[ad_1]

imaginima

By Alex Rosen

Summary

Pacer American Energy Independence ETF (NYSEARCA:USAI) tracks an index of North American midstream energy infrastructure companies. The fund follows a particular segment of the oil and gas industry that is critical to meeting the expanding need for energy.

For the uninitiated, midstream energy infrastructure is critical to the U.S. oil and gas supply chain. Upstream energy is extraction, downstream is end user, midstream is the process to get from up to down. For example, in the liquified natural gas (‘LNG’) industry, the plants or trains that convert natural gas to a liquid would be considered midstream. Also, the trains that regasify the LNG would be considered midstream.

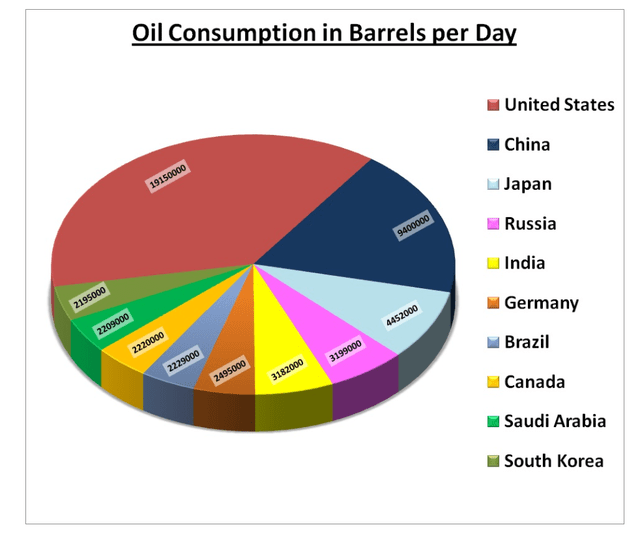

Excluding foreign demand for U.S. energy, the need for continued infrastructure expansion and maintenance is ever-present. The last decade has seen the U.S. turn from net oil importer to exporter. On the surface, this seems impressive considering the U.S. economy is the world’s largest and is basically a pure consumer country, but it gets better. The U.S. consumes 20% of the world oil supply, by far the largest share of the world’s consumption, and yet somehow they are or at least were for a few years a net exporter. While this trend has reversed itself, the expectation is that eventually, the U.S. will become a permanent net exporter.

The world oil consumption is not shared evenly (propelsteps)

This expansion in oil exporting doesn’t happen by accident. In order for this to become a reality, heavy investment in midstream infrastructure is required, and that’s where USAI has laid its hat.

As a result, we really believe in the robustness of the sector, and rate USAI a Buy.

Strategy

According to the USAI prospectus, the fund has a rules-based strategy for choosing holdings. Step one is, U.S. and Canadian equity markets are screened for companies generating the majority of their cash flow from midstream energy infrastructure activities. Step two, qualified securities are screened and excluded if they have a market cap under $500m or pay incentive distribution rights. Finally, step three, the fund chooses from the remaining qualified stocks and weighs by market cap, rebalancing quarterly.

Proprietary ETF Grades

-

Offense/Defense: Offensive

-

Segment: Oil and Gas

-

Sub-Segment: Midstream infrastructure

-

Correlation (vs. S&P 500): High

-

Expected Volatility (vs. S&P 500): Low

Holding Analysis

USAI holds a tight portfolio of 32 assets, broken up between the U.S. (76%) and Canada. The sector is almost exclusively industrial services, and the top ten holdings account for 60% of the fund makeup. The major holdings include The Williams Companies, Inc. (WMB) a premier U.S. natural gas processing and transportation company (7.54%), Kinder Morgan, Inc. (KMI) primarily a natural gas pipeline company (7.47), Cheniere Energy (LNG) a LNG liquification and export company (7.15), and Enbridge (ENB) a Canada based conglomerate that owns and operates the largest network of oil and gas pipelines in North America (7%).

