[ad_1]

Vanguard’s Long-Term Corporate Bond ETF (VCLT) is a passive portfolio of investment-grade corporate bonds and seeks to track the Bloomberg Barclays US 10+ Year Corporate Bond Index. VCLT represents the cheapest way to get broad exposure to the long-term investment-grade corporate bond market, but there are strong reasons why income investors should hedge their exposure to VCLT.

VCLT’s characteristics

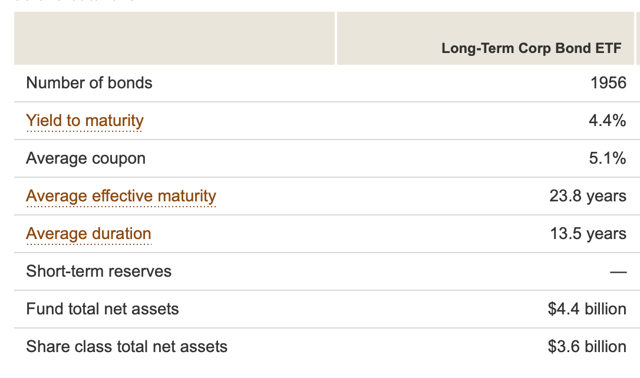

Since VCLT is a portfolio of long-term bonds, the fund has significant exposure to interest rate changes. It obtains its 4.4% yield to maturity by having an average effective maturity of 23.8 years and an average duration of 13.5 years. Duration is an approximate measure of a bond’s sensitivity to changes in interest rates.

(Source: Vanguard)

As a result of this interest rate risk and the recent decline in interest rates, VCLT declined in 2018 and has appreciated considerably during 2019. VCLT is up about nine percent within the last five months but declined around 13% in the first 11 months of 2018. This volatility is due to VCLT’s significant duration.

With interest rates being so low again, there is a risk that they may correct and return to rising, but there is a near equal probability that they will continue to decline due to a slowing global economy. There are reasons why the US dollar denominated debt is likely to perform well in the current global economy, including both US Treasuries and corporate paper. Negative interest rates for sovereign paper with similar credit quality, such as Germany and Japan, and weakness across most emerging market currencies make US denominated paper from investment-grade sources attractive.

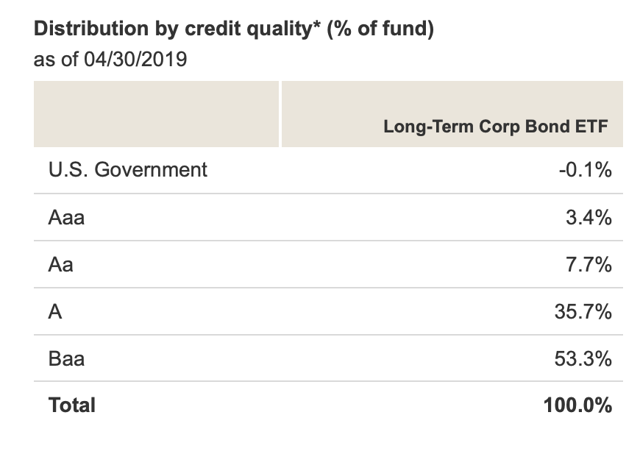

VCLT’s portfolio is made of almost 2000 holdings of various credit quality. VCLT endeavors to hold investment-grade bonds, but the spectrum of what is considered investment-grade is broad. VCLT presently primarily holds bonds in what is considered the upper medium and lower medium grades of investment-grade, as opposed to the higher tiers of prime and high grade.

(Source: Vanguard)

The above distribution by credit quality is not because the fund is seeking out lower quality bonds to juice the payout but rather largely because the investment-grade universe has become overwhelmed with medium-grade issuances. This has pushed VCLT’s average credit quality to the BBB range, which is risky for a total portfolio.

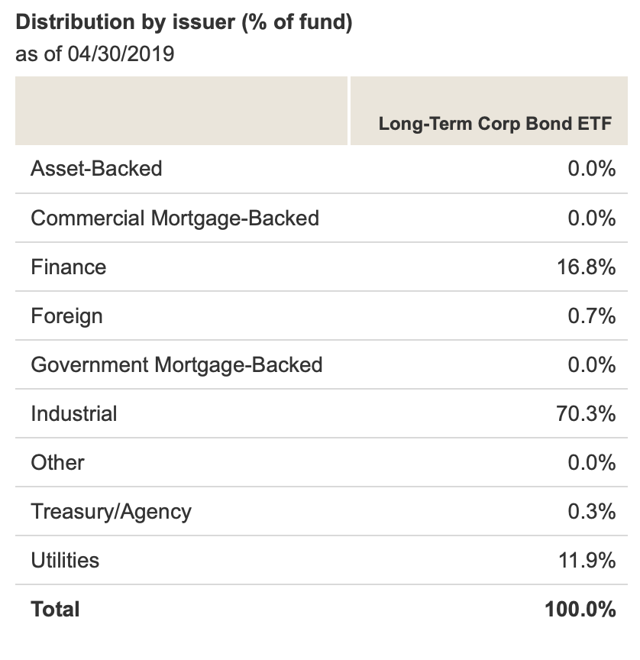

VCLT is also concentrated by sector type and into certain issuers. VCLT is primarily composed of bonds from industrial, financial, and utility issuers. Much of VCLT’s concentration is due to the underlying characteristics of the aggregate index, but the fund’s advisor also generally selects a representative sample of securities to approximate the full target index in terms of key risk factors and other characteristics, such as duration, cash flow, quality, and callability.

