[ad_1]

jetcityimage/iStock via Getty Images

Investment Thesis

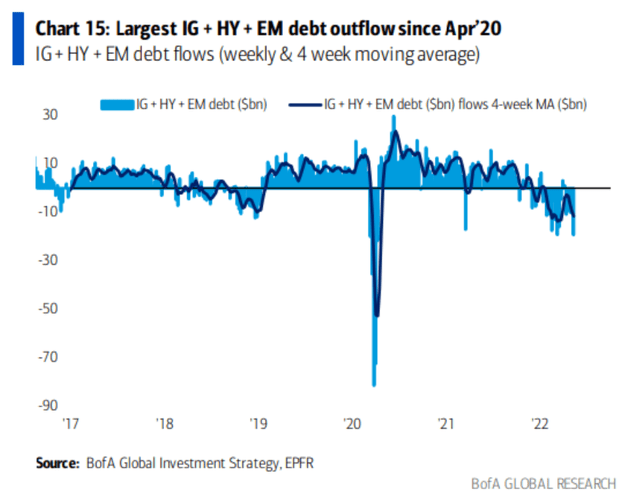

Bonds funds around the world have had a tough start to the year, registering one of the largest outflows of the last five years. High-yield (“HY”) bonds have performed poorly in the face of high inflation, and yields have now reached what is considered by many market participants to be an attractive level.

While inflation expectations have come down in recent weeks, there is still uncertainty about how far the Fed will go in its tightening cycle and how sticky inflation is likely to be. At this point, I believe HY bonds can be hit by a second whammy in the form of a recession. This could have far worse consequences for junk bonds, especially if the Fed can’t come to the rescue and liquidity dries up. Despite the attractive yield, I think it is better to stay away from HY bonds for the moment, as risks outweigh rewards.

Strategy Details

The iShares Broad USD High Yield Corporate Bond ETF (BATS:USHY) tracks the performance of the ICE BofAML US High Yield Constrained Index. The fund invests in a basket of USD-denominated high yield corporate bonds.

If you want to learn more about this strategy, please click here.

Portfolio Characteristics

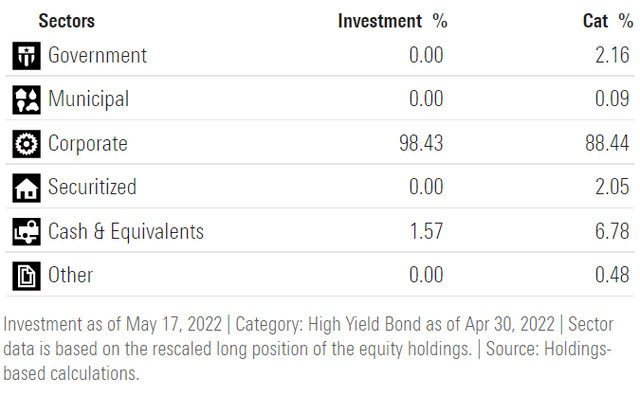

Unsurprisingly, over 98% of funds are invested in corporate bonds, with the remaining amount in cash. Corporate bonds are generally seen as riskier than government bonds, since governments can always print more money in order to service their debt.

Morningstar

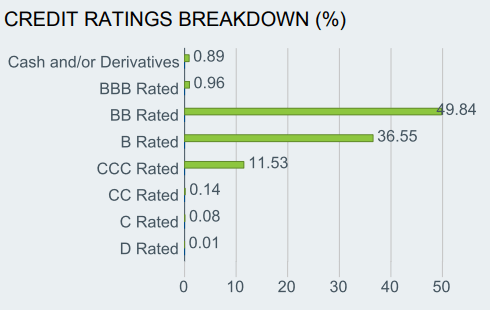

~50% of issuers are rated BB, which is a credit rating just below investment grade. This is considered a speculative rating, and it is generally assigned to companies facing financial uncertainties and/or which are vulnerable to adverse economic conditions. 48% of assets are rated B and below. These securities carry high default risk. Finally, less than 1% is assigned to BBB-rated bonds, which is in line with the strategy’s goal of investing primarily in corporate junk bonds.

iShares

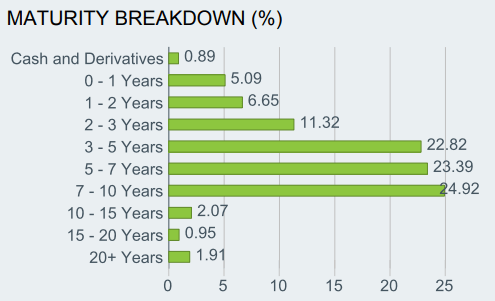

According to Morningstar, the portfolio’s average maturity stands at ~6 years. Over 53% of constituents have a maturity of 5 years or more, which is something that doesn’t surprise me since the portfolio is trying to maximize the yield.

iShares

The fund currently has 2,029 bond holdings. The top ten holdings account for ~3% of the portfolio, with no single issuer weighing more than 1%. All in all, USHY is very well-diversified across issuers.

Morningstar

Based on data from Morningstar, the fund has an effective duration of ~4.2, meaning that for each 1% increase in interest rates, the portfolio’s NAV is expected to decrease by 4.2%.

