[ad_1]

wsmahar

(This article was co-produced with Hoya Capital Real Estate)

Introduction

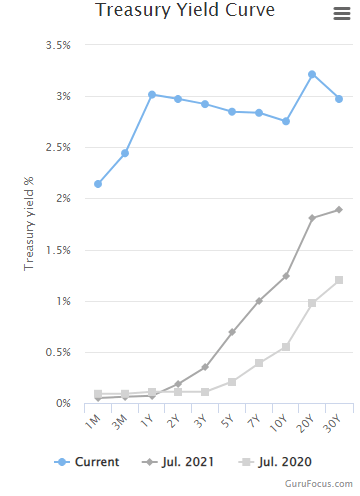

Will the Federal Reserve break the back of inflation, running at 40-year highs, by causing a recession, either mild or deeper? That unknown has some investors, when looking for Fixed Income investments, avoiding leveraged CEFs or funds that invest in “junk”. With the Fed tightening, the UST Yield Curve has risen across the board from this time one and two years ago.

gurufocus.com/yield_curve.php

This article reviews both the Vanguard Intermediate-Term Treasury ETF (NASDAQ:VGIT) and the Vanguard Long-Term Treasury ETF (NASDAQ:VGLT). Vanguard offers at least one more, the Vanguard Short-Term Treasury ETF (VGSH), which was recently reviewed by others.

Exploring the Vanguard Intermediate-Term Treasury ETF

Seeking Alpha describes this ETF as:

The investment seeks to track the performance of a market-weighted Treasury index with an intermediate-term dollar-weighted average maturity. The fund employs an indexing investment approach designed to track the performance of the Bloomberg U.S. Treasury 3-10 Year Index. This index includes fixed income securities issued by the U.S. Treasury (not including inflation-protected bonds, floating rate securities and certain other security types), with maturities between 3 and 10 years. VGIT started in 2009.

Source: seekingalpha.com VGIT

VGIT has $8.6b in assets and currently yield 1.86%. Vanguard charges just 4bps in fees. Vanguard states VGIT seeks to provide a moderate and sustainable level of current income by investing primarily in U.S. Treasury bonds, exposing investors to moderate interest rate risk, with a WAM between 5 to 10 years.

VGIT holdings review

The current portfolio holds 111 bonds with an WAM of 5.6 years and duration of 5.3 years; at the lower end of the targeted WAM. The portfolio has an average coupon of 1.6% and YTM of 3.1%, with 46% of the portfolio maturing within five years, the rest before ten years.

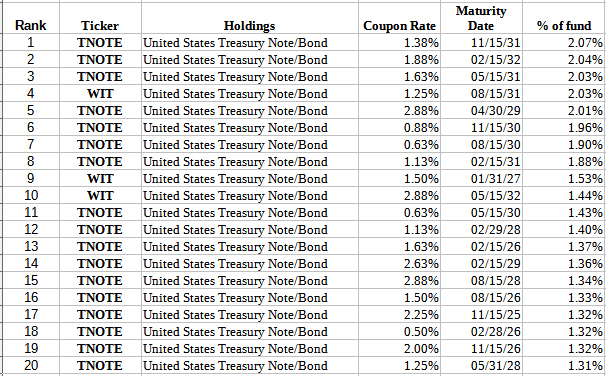

Top 20 positions

Vanguard.com; compiled by Author

The Top 10 equate to just under 19% of the portfolio, the Top 20 close to 32%. Being all UST issues, each is rated AAA. Glancing through the complete portfolio did not show any bonds maturing before 2024, making it harder to take advantage of how much the yield curve has risen and expectations for more as the Fed continues to raise the Federal Funds Rate.

