term. Unhedged funds may be more volatile, but returns are not impacted over the long term. However, what we can say for sure is that hedging definitely adds extra costs.

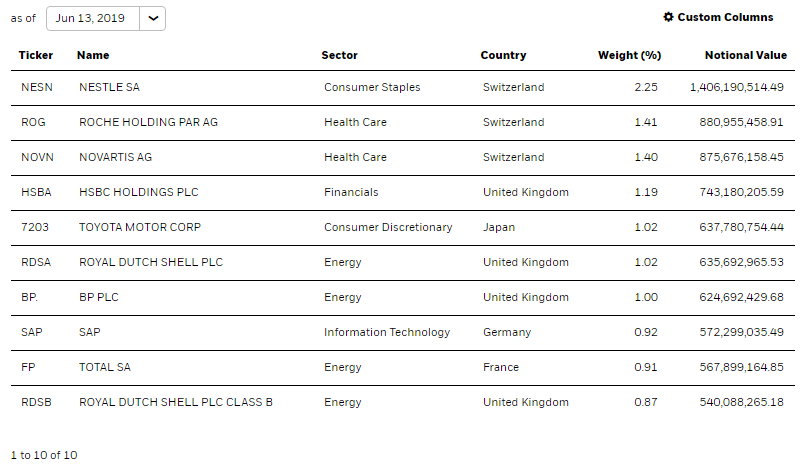

The other big issue we see with currency hedging is that it’s value may be questionable considering many of the multinationals that make up the top holdings of the funds already hedge currency exposure.

(Graphic source: Fund website)

We looked at three of the fund’s top holdings – Nestle (OTCPK:NSRGY), Novartis (NYSE:NVS), and Royal Dutch Shell (NYSE:RDS.A) (NYSE:RDS.B) – and all three companies hedged at least some of their foreign currency exposure. (Note: We choose these three since we have prior experience with investments in them).

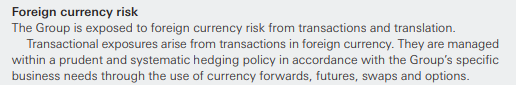

Here’s what Nestle said in its latest annual report:

(Source: Nestle annual financial statement)

Novartis also discloses substantial currency hedging operations in its 20-F:

“The Group manages its global currency exposure by engaging in hedging transactions where management deems appropriate, after taking into account the natural hedging afforded by our global business activity. For 2018, we entered into various contracts that change in value with movements in foreign exchange rates to preserve the value of assets, commitments and expected transactions. We use forward contracts and foreign currency options to hedge.”

Likewise, Royal Dutch Shell (RDS.A) (RDS.B) does as well. From its 20-F:

“While we undertake some foreign exchange and commodity hedging, we do not do so for all our activities. Furthermore, even where hedging is in place, it may not function as expected.”

This begs the question of whether or not it’s even possible to hedge foreign currency fluctuations effectively at the fund level. There’s no easy, cost effective way to calculate how each of the almost 1,000 stocks in the index are all hedging their currency exposure and then put on another set of hedges on top of that. We think investors are better off just choosing a cheaper unhedged fund. Foreign currency hedging may or may not improve returns over any given time period. Given the complexities, it is unlikely to function as much of a hedge. Instead, it probably acts as more of a bet on the direction of the dollar.

Summary

Given the similarities of the four major developed markets ex-US funds both in terms of holdings and expenses, we don’t think there is a clear winner. While SPDW may be the cheapest now, the ETF index fee wars mean it may not be in the future. The Vanguard fund (or any of the others) is a fine investment. What we can say for sure is that the utility of attempting to hedge foreign currency fluctuations does not appear to be very effective in either efficacy or cost.

Disclosure: I am/we are long VEA, SCHF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News