Strengths

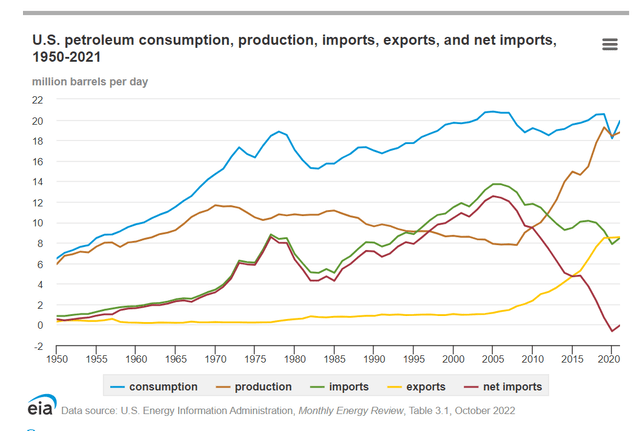

U.S. energy consumption is at an all-time high. From production to domestic demand to export, all are either at or just off record peaks. If the demand increase was met only by imports, that alone would be enough to make this sector a winner, but the added discovery/technological advances in the natural gas industry have made the sector a super-premium platinum-level winner.

U.S. petroleum is up in consumption, production, import and export (U.S. Energy Information Administration)

U.S. petroleum is up in consumption, production, importation and exportation (U.S. Energy Information Administration)

Changes in U.S. energy laws in 2016, allowed for the exportation of LNG from the continental U.S. (previously, only Alaska had been exporting). Since then, the U.S. has seen an increase of over 200% in exports to some 35 countries.

The sanctions on Russian natural gas to Europe have only made the demand higher. Higher demand means an increased need for infrastructure. Another win for USAI.

Weaknesses

All this demand for infrastructure development to meet immediate needs can eventually be an anchor around the necks of companies that invest in it. Today’s demand may mean tomorrow’s oversupply. Lest we question the possibility of this, just look at the price of oil futures in the spring and summer of 2020, when the world basically stopped moving.

Oil can be a boom or bust business, and when it’s booming, it really gushes, but when the well runs dry, it’s time to move on. For now, it’s booming, but be careful of the demand curve.

Opportunities

It is impossible to predict when the next global crisis will come, or where it will happen, but one thing is for certain, when it does happen, the demand for oil will be affected. Even without another global conflict putting a pinch on oil and gas supplies, the continued growth of the U.S. energy needs will necessitate an expansion of infrastructure.

One of the key takeaways from the sanctions on Russia is how dependent Europe is on foreign imports of oil and gas. This crisis reiterated the U.S. need for energy independence. One of the main reasons that LNG exports were prohibited for such a long time was for fear of a lack of energy dependence. Only with the advanced technological breakthroughs that led to an oversupply has the U.S. government felt comfortable allowing exports.

Now that the demand has increased again, the only way to ensure independence is by continued investment in infrastructure.

Threats

It is hard to really see any short-term threats to this particular sector. Long term, though, technological improvements will lower the cost of producing energy from renewable sources. Combining that with diminishing supplies of fossil fuels will eventually lead to a slowdown in demand for midstream infrastructure in the oil and gas sector. While this is a legitimate concern, for the immediate future, it is hard to see this as being an actual problem.

Proprietary Technical Ratings

- Short-Term Rating (next 3 months): Buy

- Long-Term Rating (next 12 months): Buy

Conclusions

ETF Quality Opinion

The fund’s narrow collection of 32 stocks has shown that it does not suffer from sector drift by any means. While the expense ratio is a little on the high side (.75%), the overall returns more than makeup for the cost. A fund that has a clearly stated plan, and then executes on that plan, is always a good strategy, and that’s exactly what USAI does.

ETF Investment Opinion

Not only does USAI do as it advertises, it does it while also bringing in returns that are very difficult to replicate, in a sector that seems to be sustainable for the long term. We like the model and the underlying fundamentals that lead to the choices of holdings. The company holdings are all producers of tangible goods with no tricks. As a result, we rate USAI a Buy.

[ad_2]

Source links Google News