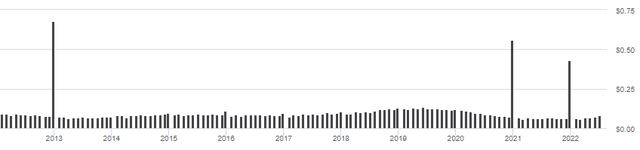

VGIT distribution review

seekingalpha.com VGIT DVDs

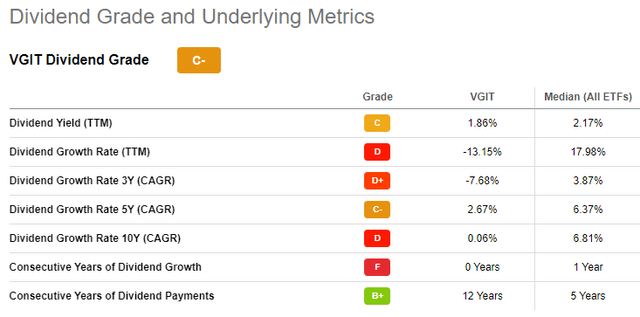

So while the monthly payout has risen, it is still below the peak reached before COVID arrived. That reveals how tough it might be for this ETF to capture the yields presented in the current yield curve. Seeking Alpha gives VGIT an overall “C-” for its dividend history.

seekingalpha.com VGIT DVD scorecard

Exploring the Vanguard Long-Term Treasury ETF

Seeking Alpha describes this ETF as:

The investment seeks to track the performance of a market-weighted Treasury index with a long-term dollar-weighted average maturity. The fund employs an indexing investment approach designed to track the performance of the Bloomberg U.S. Long Treasury Index. This index includes fixed income securities issued by the U.S. Treasury (not including inflation-protected bonds, floating rate securities and certain other security types), with maturities greater than 10 years. VGLT started in 2009.

Source: seekingalpha.com/ VGLT

VGLT has $1.4b in assets with a 2.3% yield. Like for the other ETF, Vanguard charges 4bps. Vanguard says this ETF is for investors seeking a high and sustainable level of current income, primarily in U.S. Treasury bonds, with a WAM of 10 to 25 years.

VGLT holdings review

The current portfolio holds 68 bonds with an WAM of 23.5 years and duration of 16.9 years. The portfolio has an average coupon of 2.6% and YTM of 3.3%. It maturity allocation is as follows:

Vanguard.com

As a bond’s maturity falls below 10 years, it is sold and most likely replaced with the newest long-dated UST bond. With only 1.3% becoming ineligible over the next 1-5 years, AUM growth will be the biggest source of funds to take advantage of rising interest rates.

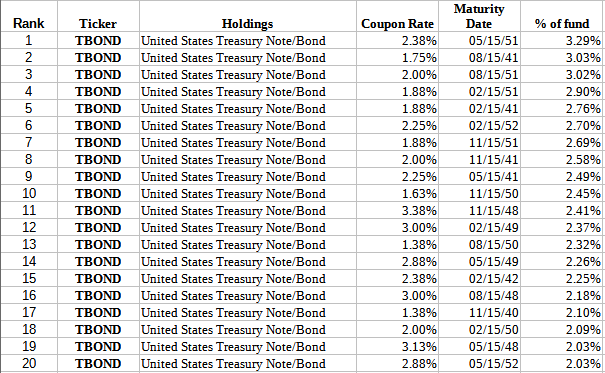

Top 20 positions

Vanguarrd.com; compiled by Author

The Top 10 equate to just under 28% of the portfolio, the Top 20 close to 50%. Again, being all UST issues, each is rated AAA.

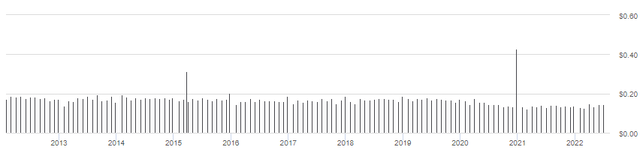

VGLT distribution review

seekingalpha.com VGLT DVDs

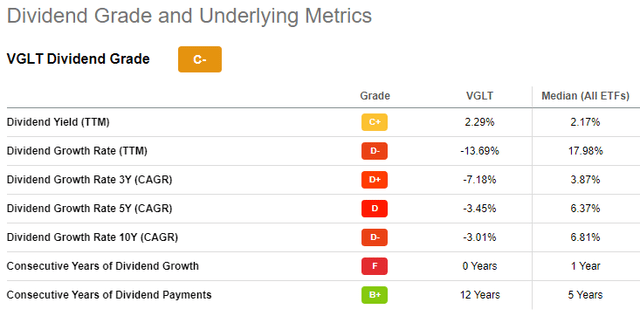

VGLT shows a similar payout pattern with VGIT, only at a higher rate as the longer maturity bonds have higher coupons. With the today’s flatter yield curve, that differential could/should shrink. VGLT also earns just “C-” from Seeking Alpha for its payout history.