My Thoughts On U.S. HY Bonds

Inflation is now at a decade high in a number of countries around the world, and the U.S. hasn’t been spared by this trend. The crisis in Ukraine accentuated some of the inflationary pressures, especially in relation to commodities costs. As a result, inflation was the main driver behind the current hiking cycle and will probably be the main factor that will lead to a reversal in monetary policy. Bonds have performed poorly going into this aggressive hiking cycle, and have experienced, as a result, one of the largest outflows of the last five years.

Bank of America

Yields on junk bonds are now much higher than 12 months ago, and many investors are wondering if it’s a good time to buy into this asset class. In my opinion, chasing a high yield is not the right strategy at the moment, as inflation and recession risks are still the main issue.

FRED

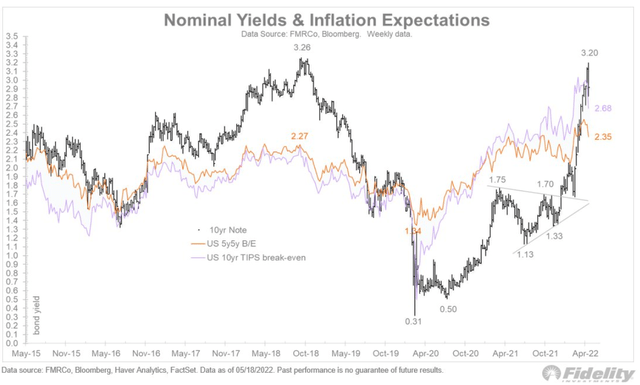

In recent weeks, inflation expectations have come down, which is illustrated by the 5y/5y breakeven rate and the U.S. 10y TIPS breakeven rate. This should be a bullish indicator for high-yield bonds, since high inflation was the initial reason that led to their massive selloff. I personally believe that inflation can turn out to be stickier than expected, and it might take longer than what is currently priced in the markets for it to return to the long-term target rate. If this scenario turns out to be true, this could have an important impact on where the Fed sees its neutral rate, and that could lead to further selling in the bond market.

Fidelity

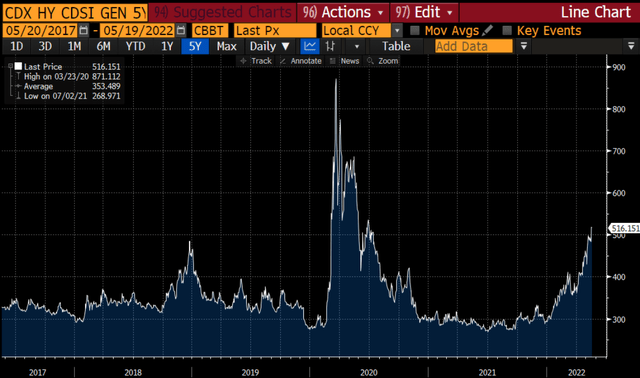

Another way to look at the updated inflation expectations is through the lens of a recession, which is likely to have a disinflationary impact. The likelihood of an economic downturn over the next year is now much higher than a few months ago, as illustrated by high yield spreads.

Bloomberg

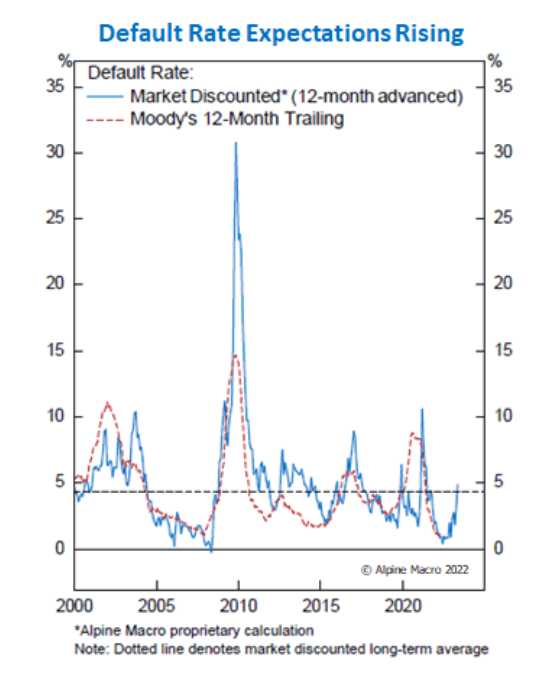

This risk is also reflected by rising default expectations in recent weeks. While we are still far from the 2020 COVID-19 highs, default expectations are meaningfully higher than in 2021. The last thing you want is to hold a basket of securities with high default risk going into a recession.

Alpine Macro

Yet, high yield option-adjusted spreads (OAS) are only slightly above the long-term average, signaling there might be more pain ahead for high yield bonds. This also suggests we haven’t even seen real stress yet, let alone a bottom.

FRED

Key Takeaways

HY bonds had a tough start to the year in the face of high inflation, and yields have now reached a level many investors consider to be attractive. While inflation expectations have declined in recent weeks, uncertainties about how far the Fed will go in its tightening cycle and how sticky inflation will be are persistent issues. At this point, a recession could add fuel to the fire, exacerbate some of the pressure that we’ve seen in the high yield market, and eventually lead to a credit crisis. I’m cautious about the outlook for USHY, and I think it’s better to stay away from it for the moment rather than to engage in yield chasing.

[ad_2]

Source links Google News