[ad_1]

Investment thesis

Since our last release on the United States 12 Month Natural Gas Fund LP (UNL), we adopted a neutral view on the ETF, given the subdued natural gas pricing and heat pattern that was developing. Since then, the complex edged lower as its proxy, natural gas futures touched the $2 per MMBtu psychological level. Despite that, the tightening of the gas supply-demand equilibrium and the hot weather pattern have marginally supported the complex. That being said, we believe that the downward pressure on UNL is not over yet and the unfriendly seasonality will further deteriorate the flammable commodity.

Natural gas prices are close to reaching yearly lows, despite a tightening supply-demand picture

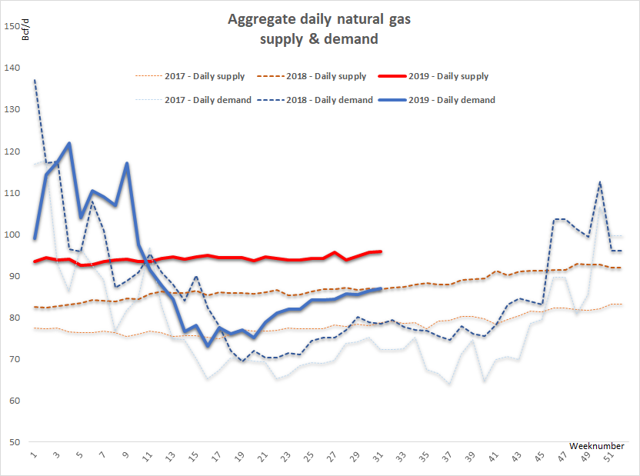

Natural gas prices rebounded slightly after touching the strong resistance level of $2 per MMBtu earlier last week, whereas UNL reached a yearly low of $8.50 per share, despite the contraction of the U.S. supply and demand natural gas equilibrium.

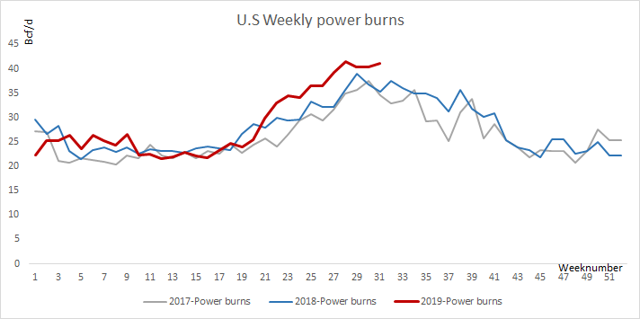

Besides, until now, mild summer 2019 temperatures marginally sustained domestic demand for natural gas. Yet, the bulk of this appreciation comes from mounting power burn needs, lifting it to 12.7% y/y to an average of 37 Bcf/d over the summer period.

Source: EIA, Oleum Research

Seasonality

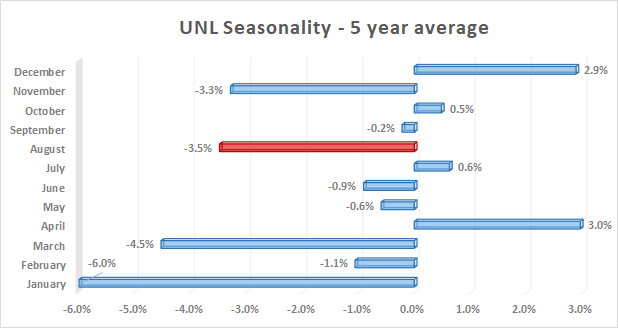

In spite of that, UNL’s seasonality remains unfavorable, with the ETF posting an average decline of 3.5% in the last 5 years, corresponding to the third worst monthly performance after January and March.

Source: EIA, Oleum Research

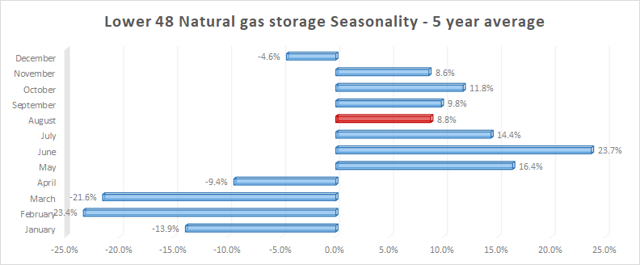

The main explanation behind this poor monthly performance comes from fast advancing storage injections registered during the first summer months. These cumulative injections ease somewhat in August as heat kicks in, but the excessive bearish momentum continues to push the complex lower, given that bulls are absent from the market in these depressed moments.