seekingalpha.com VGLT DVD scorecard

Portfolio strategy

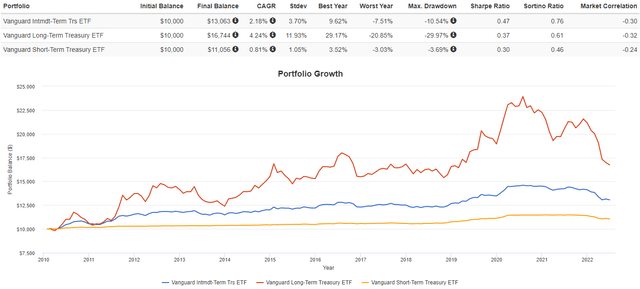

While there are investors who are 100% in equities, they probably aren’t reading this article. For the rest of us, first there is the decision of how much to allocate to fixed income assets. Next comes the strategy calls related to interest rate risk (duration decision) and credit risk (ratings decision). Here I will look at both of those decisions, first at the duration choice, using both ETFs covered here, plus the VGST mentioned earlier, which has the shortest duration.

PortfolioVisualizer.com

The above chart illustrates the duration effect well. Before the recent uptick in rates, VGLT, with the longest duration was the best in terms of return, followed by VGIT. Since the start of 2021, that has been completely reversed. The length of each ETF’s duration, is also reflected in each ETF’s StdDev, with shorter equaling less price movement. Combining both return and risk data points to VGIT being the best choice. Of note for portfolio risk, all three are negatively correlated to US stocks.

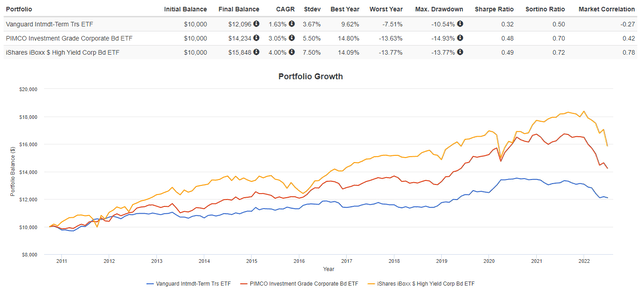

Now I will compare the VGIT ETF against ETFs that invest in investment-grade corporates, the PIMCO Investment Grade Corporate Bond Index (CORP) and the iShares iBoxx $ High Yield Corporate Bond ETF (HYG). The durations match up better than using VGLT, all in the 5-10 range.

PortfolioVisualizer.com

As one might expect when rates are level to declining and the economy is strong, going down the credit ratings scale paid off which HYG providing the highest return, followed by CORP. Even with the higher StdDev, that order held when calculating both the risk ratios. Since 2021, the order is in reverse but not as consistently as the first chart. Of note is only VGIT is negatively correlated to stocks, with HYG following stocks at a 78% rate.

Final thoughts

Taking this all into consideration, here is my analysis. How this fits into an investor’s portfolio depends on their short and long term goals and what assets they currently hold.

- Safety-minded investors would lean toward VGST or VGIT. Both would dampen the volatility better than the other ETFs presented.

- Yield-seekers would prefer HYG, but a shorter duration HY ETF like the SPDR Bloomberg Short Term High Yield Bond ETF (SJNK) is worth a look.

- Investors looking for assets that zig when stocks zag, would prefer the UST ETFs over the corporate ETFs mentioned. There, both VGIT and VGLT are about the same.

[ad_2]

Source links Google News