[ad_1]

Over the last 24 hours, shares of the United States 3x Oil Fund (USOU) have rallied an astounding 34% on news regarding the attacks on oil infrastructure in Saudi Arabia. In this piece, I will make the case that this rally will likely see further upside. In other words, if you’re looking for the aggressive long trade in crude oil, USOU is a great buy at this time.

The Instrument

Let’s start with a walkthrough of what exactly USOU is. Put simply, USOU is USCF Investments’ amped up version of its ever-so-popular USO ETF. USOU is simply just a three times leveraged return application of USO’s methodology. USOU holds three times the futures contracts as the underlying capital and rolls following the same methodology as USO.

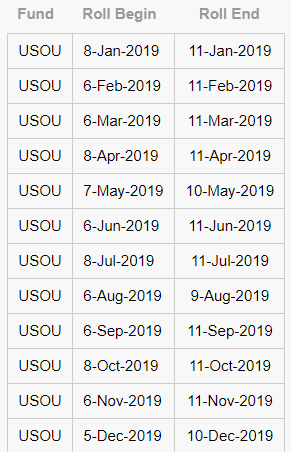

The methodology of USOU is pretty straightforward in the oil ETF and ETN space: it keeps a constant exposure in the front month contract of WTI futures and then in a specific window (around two weeks before expiry), it rolls exposure to the next futures contract. The roll dates can be seen in the table below.

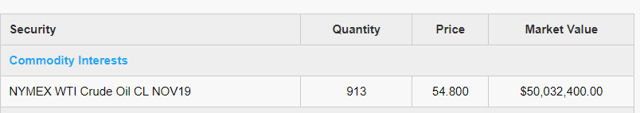

At present, we are past the roll date for the month of September which means that the contracts held in USOU’s name are all in the second month out: November. At present, USOU is holding $50 million in futures contracts as can be seen in its table of holdings.

If you’re familiar with USO, then you already know the drill for USOU since it follows the same rolling methodology. That is, roll yield is now heavily in play.

If you’re unfamiliar with roll yield, it is the gain or loss that arises from holding exposure outside of the front month contract in a futures or forward curve. Roll yield arises due to the tendency in financial markets for contracts held in later months to trade towards the front month curve as time progresses.

In a backwardated market (front contract above the back month contracts), roll yield on a long position is positive because the long contracts held at the back of the curve will tend to trade up in value as time progresses. In a contango market (front contract under back month contracts), roll yield will be negative because the long contracts held will trade down in value in relation to the front of the curve as time progresses.

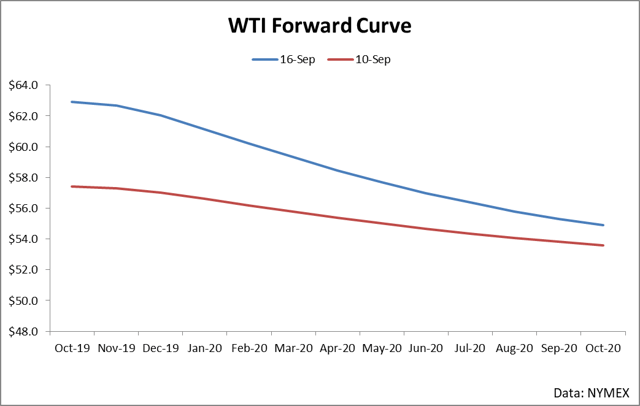

The current structure of the market is such that roll yield for almost anything related to WTI is strongly positive – especially after the attacks on the Saudi facility this week. Here is the current structure of WTI futures using the latest quotes from the CME.

As you can see, there has been a substantial movement upwards in price over the last week as well as a push further into backwardation. At present, the market is 23 cents per barrel backwardated in the front of the curve which means that roll yield is strongly positive for shares of USOU. As time progresses, shares of USOU will likely see positive appreciation due to the underlying strong roll in WTI futures.

This said, in the short run, there are substantial catalysts which are strongly impacting price and will continue to impact price as time progresses. Let’s talk about these in the next section.

Price Catalysts

If you’ve listened to the news over the last few days, you are likely aware that a key Saudi export facility was targeted in an attack. The significance of this export facility is quite large in that the attack is estimated to have brought offline something in the territory of 5 million barrels per day of export capacity, which represents around 5% of global demand for crude oil.

