[ad_1]

marketlan/iStock via Getty Images

A few weeks ago, I wrote a cautious initiation article on the United States Natural Gas Fund (NYSEARCA:UNG), highlighting the reasons why UNG had underperformed in the past few months as well as some upcoming catalysts.

Unfortunately, both of the catalysts I highlighted in my prior article failed to materialize or develop favourably. The Freeport LNG restart was delayed until the end of the year and the weather continued to be unseasonably warm.

At this point, with normalized storage levels and poor seasonality, investors bullish on UNG may have to wait until late January/early February, which could coincide with the updated Freeport LNG restart.

Freeport LNG Restart Delayed To End-of-Year

One of the main catalysts I highlighted in my prior article was the upcoming restart of the Freeport LNG facility, which had been taken offline since a June explosion. Freeport LNG represents a significant 15% of American LNG export capacity. Originally, the Freeport LNG facility was expected to restart in early November, and reach 85% of nameplate capacity by the end of the month.

However, the latest update on the facility has now pushed the restart timeline to the end of the year due to regulatory delays. With the upcoming holiday season, I would not be surprised if the restart is pushed further out into 2023.

Since Freeport LNG expects to ramp up in a slow and deliberate manner, even if the latest timeline is accurate, it will not reach 85% nameplate capacity until sometime in mid-January.

Weather Has Not Be Supportive

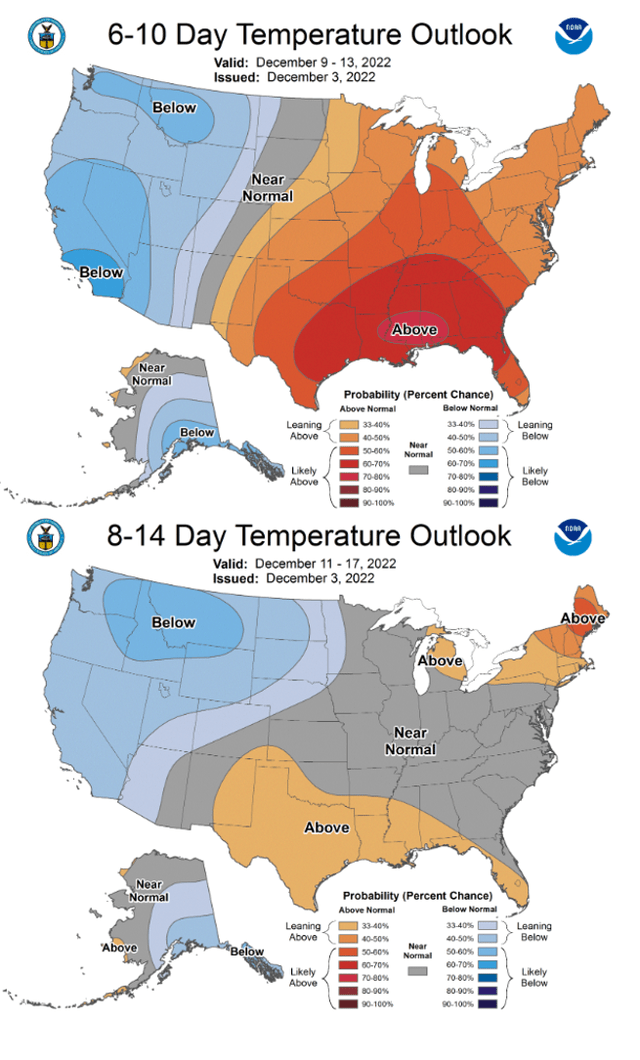

The second catalyst I highlighted was a return to seasonal temperatures, as the fall had been unseasonably warm. Unfortunately, the weather had continued to stay warmer than normal, and forecasts for the upcoming few weeks are not supportive (Figure 1).

Figure 1 – NOAA temperature forecasts (NOAA)

Warmer temperatures mean less heating demand for natural gas, which means there is more gas put in storage.