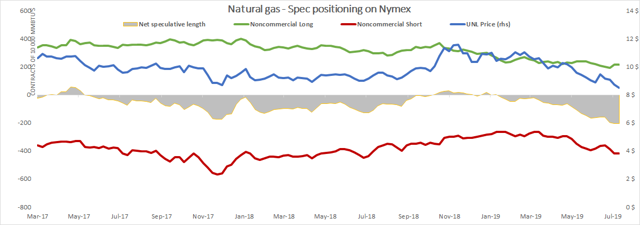

Speculator positioning

Net speculative bets on Nymex natural gas future contracts steadied for the second consecutive week to 203k net short contracts on the week ending August 8.

This marginal change indicates that interest for the flammable commodity is at its lowest and current subdued gas pricing might be responsible for market participants’ behavior.

Source: Commodity Futures Trading Commission (CFTC), Oleum Research

In front of that speculative stability, UNL retreated faintly, down 2.24% (w/w) to $8.52 per share. The sentiment remains deeply anchored to the downside, with nearly twice as many shorts than longs.

Besides, speculator bets are inclined to the downside, with latest short open interest established at 30.01% on the week versus a 20-week average of 25.57%. That being said, the sentiment could sharply reverse if the fundamental picture of the flammable market improves, namely if a long lasting heatwave builds over the country.

Sustained temperatures are likely to signal the return of short-term bullish momentum on UNL

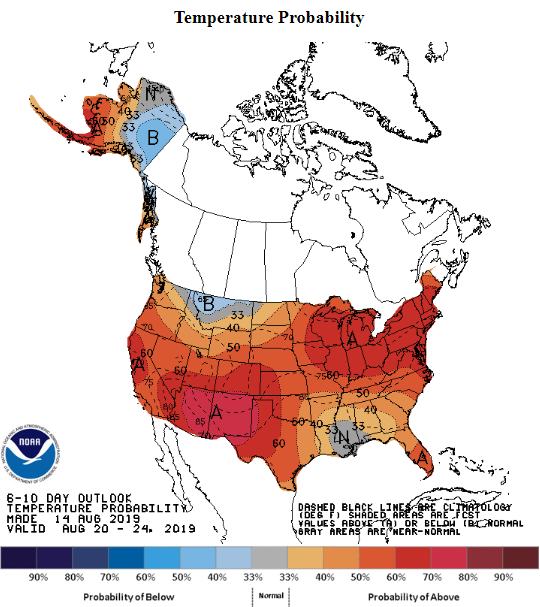

According to the most recent National Weather Service forecasts, warmer than normal temperatures are expected to develop over the country.

While warm weather should prevail in most parts of the U.S., intense heat is expected to hit the Northeast, Southwest and Midwest next week, increasing cooling demand days and sustaining power demand, providing a slight support to UNL and natural gas futures.

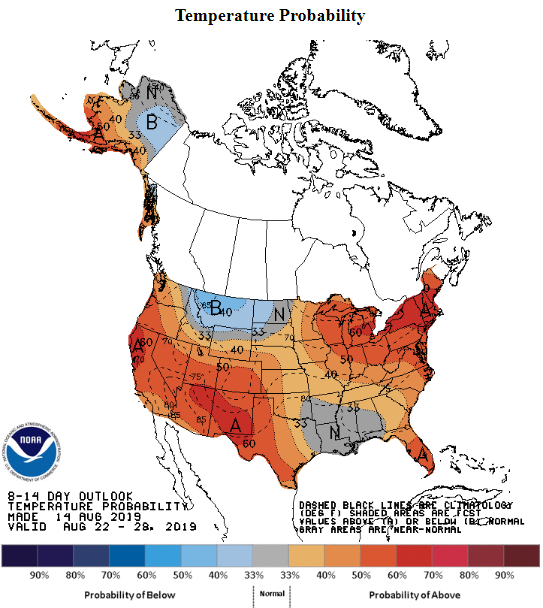

Despite that, warmth will ease in the following week and this colder pattern might bring back the short selling momentum, especially since U.S. natural gas supply continues its ramp up.

Source: National Weather Service

In this context, the tightening of the natural gas supply-demand equilibrium and warm weather developments over the next week are likely to provide some support to UNL’s shares. Nevertheless and in spite of that, historically weak August UNL performance, steadying net speculator bets on natural gas futures and brief warmth are likely to continue to weigh on the complex on a medium-term time scale.

We look forward to reading your comments.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News