(Source: Vanguard)

Nonetheless, VCLT tries to keep sector and subsector exposure within tight boundaries relative to the target index. Because the fund does not hold all issues in its target index, some of the issues and issuers will be overweighted or underweighted compared to the target index.

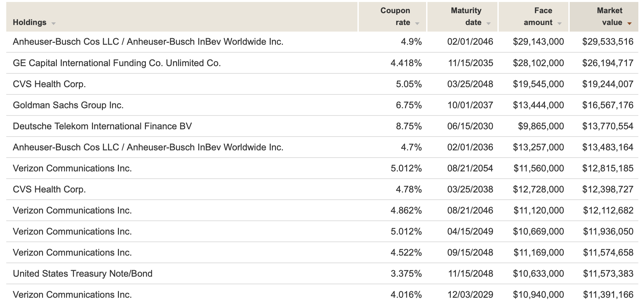

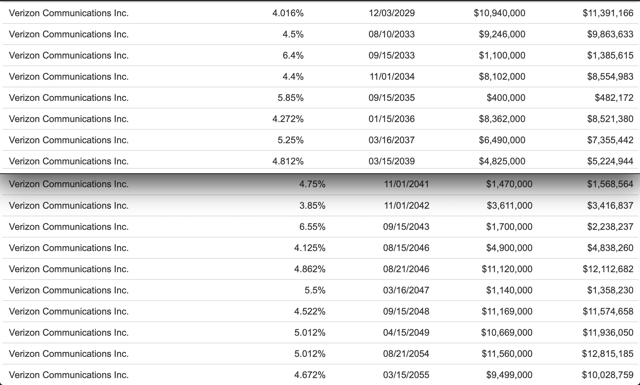

This concentration at the issuer level is starting to creep up as a risk: an issuer issue. These concentration problems are not easy to see because many of the largest issuers have multiple issues and the concentration will not necessarily pop up in a single issue. For example, if we look at the top holdings of VCLT, we see that Anheuser-Busch InBev (BUD) makes up holdings 1 and 6, and Verizon (VZ) makes up holdings 7, 9, 10, 11, and 13.

(Source: Vanguard)

There are actually 18 different Verizon bonds within the portfolio, maturities between 2029 and 2055, and these combine to be worth nearly as much as the listed top 5 holdings.

(Source: Vanguard)

There were also 18 Anheuser-Busch InBev issuances in VCLT when it last reported holdings and well over 20 AT&T bonds, but the total face value of Verizon bonds was greater (roughly 2.5% compared to 2%). Changes to the credit rating of such significant issuers could cause for more dramatic changes to the index in an effort to maintain average credit quality.

VCLT’s performance

VCLT declined about 13% in 2018 and has appreciated around 9% since the start of 2019. These are both significant moves for a portfolio of investment-grade bonds but rates have been volatile. This volatility could continue and in either direction.

VCLT has moved like this before. It is actually becoming a somewhat recurring condition. See the ten-year chart below:

(Source: Yahoo! Finance; Arrows by Zvi Bar)

If we look at the five-year chart, we see that upon prior instances of strength to current levels, VCLT generally continued to appreciate. That is, where VCLT has previously appreciated to the low 90s, it tends to go to the mid 90s within the next few quarters.

(Source: Yahoo! Finance; Bar by Zvi Bar)

This may indicate that VCLT’s recent strength is likely to continue this time too. Further, it appears that continued strength may last for between two and four quarters.

There are strong reasons why long-term US dollar bonds may continue to perform well, including a growing demand for dollar income and concerns about global growth. Another often overlooked manner in which long-term bondholders can profit is through roll down return. Essentially, if interest rates remain depressed for an extended period of time, there is a strong potential for bonds to be sold at a premium as they roll down the yield curve. VCLT’s portfolio cleans itself of paper as in falls from long-term into intermediate and those sales should result in appreciation in instances where interest rates have not substantially changed or have declined.

Conclusion

VCLT offers investors cheap access to a broad index of long-term investment-grade bonds and a sizable income stream compared to comparable dated treasuries. VCLT has performed exceedingly well so far in 2019 due to declining interest rates and a strain US dollar. Prior instances of such strength were usually followed by continued strength into the mid 90s, and that history indicates this current appreciation may not be over.

VCLT brings with it considerable duration risk and the investment-grade ratings have the potential of being inundated with downgrades due to leverage rates and other factors affecting individual businesses as well as global growth. VCLT’s holdings are also in danger of becoming overly concentrated in issuances by major issuers within the investment-grade market. VCLT’s duration risk may be mitigated by combining it with low duration income instruments or interest rate hedges.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News