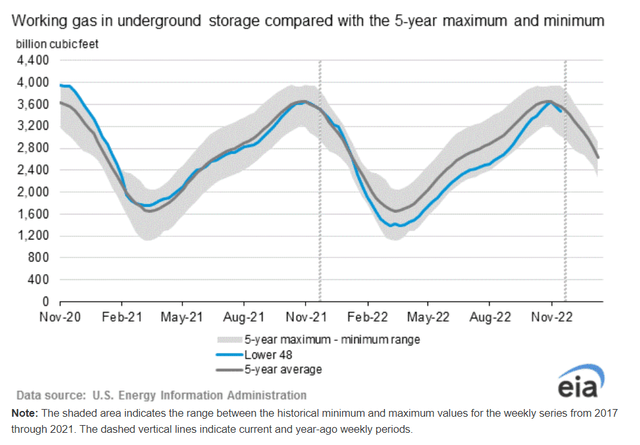

Storage At 5 Year Average

Speaking of gas in storage, the latest EIA report shows that storage levels are right in line with the 5-year average, meaning there is sufficient gas for a normal winter (Figure 2).

Figure 2 – EIA natural gas storage levels (EIA)

Seasonality Turning Bearish

Typically, by December, investors will have a good sense of whether there is sufficient gas in storage to last the winter. For example, this year, although we started at far below average storage levels as recently as August, (see figure 2 above), a warm Autumn and the Freeport LNG outage (Freeport liquefies 2.3 Bcf of gas per day) have allowed gas in storage to catch up and return to 5-year average levels.

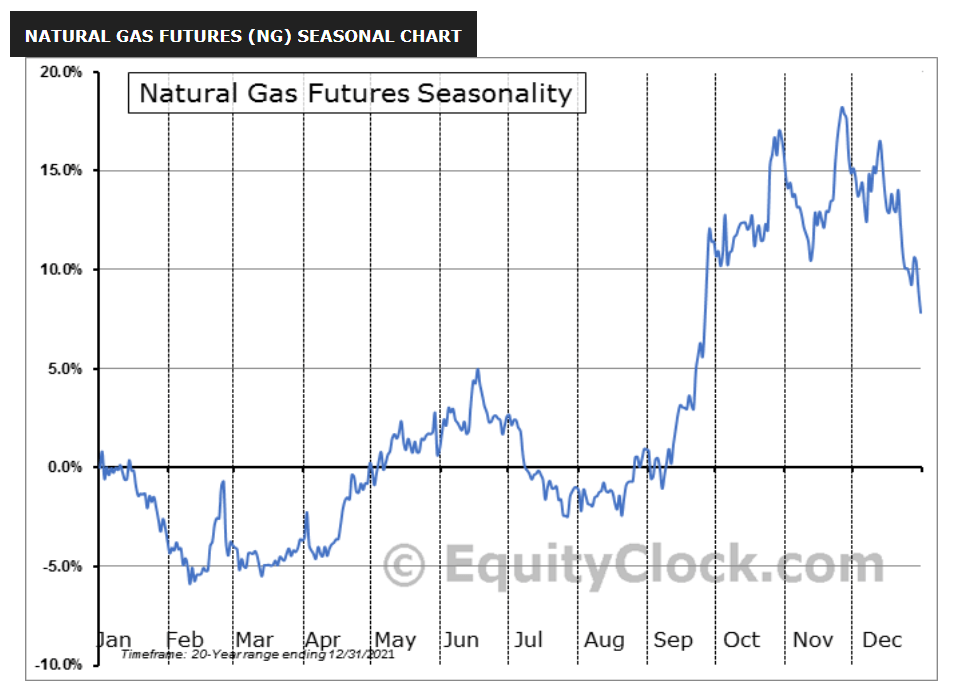

Looking at seasonality in more detail, we can see that natural gas prices tend to rally into late November as speculators bet on the upcoming winter demand, and then falls into the spring as actual heating demand is realized (Figure 3).

Figure 3 – Natural gas price seasonality (equityclock.com)

With normalized storage levels and the Freeport LNG outage into January, the UNG ETF is likely to remain weak into January/February.

Risks To My Call

Of course, natural gas is not called the ‘widowmaker’ without a reason. A freak winter storm could cause a surge in natural gas prices. In fact, even in just the past few weeks, we have had several +/- 5% to 10% days in natural gas prices as speculators traded the Freeport LNG headlines.

However, as things stand at the moment, investors will probably have to wait until the spring to get bullish on the UNG ETF.

Conclusion

In summary, I continue to recommend investors stay on the sidelines on the UNG ETF, as the catalysts I had highlighted in my prior article have not materialized favourably. With normalized storage levels and poor seasonality, bullish investors may have to wait until late January/early February, which could coincide with the updated Freeport LNG restart.

[ad_2]

Source links Google News