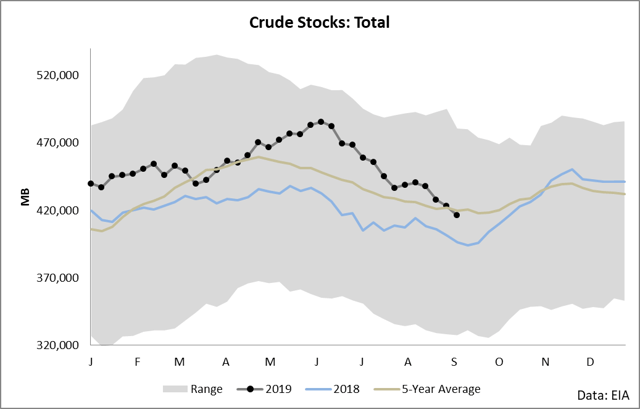

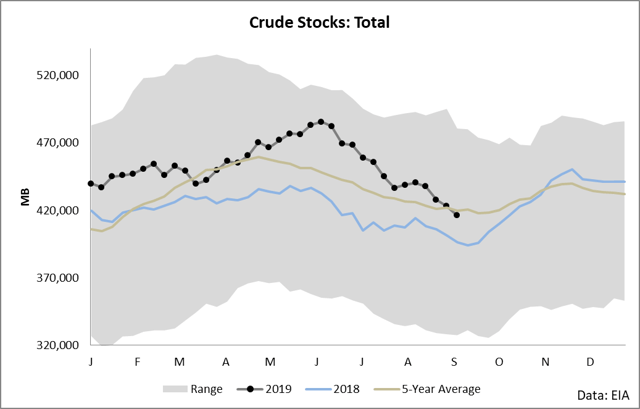

To understand why this would cause such a strong price impact, we need to look no further than United States crude fundamental data. Specifically, this attack comes on the heels of several months of strong inventory draws and progressively tightening stocks as seen through a 5-year range of inventories.

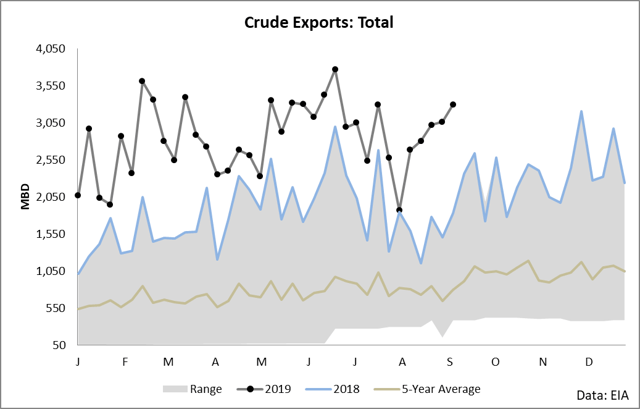

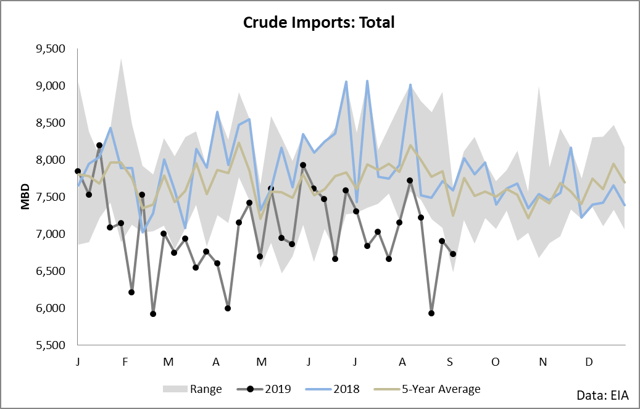

Within the last week, crude inventories have fallen below the 5-year average which is strongly indicative of bullish fundamental pressure on crude markets. This pressure has come because exports have been strong and imports have been weak.

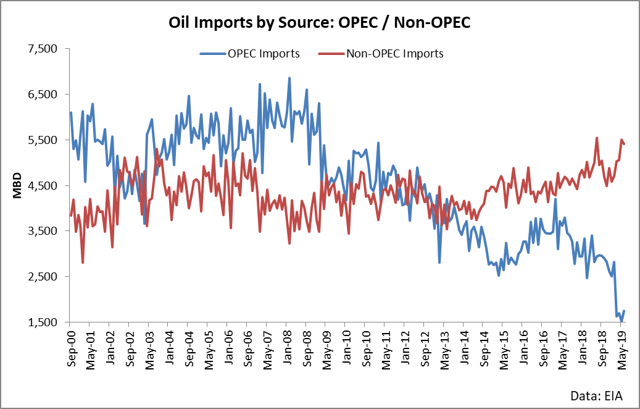

The reason why imports have been weak is that at the beginning of this year, OPEC’s cuts took effect and at the middle of this year, OPEC extended its cuts through March of 2020. The impact of these cuts upon U.S. imports can be easily seen by a breakdown of where barrels are being sourced. OPEC has been progressively bringing fewer barrels into the United States this year, bringing levels to some of the lowest seen in decades.

This tighten inventory environment sets the stage for exactly why this attack on Saudi Arabia is so critical. Inventories in the United States have been tightening due to cuts from OPEC and this attack on an OPEC nation has effectively wiped out the capability of Saudi to continue delivering the volume which it was formerly delivering. It is unknown how long it will take for this capacity to come back online, but as long as it remains offline, the inventory situation in the United States will continue to tighten and prices are potentially going to increase by several dollars per barrel.

If you are looking for an aggressive and straightforward ETF to capture the trade in crude, USOU makes for an excellent instrument at this time. Roll yield is strongly positive and the leveraged return of the instrument means that the effects of roll will be multiplied by a factor of three. Crude inventories were vulnerable coming into the Saudi attack and the situation is even more critical now. It really makes sense to buy USOU.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News